RBI Governor Shaktikanta Das has recently said that RBI is charting out the technology and procedure to roll out Central Bank Digital Currency in near future.

Context

RBI Governor Shaktikanta Das has recently said that RBI is charting out the technology and procedure to roll out Central Bank Digital Currency in near future.

Background

- In April 2018, the RBI had banned banks and other regulated entities from facilitating crypto transactions after digital currencies were used for fraudulent and criminal activities. Butin March 2020, the Supreme Court struck down the RBI’s ban on crypto, terming its circular unconstitutional.

- The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, which aims to put an embargo on all private cryptocurrencies and lays the regulatory framework for the launch of an “official digital currency” was set to be introduced in Parliament during the Budget session of 2021, but was not taken up.

- The proposed legislation on cryptocurrencies was expected to provide an exit window to the existing cryptocurrency holders of private entities.

Analysis

What is Central Bank Digital Currency (CBDC)?

- A Central Bank Digital Currency(CBDC) is the digital form of a central bank’s fiat currency that is also a claim on the central bank.

- Instead of printing money, the central bank issues electronic coins backed by the full faith and credit of the government.

- The Bank of England have described a CBDC as electronic Central Bank’s money that:

- Potentially has much greater functionality for retail transactions than cash

- Has a separate operational structure to other forms of Central Bank money, allowing it to potentially serve a different core purpose, and

- Can be interest bearing, under realistic assumptions paying a rate that would be different to the rate on reserves

- Can be accessed more broadly than reserves under bank

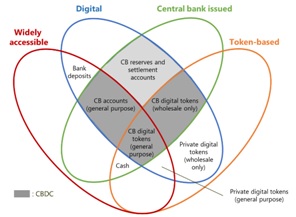

The money flower

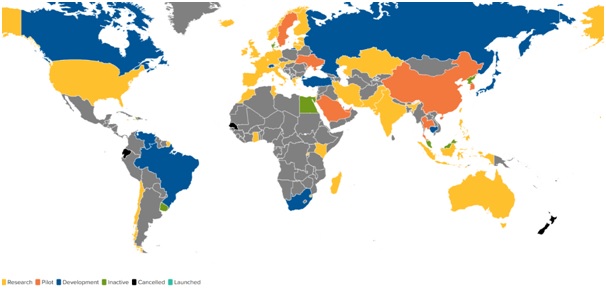

How many central banks/countries have started exploring CBDC?

- Bank of Thailand

- Bank of Lithuania

- The Riksbank, Sweden’s Central Bank

- Central Bank of Bahamas launched ‘Sand Dollar’

- Central Bank of Venezuela launched Petro

How is it similar or different to cryptocurrency?

|

Characteristics |

Cryptocurrency |

CBDC |

|

Issued by |

Private entities |

Central Bank |

|

Backed by |

NA |

Assets such as government securities |

|

Legal medium of exchange |

No |

Yes |

|

A store of value |

Yes |

Yes |

|

Determination and fluctuation of value |

Only market |

Monetary policy, trade and market |

|

Intermediary institutions |

Not required |

Not required |

|

Cost of money |

Mining cost — very high |

Low |

|

Security and maintenance |

Low |

Low |

|

Traceability |

High |

High |

|

Payments and settlement system |

Near universal acceptability |

Universal acceptability |

|

Monetary policy |

NA |

Possibility of near-real time transmission |

|

Financial stability |

Very unstable |

Difficult to answer with existing empirical evidence |

|

Scalability |

High |

High |

|

Privacy |

Not a major concern |

Normative, but can be a major concern |

Why is the government not in favour of crypto currency?

Generally, cryptocurrencies generate a negative sentiment amongst government, with the following key arguments:

- Most of the countries deny them the definition of currency and argues that they do not meet the functions of money.

- They are a highly volatile, speculative, medium that distorts the market, pulling away investment from the real economy and innovation into the bubble.

- They are vulnerable to crime and expose consumers and investors to high risks of loss.

- Despite the decentralisation claims of the underlying technology, they are prone to 51% attack.

- The technology is not scalable, is inefficient due to its slow speed of transactions, and has a high environmental impact due to miners’ energy use for computing power.

What are the advantages of CBDC?

- Practically costless medium of exchange: If CBDC were account-based, the accounts (like bank accounts) could be held directly at the central bank itself or made available via public-private partnerships with commercial banks, hence the transaction will reflect in the books of Central Bank which would eliminate the intermediaries and hence the cost of transaction will reduce drastically

- Secure storage of value useful for investment: Interest-bearing CBDC could have a rate of return in line with risk-free assets such as short-term government securities. The CBDC interest rate would serve as the main tool to attract investment

- Gradual obsolescence of paper currency: CBDC can be made widely available to the public, which will improve our cash to GDP ratio and boost digital payments and reduce tax evasion.

- True price stability: An effective monetary policy is possible if the real value of CBDC would remain stable over time. Such framework would encourage the systematic and transparent conduct and better transmission of monetary policy.

What are the concerns surrounding CBDC?

- Privacy issues: Central banks may have increased control over money issuance and greater insight into how the people spend their money, potentially depriving citizens of their privacy.

- Disintermediation of commercial banks: If citizens move their money from bank accounts into CBDC, this could start a vicious cycle as banks raise deposit rates to attract more money. In turn, this means less bank credit extended at higher interest rates

- Reputational risk for a central bank: Since CBDC involves a huge infrastructure, and if any citizen suffers glitches, cyber-attacks or human error, it could reflect poorly on the central bank’s reputation.

- Bank runs to CBDC: An oft-cited risk to introducing CBDC is the risk of a bank run as depositors would easily be able to transfer bank deposits to the Central Bank this would create a concept of flight of capital within banking system as well.

Conclusion

With a changing payments landscape, Central Banks have recognised that they too need to develop to aid this transition and incorporate new technology. If a private e-money issuer was to control the majority of payments in a country and there was a clear move away from the fiat currency, the CB would lose its ability to implement monetary policy. Against this backdrop, Central Banks are trying to understand the financial and economic impact of introducing their own digital currency, and we may expect our own CBDC in near future tweaked according to Indian financial system.