24TH July 2024 (14 Topics)

Mains Issues

Context

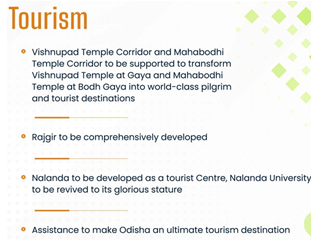

The Union Budget 2024 has marked a significant shift towards promoting tourism in Bihar and Odisha, highlighting these states' cultural richness and potential for economic development. This move aligns with the government's broader strategy of regional development under the 'Purvodaya' plan, aimed at transforming the eastern region of India into a hub of growth and cultural heritage.

What is 'Purvodaya' Plan?

- The 'Purvodaya' plan targets holistic development across Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

- To propel these states as engines of development, it emphasizes:

- human resource development

- infrastructure enhancement

- economic opportunities

- Tourism Strategy: The shift from circuit-based to destination-based tourism signifies a focused approach towards developing specific tourist destinations. This includes upgrading tourist facilities, improving connectivity, and boosting local economies through tourism-related activities.

Focus on Bihar and Odisha:

- Tourism Development: Bihar and Odisha have been identified for comprehensive tourism development initiatives. The focus includes enhancing infrastructure, connectivity, and tourist facilities at key heritage sites like the

- Vishnupad temple in Gaya

- Mahabodhi temple in Bodhgaya (Bihar)

- and various cultural and natural attractions in Odisha

- A new temple corridor will be constructed for Vishnupad at Gaya. Similarly, a new corridor will be built for Mahabodhi temple corridor at Bodh Gaya. Both the corridors will be supported and modelled on the Kashi Vishwanath temple

- On the same lines, a comprehensive development scheme has been announced for Rajgir. Rajgir has immense spiritual significance for Hindus, Buddhists and Jains.

- Nalanda in Bihar will be developed as tourist destination.

Fact Box: Key-Locations

§ Rajyatana Tree: Marked as the site where Buddha spent the Seventh Week.

|

Mains Issues

Context

Palestinian factions Hamas and Fatah signed a unity declaration in China aimed at forming a joint government to govern Gaza and the West Bank following the end of the recent Israel-Hamas conflict.

Background:

- Hamas, an Islamist party, and Fatah, a secular party, have been bitter rivals since the late 1980s.

- Their conflict intensified after Hamas won the 2006 Palestinian legislative elections and subsequently took control of Gaza from Fatah in 2007 through a violent takeover.

Key Points of the Deal:

- Formation of Unity Government: The agreement outlines the establishment of an interim national unity government to govern Gaza and the West Bank.

- Unified Palestinian Leadership: It aims to create unified leadership among Palestinian factions in preparation for future elections.

- Elections for Palestinian National Council: The deal calls for free and fair elections to elect a new Palestinian National Council.

- Declaration of Unity: It emphasizes solidarity among Palestinian groups in response to ongoing Israeli military actions.

Implications:

- Internal Palestinian Unity: The agreement potentially paves the way for reconciliation and cooperation between Hamas and Fatah after years of division and conflict.

- Political Stability: A unified government could provide greater political stability in Gaza and the West Bank, potentially reducing internal tensions and improving governance.

- International Reaction: The deal could influence international perceptions of Palestinian unity and impact foreign policy approaches towards the Palestinian territories.

- Challenges Ahead: Divergent views on Israel, Hamas's refusal to recognize Israel, and the implementation of the agreement's provisions remain significant challenges to lasting unity and peace.

Mains Issues

Context

In the Union Budget, Finance Minister Nirmala Sitharaman announced a significant boost in infrastructure spending, highlighting its pivotal role in driving economic growth and improving living standards across India.

Key Highlights:

- Infrastructure Spending Surge:The government has allocated Rs 11,11,111 crore for capital expenditure on infrastructure, equivalent to 3.4% of the GDP. This marks a doubling of infrastructure spending from 1.7% of GDP three years ago.

- Support to State Governments:A provision of Rs 1.5 lakh crore has been made for interest-free loans to state governments, aimed at bolstering their infrastructure investments.

- Pradhan Mantri Gram SadakYojana (PMGSY):Under Phase-4 of PMGSY, the government plans to provide all-weather connectivity to 25,000 rural habitations, enhancing rural accessibility and connectivity.

- Accelerated Irrigation Benefit Programme:A support of Rs 11,500 crore has been earmarked for projects like the Kosi-Mechi intra-state link under this programme, aiming to improve irrigation infrastructure and agricultural productivity.

- Special Packages for North and Northeastern States:Assam, Himachal Pradesh, Uttarakhand, and Sikkim will receive assistance for flood management and recovery from natural disasters like cloud bursts, flash floods, and landslides.

- PM AwasYojana - Housing for All:The government has committed to constructing three crore additional houses under PM AwasYojana in both rural and urban areas, ensuring adequate housing for all sections of society.

- Rural Development and Infrastructure:An allocation of Rs 2.66 lakh crore has been set aside for rural development, including infrastructure projects, aimed at improving connectivity, healthcare, education, and economic opportunities in rural India.

Multiplier Effect of Infrastructure:

Infrastructure development plays a crucial role in stimulating economic growth and improving overall quality of life. The multiplier effect of increased infrastructure spending includes:

- Industry Boost: Improved infrastructure enhances productivity and efficiency across industries, fostering economic growth and job creation.

- Connectivity: Enhanced connectivity through better roads, railways, and digital infrastructure facilitates smoother movement of goods and people, reducing logistical costs and improving trade efficiency.

- Quality of Life: Upgraded infrastructure, including better healthcare, education facilities, and housing, directly contributes to an improved quality of life for citizens.

- Economic Development: Infrastructure investments act as catalysts for economic development by attracting private investments, boosting consumer spending, and supporting entrepreneurship.

- Resilience and Sustainability: Modern infrastructure strengthens resilience against natural disasters and climate change impacts, ensuring sustainable development in the long term.

Prelims Articles

Context

The Union Budget 2024-25 has allocated significant funds under the Ministry of External Affairs (MEA) for aid to foreign countries, particularly focusing on India's neighbourhood and strategic partners. This allocation reflects India's continued emphasis on bolstering diplomatic ties and supporting developmental projects abroad.

Allocation Breakdown:

- Neighbourhood Focus:

- Bhutan emerges as the top recipient with an allocation of Rs 2,068.56 crore, slightly lower than the previous year's Rs 2,400 crore.

- Nepal receives Rs 700 crore, marking a notable increase from Rs 550 crore in the previous year's budget.

- Maldives retains its allocation at Rs 400 crore, consistent with the previous year despite diplomatic tensions.

- Sri Lanka sees an increase to Rs 245 crore from Rs 150 crore, aimed at supporting infrastructure and development projects.

- Seychelles receives Rs 40 crore, up from Rs 10 crore previously allocated.

- Other Regional Allocations:

- Afghanistan maintains its allocation at Rs 200 crore.

- The Chabahar port project in Iran continues to receive Rs 100 crore, unchanged for the past three years.

- Overall MEA Budget:

- The total Budget estimate for MEA for 2024-25 is Rs 22,155 crore, a significant increase from Rs 18,050 crore in the previous year.

- However, it falls short of the revised estimate of Rs 29,121 crore for the same fiscal, indicating adjustments in financial planning.

Purpose and Impact:

- India's aid and assistance programmes aim to strengthen bilateral and multilateral relations, enhance regional stability, and support infrastructure development in recipient countries.

- The allocations reflect strategic priorities and diplomatic efforts to maintain influence and cooperation in India's extended neighbourhood and beyond.

Fact Box:India’s Neighbourhood First Policy

Major initiatives

Infrastructure projects

|

Prelims Articles

Context

The Union Cabinet has approved the ambitious Pradhan MantriJanjati Adivasi Nyaya MahaAbhiyan (PM-JANMAN) scheme, with a whopping budget of Rs 24,104 crore. The government also announced the Pradhan MantriJanjatiUnnat Gram Abhiyan scheme for improving the conditions of tribal communities.

About PM-JANMAN

- PM-JANMAN was announced on the birth anniversary of tribal leader Birsa Munda, celebrated as Janjatiya Gaurav Diwas (November 15), in Jharkhand.

- This initiative is aimed at addressing the needs of Particularly Vulnerable Tribal Groups (PVTGs) across India, making it the largest Central scheme targeted at tribal communities in terms of financial outlay.

- The scheme will focus on various essential facilities including:

- Housing: Approximately 4.9 lakh pucca houses will be constructed at a cost of Rs 2.39 lakh per house.

- Education: Establishment of 500 hostels costing Rs 2.75 crore per unit, and setting up 2,500 Anganwadi centres.

- Connectivity: Installation of mobile towers in 3,000 villages and development of 8,000 km of road connectivity.

- Health and Nutrition: Ensuring access to healthcare through mobile medical units and wellness centres set up by the Ministry of Ayush.

- Livelihood Opportunities: Skill and vocational training initiatives by the Ministry of Skill Development and Entrepreneurship to promote sustainable livelihoods.

- Financial Allocation and Implementation:The scheme is funded with Rs 15,336 crore from the Centre and Rs 8,768 crore from the states. It involves coordination among nine ministries to ensure effective implementation of various interventions aimed at uplifting PVTGs.

About Pradhan MantriJanjatiyaUnnat Gram Abhiyan

- Pradhan MantriJanjatiyaUnnat Gram Abhiyanhas been announced for 63,000 tribal villages, benefitting 5 crore tribals.

- The programme aims at achieving saturation coverage for tribal families in tribal-majority villages and aspirational districts.

Fact Box: PVTGs in India

Government’s welfare outreach to ST communities

|

Prelims Articles

Context

The Indian government has announced a significant boost to the housing sector through a revamped version of the Pradhan MantriAwasYojana (PMAY). The fourth phase of Pradhan Mantri Gram SadakYojana (PMGSY) to connect 25,000 habitations with all-weather roads is announced.

About PMAY 2.0

- This initiative aims to address housing needs for poor and middle-class families in urban areas, with a massive budgetary allocation of Rs 10 lakh crore.

- Under PMAY 2.0, the government plans to benefit one crore families by providing affordable housing loans and interest subsidies.

- Additionally, provisions are being made to include an additional three crore houses under the scheme across rural and urban areas.

- The recent budget has allocated Rs 82,576.57 crore to the Ministry of Housing and Urban Affairs for 2024-2025, marking an 8.03% increase from the previous year.

About Pradhan MantriAwasYojana (PMAY)

Pradhan Mantri Gram SadakYojana (PMGSY)

|

Prelims Articles

Context

The government will implement three schemes for 'Employment Linked Incentive', as part of the Prime Minister's package. These will be based on enrolment in the EPFO, and focus on recognition of first-time employees, and support to employees and employers.

About the Scheme

The government will implement following 3 schemes for ‘Employment Linked Incentive’:

- Scheme A: First Timers: This scheme will provide one-month wage to all persons newly entering the workforce in all formal sectors. The direct benefit transfer of one-month salary in 3 instalments to first-time employees, as registered in the EPFO, will be up to Rs. 15,000. The eligibility limit will be a salary of Rs. 1 lakh per month. The scheme is expected to benefit 210 lakh youth.

- Scheme B: Job Creation in manufacturing: This scheme will incentivize additional employment in the manufacturing sector, linked to the employment of first-time employees.

- Scheme C: Support to employers: This employer-focussed scheme will cover additional employment in all sectors. All additional employment within a salary of Rs. 1 lakh per month will be counted.

Prelims Articles

Context

In the Union Budget for the fiscal year 2024-25, Finance Minister Nirmala Sitharaman has prioritized enhancing productivity and resilience in agriculture. This sectoral focus comes amidst ongoing challenges in the agriculture domain, including subsidy reductions which have drawn criticism from farmer organizations.

Key Highlights:

- Budget Allocation for Agriculture:52 lakh crore has been allocated for farming and allied sectors, reflecting a significant commitment to bolster agricultural infrastructure and productivity.

- Focus on Research and Innovation:A comprehensive review of the agriculture research setup is planned to emphasize productivity enhancement and the development of climate-resilient crop varieties.

- Support for Farmer-Producer Organizations (FPOs) and Cooperatives:Promotion of FPOs, cooperatives, and startups in vegetable supply chains, focusing on collection, storage, and marketing to empower farmers economically.

- Digital Public Infrastructure and Agricultural Reforms:Digital Public Infrastructure is to be implemented for Agriculture, including digital crop surveys in 400 districts to enhance agricultural data accuracy and planning.

- Financial support for setting up Nucleus Breeding Centres for shrimp broodstocks through NABARD to boost aquaculture.

- For farmers, higher Minimum Support Prices has been announced for all major crops delivering on the promise for at least a 50% margin over cost.

- A digital crop survey will be conducted, covering 6 crore farmers across 400 districts beginning in the ongoing Khareef season.

- Natural Farming: 1 crore farmers will be initiated into natural farming over the next few years. The government will also look to strengthen production, storage, and marketing for self-reliance in pulses and oilseeds.

- 6 crore farmers will be brought into the farm and land registry and Kisan credit cards will be provided.

- New Variety: New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation by farmers.

- Missions for pulses and oilseeds: A strategy is being put in place to achieve ‘atmanirbharta’ for oil seeds such as mustard, groundnut, sesame, soybean, and sunflower.

Prelims Articles

Context

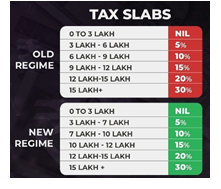

Finance Minister Nirmala Sitharaman has announced significant changes to the income tax regime for the financial year 2024–25, aimed at providing additional benefits to taxpayers opting for the new tax structure.

Key Changes in Tax Slabs:

- Revised Tax Slabs:

- Incomes in the Rs 3-6 lakh slab previously taxed at 5% will now apply to incomes in the Rs 3-7 lakh slab.

- The 10% tax rate for incomes in the Rs 6-9 lakh slab has been revised to apply to incomes of Rs 7-10 lakh.

- The Rs 9 lakh to Rs 12 lakh slab now falls under Rs 10 lakh to Rs 12 lakh with a tax rate of 15%.

- Standard Deduction Increase:

- The standard deduction under Section 115BAC for employees in the new tax regime has been raised from Rs 50,000 to Rs 75,000.

- Employees opting for the old regime will continue to receive the standard deduction of Rs 50,000.

- Deduction Limits in Employer NPS Raised:

- The deduction for employer contributions to the National Pension System (NPS) has been raised from 10% to 14% of the salary.

- This enhancement applies to both tax regimes, encouraging long-term financial security for employees.

- Introduction of NPS Vatsalya:Budget 2024 introduced NPS Vatsalya, allowing parents to open NPS accounts in the name of minor children, convertible into regular NPS accounts upon adulthood.

- Review of Income-Tax Act:The Income-Tax Act, 1961, will undergo a comprehensive review to simplify and clarify provisions, potentially reducing confusion and litigation.

- Rebate under Section 87A:The rebate limit under Section 87A remains at Rs 25,000, with implications for taxpayers under the new tax regime.

Fact Box:Income tax slabs

Standard deduction

|

Prelims Articles

Context

The Indian government has proposed the abolition of the "angel tax" across all classes of investors, aiming to bolster the country's startup ecosystem, foster entrepreneurial spirit, and support innovation.

What is Angel Tax?

- Angel tax refers to the income tax that the government imposes on funding raised by unlisted companies, or startups, if their valuation exceeds the company's fair market value.

- Introduced in 2012, it falls under Section 56 (II) (viib) of the Income Tax Act.

- This provision categorizes investments that startups receive from external investors as "income from other sources," subjecting them to a high tax rate of 30%.

Impact of Angel Tax on Startups:

- Financial Strain on Startups:Startups, often operating with limited funds, face additional financial strain due to Angel Tax. The imposed tax burden adds to their operational costs, making it challenging to allocate resources effectively.

- Valuation Disputes:Taxing investments above the "fair market value" of shares can lead to disputes regarding startup valuations with tax authorities. This discrepancy can complicate financial planning and deter potential investors.

- Deterrent to Investment:The imposition of Angel Tax creates an extra liability for startups, potentially deterring investors from funding these ventures. This reduction in investment hampers the growth and innovation that the government aims to foster in the startup sector.

More on News: Capital Gain Tax

|

Prelims Articles

Context

In her budget speech, Finance Minister Nirmala Sitharaman outlined significant policy measures aimed at accelerating India's energy transition away from fossil fuels. These initiatives are crucial for reducing carbon emissions and promoting sustainable development.

Key-highlights

- Taxonomy for Climate Finance: The government will introduce a taxonomy for climate finance. This framework will enable companies to secure capital at favorable rates for green projects like renewable energy, battery storage, and emerging sustainable technologies.

- The taxonomy is expected to boost the market for green bonds, facilitating investments in environmentally friendly sectors.

- Taxonomies help provide a framework that classifies economic activities based on their environmental sustainability. This helps streamline climate finance towards sustainable businesses. The European Union, South Africa, and Canada have their own climate finance taxonomy.

- Transition of Hard-to-Abate Industries

- Hard-to-abate industries will move from energy efficiency targets to emission-based goals. They will shift from the current 'Perform, Achieve and Trade' regulations to carbon market-based regulations.

- This shift aims to drive investments in sustainable technologies and establish a framework for carbon market development, crucial for decarbonization efforts.

- Promotion of Pumped Hydro Storage: To address the intermittency of renewable energy sources like solar and wind, the government plans to promote pumped hydro storage projects. This technology helps store renewable energy for use during periods when solar and wind energy are not available.

- Development of Small Nuclear Reactors:The government will collaborate with the private sector to set up small nuclear reactors. Research and development efforts will focus on small modular reactors and other advanced technologies for nuclear energy.

- Renewable Energy Targets: India aims to add 50 GW of renewable energy capacity annually from FY24 to FY28. By 2030, the country targets achieving 500 GW of installed electricity capacity from non-fossil fuel sources, including renewable energy and nuclear power.

- Development of Pathways: The government is advancing energy transition through initiatives such as advanced ultra super critical thermal power plants and modular nuclear reactors. Fiscal support is also extended to technologies like pumped storage and rooftop solar, reflecting a comprehensive approach to diversifying the energy mix.

- Solar Energy Focus: In the solar sector, the government is expanding the list of exempted capital goods used in manufacturing solar cells and panels within the country.

- Customs duty exemptions on solar glass and tinned copper interconnects for solar cells and modules imported into India are being removed.

- Despite short-term cost implications for domestic power producers, these measures aim to strengthen the domestic supply chain to support India's ambitious goal of achieving 50 GW of renewable energy annually.

PM Surya GharMuftBijliYojana: Finance Minister Nirmala Sitharaman highlighted the positive response to the PM Surya GharMuftBijliYojana, aimed at promoting rooftop solar panel installations with subsidies for up to 1 crore households. The scheme has garnered over 1.28 crore registrations and 14 lakh applications, underscoring its role in democratizing access to clean energy and reinforcing India's commitment to an inclusive energy future.

Editorials

Context

The FY25 Union Budget has drawn criticism for maintaining nominal allocations across various social sectors despite highlighting youth, farmers, women, and the poor as primary focus groups. There is concern over the impact of these allocations on vulnerable populations and the effectiveness of government schemes.

Allocations in Social Sectors

- Education Sector: Nominal increases in school and higher education allocations amidst rising fees and self-financing trends.

- Health Sector: Minimal increment in health budget, raising concerns over adequate healthcare provisions and quality.

- MGNREGA and Food Subsidy: Stagnant allocations for MGNREGA and food subsidy despite increasing demand and economic cost pressures.

Impact on Vulnerable Populations

- POSHAN Scheme: Marginal increase insufficient to match previous expenditure levels, impacting nutrition programs for school children.

- SakshamAnganwadi Scheme: Slight rise in allocation, but inadequate support for workers' salaries and supplementary nutrition.

- Samarthya Initiatives: Reduction in budget for maternity entitlements and social security pensions, highlighting neglect of vulnerable groups.

Shift towards Contributory Schemes and Privatization

- Contributory Schemes: Emphasis shifting towards schemes like Atal Pension Yojana, potentially neglecting non-contributory social security benefits.

- Privatization in Education and Health: Focus on cost-effectiveness and market principles, raising concerns about equity and accessibility of social services.

- Employment and Skilling: Limited budget allocation for PM's employment and skilling package, relying heavily on private sector response and CSR funds.

Mains Question:

Q. "Discuss the implications of nominal budget allocations in social sectors despite identified focus on youth, farmers, women, and the poor in the FY25 Union Budget. How far do these allocations reflect government priorities towards inclusive growth and welfare? Examine the potential socio-economic impacts of such budgetary decisions."

Editorials

Context

The FY25 Union Budget has emphasized stability in fiscal policies and continuity in sustainable growth, with a renewed focus on inclusive growth to achieve 'Viksit Bharat by 2047'.

Fiscal Stability and Growth Continuity

- Fiscal Discipline Maintained: Fiscal deficit reduced to 4.9% of GDP in FY25, signaling intent for fiscal consolidation.

- Focus on Sustainable Growth: Continued emphasis on capital spending to stimulate economic growth amidst subdued private sector investment.

- Support for Macro-economic Stability: RBI's record dividend transfer used to enhance welfare spending and reduce fiscal deficit, bolstering economic resilience.

Inclusive Growth Initiatives

- Employment Generation Focus: New schemes incentivizing job creation and skilling, aimed at integrating youth into formal employment sector.

- Housing Sector Boost: Significant increase in allocation for urban and rural housing under PMAY, aiming for inclusive urban development.

- Support for MSMEs: Enhanced funding avenues and reduced collateral requirements to boost MSME participation in economic growth.

Sectoral Focus and Future Outlook

- Promotion of Agriculture: Measures like Atmanirbharta in pulses and oilseeds, DPI in agriculture, and focus on agriculture research to enhance productivity and support farmers.

- Industrial Growth Initiatives: PLI scheme bolstered with increased allocation, sector-specific custom duty adjustments to promote domestic manufacturing.

- Global Recognition and Fiscal Prudence: India's fiscal policies aimed at global bond market inclusion, maintaining fiscal discipline to sustain investor confidence.

Mains Question:

Q. "Discuss the strategic priorities outlined in the Union Budget 2024-25 towards achieving 'Viksit Bharat 2047'. How do these priorities address the challenges of inclusive growth and fiscal sustainability in India? Illustrate with examples."

Editorials

Context

The Economic Survey and the FY25 Union Budget have highlighted the challenge of jobless growth in India, prompting the government to introduce several employment-linked incentive schemes. However, there are concerns regarding the sustainability and effectiveness of these initiatives amidst broader economic uncertainties.

Job Market Realities and Challenges

- Jobless Growth: Official data reveals limited growth in manufacturing sector jobs, with significant reductions in employment across unincorporated non-agricultural sectors.

- Workforce Composition: Majority of India's workforce is self-employed or engaged in unpaid work, with a notable increase in agricultural employment despite aspirations for non-farm sector jobs.

- Employment Demand: Economic Survey projects a need for nearly 78.5 lakh non-farm jobs annually until 2030, emphasizing the scale of employment generation required.

Government's Supply-Side Incentive Schemes

- EPFO Linked Incentives: Introduction of wage subsidies and incentives for first-time employees enrolled in EPFO, aiming to stimulate job creation in formal sectors.

- Skilling and Training Initiatives: Upgradation of 1,000 Industrial Training Institutes with significant financial outlay, alongside Prime Minister's Internship program targeting youth skilling and employability enhancement.

- PM's Package for Employment and Skilling: Allocation of ?2 lakh crore over five years to generate employment opportunities and upskill 4.1 crore youth, aligning with long-term employment targets.

Critique of Government Strategy and Alternatives

- Sustainability Concerns: Doubts over the longevity of jobs created through incentive schemes beyond the subsidy period, potential for misuse through payroll manipulation.

- Alternative Approaches: Advocacy for expanding MGNREGA to urban areas, increasing entitlement beyond 100 days, and boosting capital expenditure in labor-intensive sectors.

- Economic Growth Dynamics: Debate on the accuracy of GDP estimates amid discrepancies in inflation rates and the reliance on fiscal stimulus versus private sector dynamism.

Mains Question:

Q. "Discuss the efficacy and challenges of the government's supply-side incentive schemes for employment generation amidst the backdrop of jobless growth in India. Critically evaluate the alternative policy measures that could be adopted to address the unemployment crisis in the country."