Context

Banks have invoked the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act against telecom infrastructure provider GTL to recover their pending dues.

- The recovery action has been initiated by IDBI Bank on behalf of lenders, whose total exposure to GTL stood at Rs 7,250 crore as of December, 2021.

Analysis

What is it?

- SARFAESI (Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002 was introduced to protect financial institutions from loan defaulters.

|

Elements of the SARFAESI Act:

|

- In order to collect bad debts, under this law, banks can take control of securities pledged against credit, manage them or sell them for the purpose of collecting fees without judicial intervention.

- Applicability: The law applies throughout the country and applies to all property, movable and immovable, pledged as security to creditors.

- Objective: The SARFAESI Act has two main objectives:

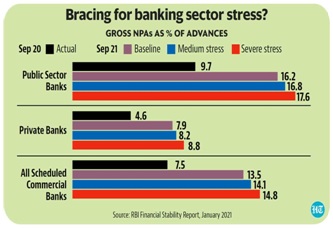

- Recovering the financial institutions’ and banks’ non-performing assets (NPAs) in a timely and effective manner.

- Allows financial organisations and banks to sell residential and commercial assets at auction if a borrower defaults on his or her debt.

Need of the Act

- Before the law was enacted in December 2002, banks and other financial institutions were forced to take a lengthy route to recover their bad debts.

- The lenders would appeal in civil courts or designated tribunals to get hold of ‘security interests’ to recovery of defaulting loans, which in turn made the recovery slow and added to the growing list of lender’s non-performing assets.

- Recognising that one out of every five borrowers is a defaulter, the government was under obligation to provide proper mechanisms for debt recovery as well as to foreclose the security.

- Hence, the SARFAESI Act, 2002 (the Securitisation Act) attempts to fulfil these dual goals, as well as to provide a wide legal framework for asset Securitisation and asset reconstruction.

What are the powers of the banks under the act?

- The Act comes into play if a borrower defaults on his or her payments for more than six months.

- The lender then can send a notice to the borrower to clear the dues within 60 days.

- In case that doesn’t happen, the financial institution has the right to take possession of the secured assets and sell, transfer or manage them.

- The defaulter, meanwhile, has recourse to move an appellate authority set up under the law within 30 days of receiving a notice from the lender.

- According to a 2020 Supreme Court judgment, co-operative banks can also invoke SARFAESI Act.

- According to the Finance Ministry, the non-banking financial companies (NBFCs) can initiate recovery in Rs. 20 lakh loan default cases.

How this act is beneficial?

- Sweeping powers to the banks: If a borrower defaults on a loan by the banks against collateral, banks get sweeping powers to recover the loan from the borrower by taking possession of the collateral.

- Time efficient: No involvement of courts are required in the process to invoke and proceed with SARFAESI Act, this reduces the time of recovery by the financial institutions.

- Financial stability: Asset Reconstruction Companies (ARCs) comes into play when SARFAESI Act is being imposed. Such intervention of the ARCs increases the financial stability of the banks by purchasing the bad loans.

- Future transactions: Banks with reduced NPAs and bad loans get a wider base for future transactions which may ensure better profitability of the banks.

- Securing the lenders money: Provisions of the Act provides a security to the lenders who have financed their capital in certain projects.

Shortcomings of the Act

Required measures

- Unsecured creditors

- Dual regulations: The recovery process is regulated not only by the SARFAESI Act, but also by Insolvency and Bankruptcy Code.

- Impacting financial stability of the financial institutions.

- Assessment of credibility of the borrowers

- Comprehensive regulation

- Assessing the Risk weightage asset

- Maintaining the buffer under the guidelines of the Basel norms and Reserve bank of India.

- Reducing burden on government exchequer

Conclusion

SARFAESI Act provides stability and sustainability to the financial institutions and improves the credit guarantee of the creditors. The issues related to the act regarding complexities of dual regulation and ARCs should be resolved in order to mobile the public funds for better developmental process. Apart from the legal measures banks and financial institutions need to be follow the guidelines under Basel norms and central bank to reduce the share of NPAs and increase their credibility and profitability.