Context

Chief Economic Advisor sated to not to apply ESG standards for developing nations by the global investors.

Background

- Investment decisions are traditionally guided primarily by financial parameters.

|

ESG investment space in India

|

- However, with growing concerns about climate change, international concerns have emerged to adapt and mitigate its consequences by moving to sustainable development (and thus investment) models.

- Investors are increasingly focusing on sustainability investing, moving away from financial-focused investment models to more socially and environmentally responsible long-term investment trends.

- As a result, the demand for environmental, social and governance (ESG) investments has grown significantly globally.

- However, there is currently no specific set of rules that describe ESG and, importantly, it is more than just compliance.

Analysis

What are ESG Goals?

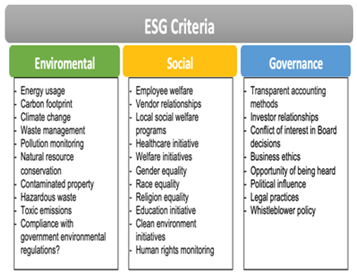

- The Environmental, Social and Governance (ESG) goals are a set of standards for company operations that compel companies to adopt better governance, ethical practices, environmental practices, and social responsibility.

|

Environmental |

Social |

Governance |

|

Environmental is all about an enterprise focus and action leadership around energy usage, waste management, and natural resources conservation. |

Social deals with an enterprise relationship and reputation with its employees, customers, stakeholders, institutions and the larger community. |

Governance is all about how an enterprise manages with the proper management structure, executive compensation and ensuring stakeholder rights, especially employees, shareholders and customers. |

How does India view ESG compliance?

|

In 2021, SEBI issued a circular containing details of a new sustainability-related reporting requirements called the Business Responsibility and Sustainability Report, which brings India’s sustainability reporting to global reporting standards. |

- In 2013, India became the first country to mandate corporate social responsibility with the Companies Act of 2013.

- SEBI in India plays the role of market regulator, regulating securities, and protecting the interests of the stakeholders in the market.

- SEBI is also responsible for the implementation of an efficient ESG policy mechanism.

- In 2021, SEBI replaced the existing BRR reporting requirement with a more comprehensive integrated mechanism, the Business Responsibility and Sustainability Report (BRSR).

- It will be compulsorily applicable to the top 1,000 listed entities (by market capitalization) from FY2022-2023 onwards.

- The BRSR requires listed entities to provide information on their performance in accordance with the nine principles of the 'National Guidelines for Responsible Business Conduct' (NGBRC).

|

How are other countries doing it?

|

What are the hurdles in the way?

- Complex ESG requirements

- Issues related to data privacy and cyber security.

- Lack of enough skilled ESG human resources

Why developing nations are relying on non-renewable source of energy?

- Low gestation period: Non-renewable source of energy like coal, has low gestation period providing energy security to the country.

- Labour intensive: The non-renewable source of energy involves various steps and methodology in the process of energy utilisation, which are labour intensive in nature.

- Employment opportunity: The developing nations are labour abundant nations with high population growth rate. The non-renewable source of energy involves labour intensive industries in the process, which serves as the employment opportunity to the available human resource.

- Available infrastructure: Non-renewable source of energy are the conventional source of energy which has gained several developments. The developing nations are availed with the infrastructure which can support the energy generation through conventional source of energy.

- Cost efficient: The past developments on the conventional process has reduced the cost of the energy production. Developing nations with low or middle income get an opportunity to produce electricity in an efficient manner.

Why is it necessary to implement ESG norms?

- Revenue growth: ESG compliance helps companies expand existing markets and provide new growth avenues as part of their blue ocean strategy.

- Better public image: ESG-compliant companies have easy access to resources – natural, financial, human talent, etc. – at lower costs.

- ESG is critical to raising funds, and free access to additional resources is equally important in countries like India, where companies face strong opposition from local communities and launch new projects in their reserved areas.

- Long-term sustainability: Adherence to the ESG framework encourages companies to seek more sustainable investment opportunities that create competitive advantage in the long term.

- Companies with lower carbon emissions, reduced waste, optimal water use, higher job creation and relatively better information will score high in the ESG index.

- Increase Employee Productivity: Integrating ESG into the corporate ecosystem instills a “purpose-driven life” in employees to excel at work.

- Cost/Risk Reduction: Complying with ESG standards such as shareholder grievance redressal, human rights and gender diversity by companies will lead to fewer penalties and enforcement actions.

- High-value business:ESG is important as it creates high value, drives long-term returns, and global stakeholders are paying attention to the topic.

- Responsibility towards society: Businesses today are expected to have an extra layer of ethics and moral duty towards the society. ESG helps gaining trust and goodwill.

- Other benefits

- Increases top-line revenue

- Costs are reduced as a result

- Increasing employee productivity and attracting talent

What are the developing nations will face in implementation of ESG norms?

Implementation of ESG norms will enable a paradigm shift in the energy production, thus resulting into several challenges for developing nations:

- Infrastructural constraints: Developing nations are not availed with proper infrastructure to shift the energy security from one source to another source.

- Financial crunches: The developing nations with low and middle income have a fund constraint which will provide a potential barrier to the transitional model.

- Cost inefficient: Non-conventional source of energy has not gained any severe and transformative R&D making it costlier for the low income and middle income countries.

- Unemployment: ESG norms increases the productivity of the labours, thus in the run period labours will be unemployed by the employees.

- The lack of standardization of reporting requirements across borders can create difficulties in harmonizing ESG principles, frameworks and considerations.

- Additional challenges related to the transparency, consistency, relevance and comparability of ESG standards may also pose obstacles to the smooth implementation of an ESG reporting framework.

What should be done?

Governments in India need to step in much more saliently. Three things are specifically important:

- Good rules and standards for what ESG means so that this does not lead to green washing or impact washing.

- Setting up the right kind of meta-governance structures that allow verification by independent third parties.

- Focus on producing high quality data from satellites and mobile phones that can enable tracking and monitoring.