Based on Khan Committee’s interim report, Securities and Exchange Board of India (SEBI) is conceiving an idea to merge Non Resident Indian (NRI) and Portfolio Investment Scheme (PIS) routes with that of Foreign Portfolio Investors (FPIs).

Issue

Context:

- Based on Khan Committee’s interim report, Securities and Exchange Board of India (SEBI) is conceiving an idea to merge Non Resident Indian (NRI) and Portfolio Investment Scheme (PIS) routes with that of Foreign Portfolio Investors (FPIs).

- The committee was formed by SEBI under the chairmanship of HR Khan, former deputy governor of RBI, to suggest measures for revitalizing and streamlining FPIs.

- The committee has suggested many reforms in foreign investment regulation mechanism in its interim report which were made public by the SEBI for comments last month.

- Taking cue from the interim report, SEBI has initiated the process of reforms especially with regard to NRIs and Overseas Citizens of India (OICs) investments in India.

Background:

- SEBI earlier this year issued a circular directing certain categories of FPIs such as trusts, banks, mutual funds, and investment managers to disclose their beneficial owners within six months. A beneficial owner is a person who, directly or indirectly, derives the benefits of ownership.

- The regulator wanted to tighten KYC norms to prevent money laundering and round tripping of funds, especially if an investment is made via a high-risk jurisdiction. Typically, countries with a known history of money laundering and funding terrorism activities are considered as high-risk jurisdictions.

- The circular said that Non Resident Indians (NRIs), Persons of Indian Origin (PIOs), Overseas Citizens of India (OCIs) and Resident Indians (RIs) cannot be beneficial owners of a fund investing in India.

- The regulator also asked FPIs to disclose names and addresses of the beneficial owners; whether they were acting alone or together through one or more natural persons as a group.

- Many stakeholders apprehended that the new guidelines would result in $75 billion worth of investments managed by OCIs, PIOs and NRIs, being disqualified from investing in India, and the funds would be withdrawn and liquidated within a short time frame.

- Following the controversy and resistance from the stakeholders, SEBI issued another circular that is in compliance with recommendation of the Khan Committee which has already been constituted to rationalise FPIs in India.

The committee was mandated:

- To rationalise the rules for foreign investors and come up with a policy regime without altering the broader framework.

- To relook at rules for foreign institutional investors that are otherwise registered within matured jurisdictions like the US, but pool their money in tax haven jurisdiction.

- To examine the time framework given to FPIs for making their funds broad based.

- To examine the feasibility of asking persons of funds to share their personal details, since these funds are of high risk in nature.

- To examine the feasibility of bringing NRIs and OCIs more under the net of SEBI regulations.

- To bridge the gaps between hundreds of FAQs released by SEBI at various points and the actual regulations.

Recommendations:

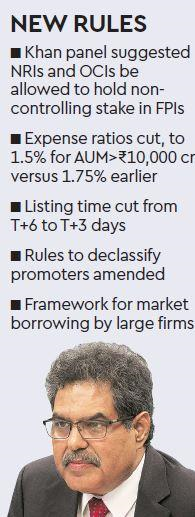

- NRIs, overseas citizens of India and resident Indians should be allowed to hold non-controlling stakes in FPIs and no restriction should be imposed on them to manage non-investing FPIs or SEBI-registered offshore funds.

- NRIs will be allowed to invest as FPIs if the single holding is under 25% and group holding under 50% in a fund, according to the panel.

- Erstwhile PIOs should not be subjected to any restrictions, while clubbing of investment limits for well-regulated and publicly held FPIs having common control should be allowed.

- Time for compliance with new norms should be extended by six months, after they are finalised and also the non-compliant investors should be given further 180 days to wind down their existing positions.

- SEBI should do away with additional Know Your Customer (KYC) requirements for beneficial owner in case of government related FPI’s.

Reforms:

Based on the interim report of the Khan Committee, along with other reports such as A.R Dave panel on the Consent Mechanism and the T.K Viswanathan on Fair Market Conduct, SEBI has initiated a process of reforms in the capital market of the country.

- SEBI eased the KYC norms and eligibility terms for FPIs. Now the beneficial ownership criteria in the Prevention of Money Laundering (Maintenance of Records) Rules, 2005 (PMLA Rules), will apply for KYC. As per the new norms clubbing of investment limit should not be done based on beneficial owner (BO).

- There will be separate set of norms for determining conditions, wherein NRIs, OCIs and resident Indian are constituents.

- NRIs, OCIs and resident Indians are allowed to be constituents of FPIs if a single NRI, OCI or RI holds less than 25% of holding.

- Investment managers of NRIs, OCIs and RIs can control the FPI, if they are regulated in the home jurisdiction and registered with SEBI as a non-investing FPI. Such an FPI may be directly or indirectly fully-owned and controlled by an NRI, OCI, or RI.

Analysis

Foreign investment is one of the most important engines of economic growth and development in India. The recent trends in the global economy have put pressure on the Indian foreign investment. In the face of it, Indian rules and regulations regarding foreign investment should have been simplified and rationalised to retain and increase the capital coming from outside the country. Although, India is one of the fastest growing economies of the world, there are certain vulnerabilities which put pressure on the overall economic performance of the country. One of the main challenges in the recent past is flight of FPIs.

There are several reasons for the flight of portfolio investment from the country in recent past. Some of the important ones are discussed below.

- Depreciation of Rupee: Since January 2018, Indian Rupee has depreciated by over 16 per cent to record a new all-time low practically every month. The decreasing value of rupee implies an increased cost for Indian economy to pay for its import obligations, thereby risking an increase in inflation. FIIs are concerned as they have to earn more returns to substitute the fall in their portfolio value due to rupee depreciation.

- Higher US Yields: The US Fed recently hiked its policy target by a quarter of a percentage point to 2.00-2.25 percent and indicated that it foresees another rate rise in December. Three more hikes are expected next year, and another in 2020. This increase in US yields is making emerging markets less attractive for foreign investors. Higher US yields have encouraged foreign investors to withdraw funds from emerging markets and re-invest in the US.

- Tumbling small and mid caps: The S&P BSE Small-cap index had hit a high of 20,046 on January 15. On October 11, it fell to 13,800, plunging 31 per cent since January. The S&P BSE Mid-cap index recorded a high of 18,321.37 on January 9 and since then, the mid-cap index has fallen 23.86 per cent. This plunge in the markets has erased most of the wealth created since March 2017. For foreign investors, mid-caps and small-caps have lost their sheen due to their consistently declining returns.

- Fear of US sanctions and trade war: The trade war between US and China has escalated on the back of import tariffs imposed by the US President Donald Trump on the Chinese imports. US has imposed tariff on Chinese imports worth $250 billion in three rounds so far this year. Reacting to the trade war, Asian Development Bank's President Takehiko Nakao has warned "people will start worrying about the credibility" of the multilateral free trade system that the world has believed in for so long and adversely affect the global investor sentiment. This could shave 1 and 0.2 per cent growth rate of China and US respectively. Foreign investors are worried the trade war may spill and negatively affect Indian export potential, and ultimately reduce investor returns.

- Reduced rating and default of NBFCs: The recent strings of default by IL&FS led the rating agencies to downgrade its commercial papers to 'junk'. This cautioned investors and led to a sell-off in NBFCs such as Dewan Housing Finance Ltd. DHFL shares tumbled by 60 per cent backed on relentless selling by DSP Mutual Fund. This lack of confidence in the NBFC space has reduced the prospects of fresh capital inflow by foreign investors.

- Rising crude oil prices: This year alone brent crude oil has appreciated by 17.25 per cent. The rise in crude oil implies that logistics cost for all commodities such as food items, agricultural output, expenses on daily transportation would raise thereby increasing inflation. This would impact the profitability of most companies, which would lead to fall in stock prices of such companies, erasing investor wealth.

In the light of these challenges, frequent changes in regulations and norms pertaining to FPIs and other foreign investments would be devastating and would send a bad signal to foreign investors. SEBI announced a set of new rules for foreign fund ownership last month. Its objective was to stop Indians from round-tripping their money.

Way forward:

A multi-pronged approach is needed to attract the foreign investment in the country both portfolio and direct investment.

Learning Aid

The main points:

Practice Question:

What are the current challenges India is facing in attracting foreign investment? Discuss in the light recent changes made by the Securities and Exchange Board of India.

Approach:

- Introduce by highlighting importance of foreign investments in India (40-50 words)

- Underline the current challenges to foreign investment (70-80 words)

- Write the recent changes made by the SEBI in FPIs. (70-80 words)

- Conclude briefly (30-40 words)