Moody’s Investors Service (“Moody’s”) downgraded the Government of India’s foreign-currency and local-currency long-term issuer ratings to “Baa3” from “Baa2”. It stated that the outlook remained “negative”.

Context

Moody’s Investors Service (“Moody’s”) downgraded the Government of India’s foreign-currency and local-currency long-term issuer ratings to “Baa3” from “Baa2”. It stated that the outlook remained “negative”.

Background

- In November 2017, Moody’s had upgraded India’s rating to “Baa2” with a “stable” outlook.

- At that time, it expected that “effective implementation of key reforms would strengthen the sovereign’s credit profile” through a gradual but persistent improvement in economic, institutional and fiscal strength.

- But those hopes were belied. Since that upgrade in 2017, implementation of reforms has been “relatively weak and has not resulted in material credit improvements, indicating limited policy effectiveness,”.

- In November 2019, Moody’s changed the outlook on India’s Baa2 rating to “negative” from “stable” precisely because these risks were increasing.

- Since many of the apprehensions that it had in November 2019 have come through, Moody’s has downgraded the rating to “Baa3” from “Baa2”, while maintaining the negative outlook.

Analysis

What is Moody’s rating?

- Founded by John Moody in 1909, Moody's Investors Service or Moody's along with Standard & Poor's and Fitch Group is considered one of the Big Three credit rating agencies.

- Moody's is an organisation which in a way ranks the creditworthiness of the borrowers.

- In order to rank the borrowers, a standardised rating scale is used which measures the expected investor loss in the event of default.

- Thus, it is a bond credit rating business of Moody's Corporation which provides international financial research on the bonds which has been issued by the commercial and government entities.

- Moody's rates debt securities which include government/municipal/corporate bonds, money market funds and fixed income funds.

- It also rates banks and NBFCs.

- The ratings by Moody's Investors Service and its other competitors is useful for the investors and hence they play a key role in global capital markets as well where they work as credit analysis provider for banks and other financial institutions and help in assessing the risk of particular securities.

How Moody gives credit ratings?

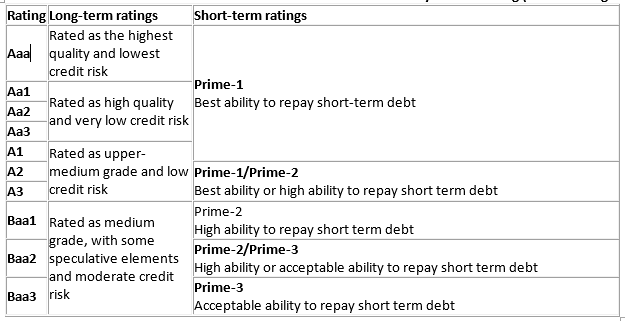

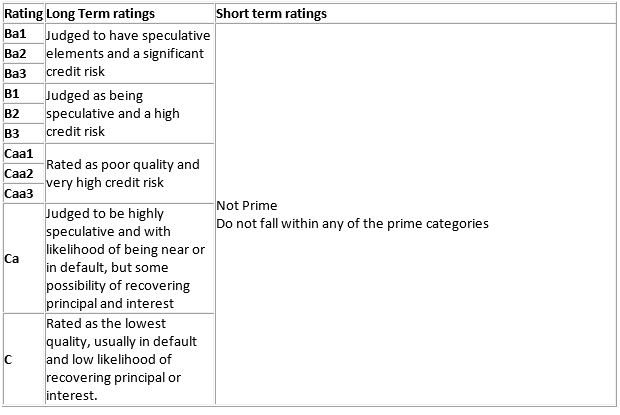

- Moody's uses a standardised rating scale from Aaa to C, where Aaa is the highest and C is the lowest. Thus, the rating process gathers information which may help the investors to evaluate the risk who might own or buy given security.

The rating process informs the marketplace and participants of Moody's actions. It also monitors on an ongoing basis whether the rating should be changed.

Moody's credit rating (Investment grade)

Moody's Credit Ratings (Speculative Grade)

Highlights

- Moody’s has just cut India’s sovereign rating to Baa3 from Baa2 (both with negative outlook) bringing it to the lowest investment grade.

- This was driven by risks of a sustained period of relatively low growth, further deterioration in the fiscal position and stress in the financial sector.

- Its negative outlook reflects dominant, mutually-reinforcing, downside risks from deeper stresses in the economy and financial system that could further erode fiscal strength.

- The cut brings Moody’s rating on India on par with S&P Global Ratings and Fitch Ratings Ltd., both of which have a BBB- rating.

- S&P and Fitch Ratings currently rate India at BBB- with stable outlook, that also happens to be the lowest investment grade.

- Reason behind the downgrade-

- Weak implementation of economic reforms since 2017

- Relatively low economic growth over a sustained period

- A significant deterioration in the fiscal position of governments (central and state)

- And the rising stress in India’s financial sector

- In its official statement, Moody’s said,

“The decision to downgrade India’s ratings reflects Moody’s view that the country’s policymaking institutions will be challenged in enacting and implementing policies which effectively mitigate the risks of a sustained period of relatively low growth, significant further deterioration in the general government fiscal position and stress in the financial sector”.

- Among other emerging markets, Moody’s has downgraded sovereign credit ratings of Mexico and South Africa and maintained a negative outlook for these two countries, while it changed its outlook on Saudi Arabia to negative from stable.

- In case of Mexico and South Africa, Moody’s cited deteriorating fiscal strength and structurally very weak growth

Current challenges faced by Indian economy

- Prolonged period of slower growth relative to the country’s potential

- Rising debt

- Further weakening of debt affordability

- Persistent stress in parts of the financial system

What does “negative” outlook mean?

- The negative outlook reflects dominant, mutually-reinforcing, downside risks from deeper stresses in the economy and financial system that could lead to a more severe and prolonged erosion in fiscal strength than Moody’s currently projects.

- In particular, Moody’s has highlighted persistent structural challenges to fast economic growth such as “weak infrastructure, rigidities in labor, land and product markets, and rising financial sector risks”.

- In other words, a “negative” implies India could be rated down further.

Conclusion

The Indian economy is facing a prolonged period of slower growth relative to the country’s potential, rising debt, further weakening of debt affordability and persistent stress in parts of the financial system. These are challenges “the country’s policymaking institutions will be challenged to mitigate and contain.” With the country opening up its high-yielding debt market to foreigners, any downgrade would hurt inflows into a nation that relies on imported capital to fund investment.