Context

It is generally accepted by economists today that an increase in the overall money supply in an economy causes a proportionate rise in the prices of goods and services over the long-run which is known as the ‘Cantillon effect’.

About

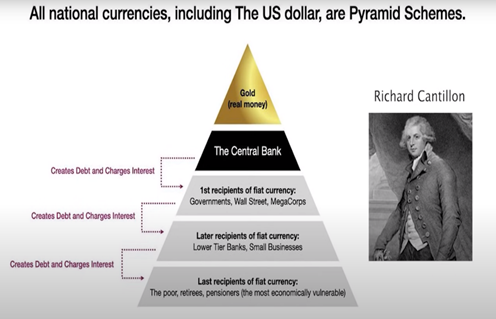

- The Cantillon effect refers to the idea that changes in the money supply in an economy causes redistribution of purchasing power among people, disturbs the relative prices of goods and services, and leads to the misallocation of scarce resources.

- The Cantillon effect is named after the 18th century French economist Richard Cantillon.

|

According to the Quantity theory of money, the total amount of money in an economy plays a crucial role in determining the general price level. So, if the money supply in an economy doubles this should lead to a rough doubling of prices across the economy. In other words, money has largely been considered to be “neutral,” in the sense that changes in its supply have no real effect on the economy. |

How this effect does works in an economy?

- A Cantillon effect is a change in relative prices resulting from a change in money supply.

- Making lots of cheap money available via banks does not automatically mean that demand for everything will rise simultaneously.

- It is also evident that the shows that certain assets take favour over others, leading to rising in some areas of the economy and falling prices in others.

- Because money added to the economy (through lending and asset purchases by the central bank) or removed from the economy (through debt write-downs and liquidations) happen at specific points in the economy rather than in all markets simultaneously, both inflation and deflation tend to occur.

- The resulting relative price changes that occur may confuse observers over whether the economy is undergoing overall inflation or deflation.

What are its Impacts on the Economic Activities?

- On Relative Prices of Commodities: Relative prices play a crucial role in the allocation of scarce resources in an economy.

- Impact on Businesses: Prices act as important signals to entrepreneurs in the allocation of scarce resources towards various ends of society and changes in relative prices can thus affect the scarce resources are allocated.

- Changes in money supply: It can also lead to the misallocation of savings in the credit market as investors may allocate savings based on the signals sent by relative prices.

- Drawback to Expansionist Policies: Expansionary monetary policy compensates the drop in aggregate demand, but can lead to Cantillon effect.

|

What is Biflation?

|

Is Cryptocurrency Susceptible to the Cantillon Effect?

- Cryptocurrencies are usually based on their underlying blockchain network, e.g., the BTC network of Bitcoin.

- The new supply of cryptocurrency on these networks is managed via the processes of mining, on Proof of Work (PoW) block chains, or staking, on Proof of Stake (PoS) platforms.

- In both cases, the new supply is distributed among the special validator nodes that help process transaction blocks and keep the block chains functioning.

- Blockchain validatorsdo not act as intermediaries between the system that issues the new supply and the rest of the user community.

- On the contrary, banks in the modern economy are the primary recipients of the new monetary supply issued by the government.

- Thus, the nature of the new supply generation and distribution on blockchains ensures that the Cantillon effect is not applicable to cryptocurrency platforms. Compared to the traditional fiat moneyinstitutions, cryptocurrency is a much more equitable system.

How this can be controlled for stabilizing the economy?

It can be controlled by using various monetary policy measures like;

- Quantitative easing

- Cutting tax rates

- Lowering interest rates

- Open market operations

- Lowering bank reserve limits

- Increasing spending by the Government