Economy: Financial Sector

Financial Sector

- The market of an economy where funds are transacted between the fund-surplus and fund scarce individuals and groups is known as the financial market.

- The basis of transaction is either interest or dividend. This market might have its organised (institutionalised) as well as non-organised (unregulated/non-institutionalised) segments in an economy.

- Financial markets in every economy are having two separate segments today, one catering to the requirements of short-term funds and the other to the requirements of long-term funds.

- The short term financial market is known as the money market, while the long-term financial market is known as the capital market.

Indian Money Market

- Money market is the short-term financial market of an economy.

- In this market, money is traded between individuals or groups (i.e., financial institutions, banks, government, companies, etc.), who are either cash-surplus or cash-scarce.

- Trading is done on a rate known as discount rate which is determined by the market and guided by the availability of and demand for the cash in the day-to-day trading.

- The ‘repo rate’ of the time (announced by the RBI) works as the guiding rate for the current ‘discount rate’.

- In the money market the financial assets, which have quick conversion quality into money and carry minimal transaction cost, are also traded.

Need for Money Market:

- In the modern industrial economies creation of productive assets is not an easy task, as it requires investible capital of longterm nature.

- Long-term capital can be raised either through bank loans, corporate bonds, debentures or shares (i.e., from the capital market).

- But once a productive asset has been created and production starts there comes the need of another kind of capital, to meet the day-to-day shortfalls of working capital.

- It means that only setting-up of firms does not guarantee production as these firms keep facing fund mismatches in the day-to-day production process.

- Such funds are required only for a short period (days, fortnights or few months) and are needed to meet shortfalls in working capital requirements.

- This requires creation of a different segment of the financial market which can cater to the short-term requirements of such funds for the eneterprises—known as the money market or the working capital market.

- The short-term period is defined as upto 364 days.

Money Market in India:

- The organized form of money market in India is just close to three decades old. However, its presence has been there, but restricted to the government only.

- It was the Chakravarthy Committee (1985) which, for the first time, underlined the need of an organized money market in the country and the Vahul Committee (1987) laid the blue print for its development.

- Today, money market in India is not an integrated unit and has two segments— Unorganized Money Market and Organized Money Market.

Unorganized Money Market

Before the government started the organized development of the money market in India, its unorganized form had its presence since the ancient times—its remnant is still present in the country. Their activities are not regulated like the organized money market, but they are recognized by the government. In recent years, some of them have been included under the regulated organized market (for example, the NBFCs were put under the regulatory control of the RBI in 1997). The unorganized money market in India may be divided into three differing categories:

- Unregulated Non-Bank Financial Intermediaries: Unregulated Non-Banking Financial Intermediaries are functioning in the form of chit funds, nidhis (operate in South India, which lend to only their members) and loan companies. They charge very high interest rates (i.e., 36 to 48 per cent per annum), thus, are exploitative in nature and have selective reach in the economy.

- Indigenous Bankers: Indigenous bankers receive deposits and lend money in the capacity of an individual or private firm. There are, basically, four such bankers in the country functioning as non-homogenous groups:

- Gujarati Shroffs: They operate in Mumbai, Kolkata as well as in industrial, trading and port cities in the region.

- Multani or Shikarpuri Shroffs: They operate in Mumbai, Kolkata, Assam tea gardens and North Eastern India.

- Marwari Kayas: They operate mainly in Gujarat with a little bit of presence in Mumbai and Kolkata.

- Chettiars: They are active in Chennai and at the ports of southern India.

- Money Lenders: They constitute the most localized form of money market in India and operate in the most exploitative way. They have their two forms:

-

- The professional money lenders who lend their own money as a profession to earn income through interest.

- The non-professional money lenders who might be businessmen and lend their money to earn interest income as a subsidiary business.

Organized money market

Since the government started developing the organized money market in India (mid-1980s), we have seen the arrival of a total of eight instruments designed to be used by different categories of business and industrial firms. A brief description of these instruments follows:

- Treasury Bills (TBs): This instrument of the money market though present since Independence got organized only in 1986. They are used by the Central Government to fulfill its short-term liquidity requirement upto the period of 364 days.

- Certificate of Deposit (CD): Organized in 1989, the CD is used by banks and issued to the depositors for a specified period ranging less than one year—they are negotiable and tradable in the money market. Since 1993 the RBI allowed the financial institutions to operate in it— IFCI, IDBI, IRBI (IIBI since 1997) and the Exim Bank—they can issue CDs for the maturity periods above one year and upto three years.

- Commercial Paper (CP): Organized in 1990 it is used by the corporate houses in India (which should be a listed company with a working capital of not less than Rs. 5 crore). The CP issuing companies need to obtain a specified credit rating from an agency approved by the RBI (such as CRISIL, ICRA, etc).

- Commercial Bill (CB): Organised in 1990, a CB is issued by the All India Financial Institutions (AIFIs), NonBanking Finance Companies (NBFCs), Scheduled Commercial Banks, Merchant Banks, Co-operative Banks and the Mutual Funds. It replaced the old Bill Market available since 1952 in the country.

- Call Money Market (CMM): This is basically an inter-bank money market where funds are borrowed and lent, generally, for one day—that is why this is also known as over-night borrowing market (also called money at call). Fund can be borrowed/raised for a maximum period upto 14 days (called short notice).

- Money Market Mutual Fund (MF): Popular as Mutual Funds (MFs) this money market instrument was introduced/organised in 1992 to provide short-term investment opportunity to individuals.

- Repos and Reverse Repos: In the era of economic reforms there developed two new instruments of money market— repo and reverse repo. Repo allows the banks and other financial institutions to borrow money from the RBI for short-term (by selling government securities to the RBI). In reverse repo, the banks and financial institutions purchase government securities from the RBI (basically here the RBI is borrowing from the banks and the financial institutions).

- Cash Management Bill (CMB): The Government of India, in consultation with the RBI, decided to issue a new short-term instrument, known as Cash Management Bills, since August 2009 to meet the temporary cash flow mismatches of the government. The Cash Management Bills are non-standard and discounted instruments issued for maturities less than 91 days.

Mutual Funds

- Of all investment options, mutual funds are touted to be the best tool for wealth creation over the long term. They are of several types, and the risk varies with the kind of asset classes these funds invest in.

- As the name suggests, a mutual fund is a fund that is created when a large number of investors put in their money, and is managed by professionally qualified persons with experience in investing in different asset classes—shares, bonds, money market instruments like call money, and other assets such as gold and property.

- Mutual funds, first of all came in the money market (regulated by the RBI), but they have the freedom to operate in the capital market, too. This is why they have provision of dual regulator—the RBI and SEBI.

- Mutual funds are compulsorily registered with the Securities and Exchange Board of India (SEBI), which also acts as the first wall of defence for all investors in these funds.

- Each mutual fund is run by a group of qualified people who form a company, called an asset management company (AMC) and the operations of the AMC are under the guidance of another group of people, called trustees.

- There are three types of schemes offered by MFs:

- Open-ended Schemes: An open-ended fund is one which is usually available from an MF on an ongoing basis, that is, an investor can buy or sell as and when they intend to at a NAV-based price. As investors buy and sell units of a particular open-ended scheme, the number of units issued also changes every day and so changes the value of the scheme’s portfolio. So, the NAV also changes on a daily basis. In India, fund houses can sell any number of units of a particular scheme, but at times fund houses restrict selling additional units of a scheme for some time.

- Closed-ended Schemes: A close-ended fund usually issue units to investors only once, when they launch an offer, called new fund offer (NFO) in India. Thereafter, these units are listed on the stock exchanges where they are traded on a daily basis. As these units are listed, any investor can buy and sell these units through the exchange.

- Exchange-Traded Funds (ETFs): ETFs are a mix of open-ended and close-ended schemes. ETFs, like close-ended schemes, are listed and traded on a stock exchange on a daily basis, but the price is usually very close to its NAV, or the underlying assets, like gold ETFs.

Indian Capital Market

- The long-term financial market of an economy is known as the ‘capital market’. This market makes it possible to raise long-term money for a period of minimum 365 days and above.

- Across the world, banks emerged as the first and the foremost segment of the capital market.

- In coming times many other segments got added to it, viz., insurance industry, mutual funds, and finally the most attractive and vibrant, the security/stock market.

- Organised development of capital market together with putting in place the right regulatory framework for it, has always been a tough task for the economies.

- It is believed today that for strong growth prospects in an economy presence of a strong and vibrant capital market is essential.

- Over the time, Indian capital market started to have the following segments:

i. Financial institutions

- The requirement of project financing made India to go for a number of FIs from time to time, which are generally classified into four categories:

(i) All India Financial Institutions (AIFIs)

- The all India FIs are IFCI (1948); ICICI (1955); IDBI (1964); SIDBI (1990) & IIBI (1997).

- All of them were public sector FIs except ICICI, which was a joint sector venture with initial capital coming from the RBI, some foreign banks and FIs.

- The public sector FIs were funded by the Government of India.

- The AIFIs witnessed a sharp decline in recent years. At this juncture the government decided to convert them into Development Banks (suggested by the Narasimhan Committee-I) to be known as the All India Development Banks (AIDBs).

- In 2000, the government allowed ICICI to go for a reverse merger (when an elder enterprise is merged with a younger one) with the ICICI Bank—the first AIDB emerged with no obligation of project financing—such entities in coming times will be known as the universal banks.

- In 2002, the government, proposed to merge IFCI and IIBI with the nationalized bank PNB to create big Universal Bank.

- Meanwhile, at present, there are only four financial institutions operating in the country as AIFIs regulated by the RBI, viz., the NABARD, SIDBI, Exim Bank and the NHB.

(ii) Specialized Financial Institutions (SFIs)

Two new FIs were set up by the Central Government in the late 1980s to finance risk and innovation in the area of industrial expansion; this was India’s trial in the area of venture capital funding.

- IFCI Venture Capital Funds Ltd (IFCI Venture), 2000: It was promoted as a Risk Capital Foundation (RCF) in 1975 by IFCI Ltd., a society to provide financial assistance to first generation professionals and technocrat entrepreneurs for setting up own ventures through soft loans, under the Risk Capital Scheme.

- Tourism Finance Corporation of India Ltd (TFCI), 1989: The Government of India had, on the recommendations of the National Committee on Tourism (Yunus Committee) set up under the aegis of the Planning Commission, decided in 1988, to promote a separate All India Financial Institution for providing financial assistance to tourism-related activities/projects. In accordance with the above decision, the IFCI Ltd. along with other all-India financial/investment institutions and some nationalized banks promoted a Public Limited Company under the name of “Tourism Finance Corporation of India Ltd. (TFCI)” to function as a Specialized All-India Development Financial Institution to cater to the financial needs of the tourism industry.

(iii) Investment Instituions (IIs)

- Three investment institutions also came up in the public sector, which are yet another kind of FIs, i.e., the LIC (1956), the UTI (1964) and the GIC (1971).

- In the present time they are no more known as DIIs (Domestic Investment Institutions) or DFIs (Domestic Financial Institutions).

- LIC is now the public sector insurance company in the life segment, GIC was been converted into a public sector re-insurance company in 2000, while UTI was converted into a mutual fund company in 2002.

- LIC is now called an ‘insurance company’, part of the Indian Insurance Industry and is the lone public sector playing in the life insurance segment competing with the private life insurance companies.

- Similarly, the UTI is now part of the Indian Mutual Fund industry and the lone such firm in the public sector competing with other private sector mutual funds.

- Similarly, the erstwhile four public sector general insurance companies are part of India’s general insurance industry and competing with private companies in the area.

(iv) State Level Finance Institutions (SLFIs)

- In the wake of states involvement in the industrial development, the central government allowed the states to set up their own financial institutions (after the states demanded so). In this process two kinds of FIs came up:

- State Finance Corporations (SFCs): First came up in Punjab (1955) with other states following its example. There are 18 SFCs working presently.

- State Industrial Development Corporations (SIDCs): A fully dedicated state public sector FI to the cause of industrial development in the concerned states. First such FIs were set up (1960) in Andhra Pradesh and Bihar.

ii. Banking Industry

- With the passage of time, the industry saw its nationalisation (1969 and 1980) and again opening up for private sector entry (1993–94) to emerge as the most dependable segement of Indian financial system—in a way its mainstay.

- Presently, the industry consists of commercial banks both in public and private sectors, Regional Rural Banks (RRBs) and co-operative banks—a total of 171 Scheduled Commercial Banks (SCBs) out of whch 113 are in the public sector (19 nationalised banks, 7 banks in SBI group, one IDBI Bank Ltd. and 86 RRBs); with the rest of the 58 banks owned by the private sector (domestic and foreign—FDI in banks is allowed upto 26 per cent).

iii. Insurance Industry - After Independence, for the purpose of expanding the industry, one after another the life and nonlife insurance businesses were nationalised by the government (in 1956 and 1970, respectively), and the public sector insurance companies did serve the better purpose in the areas of providing safety net and nation-building.

- In the wake of the process of economic refroms a restructuring of the sector was started and the industry was opened for entry of private players in 1999 and an independent regulator was set up—the IRDA (domestic and foreign—with an FDI cap of 49 per cent).

- Since then many private players have entered the industry.

- Presently, Indian insurance industry consists of one public sector life insurer (LIC) and four public sector general insurers; two specialised public sector insurers (AICIL and ECGC); one public sector re-insurer (GIC) and 37 private insurance companies (in collaboration with established foreign insurers from across the world).

iv. Security market

- After the government’s attempts to formally organise the security and stock market of India, the segment has seen accelerated expansion.

- Today, it is counted among the most vibrant share markets of the world and has challenged the monopoly of banks in the capital market of the country.

- The security market of India is regulated by SEBI. India has developed a regulated ‘forward market’ also where hunderds of commodities and derivatives are traded on spot and non-spot basis—regulated by FMC which merged into SEBI by late 2015.

Financial Regulation

India has a multiple regulatory architecture in the financial sector. The design has developed complexities over the time due to: the number of regulatory, quasi-regulatory, non-regulatorybut-still-regulating bodies; overlapping ambiguous operational design and their influence.A brief overview of the financial regulatory framework are being given here.

Regulatory Agencies

- India has product-wise regulators—Reserve Bank of India (RBI) regulates credit products, savings and remittances; the Securities and Exchange Board of India (SEBI) regulates investment products; the Insurance Regulatory and Development Authority (IRDA) regulates insurance products; and the Pension Fund Regulatory and Development Authority (PFRDA) regulates pension products. The Forward Markets Commission (FMC) regulates commodity-based exchange-traded futures (which was merged with the SEBI by late 2015).

Quasi-regulatory Agencies

- Several other government bodies perform quasi-regulatory functions—National Bank for Agriculture and Rural Development (NABARD), Small Industries Development Bank of India (SIDBI), and National Housing Bank (NHB). NABARD supervises regional rural banks as well as state and district cooperative banks. NHB regulates housing finance companies, and SIDBI regulates the state finance corporations (SFCs).

Establishment of FSDC

- Few years back, an important addition was made to the regulatory architecture—the Financial Sector Development Council (FSDC) was set up which replaced the High Level Committee on Capital Markets. The council is convened by Ministry of Finance and does not have statutory authority— it is structured as a council of regulators—Finance Minister as chairman. It has a permanent secretariat.

- The council resolves inter-agency disputes; look after the regulation of financial conglomerates that fall under various regulators’ purview; and performs wealth management functions dealing with multiple products.

- The FSLRC (Financial Sector Legislative Reforms Commission), set up (headed by Justice B. N. Srikrishna) to examine the regulatory structure and the laws governing the financial sector, submitted its report by early 2013.

- Major highlights of the recommendations are as follows:

- Developing a ‘horizontal structure’ whereby, the basic regulatory/monitoring functions to be done by a UIA (Unified Financial Agency)—in place of each agency (like SEBI, IRDA, etc.) looking after one financial type and area. It will eliminate regulatory overlap (due to which the ULIP controversy happened between the SEBI and IRDA).

- Setting up a FRA (Financial Redressal Agency) to handle consumer complaints, regardless of area. It means, regulator not to oversee the consumer complaints.

- FSAT (Financial Sector Appellate Tribunal) to be set up to hear the appeals of entire financial sector.

- Advice to set up three other agencies which will oversee banking, besides the RBI.

The Industrial Relations Code, 2019

Context

Recently, Ministry of Labour and Employment introduced the Industrial Relations Code, 2019 in Lok Sabha.

About

Salient features of the bill are:

- The Industrial Relations Code, 2019 seeks to replace three labour laws: (i) the Industrial Disputes Act, 1947, (ii) the Trade Unions Act, 1926, and (iii) the Industrial Employment (Standing Orders) Act, 1946.

- Trade unions:Under the Code, seven or more members of a trade union can apply to register it. Trade unions that have a membership of at least 10% of the workers or 100 workers, whichever is less, will be registered. Further, a registered trade union must always have at least seven workers who are employed in the establishment or the connected industry, as its members. The central or state government may recognise a trade union or a federation of trade unions as Central or State Trade Unions respectively.

- Negotiating unions:The Code provides for a negotiation union in an industrial establishment for negotiating with the employer. If there is only one trade union in an industrial establishment, then the employer is required to recognise such trade union as the sole negotiating union of the workers. In case of multiple trade unions, the trade union with support of at least 75% of workers will be recognised as the negotiating union by the central or state government.

- Unfair labour practices:The Code prohibits employers, workers, and trade unions from committing any unfair labour practices listed in a Schedule to the Code. These include: (i) restricting workers from forming trade unions, (ii) establishing employer sponsored trade union of workers, and (iii) coercing workers to join trade unions.

- Standing orders:All industrial establishments with at least 100 workers must prepare standing orders on matters listed in a Schedule to the Code. The central government will prepare model standing orders on such matters, based on which industrial establishments are required to prepare their standing orders. These matters relate to: (i) classification of workers, (ii) manner of informing workers about hours of work, holidays, paydays, and wage rates, (iii) termination of employment, (iv) suspension for misconduct, and (v) grievance redressal mechanisms for workers

- Notice of change:Employers who propose changes in the conditions of service are required to give a notice to the workers. The conditions of service for which a notice is required to be given are listed in a Schedule to the Code and include wages, contribution, and leave.

- Lay-off and retrenchment:The Code defines lay-off as the inability of an employer, due to shortage of coal, power, or breakdown of machinery, from giving employment to a worker. It also provides for employers to terminate the services of a worker, i.e., retrenchment. Employers of industrial establishments such as mines, factories and plantations with at least 100 workers are required to take prior permission of the central or state government before lay-off, retrenchment or closure. The central or state government can modify this threshold number of workers by notification. Any person who contravenes this provision is punishable with a fine between one lakh rupees and Rs 10 lakh.

- Industrial establishments, in which 50 to 100 workers are employed, are required to: (i) pay 50% of basic wages and dearness allowance to a worker who has been laid off, and (ii) give one month’s notice and wages for such period to a worker who has been retrenched. Any person who contravenes this provision is punishable with a fine between Rs 50,000 and two lakh rupees. Further, if an employer proposes to re-employ retrenched workers, such workers will have preference over other persons.

- Voluntary arbitration:The Code allows for industrial disputes to be voluntarily referred to arbitration by the employer and workers. The parties to the dispute must sign a written agreement referring the dispute to an arbitrator. After investigating the dispute, the arbitrator will submit the arbitration award to the government.

- Resolution of industrial disputes:The central or state governments may appoint conciliation officers to mediate and promote settlement of industrial disputes. These officers will investigate the dispute and hold conciliation proceedings to arrive at a fair and amicable settlement of the dispute. If no settlement is arrived at, then any party to the dispute can make an application to the Industrial Tribunal.

- Industrial Tribunals:The Code provides for the constitution of Industrial Tribunals for the settlement of industrial disputes. An Industrial Tribunal will consist of two members: (i) a Judicial Member, who is a High Court Judge or has served as a District Judge or an Additional District Judge for a minimum of three years; and (ii) an Administrative Member, who has over 20 years of experience in the fields of economics, business, law, and labour relations.

- The central government may also constitute National Industrial Tribunals for settlement of industrial disputes which: (i) involve questions of national importance, or (ii) could impact industrial establishments situated in more than one state. Members of the National Industrial Tribunal will include: (i) a Judicial Member, who has been a High Court Judge, and (ii) an Administrative Member, who has been a Secretary in the central government.

Significance

- The Indian economy grew at 5% in the June quarter, a six-year low, while the country’s factory output shrank for the second straight month at 4.3% in September, recording its worst show since the present series was launched in April 2012. The ease of compliance of labour laws will promote the setting up of more enterprises, thus catalysing the creation of employment opportunities in the country.

National Milk Day 2019

Context

November 26this celebrated as National Milk Day in India. This isn’t the same as World Milk Day, which is marked on June 1st, and was established by the Food and Agricultural Organisation.

About

- India celebrates National Milk Day on 26th November in memory of Dr Verghese Kurien, fondly known as the Father of White Revolution.

- In 2014, all the dairy majors of the country, along with the Indian Dairy Association, resolved to observe Dr Kurien’s birth anniversary on 26th November as National Milk Day.

- National Milk Day is celebrated to promote benefits related to milk and milk industry and to create awareness among people about the importance of milk and milk products.

- India is celebrating 98th birth anniversary of Dr. Kurien this year.

History: Operation Flood and the White Revolution

- In the year 1970, ‘Operation Flood’ was launched as a National Dairy Development Board (NDDB) project.

- It transformed India from a milk-deficient nation into the world’s largest milk producer, surpassing the US in 1998.

- It created a national milk grid linking producers throughout India with consumers in over 700 towns and cities, reducing seasonal and regional price variations while ensuring that the producer gets a major share of the price consumers pay, by cutting out middlemen.

- All this was achieved not merely by mass production, but by production by the masses; the process has been called the white revolution. This is known as his ‘billion-litre idea’.

Significance of National Milk Day in 2019

- India is world leader in milk production since last 15 years and the credit goes to small producers.

- India has 108.7 million buffaloes, which makes 57% of the world buffalo population.

- India is number one in bovine population with 18% of the world population and contributes 20% of the total milk produced in the world.

- Indigenous breeds are tolerant to heat and resistant to diseases.

- The indigenous breeds of cows are known to produce A2 type milk which protects us from various chronic health problems such as cardiovascular diseases, diabetes and neurological disorders.

Why there is a need of New White Revolution?

- Surplus production in India:From a chronic milk deficit country in 1950-51, with a production of 19 Million Ton per year (MMT), the production has increased to 176 MMT in 2017, and per capita availability of Milk has reached 375 grams per day. As Indian milk production has continued to grow rapidly, growth in Milk production has outstripped population growth.

- Negligence of development of recognized Indian breeds: In White Revolution, the focus was on introduction of exotic cattle breeds like HF and jersey and producing their cross bred. Therefore the developments of recognized Indian breeds were largely neglected.

- Adulteration of milk and rising demand for organic milk:

- About 68 per cent of the milk produced in India is found to have adulterants like detergent, starch, urea and white paint.

- Consumers are becoming more health conscious day by day which is fuelling growth for organic and natural milk products instead of milk from animals that are injected with growth hormones for more milk production and are full of antibiotics.

Therefore there is a need to have a re-look at the whole policy for Dairy sector and to take steps so that the interests of the Indian farmers and consumers are protected.

Leaked NSSO data

Context

Leaked findings from the 2017-18 Consumer Expenditure Survey (CES) show that inflation-adjusted average monthly per capita expenditure (MPCE) declined by 3.7% in between 2011-12 and 2017-18. Government has debunked the report and decided not to release it siting ‘data quality issues’.

About

- Inflation-adjusted average monthly per capita expenditure (MPCE) declined by 3.7% in the country between 2011-12 and 2017-18, first time in four decades.

- The decline came because of an 8.8% decline in rural MPCE even as urban MPCE increased by 2%.

- The CES is a flagship survey of the National Statistical Office (NSO), formerly known as the National Sample Survey Office (NSSO), and is conducted every five years.

- The CES, in addition to being a source of information on consumption spending and inequality, is also used extensively in other statistical processes including revision of base years for calculation of GDP and the composition of the inflation basket.

- The 2017-18 CES was scheduled for release in June 2019. The previous CES was conducted in 2011-12.

- MOSPI has withheld the report and is examining the feasibility of conducting the next CES in 2020-2021 and 2021-22 after incorporating all data quality refinements in the survey process.

- CES 2017-18 is the second major NSO report to run into controversy. Earlier publication of the NSSO Periodic Labour Force Survey (PLFS) for 2017-18 was also in controversy. 75th round (Consumer Expenditure), 76th round (Drinking water, Sanitation, Hygiene, and Housing Conditions) survey results were also deemed controversial.

- Leaked PLFS findings showed the unemployment rate in the country to be 6.1%, a four-decade high.

- Data for 2017-18 shows Kerala has the most number of jobless people at 11.4 per cent. It is followed by Haryana (8.6 per cent), Assam (8.1 per cent) and Punjab (7.8 per cent).

- At 3.3 per cent, Chhattisgarh had the least unemployment in 2017-18. Madhya Pradesh (4.5 per cent) and West Bengal (4.6 per cent) were at second and third places.

- The joblessness rate rose the quickest in Gujarat — from 0.5 per cent in 2011-12 to 4.8 per cent in 2017-18.

Impact of not releasing CES report

- The decision of not releasing CES 2017-18 will have important policy implications given its widespread use in calculating GDP and measuring inflation.

- GDP base year revisions coincide with the period of CES surveys.

- The base year for GDP and Index of Industrial Production (IIP) was due to be revised to 2017-18. The base year of Consumer Price Index (CPI), India’s benchmark inflation measure, was to be changed to 2018.

- But by delaying the CES to 2020-21, the GDP base year revision will have to be postponed to at least 2025 because the survey results will not be available until 2023.

- CES surveys are also essential in calculating the contribution of the informal sector to the GDP and deciding weight of various items in the CPI basket.

Concluding arguments

Previous CES rounds have also been subject to other kinds of controversy but never has data been withheld, and a report was junked. The best way to resolve such controversies is to release the data transparently and let everybody who is familiar with such numbers, look at it. Otherwise it gives the impression that only statistics which are acceptable will be released and it is dangerous for the credibility of our statistical system.

Microhyla Eos

New Burrowing Frog Species

New Species of Freshwater Fish Found in Mizoram and Himachal Pradesh

Tarantula found in Kerala

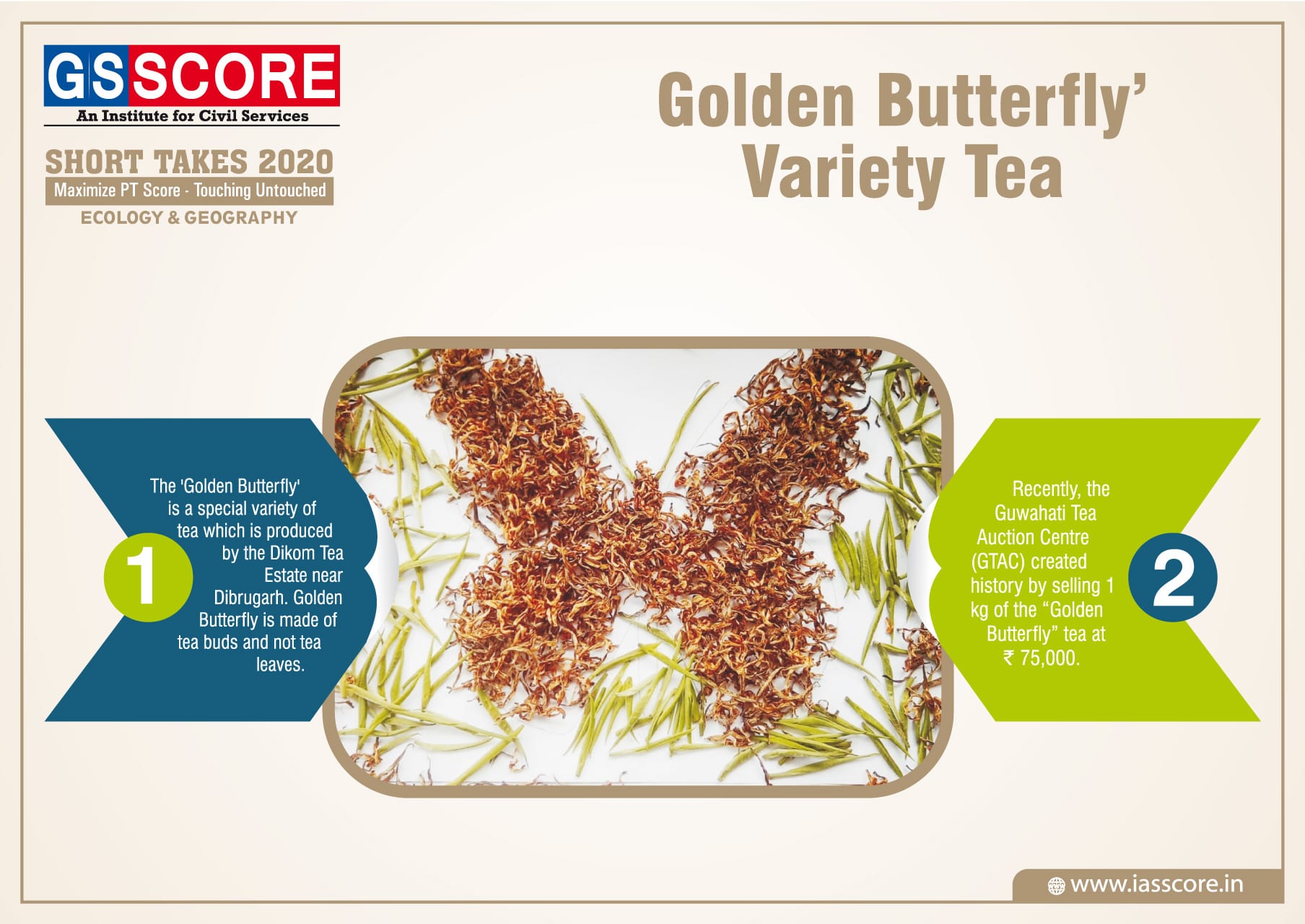

Golden Butterfly’ Variety Tea