Economy: External Sector

External Sector

All economic activities of an economy which take place in foreign currency fall in the external sector such as export, import, foreign investment, external debt, current account, capital account, balance of payment, etc.

Forex reserves

- The total foreign currencies (of different countries) an economy possesses at a point of time is its ‘foreign currency assets/reserves’.

- The Forex Reserves (short for ‘foreign exchange reserves’) of an economy is its ‘foreign currency assets’ added with its gold reserves, SDRs (Special Drawing Rights) and Reserve Tranche in the IMF.

- In a sense, the Forex reserves is the upper limit upto which an economy can manage foreign currency in normal times if need be.

Exchange Rate

As India started managing its balance of payment in a more prudent way after the reform period, its external debt position has also improved in a big way. Exchange rate is the value for domestic currency with respect to foreign currency and vice-versa. In India, exchange rates are managed and any capital inflows would be mopped up by RBI to prevent rupee from appreciating thus resulting in build of reserves. They can be either fixed exchange rate or market determined exchange rates.

Fixed currency regime

- A method of regulating exchange rates of world currencies brought by the IMF.

- In this system exchange rate of a particular currency was fixed by the IMF keeping the currency in front of a basket of important world currencies (they were UK£, US $, Japanese ¥, German Mark DM and the French Franc FFr).

- Different economies were supposed to maintain that particular exchange rate in future.

- Exchange rates of currencies were modified by the IMF from time to time.

Floating currency regime

- A method of regulating exchange rates of world currencies based on the market mechanism (i.e., demand and supply).

- In the floating exchange rate system, a domestic currency is left free to float against a number of foreign currencies in its foreign exchange market and determine its own value.

- Such exchange rates, are also called as market driven or based exchange rates, which are regulated by factors such as the demand and supply of the domestic and the foreign currencies in the concerned economy.

Managed exchange rates

- A managed-exchange-rate system is a hybrid or mixture of the fixed and flexible exchange rate systems in which the government of the economy attempts to affect the exchange rate directly by buying or selling foreign currencies or indirectly, through monetary policy.

- Almost all countries tend to intervene when the markets become disorderly or the fundamentals of economics are challenged by the exchange rate of the time.

Foreign exchange market

- The market where different currencies can be bought and sold is called the foreign exchange market.

- Out of the trades in different currencies, the exchange rate of the currency is determined by the economy.

- This is an institutional framework for the exchange of one national currency for another.

- This is particularly correct either in the case of a free float exchange (i.e., floating currency) regime or is a managed or hybrid exchange rate system.

- It is altogether not allowed either in a fixed currency system or a hard fix (in a hard fix this happens once the currency to which the hard fix has been done itself starts fluctuating).

Exchange rate in India

- Indian currency, the ‘rupee’, was historically linked with the British Pound Sterling till 1948 which was fixed as far back as 1928.

- Once the IMF came up, India shifted to the fixed currency system committed to maintain rupee’s external value (i.e., exchange rate) in terms of gold or the US ($ Dollar).

- In 1948, Rs. 3.30 was fixed equivalent to US $ 1. In September 1975, India delinked rupee from the British Pound and the RBI started determining rupee’s exchange rate with respect to the exchange rate movements of the basket of world currencies (£, $, ¥, DM, Fr.).

- This was an arrangement between the fixed and the floating currency regimes.

- In 1992–93 financial year, India moved to the floating currency regime with its own method which is known as the ‘dual exchange rate’.

- There are two exchange rates for rupee, one is the ‘official rate’ and the other is the ‘market rate’.

- None of the economies have till date followed an ideal free-floating exchange rate. They require some mechanism to intervene in the foreign exchange market because this is a highly speculative market.

Trade balance

- The monetary difference of the total export and import of an economy in one financial year is called trade balance. It might be positive or negative, known to be either favorable or unfavorable, respectively to the economy.

Trade Policy

- Broadly speaking, the economic policy which regulates the export-import activities of any economy is known as the trade policy.

- It is also called the foreign trade policy or the Exim Policy.

- This policy needs regular modifications depending upon the economic policies of the economies of the world or the trading partners.

Depreciation

- This term is used to mean two different things. In foreign exchange market, it is a situation when domestic currency loses its value in front of a foreign currency if it is market-driven. It means depreciation in a currency can only take place if the economy follows the floating exchange rate system. In domestic economy, depreciation means an asset losing its value due to its use, wear and tear or due to other economic reasons. Depreciation here means wear and tear. This is also known as capital consumption. Every economy has an official annual rates for different assets at which fixed assets are considered depreciating.

Devaluation

- In the foreign exchange market when exchange rate of a domestic currency is cut down by its government against any foreign currency, it is called devaluation. It means official depreciation is devaluation.

Revaluation

- A term used in foreign exchange market which means a government increasing the exchange rate of its currency against any foreign currency. It is official appreciation.

Appreciation

- In foreign exchange market, if a free floating domestic currency increases its value against the value of a foreign currency, it is appreciation.

- In domestic economy, if a fixed asset has seen increase in its value it is also known as appreciation.

- Appreciation rates for different assets are not fixed by any government as they depend upon many factors which are unseen.

Current Account

It has two meanings—one is related to the banking sector and the other to the external sector:

- In the banking industry, a business firms bank account is known as current account. The account is in the name of a firm run by authorised person or persons in which no interest is paid by the bank on the deposits. Every withdrawal from the account takes place by cheques with limitations on the number of deposits and withdrawals in a single day. The overdraft facility or the cash-cum-credit (c/c Account) facility to business firms is offered by the banks on this account only.

- In the external sector, it refers to the account maintained by every government of the world in which every kind of current transactions is shown—basically this account is maintained by the central banking body of the economy on behalf of the government. Current transactions of an economy in foreign currency all over the world are—export, import, interest payments, private remittances and transfers.

All transactions are shown as either inflow or outflow (credit or debit). At the end of the year, the current account might be positive or negative. The positive one is known as a surplus current account, and the negative one is known as a deficit current account.

Capital Account

- Every government of the world maintains a capital account, which shows the capital kind of transactions of the economy with outside economies.

- Every transaction in foreign currency (inflow or outflow) considered as capital is shown in this account—external lending and borrowing, foreign currency deposits of banks, external bonds issued by the Government of India, FDI, PIS and security market investment of the QFIs (Rupee is fully convertible in this case).

- There is no deficit or surplus in this account like the current account.

Balance of Payment (BoP)

- The outcome of the total transactions of an economy with the outside world in one year is known as the balance of payment (BoP) of the economy.

- Basically, it is the net outcome of the current and capital accounts of an economy.

- It might be favourable or unfavourable for the economy.

- However, negativity of the BoP does not mean it is unfavourable.

- A negative BoP is unfavourable for an economy if only the economy lacks the means to fill the gap of negativity.

- The BoP of an economy is calculated on the principles of accountancy (double-entry bookkeeping) and looks like the balance sheet of a company—every entry shown either as credit (inflow) or debit (outflow).

- If there is a positive outcome at the end of the year, the money is automatically transferred to the foreign exchange reserves of the economy.

- And if there is any negative outcome, the same foreign exchange is drawn from the country’s forex reserves.

- If the forex reserves are not capable of fulfilling the negativity created by the BoP, it is known as a BoP crisis and the economy tries different means to solve the crisis in which going for forex help from the IMF is the last resort.

Convertibility in India

India’s foreign exchange earning capacity was always poor and hence it had all possible provisions to check the foreign exchange outflow, be it for current purposes or capital purposes (remember the draconian FERA). But the process of economic reforms has changed the situation to unidentifiable levels.

Current Account

- Current account is today fully convertible (operationalized on 19 August, 1994).

- It means that the full amount of the foreign exchange required by someone for current purposes will be made available to him at official exchange rate and there could be an unprohibited outflow of foreign exchange (earlier it was partially convertible).

- India was obliged to do so as per Article VIII of the IMF which prohibits any exchange restrictions on current international transactions (keep in mind that India was under pre-conditions of the IMF since 1991).

Capital Account

After the recomendations of the S.S. Tarapore Committee (1997) on Capital Account Convertibility, India has been moving in the direction of allowing full convertibility in this account, but with required precautions. India is still a country of partial convertibility (40:60) in the capital account, but inside this overall policy, enough reforms have been made and to certain levels of foreign exchange requirements, it is an economy allowing full capital account convertibility—

- Indian corporate are allowed full convertibility in the automatic route upto $ 500 million overseas ventures (investment by Ltd. companies in foreign countries allowed) per annum.

- Indian corporate are allowed to prepay their external commercial borrowings (ECBs) via automatic route if the loan is above $ 500 million per annum.

- Individuals are allowed to invest in foreign assets, shares, etc., upto the level of $ 2,50,000 per annum.

- Unlimited amount of gold is allowed to be imported (this is equal to allowing full convertibility in capital account via current account route, but not feasible for everybody) which is not allowed now.

The Second Committee on the Capital Account Convertibility (CAC)—again chaired by S.S. Tarapore—handed over its report in September 2006 on which the RBI/the government is having consultations.

Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER)

- The indices of Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) are used as indicators of external competitiveness. NEER is the weighted average of bilateral nominal exchange rates of the home currency in terms of foreign currencies. Conceptually, the REER, defined as a weighted average of nominal exchange rates adjusted for relative price differential between the domestic and foreign countries, relates to the purchasing power parity (PPP) hypothesis.

- These are prepared jointly in the Division of International Finance, Department of Economic Analysis and Policy and the Department of External Investments and Operations, Reserve Bank of India.

Coverage

- The new six-currency indices represent the US, the Eurozone (comprising of 12 countries), UK, Japan, China and Hong Kong SAR. Two currencies in the existing five-country series, viz., French franc and Deutsche mark have been replaced by the Euro in the new indices. Two new currencies have been included in the new indices, both being Asian - the Chinese yuan and the Hong Kong Dollar.

- The coverage has also been revised for the 36-country REER/NEER indices. The old indices comprised 36 countries including five members of the Euro Area. With an objective to broad base the REER/NEER and also to highlight India’s changing trade pattern, countries have been chosen in the new series based on three broad criteria: (i) the share in India’s exports and trade, (ii) regional representation and (iii) the regular availability of data on exchange rates and prices on a monthly basis.

- The new countries included in the revised series are Hong Kong SAR, Denmark, Iran, Kuwait, Qatar, Russia, South Africa, Sweden and United Arab Emirates (Annex). Besides, with the inclusion of the Euro zone, the new 36-currency indices include all the twelve countries that have Euro as common currency. Thus, the revised 36-currency REER indices effectively represent 47 countries.

Significance of REER

- REER is used to measure the value of a specific currency in relation to an average group of major currencies. A country’s REER is an important measure when assessing its trade capabilities.

- The REER can be used to measure the equilibrium value of a country’s currency, identify the underlying factors of a country’s trade flow, and analyze the impact of other factors such as competition, and technological changes have on a country and ultimately the trade-weighted index.

- For example, if the U.S. dollar exchange rate weakened against the euro, U.S. exports to Europe become cheaper. European businesses or consumers buying U.S. goods need to convert their euros to dollars to buy our exports.

- If the dollar is weaker than the euro, it means Europeans can get more dollars for each euro. As a result, U.S. goods are cheaper due solely to the exchange rate between the euro and U.S. dollar.

- The real effective exchange rate is important because if the U.S. has a large trading relationship with Europe, the euro to U.S. dollar exchange would have a larger weighting in the index. As a result, a large move in the euro exchange rate would impact the REER more so than if another currency with a smaller weighting strengthened against the dollar.

Foreign Investment

- Foreign Direct Investment (FDI) FDI is a foreign investment which aims to maximize profit and provide unique mixture of resources, technology, knowledge, professionalism and management techniques.

- India’s economy has been opening for more FDI. 100% FDI is permitted in sectors like petroleum sector, road building, power, drugs and pharmaceuticals hotels and tourism.

- No FDI is allowed in gambling, betting, lottery, atomic energy etc.

- FDI in India is allowed under Automatic Route i.e. without prior approval of government/RBI whereas other is government route which requires approval of FIPB.

Foreign Institutional Investment (FII)

- FII is done in the stock market with the purpose of only trading in shares of companies, in corporate debt and in government securities. Such investments are volatile in nature.

- There is no restriction on FII in the stock market except for the maximum percent shares of a company including in corporate debt instruments and government securities.

- FII also comes in the form of participatory notes (PN) (unregistered FII) and round tipping. Through round tipping, capital goes out of the country only to return from a different route to avoid incidence of tax on profit earned.

- Much of FII invested in India comes from Mauritius taking advantage of Double Taxation Avoidance Treaty.

Some key points from Mayaram Committee Report:

- Foreign investment of 10% or more in a listed company will now be treated as FDI.

- An investor may be allowed to invest below 10% and this can be treated as FDI subject to the condition that the FDI stake is raised to 10% or beyond within one year from the date of the first purchase.

- If the stake is not raised to 10% or above, then the investment can be treated as portfolio investment.

- Foreign Portfolio Investors include Foreign Institutional Investors (FIIs) and Qualified Foreign Investors (QFIs).

- Foreign investment in an unlisted company, irrespective of the threshold limit, may be treated as FDI

Exchange Traded Fund

Context

Edelweiss AMC recently got the government’s permission to launch India’s first bond ETF (exchange traded fund) which will invest in central public sector undertakings.

About

- Soon, Bond ETFs will be another investment vehicle available to retail investors providing access to bonds of state-run enterprises.

- Bond ETFs are similar to how equity ETFs invest in line with indices covering specific baskets like the Nifty50, Nifty Next 50 and Nifty Quality 30, among others

- While bond ETFs are not new in India, they have not been very popular. At present, only three GSec ETFs are available, all with miniscule assets and poor trading volumes.

- The entry of newer bond ETFs comes at a time when traditional bond funds are only just emerging from a painful period of multiple credit defaults. Investors are wary.

- Bond ETFs claim to be different from traditional bond funds by offering high liquidity, transparency and lower costs.

- The cost angle is the most distinguishing facet of bond ETFs. Being passively managed products, these charge a much lower fee than actively managed bond funds. Sometimes even less than 0.5%.

- In the debt segment, there is not much the fund manager can do to enhance returns. Any strategy that can optimise costs is the need of the hour.

- Globally, Bond ETFs have reported a healthy growth over the last decade. The size of Global Bond ETFs now accounts for over $1 trillion assets under management (AUM) out of total $4 trillion AUM across various ETFs.

- The key objectives of launching Bond ETF are:

- To suffice borrowing needs of CPSEs

- To increase retail participation

- To deepen the bond market and increase liquidity

What are ETFs?

- An exchange-traded fund (ETF) is a marketable security, meaning it has an associated price that allows it to be easily bought and sold.

- ETFs are in many ways similar to mutual funds; however, they are listed on exchanges and ETF shares trade throughout the day just like ordinary stock.

- ETFs offer low expense ratios and fewer broker commissions than buying the stocks individually.

- ETFs can contain all types of investments including stocks, commodities, or bonds; some offer domestic holdings only, while others are international.

What are Bond ETFs?

- Bond ETFs are a type of ETF that exclusively invests in bonds. Bond ETFs invest in various fixed-income securities such as corporate bonds, treasuries, municipal, international, high-yield, etc.

- Bond ETFs are passively managed and trade, much like stock ETFs on major stock exchanges. This helps promote market stability by adding liquidity and transparency during times of stress.

- Bond ETFs allow ordinary investors to gain passive exposure to benchmark bond indices in an inexpensive way.

- Investors of bond ETFs are exposed to the risk of interest rate changes.

- Bond ETFs are typically of two types: They either track a specific maturity bucket like short, medium or long term or they track a target maturity where they invest in bonds with similar maturity as the product.

- Target Maturity Bond ETFs: They provide predictable returns like Fixed Maturity Plans (FMPs), if they are held till maturity.

Other type of ETFS

- Market ETFs: Designed to track a particular index like the NIFTY.

- Sector and industry ETFs: Designed to provide exposure to a particular industry, such as oil, pharmaceuticals, or high technology.

- Commodity ETFs: Designed to track the price of a commodity, such as gold, oil, or corn.

- Style ETFs: Designed to track an investment style or market capitalization focus, such as large-cap value or small-cap growth.

- Foreign market ETFs: Designed to track non-Indian markets, such as US’s Dollar 30 or Dow Jones Industrial Average (DJIA).

- Inverse ETFs: Designed to profit from a decline in the underlying market or index.

- Actively managed ETFs: Designed to outperform an index, unlike most ETFs, which are designed to track an index.

- Exchange-traded notes: In essence, debt securities backed by the creditworthiness of the issuing bank; created to provide access to illiquid markets and have the added benefit of generating virtually no short-term capital gains taxes.

- Alternative investment ETFs: Innovative structures, such as ETFs that allow investors to trade volatility or gain exposure to a particular investment strategy, such as currency carry or covered call writing.

Benefits

- Lower Costs: An investor who buys an ETF doesn't have to pay an advisory/management fee to the fund manager and taxes are relatively lower in ETFs.

- Lower Holding Costs: As commodity ETFs are widely traded in, there isn't any physical delivery of commodity. The investor is just provided with an ETF certificate, similar to a stock certificate.

- Exposure to debt market: Bond ETFs are a cost-effective way for investors to take debt-market exposure.

- Tax considerations: ETFs tend to be very tax efficient and ideal for holding in taxable accounts. Since ETFs don’t sell shares very often and their portfolio turnover is very low, it is very rare for them to generate a taxable distribution for their shareholders.

- IETFs also have the option of making an “in-kind” distribution to shareholders if they want to sell themselves and want the cash.

- However, if the ETF’s portfolio generates dividend income, this income is taxable.

- Transparency: The entire portfolio held by the bond ETF is disclosed on a daily basis to investors.

- This is unlike conventional bond funds which disclose portfolios at the end of every month.

- Further, since bond ETFs are listed on exchanges, they provide live price updates after every trade.

- Liquid: Being listed on the exchanges, bond ETFs also claim to offer liquidity—ability to buy and sell units instantly—for the investor.

- The liquidity in bond ETFs will depend on how actively market makers buy and sell units on the exchange in bulk.

- This will allow the investor to fetch a purchase or sale price closer to the fair value of the ETF, as indicated by its net asset value (NAV).

- Increasing participation: In India, retail participation in corporate bond market is shallow due to structural challenges like poor accessibility, lack of transparency and awareness. Bond ETFs can address these challenges and can play an important role in increasing retail investor participation in corporate bond market.

Disadvantages

- Several ETFs in India are plagued by crippling illiquidity. In the absence of trading volumes, investors often end up buying or selling at a steep premium, or discount to the prevailing NAV.

- While lower cost enhances the return potential of ETFs, absence of liquidity can effectively wipe out cost benefits. Conventional bond funds do not face these issues.

- If evidence is to go by, the initial liquidity in these products will be low, restricting investor’s ability to move in and out at a desired price.

- If the ETFs are not able to amass a decent corpus size, poor liquidity will continue. C

- Bond ETFs cannot assure return to investors any more than conventional bond funds, except certain categories of bond ETFs such as target maturity bond ETFs which have a defined maturity date.

- Unlike actively managed bond funds, bond ETFs will not be in a position to gain from opportunities emerging from movements in interest rates or credit spreads.

Conclusion

To conclude, ETFs offer both tax efficiency as well as lower transaction and management costs. Bond ETFs combine the best of both bonds and debt funds. Indians invest a substantial portion of their savings in fixed income instruments such as small savings schemes, fixed deposits, bonds and various types of fixed income mutual funds. If liquidity is sufficiently high, bond ETFs may be a good first stop for those looking to move from bank fixed deposits.

Disinvestment in Five PSE

Context

Recently, Cabinet approves strategic sale of BPCL and 4 other PSUs.

About

- The Cabinet Committee on Economic Affairs approved the strategic disinvestment in Bharat Petroleum Corporation Limited, Shipping Corporation of India, Container Corporation of India, THDC India Limited, and North Eastern Electric Power Corporation (NEERCO) while giving up management control in these companies.

- It also gave an in-principle approval for the government to reduce stake in certain state-owned companies to below 51 per cent in some while retaining majority stake management control.

- These major divestment decisions were taken even as the government races against time to meet its highest ever divestment target of Rs 1.05 trillion for 2019-20. The Centre hopes that disinvestment proceeds will make up for some of the revenue shortfall that is expected this year.

- Privatisation of BPCL will be without the company’s equity shareholding of 61.65 per cent in Numaligarh Refinery in Assam.

- The Numaligarh Refinery will be carved out of BCPL and will be taken over by another state-owned company

- Numaligarh Refinery is the largest producer of paraffin wax in the country. The GRM of NRL during FY19 was seen at $11.8 a barrel. The remaining 38.35 per cent stake is held by the Assam government (12.35 per cent) and Oil India (26 per cent).

- Of the total 249.4 million tonne per annum (MTPA) refining capacity in India, BPCL has around 15 per cent or 38.3 MTPA. BPCL also has 15,177 retail outlets in India.

- The major reason why Numaligarh was kept out of the strategic disinvestment was because of its importance being part of the Assam Accord of 1985 signed between All Assam Students’ Union and the Centre following the anti-immigrant agitation.

Significance

- It will provide revenue to the government which is faced with massive shortfall in revenue and capital receipts.

- It will hand over management of the non-performing PSE to the private management which will make them profitable in the longer run

Criticism

- BPCL is a profitable refinery and oil marketing company that has consistently paid a healthy dividend. It has also made investments in energy resources and holds interests in overseas hydrocarbon blocks. Privatization of BPCL and saving its stakes in Numaligarh is a clear sign that politics taking precedence over any economic interest.

- The Centre has very less time to realize these strategic sale proposals to make available the money for the current fiscal.

National grid of ports

Context

Government plans to develop a National Grid for Ports based on the synergy between the major and minor ports in the country.

About

- During the 17th Meeting of Maritime states Development Council (MSDC)—the apex advisory body for the development of the maritime sector—government announced a plan to develop a National Grid for Ports.

- Out of the 204 minor ports in the country, only 44 are functional; the National Grid for Ports (NGP) will connect the major and minor ports.

- Ports have been centres of India’s maritime activity in the past; the objective is to once again revive ports as important centres of sea trade.

- The objective is also to improve infrastructure and to reduce and finally eliminate human interface.

- Ministry of shipping is planning a wider expansion of port capacity across the country.

- The study on NGP will be different than ‘Sagarmala’ study.

How will NGP be developed?

- The plan will be carried through cooperation between the Centre and State.

- The Centre will share findings with the States so that the non-functional minor ports can be developed and made functional.

- Port capacity will be expanded by implementing well-conceived infrastructure development projects.

- A host of measures will be undertaken to cut time and cost, digitization of processes, and to strongly address environment-related concerns.

- Specific cargo linked to the ports and the downstream industry will be identified for the revival of each port.

- Over 100 minor ports in India could be renewed and integrated with major ports in a new system.

- States also run barges along the coastal route. All States will implement a set of common rules to ease movement of barges across the coastal route.

- States will be free to develop it themselves or through public-private partnership ports.

- Government is considering giving deep sea vessels to fishermen.

- There are two layers of port security – one is to scan containers that are handled and second is to track the ships that enter and exit the ports. Government is planning to implement international standards of security in major and non-major ports.

Benefits

- The coastal shipping and inland waterways sector are poised to play a vital role in the development of the country.

- The cost-effective and pollution-free water transport can reduce logistics costs in the country, making Indian goods more competitive in the global markets.

- NGP will help increasing the efficiency of port operations

- Developing connectivity between the major and minor ports can bring port-led development into the country.

- A NGP will ensure that cargo or agricultural produce located near the non-major ports can be shipped to major ports.

Conclusion

- Given other seminal initiatives such as the Regional (Air) Connectivity Scheme, national plans for development of transportation & logistics infrastructure and the consequent progress, the proposed national grid of ports is an idea with potential. It, however, needs careful consideration, planning and phased implementation, most importantly through extensive engagement with the trade/stakeholders.

Veer Parivar App

ASEAN Senior Officials Meeting

Saraswati Samman

Indo-Pacific Division

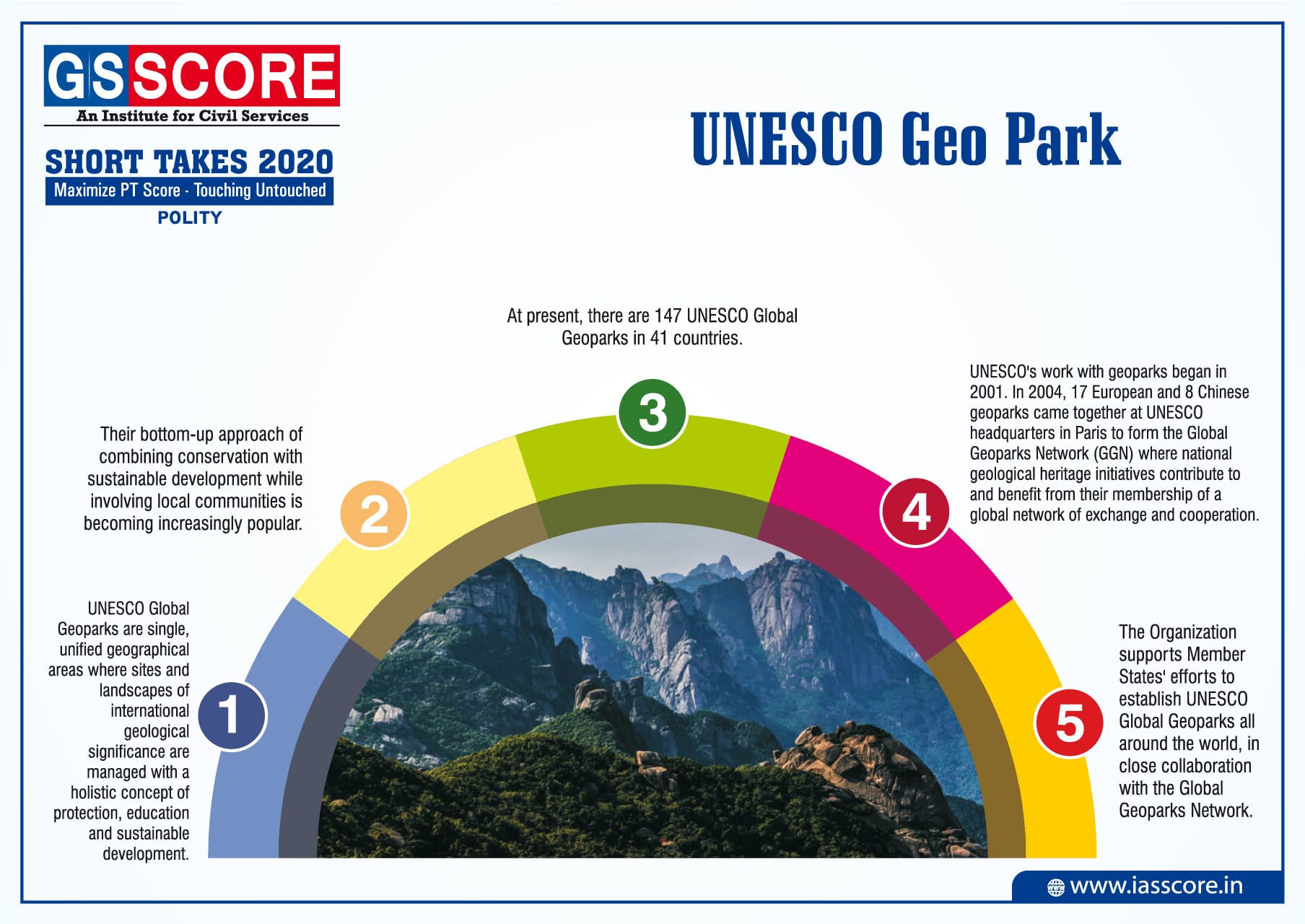

UNESCO Geo Park