24TH July 2024 (14 Topics)

Context

Finance Minister Nirmala Sitharaman has announced significant changes to the income tax regime for the financial year 2024–25, aimed at providing additional benefits to taxpayers opting for the new tax structure.

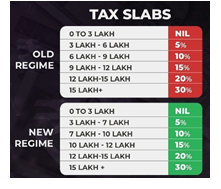

Key Changes in Tax Slabs:

- Revised Tax Slabs:

- Incomes in the Rs 3-6 lakh slab previously taxed at 5% will now apply to incomes in the Rs 3-7 lakh slab.

- The 10% tax rate for incomes in the Rs 6-9 lakh slab has been revised to apply to incomes of Rs 7-10 lakh.

- The Rs 9 lakh to Rs 12 lakh slab now falls under Rs 10 lakh to Rs 12 lakh with a tax rate of 15%.

- Standard Deduction Increase:

- The standard deduction under Section 115BAC for employees in the new tax regime has been raised from Rs 50,000 to Rs 75,000.

- Employees opting for the old regime will continue to receive the standard deduction of Rs 50,000.

- Deduction Limits in Employer NPS Raised:

- The deduction for employer contributions to the National Pension System (NPS) has been raised from 10% to 14% of the salary.

- This enhancement applies to both tax regimes, encouraging long-term financial security for employees.

- Introduction of NPS Vatsalya:Budget 2024 introduced NPS Vatsalya, allowing parents to open NPS accounts in the name of minor children, convertible into regular NPS accounts upon adulthood.

- Review of Income-Tax Act:The Income-Tax Act, 1961, will undergo a comprehensive review to simplify and clarify provisions, potentially reducing confusion and litigation.

- Rebate under Section 87A:The rebate limit under Section 87A remains at Rs 25,000, with implications for taxpayers under the new tax regime.

Fact Box:Income tax slabs

Standard deduction

|

More Articles