- According to a report by the Centre for Asia-Pacific Aviation (CAPA), India’s airlines were expected to post losses of around Rs 15,000 crore in 2018.

- Jet Airways and Spice Jet declared losses and IndiGo’s profits collapsed 97 per cent to just 28 crore.

Issue

Context:

- According to a report by the Centre for Asia-Pacific Aviation (CAPA), India’s airlines were expected to post losses of around Rs 15,000 crore in 2018.

- Jet Airways and Spice Jet declared losses and IndiGo’s profits collapsed 97 per cent to just 28 crore.

Background:

India’s second-biggest airline (Jet airways) by market share posted a standalone net loss of Rs 1,319 crore for April-June compared with a net profit of Rs 55.73 crore a year earlier. Revenue grew 6% to Rs 6,010.46 crore, but the airline failed to control its salary expenses that grew 13% to Rs 816 crore or its finance costs that increased 27% to Rs 249 crore.

Analysis

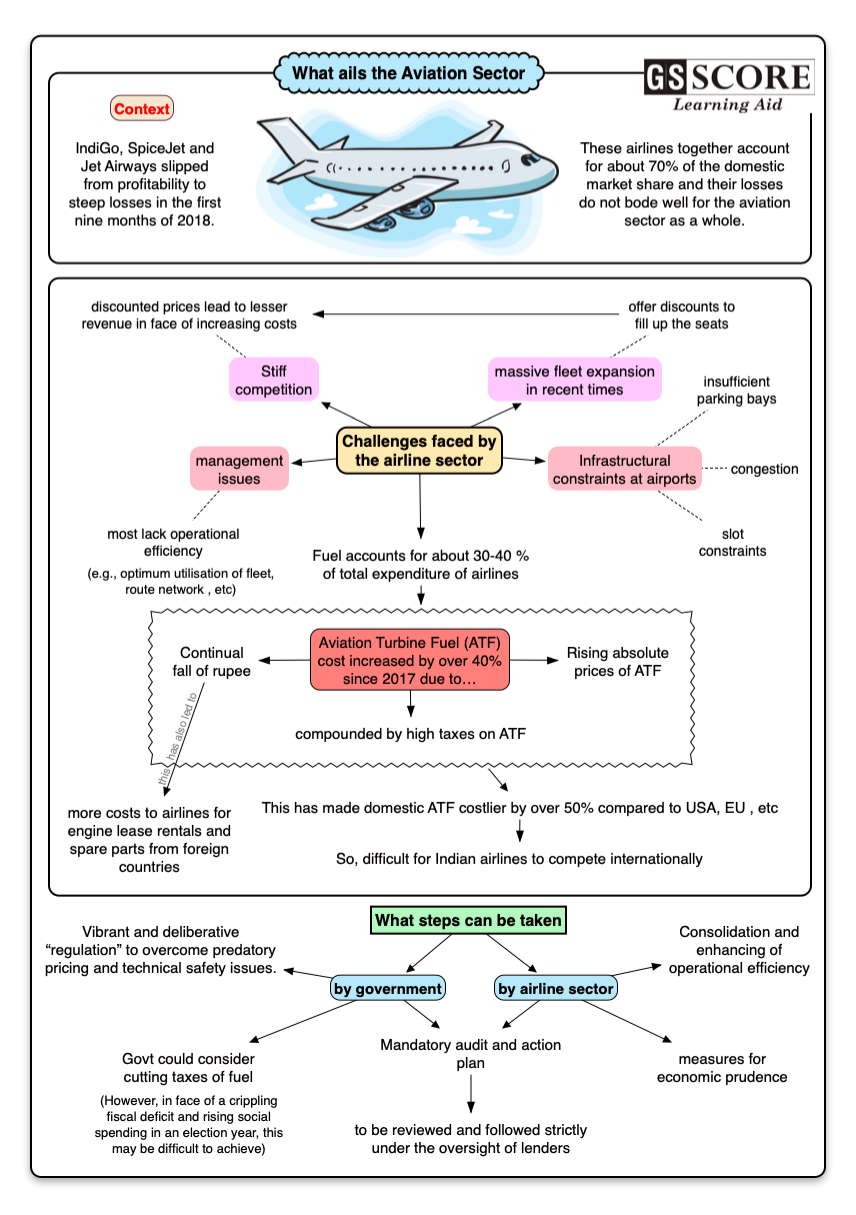

- One crucial reason for the losses is the rising price of Aviation Turbine Fuel (ATF).

- Jathropa-derived biofuel (aka Green Fuel) won’t be able to make a huge dent in fuel costs for another decade or two due to techno-commercial reasons.

- With crude prices shooting up coupled with the fact that the US Dollar has strengthened against the rupee, airlines are having to pay a lot more for aircraft leases and servicing, since the entire industry runs on the greenback (prompt payments).

- Usually when costs go up, prices usually follow, but the airlines are finding themselves forced to offer more and more seats on discount sales.

- Airlines are offering so many flights just to lock up valuable slots in airports like Delhi and Mumbai, where despite expensive renovation and construction over the past decade, almost no slots are available.

Delhi’s Indira Gandhi International Airport, whose redesign was supposed to be sufficient till 2030, has already hit peak capacity of 60 million passengers and even with three runways has massive congestion problems, with aircraft holding in the air for upwards of an hour.

A Delhi-Mumbai flight which used to take just one hour and forty-five minutes from gate to gate a decade ago, can now take two hours fifteen minutes when counting the amount of time planes have to wait on the ground and in the air.

Airlines measure their performance on two key metrics, Costs per Average Seat Kilometer (CASK) and Revenue per Average Seat Kilometer (RASK):

- While costs have gone up thanks to fuel prices, the falling rupee and rising wages, revenues have not kept pace at all.

- Leading airlines have actually seen yields from passengers drop according to their results. This clearly means that Indians want to fly, but they don’t want to pay more to fly

Price elasticity: with more Indians flying and with more flying options, they can look at multiple destinations at the same time on multiple airlines and if the fares do not suit them they can easily cancel their travel plans.

Directorate General of Civil Aviation (DGCA) has made it difficult for the airlines to make ancillary revenues with passengers calling for caps on cancellation charges and calls for caps on excess baggage and other charges.

Consider an example on the matter: Airlines will soon be permitted to offer onboard Wi-Fi, but with costs of installing such systems up to a million dollars per aircraft, can they afford to do so, given that some airlines are believed to have less than a month of cash in hand.

A combination of too many flights, too many airlines and the subsidized Air India adding to the overall woes of the private airlines, things are not looking good for the airlines.

In fact, Air India has already reached to a stage of comatose.

But, even the “bailers” are hard hit: Tata Group find themselves supporting two airlines right now, Air Asia which has a muddled direction and Vistara which is apparently far from profitable. Jet Airways increasingly looks like it might have a change of management and of strategic direction, especially given that its savior in its last time of crisis, the Abu Dhabi based Etihad Airlines is itself bleeding and some of the other airline groups could pitch in for Jet, especially Air France - KLM Group are also deep in trouble.

What about Low Cost Carriers (LCC)?

The low-cost carriers have to figure out ways to increase ancillary revenues.

- LCC has moved away from Hub and Spoke model. In Hub and Spoke model, a major airport becomes the hub, and other destinations become the spoke.

- The hub-and-spoke system allows airlines to consolidate their passengers at the hub and then fly on to their ultimate destination (the spokes) in a smaller aircraft, which increases load factors and helps drive down fares.

- It also has some drawbacks, such as the high costs required maintaining the complex infrastructure for such a massive, interconnected system; longer travel times due to the necessity for travelers of transiting through the hub; and susceptibility to cascading flight delays due to hub congestion.

- The point-to-point system, on the other hand, connects each origin and destination via non-stop flights. This provides substantial cost savings by eliminating the intermediate stop at the hub, which means the huge upfront cost in hub development can be avoided. It also reduces total travel time—a priority or travelers — while enabling better aircraft utilization due to faster aircraft turn times.

Why LCC perform better?

- The higher efficiency and better fleet utilization of LCCs, coupled with lower overheads, means that they can offer prices that are significantly discounted.

- Agent less ticketing: The emergence of the Internet as the primary medium for booking tickets has greatly increased transparency of ticket pricing, which works to the LCCs' advantage because of their lower ticket prices.

- A significant benefit of the point-to-point model is that LCCs can use a single fleet type, since they may not have much variability in passenger demand between the major city-pairs that they serve.

But can the “ailing” airline sector adapt to LCC model?

This depends upon consumer preference as LCC are mostly “no-frills” service providers.

How the “JET” situation does look like:

- The Bank-led Resolution Plan (BLRP) for troubled carrier Jet Airways has projected that the airline will start turning in net profits from the October-December quarter of 2019-20.

- As per the BLRP, lenders will convert a part of their Rs 8,200 crore debt into equity such that they will collectively have 51% stake initially in the company.

- After conversion of debt into equity, the holding of promoters and existing shareholders would be reduced by half (Naresh Goyal’s stake would fall from 51% to 25.5%, Etihad’s from 24% to 12% and the general public holding from 25% to 12.5%).

- Jet would reduce the distribution cost as it had a huge network of travel agents as compared with competitors. The airline would also look at rationalizing some sectors and stop flying in non-profitable routes.

What is the solution?

- Government cuts taxes on fuel, but a crippling fiscal deficit and the need to promote social spending ahead of an election year will jeopardize this move.

- Second factor could be of

- Economic prudence by the airline sector is third factor

- Vibrant and deliberative “regulation” to overcome predatory pricing and technical safety issues.

- Mandatory audit and action plan – to be reviewed and followed strictly under the oversight of lenders.

Learning Aid

Practice Question:

After Kingfisher, Jet airways and Air India are facing meltdown. While certain Low Cost Carriers are performing above the benchmark, the airline sector as a whole is facing downtime. Evaluate the risk faced and importance of the sector and suggest a way forward.