Context

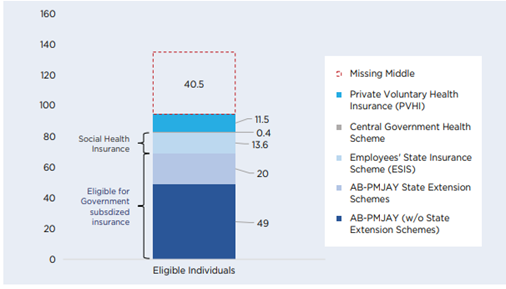

Under the Public health insurance policies, the middle segment of the population i.e. too rich to be covered by government health insurance and too poor to buy private insurance — has been one of Indian healthcare’s most stubborn problems.

Background

- India’s public expenditure on healthcare is a little over 1 percent, which is considerably low as compared to the vulnerable section of the society.

- The government launched the Pradhan Mantri Jan Arogya Yojana (PMJAY) — the tertiary care arm of Ayushman Bharat— in 2018.

- The scheme aimed at helping over 10 crore households with “deprivations” — as defined in the socio-economic caste census (SECC) of 2011 — to access healthcare.

- Despite this, about 80 crore Indians (at an estimated average family size of five) were left out of the scheme’s ambit.

- Health insurance penetration in India is pegged at 35 per cent.

According to NITI’s Aayog document on how to cover the “missing middle”, it was mentioned that 30 per cent of India’s population — still lacked any form of financial protection for health.

Analysis

Why does Public Health matter?

- Public health promotes and protects the health of people and the communities where they live, learn, work and play.

- Public health works to track disease outbreaks, prevent injuries and shed light on why some of us are more likely to suffer from poor health than others.

What are the loopholes in present health insurance coverage for the middle man of India?

- Uncovered population: In the absence of a low-cost health insurance product, the missing middle remains uncovered despite the ability to pay nominal premiums.

- Ignored segment: Most health insurance schemes and products in the Indian market are not designed for the missing middle.

- Out of Budget: Private voluntary health insurance is designed for high-income groups – it costs at least two to three times the affordable level for the missing middle.

- Affordable goes to BPL: Affordable contributory products such as ESIC, and Government subsidized insurance including PMJAY are closed products. They are not available to the general population due to the risk of adverse selection.

What are its implications?

- High out-of-the-pocket expenditure (OOPE): The private sector is characterized by high OOPE, leading to low financial protection, and is mostly self-employed or middle-income groups of the society.

- Impact on the standard of living: The catastrophic health expenditure and its impact on savings and standard of living are experienced by a substantial share of the population, almost 1/4th at the 10% threshold level, connecting it to the purchase of health insurance as an investment for health security is not intuitive ex-ante (Ex-ante refers to future events, such as the potential returns of a particular security, or the returns of a company).

Who are those missing ‘middle’ people in the country?

- The ‘missing middle’ is a broad category that lacks health insurance, positioned between the deprived poorer sections, and the relatively well-off organized sector.

- The deprived and poor sections receive Government subsidized health insurance, while the relatively well-off in the organized sector of the economy are covered under social health insurance or private voluntary insurance.

- The missing middle refers to the non-poor segments of the population who remain prone to catastrophic and even impoverishing health expenditure, despite the financial capacity to pay for contributory health insurance.

|

Health insurance policies in India

|

How their numbers are estimated?

- The occupations or sources of income of the ‘missing middle’ can be inferred using the NSSO’s 75th Round (2017-18) health survey.

Why does Public health needs ‘insurance coverage’?

- Achieving UHC: Expansion of health insurance/assurance coverage is a necessary step and a pathway in India’s effort to achieve Universal Health Coverage (UHC).

- To lower the expenditure burden: Low Government expenditure on health has constrained the capacity and quality of healthcare services in the public sector. It diverts the majority of individuals – about two-thirds – to seek treatment in the costlier private sector.

- To manage expensive treatments: India’s population is vulnerable to catastrophic spending and impoverishment from expensive trips to hospitals and other health facilities, which is not limited to the poor but it impacts all segments of the population.

- Safeguarding from health shocks: Pre-payment through health insurance emerges as an important tool for risk-pooling and safeguarding against catastrophic (and often impoverishing) expenditure from health shocks.

|

What are the challenges? |

What can be done further to include the missing middle ones? |

|

|

Conclusion

The primary purpose of the government agencies is to recognize the policy issue of low financial protection for health in the missing middle segment. Health insurance is a potential pathway to addressing that, and improving the efficiency and quality of healthcare delivered. In doing so, broader discussions on solutions and specific products are required to improve insurance coverage for the missing middle.