|

Overview

|

Context

The Union Cabinet has approved a proposal to empower the board of public sector undertakings (PSUs) to recommend strategic divestment, minority stake sale, or closure of their subsidiaries and joint ventures.

Background

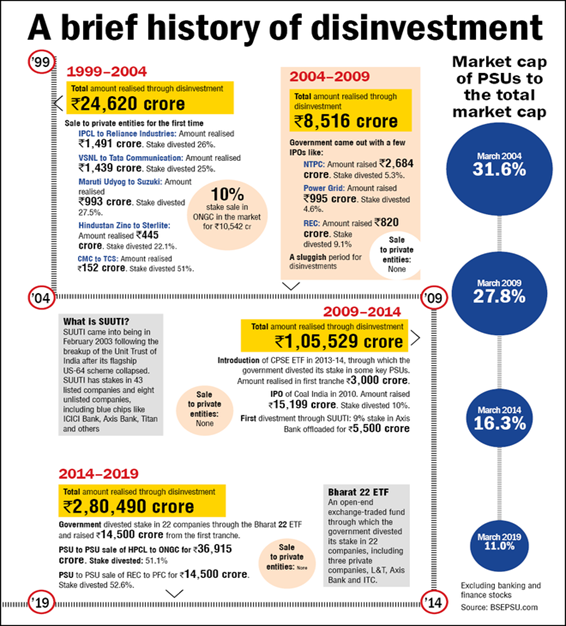

- Disinvestment of public enterprises emerged as a policy option in the wake of economic liberalization, globalization, and structural reforms launched in 1991.

- Initially, disinvestment was not conceived as the privatization of existing PSUs but as limited sales of equity/shares with the objective of raising resources and ensuring market discipline to boost the performance of public enterprises.

- Department of Investment and Public Asset Management (DIPAM)under the Ministry of Finance is the nodal agency for disinvestment in India.

- DIPAM and NITI Aayog jointly identify PSUs for strategic disinvestment.

Analysis

Key Highlights

- At present, PSU boards have the authority to make equity investments, undertake mergers and acquisitions subject to certain ceilings of net-worth.

- However, power for disinvestment and closure of their subsidiaries is not available to PSUs, except for suggesting minority stake sales for some PSUs.

- The process for strategic disinvestment would be open and based on the principles of competitive bidding.

- The guidelines for the same would be laid down by the Department of Investment and Public Asset Management (DIPAM).

- For closure of PSUs, guidelines would be issued by the Department of Public Enterprises (DPE).

- The Cabinet has also empowered alternative mechanism that comprises of Finance Minister NirmalaSitharaman, Minister of Roads, Transport and Highways NitinGadkari and minister of administrative ministry to grant ‘in principle’ approval for strategic disinvestment, minority stake sale, closure of subsidiaries, and sale of stake in JVs of parent PSUs

What is disinvestment?

- Disinvestment is selling or liquidating an asset or subsidiary by the government. It is also referred to as ‘divestment’ or ‘divestiture.’

- Disinvestment of an asset is either a strategic move for the company (or government), or used for raising resources to meet general/specific needs.

Disinvestment vs. Strategic Disinvestment

- If the government is selling minority shares in a PSE (less than 50%), it will continue to be the owner of the PSE. This is normal disinvestment procedure.

- But if the government is selling majority shares (50% or more) of PSE to some other entity (mostly to a private sector entity), then this method is called strategic disinvestment or strategic sale). Unlike the simple disinvestment, strategic sale implies some sort of privatization, along with transfer of management control.

- PSEs for strategic disinvestment are selected based on certain criteria.

- They may be incurring losses

- Or it may be operationally difficult for the government to continue with the PSE.

|

National Investment Fund The National Investment Fund (NIF) was constituted to channelize the proceeds from disinvestment of Central Public Sector Enterprises. NIF was to be maintained outside the Consolidated Fund of India. At present, the funds under NIF exist as a ‘Public Account’ which is outside the Consolidated Fund of India. The funds under NIF are permanent in nature. NIF would be utilized for the following purposes:

|

Importance of Disinvestment

The importance of disinvestment by the government lies in utilisation of funds for:

- To improve public finances and fund increasing fiscal deficit.

- Financing large-scale infrastructure development.

- For investing in the economy to encourage spending and fund growth.

- For retiring Government debt- since a big part of Centre’s revenue receipts go towards repaying public debt/interest.

- For expenditure on social programs like health and education.

- To encourage wider share of ownership in an enterprise, and reduce monopoly like enterprises.

- To introduce, competition, market discipline and efficiency.

- To depoliticize non-essential services and move out of non-core businesses, especially ones where private sector has now entered in a significant way.

- It also sends a positive single to the market and can boost economic activity.

Criticism of Disinvestment

- It has been alleged that shares of PSUs are sold at subpar prices.

- It has been seen as a resource raising exercise rather than a way to reform PSUs.

- There are no evidences that mere sale of PSUs will improve productivity and efficiency.

- It is argued that government is selling profit-making enterprises and is weakening the public sector.

- There are fears of job loss in an already poor job market in India.

- It may lead to emergence of private monopolies.

- It is seen as a policy of diverting attention from the economic slowdown.

- It is skipping the normal channel of parliamentary procedures.

Conclusion

Disinvestment assumes significance due to prevalence of an increasingly competitive environment, which makes it difficult for many PSUs to operate profitably.But government should also concentrate on increasing its own-revenue receipts to meet the public finances.It should also take into account the suggestions of the 14th FC in this regard. For example, selling stake in those companies with less than 1% market share.

Q1. What is the difference between disinvestment and strategic disinvestment? Critically examine the policy of disinvestment in India.

Q2 Discuss the objectives of disinvestment in India. Do you think the state should privatise even the profit-making public sector enterprises? Give reasons in support of your answer.