20th September 2024 (8 Topics)

Context

As per a report by the Financial Action Task Force (FATF), India has employed an effective system that has improved anti-money laundering (AML) and tackled counter-terrorist financing over the past 5 years, but there is room for improvement in aspects such as long pendency of trials and shortcoming in assessment of money laundering risks emanating from offences such as human trafficking.

Key Findings

- Progress in AML/CFT Framework

- India’s AML/CFT framework shows good results in risk understanding, access to beneficial ownership information, and asset deprivation from criminals.

- Authorities effectively utilize financial intelligence and cooperate well domestically and internationally.

- Economic and Risk Landscape

- As a lower-middle-income country with the world’s fifth-largest economy, India faces significant money laundering risks from fraud, corruption, and drug trafficking.

- India confronts serious threats from terrorist groups like ISIL and Al Qaeda, necessitating improved prosecution and sanctions for terrorist financiers.

- Financial Inclusion and Transparency

- Increased Bank Access: India has significantly boosted financial inclusion, with more citizens gaining access to bank accounts and digital payment systems.

- Financial Sector Understanding: There is a strong understanding of risks in the financial sector, particularly among commercial banks, although smaller institutions require further development.

- Areas for Improvement

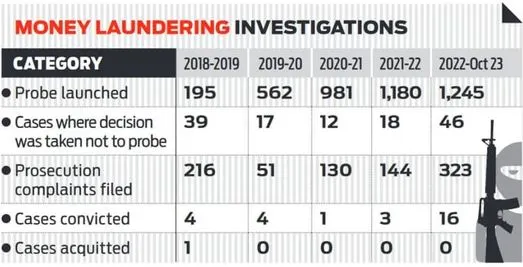

- Court Backlog: A significant backlog of pending money laundering cases hampers progress in prosecution.

- The number of investigations has been increasing but the number of prosecution complaints has not kept pace. To increase the rate of conviction,

- Enforcement Directorate has made non-conviction based seizures to the tune of Rs 16,497 crore from FY19 to FY23, while confiscations based on convictions were worth Rs 39 crore. During the five-year period, the ED started 4,163 investigations, of which 28 cases ended in conviction. In 132 cases, the ED decided to not probe further.

What is Money Laundering?

- Money laundering is the process of transforming proceeds from criminal activities to disguise their illegal origin. This allows criminals to enjoy their profits without attracting attention to the underlying illicit activities

- Common Sources of Criminal Proceeds

- Illegal Activities: Arms sales, drug trafficking, smuggling, and organized crime (e.g., prostitution rings).

- Financial Crimes: Embezzlement, insider trading, bribery, and computer fraud.

- Objectives of Money Laundering: Criminals aim to control their funds while minimizing attention to their illegal activities. They achieve this by:

- Disguising the sources of funds

- Changing the form of the money

- Moving funds to jurisdictions where they are less likely to attract scrutiny

- Authorities investigate and prosecute anti-money laundering offences in India?

- The Directorate of Enforcement (ED): Directorate of Enforcement (ED) is the principal legal entity in charge of looking into and prosecuting money laundering offences under the PMLA.

- ED comes under the Department of Revenue within the Ministry of Finance.

- Financial Intelligence Unit – India (FIU-IND):I is a part of the Department of Revenue and Ministry of Finance. It is the primary national body in charge of collecting, processing, assessing, and disseminating data about suspicious financial transactions to law enforcement authorities and foreign FIUs.

- Others:

- Economic Offences Wing

- Central Bureau of Investigation (CBI)

- Income Tax Department

- Registrar of Companies (RoC)

- Regulators (Reserve Bank of India (RBI), Securities & Exchange Board of India (SEBI), and Insurance Regulatory & Development Authority of India (IRDAI))

- The Directorate of Enforcement (ED): Directorate of Enforcement (ED) is the principal legal entity in charge of looking into and prosecuting money laundering offences under the PMLA.

Anti-Money Laundering Laws

- The international community has established the Financial Action Task Force (FATF) in 1989, an intergovernmental organisation that sets international standards to combat money laundering and terrorist financing.

- As part of its mandate, the FATF issued 40 recommendations, providing a framework for countries to prevent and combat these financial crimes.

- India became the 36th member of the watchdog in 2010.

- In response to this international obligation, India enacted as the Prevention of Money Laundering Act (PMLA) in 2002 (under Article 253).

- The core objective of the PMLA is to address the laundering of illicit funds generated through activities such as drug trafficking.

- By targeting the flow of illegal proceeds, the legislation aims to protect the financial infrastructure of the country.

Initiatives by the Indian government against money laundering

|