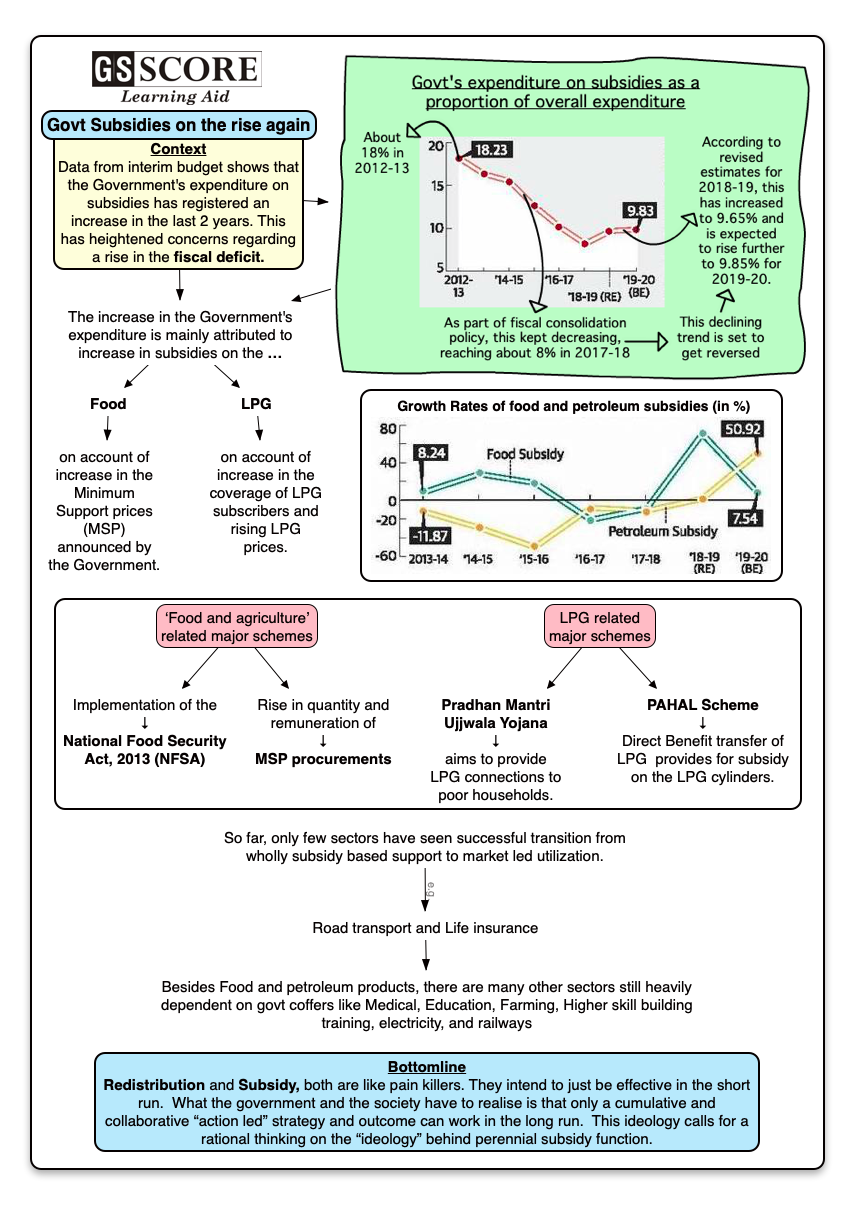

Government’s total expenditure on subsidies is expected to make up 83% of its total expenditure overall in 2019-20. Whereas, revised estimates for last year have also increased from 9.65%.

Issue

Contex:

- Government’s total expenditure on subsidies is expected to make up 83% of its total expenditure overall in 2019-20. Whereas, revised estimates for last year have also increased from 9.65%.

- With the rise in crude oil prices and the depreciation of the rupee, gross under-recoveries of the oil marketing companies for the ongoing fiscal are estimated to exceed the budgetary allocation for fuel subsidies, exerting pressure on the overall fiscal deficit target.

About:

- This increase in subsidies is significant when viewed against the backdrop of a consistent annual fall from2% in 2012-13 to present 8.15% in 2017-18.

- If the trend of rising subsidy prices continues into the future, then it could certainly be a matter of concern when it comes to the government’s fiscal consolidation plans.

Analysis

Reason for this reversal:

- Sharp rise seen in the food and petroleum subsidies over the last two budgets (2018-19 and 2019-20).

- Food subsidies increased by 70.8%.

- The increase in the food subsidy allocation is a reflection of the increase in the Minimum Support Prices hiked across the board.

- Petroleum subsidies have increased by 50.9%.

- The reason for the increase in the petroleum subsidy is because of an increased allocation for the Direct Benefit Transfer scheme for LPG (government’s focus on LPG as a source of cleaner cooking fuel).

- The government has two major schemes in the LPG sector:

- PAHAL scheme:Direct cash transfers to LPG consumers for 12 numbers of 14.2 kg cylinders per year.

- Ujjwala Yojana:Seeks to give free LPG connections to poor households.

Elaboration of Schemes/Programmes in the “Food and agriculture” sector:

Implementation of the National Food Security Act, 2013 (NFSA): NFSA is benefiting 80.72 crore persons in the country by providing them access to highly subsidized food grains at Rs.1/2/3 per kg for coarse grains/wheat/rice respectively.

Sugar Sector:

- Due to surplus sugar production and depressed ex-mill prices of sugar the liquidity position of sugar mills was adversely affected.

- With a view to improve the liquidity position of sugar mills enabling them to clear cane price arrears of farmers, the Government has taken the following measures during last few months-

- In order to prevent cash loss and to facilitate sugar mills to clear cane dues of farmers in time, the Government has fixed a minimum selling price of sugar at Rs.29/kg for sale at factory gate in domestic market, below which no sugar mill can sell sugar.

- Extending Assistance to sugar mills @Rs.13.88/quintal of cane crushed for sugar season 2018-19 to offset the cost of cane amounting to about Rs.4163 crore.

The importance of Fossil fuels:

- India imports 84% of the petroleum products consumed in the country.

- This implies that any change in the global prices of crude oil has a significant impact on the domestic price of petroleum.

- In 2000-01, net import of petroleum products constituted 75% of the total consumption in the country. This increased to 95% in 2016-17.

- The Ministry of Petroleum and Natural Gas provides subsidy on LPG cylinders and kerosene.

- This subsidy seeks to fill the gap between production cost of these petroleum products, and the price at which they are provided to consumers.

- The production cost of these items is dependent on the global crude oil price, which the primary input.

Under-recoveries:

- Under-recovery refers to the difference in the cost of producing petroleum products, and the price at which they are delivered to consumers.

- They indicate the loss incurred by oil marketing companies while supplying these products. This difference is shared by the central government and the oil companies.

The “Monday Blue” factors:

- Available information indicated the prospect of a slippage in the fiscal deficit target for FY19 because of an anticipated shortfall in the budgeted proceeds for disinvestment and indirect taxes.

- The likelihood of the government meeting the fiscal deficit target of 3.3% of GDP will also depend on whether it achieves the budgeted revenue targets related to the goods and services tax, dividend income and disinvestment proceeds, as well as fund requirements for revised minimum support prices, the Ayushman Bharat scheme and bank recapitalization.

- Union government explored additional support from the RBI for the budget, so that any downward adjustment in the budgeted government expenditure may be avoided if the fiscal deficit targets are to be adhered to.

- Any reduction in budgeted expenditure, particularly budgeted capital expenditure, might adversely impact growth as private sector demand has not tangibly strengthened.

Way Forward:

- Subsidy is given with the intention to make it an “enabler” movement.

- The motto is to make private capital and market economics compete to replace the government agencies in providing social goods to the masses.

- So far, only few sectors have seen successful transition from wholly subsidy based support to market led utilization e.g. road transport and life insurance sectors

- Medical, Education, Farming, Higher skill building training, electricity, railways and fossil fuel sectors are still heavily dependent on the government coffers.

- What is missed is an analysis, mostly by the masses, that government “does not earn”.It merely collects from Peter to pay it to Tom (Redistribution).

- If this redistribution mechanism is not efficient and effective, then the Peter feels being cheated and finds ways to hide his hard earned money. That leads to tax evasion.

- To correct it, government of the day enacts multiple laws, which leads to more innovative tax frauds. And, this vicious cycle goes on.

- On the Other hand, since Tom is receiving “stuffs” freely, he develops a tendency to remain dependent.

- These curbs any “capacity building” exercises. The outcome leads to a window of “demographic period of dependency”.

- Hence, Redistribution and Subsidy, both are like pain killers. They intend to just be effective in the short run.

- What the government and the society have to realize that only a cumulative and collaborative “action led” strategy and outcome can work in the longer run.

- This ideology calls for a rational thinking on the “ideology” behind perennial subsidy function.

Learning Aid

Practice Question:

Redistribution and Subsidy, both are like pain killers. They intend to be effective only for the short run. In your view, how far the government can go in enhancing subsidy bill? What impact does it create on the national economic governance?