Social Schemes: Ministry of Finance and Ministry of Minority Affairs

Ministry of Finance

Schemes

1. Pradhan Mantri Jan Dhan Yojana (PMJDY)

- Pradhan Mantri Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

- Account can be opened in any bank branch or Business Correspondent (Bank Mitr) outlet. Accounts opened under PMJDY are being opened with Zero balance. However, if the account-holder wishes to get cheque book, he/she will have to fulfill minimum balance criteria.

Document required to open an account under Pradhan Mantri Jan-Dhan Yojana

An account can be opened by presenting an officially valid document.

- the passport,

- the driving licence,

- the Permanent Account Number (PAN) Card,

- the Voter’s Identity Card issued by Election Commission of India,

- job card issued by NREGA duly signed by an officer of the State Government,

- the letter issued by the Unique Identification Authority of India containing details of name, address and Aadhaar number, or

- any other document as notified by the Central Government in consultation with the Regulator:

Provided that where simplified measures are applied for verifying the identity of the clients the following documents shall be deemed to be officially valid documents:—

- identity card with applicant's Photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks, and Public Financial Institutions;

- letter issued by a Gazetted officer, with a duly attested photograph of the person.

Special Benefits under PMJDY Scheme

- Interest on deposit.

- Accidental insurance cover of Rs. 2 lakhs

- No minimum balance required.

- The scheme provide life cover of Rs. 30,000/- payable on death of the beneficiary, subject to fulfillment of the eligibility condition.

- Easy Transfer of money across India

- Beneficiaries of Government Schemes will get Direct Benefit Transfer in these accounts.

- After satisfactory operation of the account for 6 months, an overdraft facility will be permitted

- Access to Pension, insurance products.

- The Claim under Personal Accidental Insurance under PMJDY shall be payable if the Rupay Card holder have performed minimum one successful financial or non-financial customer induced transaction at any Bank Branch, Bank Mitra, ATM, POS, E-COM etc. Channel both Intra and Inter-bank i.e. on-us (Bank Customer/rupay card holder transacting at same Bank channels) and off-us (Bank Customer/Rupay card holder transacting at other Bank Channels) within 90 days prior to date of accident including accident date will be included as eligible transactions under the Rupay Insurance Program 2019-2020.

- Overdraft facility upto Rs. 10,000/- is available in only one account per household, preferably lady of the household.

2. Pradhan Mantri Suraksha Bima Yojana

Eligibility: Available to people in age group 18 to 70 years with bank account.

Premium: Rs.12 per annum.

Payment Mode: The premium will be directly auto-debited by the bank from the subscribers account on or before 1 st June of each annual coverage period under the scheme.

Risk Coverage:

- Death - Rs 2 Lakh

- Total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot - Rs 2 Lakh

- Total and irrecoverable loss of sight of one eye or loss of use of one hand or foot – Rs.1 Lakh.

Eligibility : Any person having a bank account and Aadhaar number linked to the bank account can give a simple form to the bank every year before 1st of June in order to join the scheme. Name of nominee to be given in the form.

Terms of Risk Coverage : A person has to opt for the scheme every year. S/He can also prefer to give a long-term option of continuing in which case his/her account will be auto-debited every year by the bank.

Who will implement this Scheme?

- The scheme will be offered by all Public Sector General Insurance Companies and all other insurers who are willing to join the scheme and tie-up with banks for this purpose.

Government Contribution:

- Various Ministries can co-contribute premium for various categories of their beneficiaries from their budget or from Public Welfare Fund created in this budget from unclaimed money. This will be decided separately during the year.

- Common Publicity Expenditure will be borne by the Government.

3. The Pradhan Mantri Jeevan Jyoti Bima Yojana (for Life Insurance Cover

Eligibility: Available to people in the age group of 18 to 50 and having a bank account. People who join the scheme before completing 50 years can, however, continue to have the risk of life cover up to the age of 55 years subject to payment of premium.

Premium: Rs.330 per annum. It will be auto-debited in one instalment.

Payment Mode: The payment of premium will be directly auto-debited by the bank from the subscribers account.

Risk Coverage: Rs.2 Lakh in case of death for any reason.

Terms of Risk Coverage: A person has to opt for the scheme every year. He can also prefer to give a long-term option of continuing, in which case his account will be auto-debited every year by the bank.

Who will implement this Scheme?

- The scheme will be offered by Life Insurance Corporation and all other life insurers who are willing to join the scheme and tie-up with banks for this purpose.

Government Contribution:

- Various other Ministries can co-contribute premium for various categories of their beneficiaries out of their budget or out of Public Welfare Fund created in this budget out of unclaimed money. This will be decided separately during the year.

- Common Publicity Expenditure will be borne by Government.

4. Atal Pension Yojana (APY)

Atal Pension Yojana (APY) addresses the old age income security of the working poor and the longevity risks among the workers in unorganised sector. It encourages the workers in unorganised sector to voluntarily save for their retirement. The Government had launched the scheme with effect from 1st June, 2015. The scheme replaces the Swavalamban Yojana / NPS Lite scheme.

Benefits of APY

- Fixed pension for the subscribers ranging between Rs.1000 to Rs. 5000, if s/he joins and contributes between the age of 18 years and 40 years. The contribution levels would vary and would be low if subscriber joins early and increase if s/he joins late.

- The same pension is payable to Spouse after death of Subscriber.

- Return of indicative pension wealth to nominees after death of spouse.

- Contributions to the Atal Pension Yojana (APY) is eligible for tax benefits similar to the National Pension System (NPS). The tax benefits include the additional deduction of Rs 50,000 under section 80CCD(1).

Eligibility for APY

- Atal Pension Yojana (APY) is open to all bank account holders who are not members of any statutory social security scheme.

- Any individual who is eligible to receive benefits under the APY will have to furnish proof of possession of Aadhaar number or undergo enrolment under Aadhaar authentication. An APY subscriber will have to get the Aadhaar number recorded in his or her APY pension account and also in his/ her savings account where the periodic pension contribution instalments are debited and government co-contribution is to be credited.

Age of joining and contribution period

- The minimum age of joining APY is 18 years and maximum age is 40 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

Focus of APY

- Mainly targeted at unorganised sector workers.

Enrollment and Subscriber Payment

- All bank account holders under the eligible category may join APY with auto-debit facility to accounts, leading to reduction in contribution collection charges.

Enrollment agencies

- All Points of Presence (Service Providers) and Aggregators under Swavalamban Scheme would enroll subscribers through architecture of National Pension System.

Operational Framework of APY

- It is Government of India Scheme, which is administered by the Pension Fund Regulatory and Development Authority. The Institutional Architecture of NPS would be utilised to enroll subscribers under APY.

Funding of APY

Government would provide

- fixed pension guarantee for the subscribers;

- Under the APY, the Central Government’s co-contribution of 50% of the subscriber’s contribution upto Rs. 1000 per annum, was available to each eligible subscriber, for a period of 5 years, i.e. from 2015-16 to 2019-20, who join APY before 31st March, 2016 and who is not a beneficiary of any social security scheme and is not an income tax payer.

- Government would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

5. Pradhan Mantri Vaya Vandana Yojana

Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a Pension Scheme announced by the Government of India exclusively for the senior citizens aged 60 years and above which is available from 4th May, 2017 to 31st March, 2020.

Benefits of the scheme

Following are the major benefits under the Pradhan Mantri Vaya Vandana Yojana (PMVVY):

- Scheme provides an assured return of 8% p.a. payable monthly (equivalent to 8.30% p.a. effective) for 10 years.

- Pension is payable at the end of each period, during the policy term of 10 years, as per the frequency of monthly/ quarterly/ half-yearly/ yearly as chosen by the pensioner at the time of purchase.

- The scheme is exempted from Service Tax/ GST.

- On survival of the pensioner to the end of the policy term of 10 years, Purchase price along with final pension installment shall be payable.

- Loan upto 75% of Purchase Price shall be allowed after 3 policy years (to meet the liquidity needs). Loan interest shall be recovered from the pension installments and loan to be recovered from claim proceeds.

- The scheme also allows for premature exit for the treatment of any critical/ terminal illness of self or spouse. On such premature exit, 98% of the Purchase Price shall be refunded.

- On death of the pensioner during the policy term of 10 years, the Purchase Price shall be paid to the beneficiary.

- The ceiling of maximum pension is for a family as a whole, the family will comprise of pensioner, his/her spouse and dependants.

- The shortfall owing to the difference between the interest guaranteed and the actual interest earned and the expenses relating to administration shall be subsidized by the Government of India and reimbursed to the Corporation.

Eligibility Conditions and Other Restrictions

- Minimum Entry Age: 60 years (completed)

- Maximum Entry Age: No limit

- Policy Term : 10 years

- Investment limit : Rs 15 lakh per senior citizen

- Minimum Pension: Rs. 1,000/- per month

Rs. 3,000/- per quarter

Rs.6,000/- per half-year

Rs.12,000/- per year - Maximum Pension: Rs. 10,000/- per month

Rs. 30,000/- per quarter

Rs. 60,000/- per half-year

Rs. 1,20,000/- per year

Ceiling of maximum pension is for a family as a whole i.e. total amount of pension under all the policies allowed to a family under this plan shall not exceed the maximum pension limit. The family for this purpose will comprise of pensioner, his/her spouse and dependants.

The Scheme can be purchased offline as well as online through Life Insurance Corporation (LIC) of India which has been given the sole privilege to operate this Scheme.

Ministry of Minority Affairs

Schemes

6. Padho Pardesh

- The Ministry of Minority Affairs have implemented "Padho Pardesh"- A scheme of interest subsidy on educational loans for overseas studies for the students belonging to the minority communities viz. Muslims, Christians, Sikhs, Buddhists, Jains and Parsis and want to pursue higher studies like Masters, M.Phil & Ph.D level outside India.

- The interest subsidy will be given for the period of moratorium (i.e. course period plus one year or six months after getting a job, whichever is earlier) as per the education loan scheme of the Indian banks Association (IBA). Student can take Educational Loan from any Private Bank, Public Sector Bank, Scheduled commercial Bank and Co-operative Banks etc. which is a member of IBA.

Eligibility for Padho Pardesh Scheme

- A candidate must have secured admission in University abroad to pursue Post Graduate Diploma, Masters, Ph.D or M. Phil courses with overall family income exceeding not more than 6 lakhs per annum. Family income refers to gross income of parents of the candidate if he/she is unmarried or gross income of the spouse in case the candidate is married.

How to avail the Padho Pardesh Scheme

- While taking loan from any Private Bank, Public Sector Bank, Scheduled commercial Bank or Co-operative Bank, the candidate should inform the bank that the Ministry of Minority Affairs have introduced Padho Pardesh Scheme for minority community students to help them pursue higher education abroad. The concerned bank will fill the candidate's info in the Padho Pardesh Portal launched by Canara which is the implementing agency for this particular scheme. The portal will be open for two months in every quarter.

7. USTAAD:-

- The Scheme aims at upgrading Skills and Training in preservation of traditional Ancestral Arts/Crafts of minorities.

8. Hamari Darohar:-

- The Scheme aims to preserve rich heritage of minority communities in context of Indian culture.

9. Khwaza Garib Nawaz Senior Secondary School

- It will be established at Ajmer by Maulana Azad Education Foundation (MAEF) to give a fillip to minority education.

10. Nai Manzil:

- A bridge course to bridge the academic and skill development gaps of the deeni Madrasa passouts with their mainstream counterparts.

11. Strengthening of State Wakf Boards:

- The scheme envisages to provide assistance for meeting the training and administrative cost of State Wakf Boards, removal of encroachment from Waqf Properties and also strengthening of Zonal/Regional offices of Waqf Boards.

The government has taken the following steps to ensure that these benefits reach the intended beneficiaries.

- The Scholarship Schemes have been restructured to allow for greater transparency and accountability during processing and sanction.

- To help evaluation of flow of benefits, segregated data for the different minority communities is being sought from all Ministries. The states/UTs have also been requested to provide better and timely feedback.

- The scholarship schemes are reviewed regularly through interaction with the State Governments at regular intervals and field visits by the Ministry officials.

- The Online Scholarship Management System (OSMS) earlier introduced for the Merit-cum-Means scholarship scheme has now been extended to Post Matric scholarship scheme.

World Heritage List for the year 2020

Context

- Government of India has submitted two nomination dossiers namely ‘Dholavira: A Harappan City’ and ‘Monuments and Forts of Deccan Sultanate’ for inclusion in the World Heritage List for the year 2020.

- of Madhya Pradesh has submitted the proposal of ‘Group of Monuments at Mandu’ in the year 2019.

- The dossier was further forwarded to World Heritage Centre (WHC) for completeness check.

- A consultation workshop was organized by the Wild Life Institute of India and State Govt. of Madhya Pradesh to inventorize and prioritize the potential World Heritage Sites of M.P.

- The workshop has proposed Bhedaghat (Narmada Valley) as one of the recommended potential site subject to criteria set by UNESCO World Heritage Centre.

Blue Dot network

Context

India and the United States may not have signed the elusive limited trade deal during the visit of US President Donald Trump, but Washington was able to ask New Delhi to participate in the Blue Dot Network (BDN), an initiative under the quadrilateral mechanism that seeks to build and finance quality infrastructure projects.

About

- The concept of the Blue Dot Network was officially launched on 4 November 2019 at the Indo-Pacific Business Forum in Bangkok, Thailand.

- It will be led by the US (International Development Finance Corporation (DFC)), along with Japan (Japanese Bank for International Cooperation) and Australia (Department of Foreign Affairs and Trade)- the three countries, along with India, form the Quadrilateral grouping.

- Multi-stakeholder initiative: It is meant to be a multi-stakeholder initiative that aims to bring governments, the private sector and civil society together to promote “high quality, trusted standards for global infrastructure development”.

- This means that as part of this initiative, infrastructure projects will be vetted and approved by the network depending on standards, as per which, the projects should meet certain global infrastructure principles.

- The projects that are approved will get a “Blue Dot”, thereby setting universal standards of excellence, which will attract private capital to projects in developing and emerging economies.

Countering China’s Belt and Road Initiative?

- The proposal for the Blue Dot network is part of the US’s Indo-Pacific strategy, which is aimed at countering Chinese ambitious BRI.

- Blue Dot may be seen as a counter to BRI, it will need a lot of work for two reasons.

- First, there is a fundamental difference between BRI and Blue Dot — while the former involves direct financing, giving countries in need immediate short-term relief, the latter is not a direct financing initiative and therefore may not be what some developing countries need.

- Secondly, Blue Dot will require coordination among multiple stakeholders when it comes to grading projects. “Given the past experience of Quad, the countries involved in it are still struggling to put a viable bloc. Therefore, it remains to be seen how Blue Dot fares in the long run.” (Quad is an informal strategic dialogue between the US, Japan, Australia and India)

US foreign policy towards China

- Before 2001, US foreign policy was focussed towards integrating China into its plan, but this changed after China’s emergence as a global superpower.

- Under Barack Obama, US foreign policy started shifting focus to Asia, where the US wanted to counter China’s growing influence.

- The Indo-Pacific region, which stretches from India’s west coast to the west coast of the US, is the most economically dynamic and populous part of the world.

- Further, the US sees China’s infrastructure investments and trade strategies as reinforcing its geopolitical aspirations, including efforts to build and militarise outposts in the South China Sea, which as per the US, restricts the free movement of trade and undermines regional stability.

Significance of the network:

- Boost to infrastructure: A country that joins the Blue Dot Network as a partner will boost its project capability efforts. Further, if the infrastructure development projects of that particular country obtain a Blue Dot certification, they will be seen as adhering to the highest level of global standards.

- Access to financing institutions: Access to private and public financing institutions will help mitigate financing risks, acting as an impetus for developing countries like India to smoothly undertake development projects domestically as well as internationally.

- Clear project standards: The Blue Dot Network will provide countries with clear project standards. Projects, companies, and governments that meet or uphold the standards can build public confidence in their commitment to good practices.

Agreement for Bringing Peace to Afghanistan

Context

The United States has signed an agreement with Taliban insurgents that could pave the way for ending the 18-year-war in Afghanistan in Doha (Qatar).

About

Highlights of the Agreement

- Military troops withdrawal: It lays out a 14-month timetable for the withdrawal of “all military forces of the United States, its allies, and Coalition partners, including all non-diplomatic civilian personnel, private security contractors, trainers, advisors, and supporting services personnel.”

- Release of prisoners: The agreement also calls for the release of 5,000 Taliban prisoners and 1,000 “prisoners of the other side” on the first day of intra-Afghan negotiations. The relevant sides have the goal of releasing all the remaining prisoners over the course of the subsequent three months.

- Comprehensive Ceasefire between the Afghan Government and Taliban.

- The prevention of the use of Afghanistan by any group or individual against the security of the United States and its allies.

- Facilitation of an intra-Afghan dialogue: The participants of intra-Afghan negotiations will discuss the date and modalities of a permanent and comprehensive ceasefire, including agreement over the future political roadmap of Afghanistan.

Background

- The war in Afghanistan was launched by the US in 2001 after the 9/11 attack. The US-led coalition aimed to overthrow the Taliban.

- However, the war in Afghanistan got derailed as the U.S. shifted focus and resources towards Iraq from 2003 onwards.

- The end objective of a stable and peaceful Afghanistan began to recede as the Taliban launched their insurgency in 2005 after they had recovered, regrouped and refinanced themselves from their sanctuary in Pakistan.

- Since then, the insurgency has gathered momentum and also exposed the U.S 's policy weaknesses.

- After taking over in 2009, President Barack Obama authorised a surge in U.S. troop presence with the objective to gain a decisive victory over the insurgency. He simultaneously announced the drawdown of forces would commence in 2011, and by 2014 the Afghan security forces would take charge of all combat operations.

- However, this only encouraged the Taliban insurgency and exposed the shortcomings of the Afghan army and the police forces, in terms of numbers, training and equipment to deal with the post-2014 situation.

- In 2014, the U.S. announced the withdrawal of the bulk of soldiers but a few thousand U.S. soldiers were to stay behind to “advise, train and assist” the Afghan security forces under Operation Resolute Support.

- In 2017, the U.S. President Donald Trump laid out a strategy for “Afghanistan and South Asia”.

- His policy was different from those of his predecessors as it stated that American involvement in Afghanistan was “not for nation-building” but was limited to “killing terrorists.”

- He called this policy “Principled Realism” - with a shift from a time-based approach to one based on conditions. This policy was based on two pillars:

- Military Involvement: The additional troops which would serve two roles: counterterrorism missions and training the Afghan forces.

- Political Involvement: A negotiated political settlement with the Taliban, if the situation moves in that direction.

- Since October 2018, Taliban representatives and US officials have been meeting to chalk out a peace treaty.

India’s Stand

- India has been always supportive of the inclusive peace process, specifically Afghan-owned, Afghan-led and Afghan-controlled.

- The participation of the Afghan government’s delegation during the Doha agreement as well as the upcoming intra-Afghan peace negotiations would be following the path desired by India.

- The deal has reiterated India’s commitment to Afghanistan’s pursuit of “sustainable peace and reconciliation”.

- Thus, India has accepted the Doha Agreement (2020).

Conclusion

- Achieving lasting peace in Afghanistan will require more than the Doha Agreement. It is indeed a good step for peace in Aisa as well in Afghanistan. To resolve conflict within Afghanistan, the battlefield needs to be isolated i.e. external support to the terrorist activities needs to be abandoned. Also, the countries need to keep their respective interests aside, to build peace in the region.

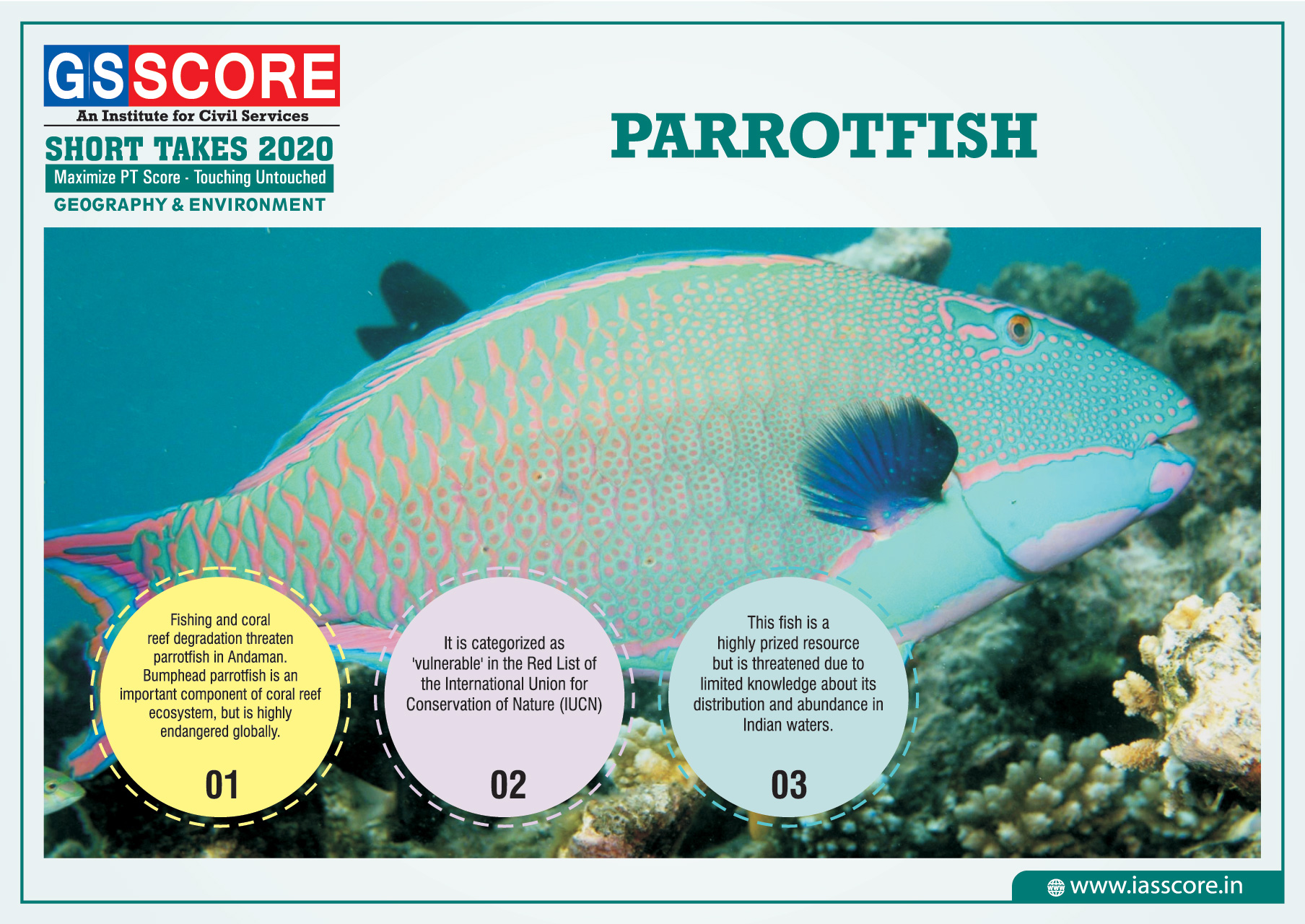

Parrotfish

Bramble Cay Melomys: The First Mammal to Go Extinct Due To Climate Change

World’s Largest Bee

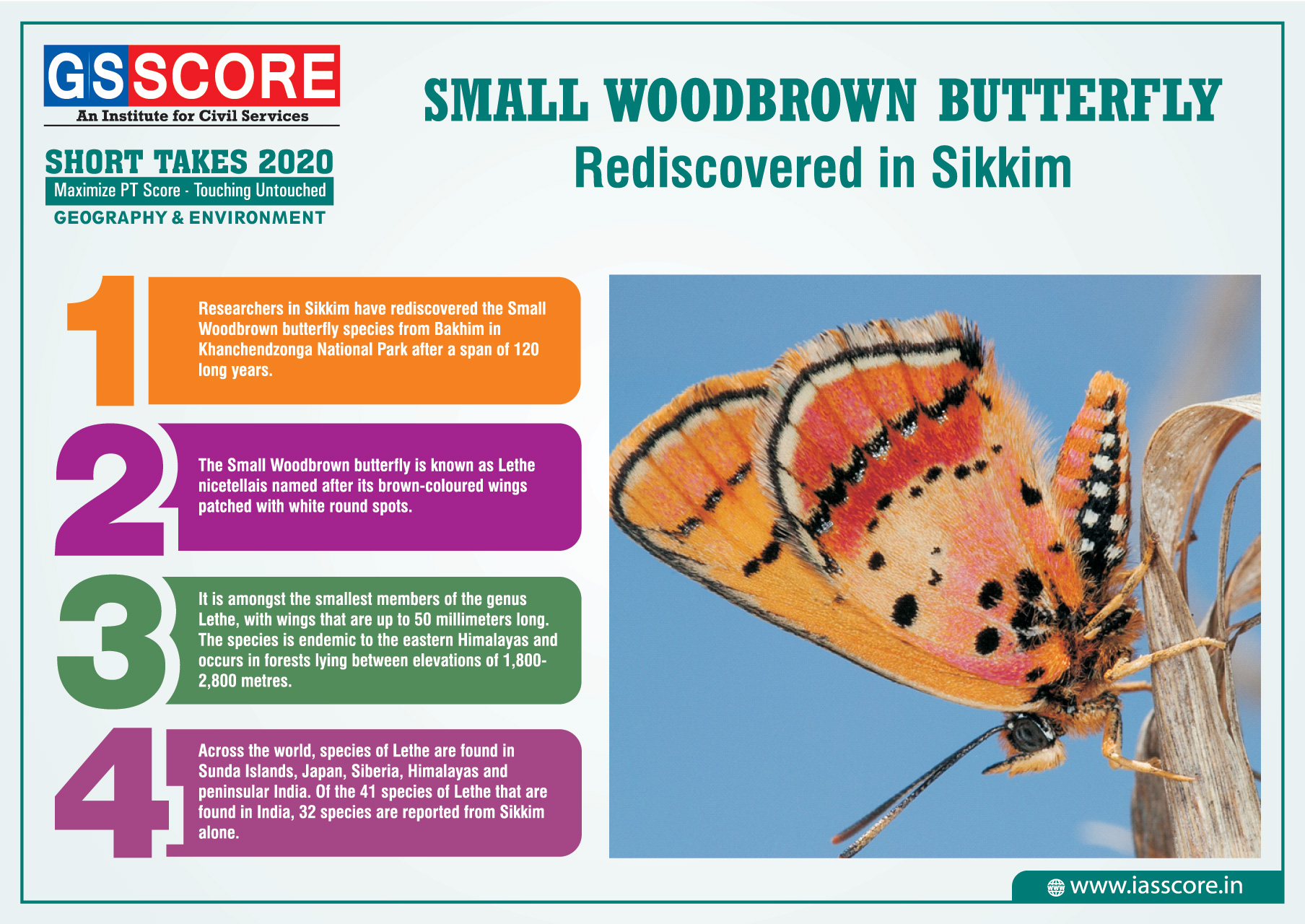

Small Woodbrown Butterfly: Rediscovered in Sikkim

Success of Golden Langur Breeding Project