- Ten years after the collapse of Lehman Brothers triggered the global financial crisis, India’s non-banking financial companies (NBFC) sector is roiled by a series of defaults by the Infrastructure Leasing & Financial Services (IL&FS) group of companies –triggering concerns about risks in the country’s shadow banking sector.

- The crisis has shaved off Rs 8.48 lakh crore ($116.33 billion) in investor wealth in the past few days.

Issue

Context

- Ten years after the collapse of Lehman Brothers triggered the global financial crisis, India’s non-banking financial companies (NBFC) sector is roiled by a series of defaults by the Infrastructure Leasing & Financial Services (IL&FS) group of companies –triggering concerns about risks in the country’s shadow banking sector.

- The crisis has shaved off Rs 8.48 lakh crore ($116.33 billion) in investor wealth in the past few days.

- It raises the matter of overall corporate governance in India

Background

IL&FS

- The three-decade-old infrastructure lending giant, IL&FS, is a 'shadow bank' or a non-banking financial company that provides services similar to traditional commercial banks.

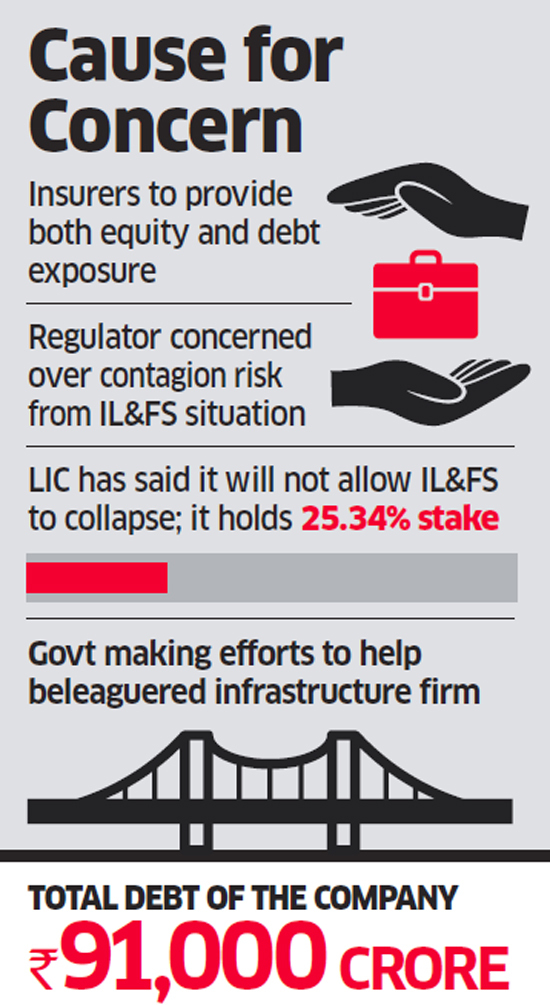

- At present, the major shareholders of IL&FS include state-backed Life Insurance Corp of India holding 25.3 per cent stake, Housing Development Finance Corporation with 9.02 per cent, Central Bank of India with 7.67 per cent and State Bank of India with 6.42 percent. Other key shareholders are the Japan’s Orix Corp, holding 23 per cent, and Abu Dhabi Investment Authority with 12.56 per cent.

IL&FS crisis

- IL&FS has been facing a serious credit crunch, which has caused severe disruption among India’s financial markets in recent days. Fears of the contagion spreading has led to a sharp fall in the stocks of housing finance companies (HFCs) and NBFCs (which operate on borrowed funds), causing the Sensex to plunge 1,785 points in the five trading days.

- Till the end of September 2018, the IL&FS had defaulted on debt obligations amounting to Rs 3,800 crores. Though the IL&FS is a private entity, more than 40% of its shares are held by government-owned firms – this meant that the government had to ensure the solvency of IL&FS in order to maintain financial stability in the country.

- According to the government, infrastructure and financial assets owned by IL&FS are worth more than Rs 1,15,000 or $15.77 billion, but its debts are the result of “mismanaged borrowings in the past.”

Corporate Governance in India

Corporate Governance deals with how a corporate is governed. It is the system by which companies are directed and controlled. It refers to the set of rules and regulations, processes and procedures which ensure that a company is run in a way so as to achieve its goals and objectives, add value to the company and also provide benefits to all the stakeholders in the long run.

- Corporate governance essentially involves balancing the interests of a company’s many stakeholders, such as shareholders, management, customers, suppliers, financiers, government and the community.

- The debate around transparency, role of independent directors, promoters etc. have received wide attention in the country in the light of episodes of Tata, Infosys, ICICI bank, PNB bank and now IL&FS, to further secure corporate governance in India.

Analysis

Possible reasons for the crisis

- The government blames IL&FS’s board and management for the crisis and in order to ensure that the IL&FS stays afloat, the government replaced the IL&FS board with six selected nominees. Kotak Mahindra Bank’s managing director Uday Kotak will serve as chairman of the new IL&FS board. Additionally, the government nominated technocrats with substantial experience in their fields.

- The government said that it would make sure that the IL&FS has sufficient liquidity so that no more defaulting takes place and infrastructure projects are implemented smoothly.

- The move came as a surprise since the central government has rarely stepped in to take control of a private company. Reuters reported that the new six-member IL&FS board would prepare a revival plan, but it would be inevitable for some lenders to suffer major losses.

- Another reason for the crisis could be attributed to a business model where short-term loans were taken to pay for long-term projects. But the long-term projects did not earn enough or fast enough to pay off the short-term loans.

- IL&FS defaulted on a few payments and failed to service its commercial papers (CP) on due date—which means the company has run out of cash or it is facing a liquidity crunch. The company piled up too much debt to be paid back in the short-term while revenues from its assets are skewed towards the longer term.

- The market regulator Sebi and other agencies are also looking into alleged Corporate Governance and disclosure-related lapses at various group firms.

Need for Corporate Governance norms in India

- Many companies in India, including the large corporate groups, were born as family-owned enterprises. Family members occupied managerial positions in such companies and took all the key business decisions. This practice had blurred the distinction between company’s finances and that of family owners.

- With the evolution of equity markets, many such family-run businesses listed themselves on the stock markets. This led to a separation of the ownership from the management of firms. Despite this, the promoters continue to wield disproportionate influence over company decisions.

- Corporate Governance norms are needed to ensure that a company is run in the interest of all the stakeholders, without the promoters and the management lining their own pockets.

- Further, a company with good corporate governance standards enjoys greater investor confidence, adding value to its share price in the stock markets.

- Foreign Institutional/Portfolio Investors (FII/FPI) prefer to invest in those companies with good corporate governance reputation.

- India has a history of high profile scams like the stock market scams (Harshad Mehta, Ketan Parekh), UTI scam, Satyam scandal etc. which were termed as the outcomes of failed corporate governance. Therefore, there is a need to institutionalize stringent norms surrounding corporate governance to prevent their recurrence in future.

- Apart from this, changing ownership structure, wide spread of investor, greater expectations of society of the corporate sector, hostile take-overs, huge increase in top management compensation, Globalisation, Deregulation and capital market integration are some other factors that calls for strict corporate governance norms in India.

Present Legislative Framework to improve Corporate Governance in India

- The Companies Act, 1956: All listed and unlisted companies in India are governed by the Companies Act 1956. It is administrated by Ministry of Corporate Affairs.

- The Securities Contracts Act, 1956: It covers all types of tradable government paper, shares, stocks, bonds, debentures, and other forms of marketable securities issued by companies.

- The SEBI Act, 1992: The act established SEBI as an independent capital market regulatory authority. It is a regulatory authority having jurisdiction over listed companies and which issues regulations, rules and guidelines to companies to ensure protection of investors.

- Indian Companies Act 2013: The key provisions of Indian companies act include:

- Maximum number of members (shareholders) permitted for a private limited company is increased to 200 from 50.

- Section 135 of the act deals with a new added provision called Corporate Social Responsibility (CSR).

- Women empowerment in the corporate sector by including the provision for more number of women in the board of directors.

- Fast track mergers and cross border merger.

- Establishment of Company Law Tribunal and Company Law Appellate Tribunal.

- The Companies (Amendment) Bill, 2017: The amendments under the Companies (Amendment) Act, 2017,are broadly aimed at:

- Addressing difficulties in implementation of companies act 2013.

- Facilitating ease of doing business in order to promote growth with employment;

- Harmonization with the accounting standards, the Securities and Exchange Board of India Act, 1992 and the regulations made thereunder, and the Reserve Bank of India Act, 1934 and the regulations made thereunder;

- Rectifying omissions and inconsistencies in the Act.

Important Committees on Corporate Governance in India

• Rahul Bajaj committee (1995): The Confederation of Indian Industries (CII) had set up a task force under Rahul Bajaj. The CII came up with a voluntary code called “Desirable Corporate Governance” in 1998.

• Kumarmanlagam Birla committee report (2000):The committee was set up by SEBI and covers issues such as protection of investor’s interest, promotion of transparency, building international standards in terms of disclosure of information. The SEBI implemented the recommendations of the Birla committee through the enactment of Clause 49.

• Naresh Chandra Committee Report (2002): It extensively covers Auditor-company relationship.

• R. Narayana Murthy Committee (2003): The committee was set up by SEBI to review the performance of corporate governance in India and make appropriate recommendations.

• Udaykotak Panel: In the light of recent Tata and Infosys episodes, SEBI appointed UdayKotak panel to enhance corporate governance norms in India.

Recommendations of Uday Kotak Panel

- A listed company should have at least six directors on its board.

- The panel has suggested for at least one independent director to be a woman.

- It also proposed that directors attend at least half of the total board meetings held in a financial year. If they fail to do so, they would require shareholders’ nod for continuing. The committee has proposed to increase the number of meetings to five a year.

- Companies have asked to make public the relevant skills of directors.

- The age of non-executive directors has been capped at 75 years.In addition, the chairperson of a listed company will be a non-executive director to ensure that s/he is independent of the management.

- The committee has recommended that the number of independent directors on a company board be increased from 33% to 50%.

- An independent director cannot be in more than eight listed companies and a managing director can hold the post of an independent director in only three listed companies.Every board meeting would require the presence of an independent director.

- Detailed reasons would need to be furnished when an independent director resigns. This is to ensure that they remain independent of the company’s management.

- An audit committee is being proposed with the mandate to look into utilization of funds infused by a listed entity into unlisted subsidiaries including foreign subsidiaries.

- The committee has also recommended that SEBI should have clear powers to act against auditors under the securities law.

- For government companies, the committee has recommended that the board have final say on the appointment of independent directors and not the nodal ministry.

-

Way Forward

- Strengthening the role and providing enough autonomy to institutions like SEBI, ICAI, and ICSI to handle the corporate governance failures efficiently.

- A robust mechanism should be developed to mitigate risk so as to avoid failure of big giants like Kingfisher, Satyam etc. as seen in the past.

- CSR projects should be effectively managed and monitored so that its benefits reach to the intended population.

- Persons from diverse background must be promoted rather than only from families as member of board of directors.

Learning Aid

Practice Question:

- Q. What do you understand by corporate governance? Why corporate governance norms are essential in India? Discuss in the light of recent episodes of alleged failure of corporate governance standards in major corporate entities in India.