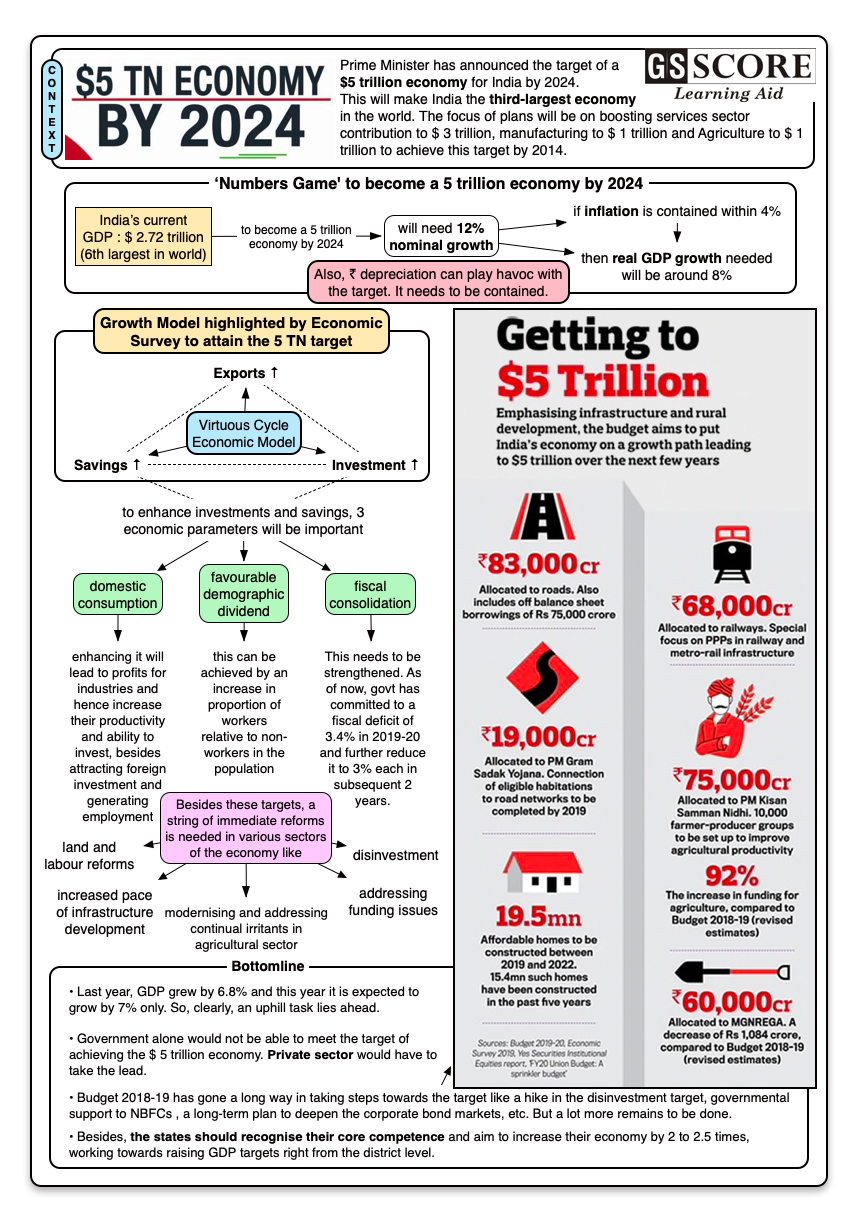

- Prime Minister had announced the target of a $5 trillion economy for India by 2024. This will make India the third-largest economy in the world.

- The focus of plans will be on boosting services sector contribution to $ 3 trillion, manufacturing to $ 1 trillion and Agriculture to $ 1 trillion.

Issue

Context:

- Prime Minister had announced the target of a $5 trillion economy for India by 2024. This will make India the third-largest economy in the world.

- The focus of plans will be on boosting services sector contribution to $ 3 trillion, manufacturing to $ 1 trillion and Agriculture to $ 1 trillion.

Analysis

What is a $5-trillion economy?

- Essentially $5-trillion economy is the size of an economy as measured by the annual Gross Domestic Product (GDP).

- The GDP of an economy is the total monetary value of all goods and services produced in an economy within a year.

- GDP is a way among countries (economies) to keep score about who is ahead.

- In 2014, India’s GDP was $1.85 trillion. In 2018, it is $2.7 trillion and India is the sixth-largest economy in the world.

- Apart from the monetary definition, a $ 5 Trillion Economy calls for pulling all the economic growth levers—investment, consumption, exports, and across all the three sectors of agriculture, manufacturing and services.

- It also means improving all three sectors of the economy, India will more likely achieve its ambitious Sustainable Developmental Goals (SDGs).

- By attaining double-digit growth, India has little hope of employing the roughly one million young people. Favourable demographics will emerge as an upper-middle-income economy with a prosperous and thriving middle class.

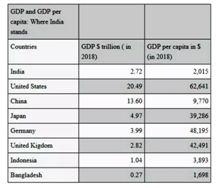

Comparison with Major Economies of the World

- India is the sixth-largest economy does not necessarily means that Indians are the sixth-richest people on the planet. If one wants to better understand the wellbeing of the people in an economy, one should look at GDP per capita.

- The second column of the table reveals a very different, and indeed a more accurate picture of the level of prosperity in the respective economies. For instance, on average, a UK resident’s income was 21 times that of an average Indian in 2018. This wide gap exists even though India’s overall GDP is very nearly the same as UK’s.

Characteristics of a valuable economy

Today the economy must be evaluated in terms of how much it contributes to the ease of our living. So following are some of the characteristics of a valuable economy:

- First, Indians should feel empowered by the economy. But India is placed very low in the United Nations’ World Happiness Report. Happiness is related to being educated and experiencing good health. So, the first attribute of the valuable economy would be access to quality health and education for all.

- Second attribute would be equality of opportunity. According to some measures, India is today more unequal than China, itself a society widely perceived as highly unequal, which is related to unequal distribution of income, gender inequality and sex ratio, already unfavourable to women. Inequality in India can only be ended by equalising capabilities across individuals. Concerted public action via education is the means to this outcome.

- Recently released Global Multi Poverty Index shows that India has lifted 271 million people out of poverty between 2006 and 2016. But still it remains a major issue. As $ 5 Trillion economy is accompanied by job growth, equality of opportunity and better health and education, it will indirectly improve the status of social inequality.

Contribution of Different Sectors in achieving the goal of $5 Trillion Economy

Primary Sector

- Investment is the key for the flourishment of areas like agro-processing, and exports, agri-startups and agri-tourism, where the potential for job creation and capacity utilisation is far less.

- Investment needs to be driven to strengthen both public and private extension advisory systems (educating farmers about technology and management practices) and the quality of agri-education and research through collaboration and convergence.

- It would also serve as a stage to demonstrate resource conservation and sustainable use through organic, natural and green methods, and also zero budget natural farming.

- India has the highest livestock population in the world, investment should be made to utilise this surplus by employing next-generation livestock technology. This would lead to a sustained increase in farm income and savings with an export-oriented growth model.

- Investment in renewable energy generation (using small wind mill and solar pumps) on fallow farmland and in hilly terrain would help reduce the burden of debt-ridden electricity distribution companies and State governments, besides enabling energy security in rural areas.

- A farm business organisation is another source of routing private investment to agriculture. Linking these organisations with commodity exchanges would provide agriculture commodities more space on international trading platforms and reduce the burden of markets in a glut season, with certain policy/procedural modifications.

Manufacturing Sector

- A three-pillar strategy has been suggested to achieve required expansion of output -- focus on existing high impact and emerging sectors as well as MSMEs.

- To boost electronics manufacturing, it said the government should consider offering additional fiscal incentives such as a limited-period tax holiday to players investing more than an identified threshold of investment.

- Similarly for the auto and auto-components sector, it recommended encouragement of global leaders for the identified components to set up manufacturing bases, and incentivising players willing to invest more than a threshold in identified areas.

- The report suggested measures to boost manufacturing in other areas including aeronautical, space, garments, organic/ayurvedic products besides emerging areas such as biotechnology, electric mobility, unmanned aerial vehicles, medical devices, robotics and chemicals.

- For micro, small and medium enterprises, the working group said there is a need to improve access to funding by way of development of SME credit risk databases, SME credit rating, and creation of community-based funds.

Service Sector

- Services sector include improving rail connectivity and seamless connectivity to major attractions; facilitating visa regime for medical travel; allowing expatriate professional to perform surgeries in identified hospitals; and e-commerce policy and regulatory framework for logistics segment.

- This sector contributes significantly to India’s GDP, a goal of around 60 % contribution of services sector has been envisaged for 2024. Exports and job creation, increased productivity and competitiveness of the Champion Services Sectors like IT, tourism, medical value travel and legal will further boost exports of various services from India.

- The Commerce Minister has identified 15 strategic overseas locations where the Trade Promotion Organisations (TPOs) are proposed to be created.

- Multi-Modal Logistics Parks Policy (MMLPs) aims to improve the country’s logistics sector by lowering over freight costs, reducing vehicular pollution and congestion and cutting warehouse costs with a view to promoting moments of goods for domestic and global trade.

- In the defence sector, there is a need to identify key components and systems and encourage global leaders to set up manufacturing base in India by offering limited period incentives; and ensure incentives result in technology/process transfer.

- To promote growth of accounting and financial services, there is a need to FDI in domestic accounting and auditing sector, transparent regulatory framework, and easing restriction on client base in the accounting and auditing sector.

- Measures like exploring introduction of insurance in the film industry, promoting private investments in film schools, exploring franchise business models to exploit film franchise, and promoting gaming industry value chains aims to push audio visual services.

- Foreign universities are allowed to set up campuses in India, easy visa regime for students and education service providers, removing regulatory bottlenecks, providing recognition of online degrees and setting up appropriate evaluation techniques for online courses for the education sector.

INITIATIVES BY INDIA

Primary Sector

- The Government has several on-going initiatives across sectors focused on growth. In agriculture the Government is aiming to reorient policy focus from being production-centric to becoming income-centric.

- The Commerce Ministry has formulated India’s first ever Agricultural Export Policy with a focused plan to boost India’s agricultural exports to $ 60 billion by 2022 thereby assisting the Agriculture Ministry in achieving its target of $ 100 billion and to integrate Indian farmers and the high quality agricultural products with global value chains and to double India’s share in world agriculture.

Manufacturing Sector

- The emphasis on incomes provides a broader scope towards achieving the needed expansion of the sector. The proposed Industrial Policy 2018 provides an overarching, sector-agnostic agenda for the enterprises of the future and envisions creating a globally competitive Indian industry that is modern, sustainable and inclusive.

- India has improved its rank in Ease of Doing Business Index from 100 in 2017 to 77 in 2018.

- Ministry of Commerce is making all efforts to ensure that in public procurement preference is given to Make in India. Its aim is to make India the hub of manufacturing, India has emerged as one of the fastest growing economies.

- India has jumped 3 places on the Global Innovation Index from rank 60 in 2017 to rank 57 in 2018.

- Start-up India is a flagship initiative of the Government of India, intended to build a strong ecosystem that is conducive for the growth of start-up businesses, to drive sustainable economic growth and generate large scale employment opportunities.

- In Union Budget 2018-19, the Government of India reduced the income tax rate to 25 per cent for all companies having a turnover of up to Rs 250 crore.

- Under the Mid-Term Review of Foreign Trade Policy (2015-20), the Government of India increased export incentives available to labour intensive MSME sectors by 2 per cent.

- The Government of India has launched a Phased Manufacturing Programme (PMP) aimed at adding more smartphone components under the Make in India initiative thereby giving a push to the domestic manufacturing of mobile handsets.

- The Government of India is in talks with stakeholders to further ease foreign direct investment (FDI) in defence under the automatic route to 51 per cent from the current 49 per cent, in order to give a boost to the Make in India initiative and to generate employment.

- The Ministry of Defence, Government of India, approved the “Strategic Partnership” model which will enable private companies to tie up with foreign players for manufacturing submarines, fighter jets, helicopters and armoured vehicles.

Service Sector

- The Champion Services sector initiative is also under way to accelerate the expansion of select service sectors.

- The 2019 Union Budget talks about plans with a pan-India focus to give a further boost to Sagarmala, Bharatmala and UDAN projects, besides the dedicated industrial and freight corridors.

- The budget proposes further opening of FDI in aviation sector, media, animation AVGC and insurance sectors in consultation with all stakeholders. 100 per cent FDI will be permitted for insurance intermediaries.

FEASIBILITY OF BECOMING $5 TRILLION ECONOMY

- If India grows at 12% nominal growth (that is 8% real GDP growth and 4% inflation), then from the 2018 level of $2.7 trillion, India would reach the 5.33 trillion mark in 2024.

- But last year, India grew by just 6.8%. This year, most observers expect it to grow by just 7%. So India must keep growing at a rapid pace to attain this target.

- The Economic Survey 2018-19 highlighted that international experience, especially from high-growth East Asian economies, suggested that such growth can only be sustained by a “virtuous cycle” of savings, investment and exports catalysed and supported by a favourable demographic phase.

- Investment, especially private investment, is the key driver that drives demand, creates capacity, increases labour productivity, introduces new technology, allows creative destruction and generates jobs.

CHALLENGES:

Sectors of Indian Economy

Primary Sector

- One of the major problems that this sector faces is the under-employment and the disguised employment. Underemployment accounts for the workers not working to the best of their capabilities while the latter accounts for the workers not working to their true potential.

- The slow-down in agricultural growth has become a major cause for concern. India’s rice yields are one-third of China’s and about half of those in Vietnam and Indonesia. The same is true for most other agricultural commodities.

- Water resources are also limited and water for irrigation must contend with increasing industrial and urban needs

Manufacturing Sector

- Poor networks of roads, inadequate air & sea port capacities along with undeveloped railway networks are hindering the growth of this sector. This leads to slow & inefficient delivery of the product to the customers.

- The turnaround times are also high due to heavy congestion on berths and slow evacuation of cargo unloaded at berths. High cost of fuel & high waiting times negatively impact the logistic sector.

- The transportation industry is also severely unorganised. The employees of this sector have inadequate skills which lead to inefficient supply of goods. Low level of technology and poor maintenance of the tools are also responsible for inefficiency of the transportation industry.

Service Sector

- The main problem that this sector is that the jobs which involve lower salaries do not attract much employment. And this remains the future dilemma as India is looking for double-digit growth in the near future.

COMMON CHALLENGES

- Depressing pace in carrying out land and labour reforms: This has been a major turn-off for investors looking at setting shop in the country. Budget talks about narrowing labour laws. This is a step in the right direction but quick execution is important. Since land is a state subject, respective state governments need to work with the Centre to bring about the change. In the past, investors got a shocker from episodes such as Singur.

- Slow pace of infrastructure development in the last decade: India is still at the position where China was 20 years ago in terms of infrastructure development. The plans are ambitious, but the problem is resources.

- Funding Problem: India does not have powerful institutions that can fund long-gestation infrastructure projects. Banks do not have enough long-term liabilities to match such loans. Lenders have gone terribly wrong in the past by not following healthy lending practices.

- India does not have a deep bond market to take up the financing burden. The state-insurer Life Insurance Corporation of India (LIC) has been overexploited to do businesses it has never understood. There aren't many other options left to take up the infra-funding burden. The government's plan to borrow off-budget is risky and unadvisable.

- Government's excessive involvement in businesses: The government remains active participant in several entities including banks, airline, and infrastructure firms. It controls 70 % of the banking industry. This participation has resulted in a lot of money getting stuck in these entities.

- The government will have to exit these businesses backed by a solid, aggressive disinvestment plan to unlock this money.

- Private investors back: This is even more critical now since domestic consumption is dropping to dangerous levels. Investment in new projects plunged to a 15-year low in the quarter ending June 2019. Both private and public sectors announced new projects worth Rs 43,400 crore in June 2019 quarter, 81 % lower than what was announced in the March quarter and 87 % lower than during the same period a year ago.

- According to the finance ministry’s data, projects worth almost Rs 11 lakh crore remain ‘stalled’ or are having issues. Railways, roads, and power sectors account for more than half of these stalled projects.

- Public money: Government spending has largely aided GDP growth. Sure, this was needed at a time when private investors were absent. However, an economy which rides largely on government money for a prolonged period of time does not promise much to the economy in the long run. What is needed is the participation of private investors.

Way Forward

- There is a need to place India’s official statistics on a firmer footing, so that we can be sure that economic policy-making is based on reality. However, getting the numbers right will not ideally end the task.

- Government alone would not be able to meet the target of achieving the $ 5 trillion economy. Private sector would have to take the lead. Budget 2018-19 included a hike in the disinvestment target, governmental support to NBFCs and a long-term plan to deepen the corporate bond markets.

- Structural reforms in the agriculture sector would also have to carry out. There is a need to modernise the farm sector.

- The States should recognise their core competence and aim to increase their economy by 2 to 2.5 times, working towards raising GDP targets right from the district level. States to focus on their potential to grow exports.

- Development should be seen right when a child is born, this attitude can make a real change in the field of Human development Hence, it shall

What is a $5-trillion economy?

- Essentially $5-trillion economy is the size of an economy as measured by the annual Gross Domestic Product (GDP).

- The GDP of an economy is the total monetary value of all goods and services produced in an economy within a year.

- GDP is a way among countries (economies) to keep score about who is ahead.

- In 2014, India’s GDP was $1.85 trillion. In 2018, it is $2.7 trillion and India is the sixth-largest economy in the world.

- Apart from the monetary definition, a $ 5 Trillion Economy calls for pulling all the economic growth levers—investment, consumption, exports, and across all the three sectors of agriculture, manufacturing and services.

- It also means improving all three sectors of the economy, India will more likely achieve its ambitious Sustainable Developmental Goals (SDGs).

- By attaining double-digit growth, India has little hope of employing the roughly one million young people. Favourable demographics will emerge as an upper-middle-income economy with a prosperous and thriving middle class.

Comparison with Major Economies of the World

- India is the sixth-largest economy does not necessarily means that Indians are the sixth-richest people on the planet. If one wants to better understand the wellbeing of the people in an economy, one should look at GDP per capita.

- The second column of the table reveals a very different, and indeed a more accurate picture of the level of prosperity in the respective economies. For instance, on average, a UK resident’s income was 21 times that of an average Indian in 2018. This wide gap exists even though India’s overall GDP is very nearly the same as UK’s.

Characteristics of a valuable economy

Today the economy must be evaluated in terms of how much it contributes to the ease of our living. So following are some of the characteristics of a valuable economy:

- First, Indians should feel empowered by the economy. But India is placed very low in the United Nations’ World Happiness Report. Happiness is related to being educated and experiencing good health. So, the first attribute of the valuable economy would be access to quality health and education for all.

- Second attribute would be equality of opportunity. According to some measures, India is today more unequal than China, itself a society widely perceived as highly unequal, which is related to unequal distribution of income, gender inequality and sex ratio, already unfavourable to women. Inequality in India can only be ended by equalising capabilities across individuals. Concerted public action via education is the means to this outcome.

- Recently released Global Multi Poverty Index shows that India has lifted 271 million people out of poverty between 2006 and 2016. But still it remains a major issue. As $ 5 Trillion economy is accompanied by job growth, equality of opportunity and better health and education, it will indirectly improve the status of social inequality.

Contribution of Different Sectors in achieving the goal of $5 Trillion Economy

Primary Sector

- Investment is the key for the flourishment of areas like agro-processing, and exports, agri-startups and agri-tourism, where the potential for job creation and capacity utilisation is far less.

- Investment needs to be driven to strengthen both public and private extension advisory systems (educating farmers about technology and management practices) and the quality of agri-education and research through collaboration and convergence.

- It would also serve as a stage to demonstrate resource conservation and sustainable use through organic, natural and green methods, and also zero budget natural farming.

- India has the highest livestock population in the world, investment should be made to utilise this surplus by employing next-generation livestock technology. This would lead to a sustained increase in farm income and savings with an export-oriented growth model.

- Investment in renewable energy generation (using small wind mill and solar pumps) on fallow farmland and in hilly terrain would help reduce the burden of debt-ridden electricity distribution companies and State governments, besides enabling energy security in rural areas.

- A farm business organisation is another source of routing private investment to agriculture. Linking these organisations with commodity exchanges would provide agriculture commodities more space on international trading platforms and reduce the burden of markets in a glut season, with certain policy/procedural modifications.

Manufacturing Sector

- A three-pillar strategy has been suggested to achieve required expansion of output -- focus on existing high impact and emerging sectors as well as MSMEs.

- To boost electronics manufacturing, it said the government should consider offering additional fiscal incentives such as a limited-period tax holiday to players investing more than an identified threshold of investment.

- Similarly for the auto and auto-components sector, it recommended encouragement of global leaders for the identified components to set up manufacturing bases, and incentivising players willing to invest more than a threshold in identified areas.

- The report suggested measures to boost manufacturing in other areas including aeronautical, space, garments, organic/ayurvedic products besides emerging areas such as biotechnology, electric mobility, unmanned aerial vehicles, medical devices, robotics and chemicals.

- For micro, small and medium enterprises, the working group said there is a need to improve access to funding by way of development of SME credit risk databases, SME credit rating, and creation of community-based funds.

Service Sector

- Services sector include improving rail connectivity and seamless connectivity to major attractions; facilitating visa regime for medical travel; allowing expatriate professional to perform surgeries in identified hospitals; and e-commerce policy and regulatory framework for logistics segment.

- This sector contributes significantly to India’s GDP, a goal of around 60 % contribution of services sector has been envisaged for 2024. Exports and job creation, increased productivity and competitiveness of the Champion Services Sectors like IT, tourism, medical value travel and legal will further boost exports of various services from India.

- The Commerce Minister has identified 15 strategic overseas locations where the Trade Promotion Organisations (TPOs) are proposed to be created.

- Multi-Modal Logistics Parks Policy (MMLPs) aims to improve the country’s logistics sector by lowering over freight costs, reducing vehicular pollution and congestion and cutting warehouse costs with a view to promoting moments of goods for domestic and global trade.

- In the defence sector, there is a need to identify key components and systems and encourage global leaders to set up manufacturing base in India by offering limited period incentives; and ensure incentives result in technology/process transfer.

- To promote growth of accounting and financial services, there is a need to FDI in domestic accounting and auditing sector, transparent regulatory framework, and easing restriction on client base in the accounting and auditing sector.

- Measures like exploring introduction of insurance in the film industry, promoting private investments in film schools, exploring franchise business models to exploit film franchise, and promoting gaming industry value chains aims to push audio visual services.

- Foreign universities are allowed to set up campuses in India, easy visa regime for students and education service providers, removing regulatory bottlenecks, providing recognition of online degrees and setting up appropriate evaluation techniques for online courses for the education sector.

INITIATIVES BY INDIA

Primary Sector

- The Government has several on-going initiatives across sectors focused on growth. In agriculture the Government is aiming to reorient policy focus from being production-centric to becoming income-centric.

- The Commerce Ministry has formulated India’s first ever Agricultural Export Policy with a focused plan to boost India’s agricultural exports to $ 60 billion by 2022 thereby assisting the Agriculture Ministry in achieving its target of $ 100 billion and to integrate Indian farmers and the high quality agricultural products with global value chains and to double India’s share in world agriculture.

Manufacturing Sector

- The emphasis on incomes provides a broader scope towards achieving the needed expansion of the sector. The proposed Industrial Policy 2018 provides an overarching, sector-agnostic agenda for the enterprises of the future and envisions creating a globally competitive Indian industry that is modern, sustainable and inclusive.

- India has improved its rank in Ease of Doing Business Index from 100 in 2017 to 77 in 2018.

- Ministry of Commerce is making all efforts to ensure that in public procurement preference is given to Make in India. Its aim is to make India the hub of manufacturing, India has emerged as one of the fastest growing economies.

- India has jumped 3 places on the Global Innovation Index from rank 60 in 2017 to rank 57 in 2018.

- Start-up India is a flagship initiative of the Government of India, intended to build a strong ecosystem that is conducive for the growth of start-up businesses, to drive sustainable economic growth and generate large scale employment opportunities.

- In Union Budget 2018-19, the Government of India reduced the income tax rate to 25 per cent for all companies having a turnover of up to Rs 250 crore.

- Under the Mid-Term Review of Foreign Trade Policy (2015-20), the Government of India increased export incentives available to labour intensive MSME sectors by 2 per cent.

- The Government of India has launched a Phased Manufacturing Programme (PMP) aimed at adding more smartphone components under the Make in India initiative thereby giving a push to the domestic manufacturing of mobile handsets.

- The Government of India is in talks with stakeholders to further ease foreign direct investment (FDI) in defence under the automatic route to 51 per cent from the current 49 per cent, in order to give a boost to the Make in India initiative and to generate employment.

- The Ministry of Defence, Government of India, approved the “Strategic Partnership” model which will enable private companies to tie up with foreign players for manufacturing submarines, fighter jets, helicopters and armoured vehicles.

Service Sector

- The Champion Services sector initiative is also under way to accelerate the expansion of select service sectors.

- The 2019 Union Budget talks about plans with a pan-India focus to give a further boost to Sagarmala, Bharatmala and UDAN projects, besides the dedicated industrial and freight corridors.

- The budget proposes further opening of FDI in aviation sector, media, animation AVGC and insurance sectors in consultation with all stakeholders. 100 per cent FDI will be permitted for insurance intermediaries.

FEASIBILITY OF BECOMING $5 TRILLION ECONOMY

- If India grows at 12% nominal growth (that is 8% real GDP growth and 4% inflation), then from the 2018 level of $2.7 trillion, India would reach the 5.33 trillion mark in 2024.

- But last year, India grew by just 6.8%. This year, most observers expect it to grow by just 7%. So India must keep growing at a rapid pace to attain this target.

- The Economic Survey 2018-19 highlighted that international experience, especially from high-growth East Asian economies, suggested that such growth can only be sustained by a “virtuous cycle” of savings, investment and exports catalysed and supported by a favourable demographic phase.

- Investment, especially private investment, is the key driver that drives demand, creates capacity, increases labour productivity, introduces new technology, allows creative destruction and generates jobs.

CHALLENGES:

Sectors of Indian Economy

Primary Sector

- One of the major problems that this sector faces is the under-employment and the disguised employment. Underemployment accounts for the workers not working to the best of their capabilities while the latter accounts for the workers not working to their true potential.

- The slow-down in agricultural growth has become a major cause for concern. India’s rice yields are one-third of China’s and about half of those in Vietnam and Indonesia. The same is true for most other agricultural commodities.

- Water resources are also limited and water for irrigation must contend with increasing industrial and urban needs

Manufacturing Sector

- Poor networks of roads, inadequate air & sea port capacities along with undeveloped railway networks are hindering the growth of this sector. This leads to slow & inefficient delivery of the product to the customers.

- The turnaround times are also high due to heavy congestion on berths and slow evacuation of cargo unloaded at berths. High cost of fuel & high waiting times negatively impact the logistic sector.

- The transportation industry is also severely unorganised. The employees of this sector have inadequate skills which lead to inefficient supply of goods. Low level of technology and poor maintenance of the tools are also responsible for inefficiency of the transportation industry.

Service Sector

- The main problem that this sector is that the jobs which involve lower salaries do not attract much employment. And this remains the future dilemma as India is looking for double-digit growth in the near future.

COMMON CHALLENGES

- Depressing pace in carrying out land and labour reforms: This has been a major turn-off for investors looking at setting shop in the country. Budget talks about narrowing labour laws. This is a step in the right direction but quick execution is important. Since land is a state subject, respective state governments need to work with the Centre to bring about the change. In the past, investors got a shocker from episodes such as Singur.

- Slow pace of infrastructure development in the last decade: India is still at the position where China was 20 years ago in terms of infrastructure development. The plans are ambitious, but the problem is resources.

- Funding Problem: India does not have powerful institutions that can fund long-gestation infrastructure projects. Banks do not have enough long-term liabilities to match such loans. Lenders have gone terribly wrong in the past by not following healthy lending practices.

- India does not have a deep bond market to take up the financing burden. The state-insurer Life Insurance Corporation of India (LIC) has been overexploited to do businesses it has never understood. There aren't many other options left to take up the infra-funding burden. The government's plan to borrow off-budget is risky and unadvisable.

- Government's excessive involvement in businesses: The government remains active participant in several entities including banks, airline, and infrastructure firms. It controls 70 % of the banking industry. This participation has resulted in a lot of money getting stuck in these entities.

- The government will have to exit these businesses backed by a solid, aggressive disinvestment plan to unlock this money.

- Private investors back: This is even more critical now since domestic consumption is dropping to dangerous levels. Investment in new projects plunged to a 15-year low in the quarter ending June 2019. Both private and public sectors announced new projects worth Rs 43,400 crore in June 2019 quarter, 81 % lower than what was announced in the March quarter and 87 % lower than during the same period a year ago.

- According to the finance ministry’s data, projects worth almost Rs 11 lakh crore remain ‘stalled’ or are having issues. Railways, roads, and power sectors account for more than half of these stalled projects.

- Public money: Government spending has largely aided GDP growth. Sure, this was needed at a time when private investors were absent. However, an economy which rides largely on government money for a prolonged period of time does not promise much to the economy in the long run. What is needed is the participation of private investors.

Way Forward

- There is a need to place India’s official statistics on a firmer footing, so that we can be sure that economic policy-making is based on reality. However, getting the numbers right will not ideally end the task.

- Government alone would not be able to meet the target of achieving the $ 5 trillion economy. Private sector would have to take the lead. Budget 2018-19 included a hike in the disinvestment target, governmental support to NBFCs and a long-term plan to deepen the corporate bond markets.

- Structural reforms in the agriculture sector would also have to carry out. There is a need to modernise the farm sector.

- The States should recognise their core competence and aim to increase their economy by 2 to 2.5 times, working towards raising GDP targets right from the district level. States to focus on their potential to grow exports.

- Development should be seen right when a child is born, this attitude can make a real change in the field of Human development Hence, it shall ultimate help the real economic growth.

- Global healthcare and wellness is a $8 trillion industry, need to convert India’s 600 district hospitals as medical, nursing and paramedical schools to train 5 million doctors, nurses, and paramedics to meet the global requirement.

Learning Aid