Researchers say the amount of electricity generated from burning fossil fuels has likely peaked worldwide, as emerging markets invest in clean and cheap renewables over coal, oil and gas.

Context

Researchers say the amount of electricity generated from burning fossil fuels has likely peaked worldwide, as emerging markets invest in clean and cheap renewables over coal, oil and gas.

Background

- A report titled “Reach for the Sun: The emerging market electricity leapfrog” has been published by environmental think tanks Carbon Tracker, in the UK, and the Council on Energy, Environment and Water (CEEW) in India

- The researchers say that emerging markets will provide 88% of the growth in electricity demand over the next two decades, and say these markets are increasingly leapfrogging polluting energy sources that are uncompetitive

Analysis

What is the emerging market electricity leapfrog?

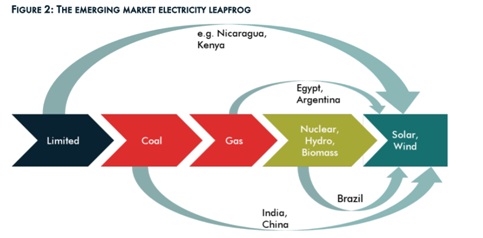

- Emerging markets will not follow the same path to renewables as developed markets.

- They have much lower levels of electricity consumption per capita, and 770 million people still have no access to electricity.

- Because demand for electricity is growing, countries can leapfrog the fossil fuel system by obtaining their growth in demand from renewable sources

Forces driving the leapfrog

- Economics

- The cost of solar and wind has been falling for years and is below the cost of fossil fuels in most locations for new electricity generation

- As renewables supply all the growth in supply and at ever lower costs, fossil fuel assets will be stranded because the total cost of renewables falls

- Technology

- Drivers include: digitisation of grids; better handling of intermediate solutions; and falling battery costs

- New business models (like aggregators) and system interconnection between for example transport, heat and electricity, is making flexibility easier.

- Domestic politics

- There are many domestic factors which are likely over time to persuade politicians to overcome the vested interests that are holding up the fossil fuel system.

- They include: jobs, votes, pollution, energy dependency, energy availability, speed to market, universal electricity access, industrial opportunities and competitive advantage.

Barriers to change

- Intermittency

- plenty of countries have high levels of penetration of renewables, so intermittency is clearly a soluble problem

- System costs

- Fossil fuel advocates argue that the levelized cost of energy of renewables is indeed cheaper than fossil fuels, but that system costs will be higher for renewables-based systems.

- After all, renewables are an intermittency technology and need some backup as well as bigger grids and so on

- Capital

- On the debt side, emerging markets suffer from underdeveloped domestic bond markets; hence refinancing is challenging

- International debt markets are deeper, but they provide more expensive capital after hedging for various non-project risks, such as currency fluctuations, policy and political, off taker risk, and transmission and power evacuation risk

- Systemic barriers

- Weak grid, Highly inefficient system, Weak legal system, Political risk, Currency risk, and Weak local banking markets

How to speed up the leapfrog?

- Stop financing fossils: it makes sense thus for developed markets policymakers to curtail the finance flowing to fossil fuel generation

- Technology and policy transfer: Technologies and successful policies can be transferred from the leaders to those aspiring countries in the emerging markets. It will be necessary, for example, to help build up robust local currency financial markets to help to channel domestic savings into renewable projects

- Reduce cost of capital: Capital needs to be made available to those who can deploy it. Development finance institutions need to de-risk projects in order to bring the cost of capital down to acceptable levels for countries that are serious about embracing renewables.

Highlights of the report

- This is the leapfrog decade. Emerging markets are about to leapfrog fossil fuels to generate all the growth in their electricity supply from renewables. That means peak global fossil fuel usage for electricity generation was probably 2018.

- Developed market demand for fossil fuels for electricity generation peaked in 2007, and is down 20% since then; 99% of developed markets have already seen a peak. Meanwhile, South African fossil fuel demand for electricity peaked in 2007, Chile in 2013, Thailand in 2015, Turkey in 2017

- India’s double leapfrog — connecting nearly all households to electricity and its renewable energy rollout — is one of the most revolutionary in scale.

- Renewables are the cheapest source of new electricity in 90% of the world, and the rest will soon follow

- Leaders of the countries with over 70% of global GDP have pledged to get to net-zero by mid-century, competition between China and the US favours a rapid dissemination of renewable technologies

- Intermittency can be managed; solar and wind are still only 4% of emerging market ex-China electricity supply, far below the current feasibility ceiling

Conclusion

We need innovative interventions — in policy, finance, technology and cost of capital, which could be modified for countries based on their local situations. Together, they could form the bedrock of a more determined push towards a leapfrog for all emerging economies to a cleaner energy future.