26th May 2023 (5 Topics)

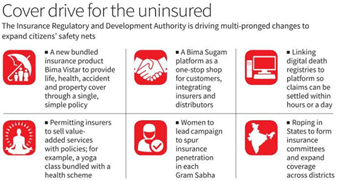

The Insurance Regulatory and Development Authority (IRDA) is developing an affordable single policy that covers health, life, property, and accident risks in order to safeguard residents and speed up claim settlements by merging death records onto a single industry platform.

What is the need for an affordable single insurance policy in India?

- Simplified Coverage: Instead of managing multiple policies and premiums, a comprehensive policy streamlines the insurance process and offers ease of administration.

- Cost Efficiency: Combining various insurance coverages into a single policy can lead to cost savings for individuals.

- Comprehensive Protection: A single insurance policy covering health, life, property, and accident risks ensures comprehensive protection for individuals.

- Flexibility and Customization: An affordable single insurance policy can be designed to allow individuals to customize coverage based on their specific needs.

- Enhanced Risk Mitigation: By integrating different types of risks under a single policy, individuals can benefit from a more comprehensive risk mitigation strategy.

- Increased Insurance Penetration: An affordable single insurance policy that covers multiple risks can encourage higher insurance penetration.

|

Snapshot of Indian Insurance market

|

What are the IRDA plans to compensate the protection gaps through the initiative?

- Bima Trinity: The IRDA is striving to create an "UPI-like moment" in insurance through a plan called the "Bima Trinity".

- Bima Vistar: A new Bima Sugam platform will integrate insurers and distributors on to one platform, while the regulator is developing a possible lynchpin product Bima Vistar, which will be a bundled risk cover for life, health, property and casualties or accidents.

- Bima Vaahaks (carriers): The next part of the trinity involves a women-centric workforce of Bima Vaahaks (carriers) in each Gram Sabha to convince the women heads of each household that a composite insurance product like Bima Vistar can come in handy if there is any distress.

- With many States digitising their birth and death registries on the IRDA platform, if integrated with those registries, claims could be settled as fast as six to eight hours or a day.

Will the latest amendment benefit the residents?

- Attracting investment: These initiatives are part of a broader overhaul, including legislative amendments to attract more investments through differentiated licences for niche players similar to the banking sector.

- Increasing accessibility: It would make insurance “available, affordable and accessible” to citizens with a ‘Gram Sabha- to district- to State-level’ approach.

- Increased employment: These changes could double the number of jobs in the sector to 1.2 crore.

- Addition of value added service: The IRDA is proposing amendments to the insurance laws that will allow differentiated capital requirements for niche insurers and permit players to add value-added services to the policies they sell.

- Enable the entry of new players: The proposed amendments will also enable the entry of new players in the form of micro, regional, small, captive players, specialised players, and even composite licences, which will be able to cater to different geographies and segments of the population.

|

Insurance Regulatory and Development Authority or IRDA

|