Context

The finance ministry cautioned the re-emergence of the twin deficit problem in the economy, with higher commodity prices and rising subsidy burden leading to an increase in both fiscal deficit and current account deficit.

Background

- In the backdrop of the pandemic and international crisis the world is facing a distinct possibility of stagflation, with supply chain remained unchanged.

- India, however, is at low risk of stagflation, owing to its prudent stabilization policies.

- Increased socio-economic inequality has induced the government more to spend on the subsidy schemes widening the fiscal deficit of the government.

- In the recovery phase, central banks of various nations have opted for the tightening of the monetary policy led to out flow of foreign currency from the Indian market, depreciating the India domestic currency.

- Cumulatively the India is facing a situation of deficit in both fiscal part of the government and current account part of the balance of payment.

Analysis

What is Twin Deficit Problem?

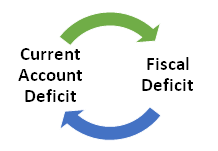

- Twin Deficit Problem: The situation of high fiscal deficit along with current account deficit is termed as twin deficit problem.

- The situation of high fiscal deficit arises, when the expenditure of the government is much higher than the revenue collection.

- When the import volume of the nation dominates over the export volume at a higher degree, resulting into a disruption in balance of payment termed as current account deficit.

Why this problem has arisen?

- High subsidy: The rising subsidy bills of the governments have increased the revenue expenditure of the government and widened the revenue deficit.

- Reduction in revenue collection: Reduction in the excise duty on oil and natural gas and cut on import duty have impacted the revenue collection.

|

Global Liquidity Tapering:

|

- Rising fuel prices: The fuel prices in the international market are increasing due to middle crisis and Ukraine war, inducing cost push inflation and increasing the government’s expenditure on subsidy schemes.

- Out flow of foreign currency: Global liquidity tapering had led to outflow of foreign funds from the Indian market, lowering the value of rupee.

- Skewed trade balance: The trade balance is the net export of a nation in terms of goods, which remains negative for India since liberalization.

- Costlier imports due to rupee depreciation.

What are the concerns associated with the problem?

- Increasing government expenditure: Costlier imports and rise in fuel price increases the cost of production, leading to imported inflation, which again invokes the government to spend more on the subsidies, widening the fiscal deficit.

- Outflow of foreign currency: High Fiscal deficit of the government creates mistrust among the foreign investors, which results into reduction in foreign investment and out flow of foreign currency.

- Rupee depreciation: Out flow of currency increases the value of foreign currency with respect to domestic currency ‘Rupee’.

- Rise in import bills: Currency depreciation increases the burden of import bills.

- Imported inflation: Increase in global oil prices in the international market results into rise in domestic price level of the commodities.

- Vicious cycle: Fiscal deficit and current account deficit are correlated to each other in a vicious process; fiscal deficit has the potential to influence high current account deficit and vice-versa.

How this problem can be resolved?

- Rationalising the expenditure: Government should rationalize the revenue expenditure to narrow down the deficit.

- Increasing capital expenditure: Expenditure on the capital budget will provide a sustainable solution to the problem, by increasing the employment opportunity and asset creation in the economy.

- Rationalization of taxation: Taxation policy should be rationalized and tax base must widen up to support the expenditure of the government.

- Reduction in non-essential imports: Non-essential imports needs to be reduced to bring down the burden of import bills.

- Indigenization of consumer goods: Government should promote Indian goods under the idea of ‘Aatmanirbhar Bharat’.

- Increasing export capacity: Making the Indian industries more export competitive in the international market will help to narrow down the current account deficit.

Conclusion

The health crisis and the contemporary changes in the world politics have disrupted supply chain and increased the chances of imported inflation for India. India’s policy measures have prevented the situation of stagflation the world is likely to face, but the increasing government burden on the subsidy schemes and import bills have arisen a problem of twin deficit which needs to be countered to maintain its sovereign credibility. More impetus should be given on capital expenditure and policies promoting the increasing the export competitiveness.