|

Overview

|

Context

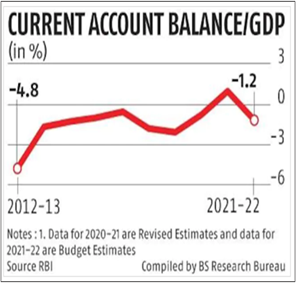

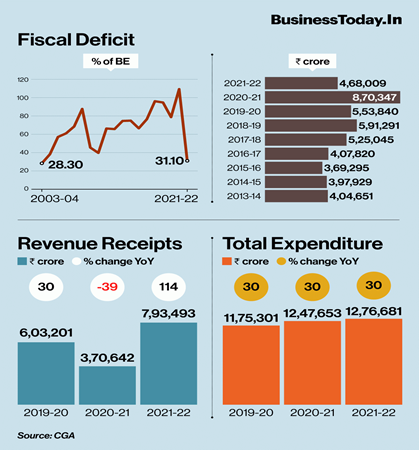

RBI in its ‘Monthly Economic Review’ report highlighted two key areas of concern for the Indian economy: the fiscal deficit and the current account deficit (or CAD).

Background

- As the on-going Russia-Ukraine conflict and global supply chains remain unrepaired, the trade disruptions, export bans and the resulting surge in global commodity prices will affect several factors of Trade in the world.

- The Finance Ministry in its latest monthly economic report said that India faces near term challenges in managing its fiscal deficit due to various global challenges.

- It added that there is now an upside risk to gross budget deficit due to additional welfare and subsidy spending and cut in excise duty on fuel.

What does the report says?

- On Fiscal deficit:Fiscal deficit may be high due to cuts in excise duties on diesel and petrol.

- On Current account deficit:

- Higher import bills may increase CAD: Costlier imports such as crude oil and other commoditieswill not only widen the CAD but also depreciate the rupee.

- A weaker rupee will, in turn, make future imports costlier.

- Pulling out of funds from emerging markets: Rupee can also weaken if, in response to higher interest rates in the western economies especially the US, foreign portfolio investors (FPI) continue to pull out money from the Indian markets, which too will hurt the rupee and further increase CAD.

What does a Deficit mean for an Economy?

- A deficitimplies that more money is going out of the country than coming in via the trade of physical goods. Similarly, the same country could be earning a surplus on the invisibles account — that is, it could be exporting more services than importing.

- Definition of Stagflation: Stagflation is defined as an economy that is suffering both an increase in inflation and low growth.

- Stagflation was initially identified in the 1970s, when an oil shock caused fast inflation and significant unemployment in many industrialised economies.

- The latest RBI report also point out that “even as the world was looking at a distinct possibility of widespread stagflation, India was at low risk due to its stabilisation policies.”

|

About Current Account Deficit (CAD) It has two parts:

|

Impacts of twin deficit on India

- Although no cause of worry in the short term, the twin deficit may in the long-term reduce the savings, depreciate the rupee and imbalance the financial investments of the government for social purposes.

- Costlier imports such as crude oil and other commodities will not only widen the CAD but also put downward pressure on the rupee. A weaker rupee will, in turn, make future imports costlier.

- If, in response to higher interest rates in the western economies especially the US, foreign portfolio investors (FPI) continue to pull out money from the Indian markets, that too will hurt the rupee and further increase CAD.

- As government revenues take a hit following cuts in excise duties on diesel and petrol, upside risk to the budgeted level of gross fiscal deficit has emerged. An increase in the fiscal deficit may cause the current account deficit to widen, compounding the effects of costlier imports, and weaken the value of the rupee, thereby further aggravating external imbalances, creating the risk (admittedly low, at this time) of a cycle of wider deficits and a weaker currency.

- As per the report, the recent surge in inflation in EMEs is mainly on due to supply-side shock arising from the Russian-Ukraine conflict.

What needs to be done?

- Trim revenue expenditure(or the money government spends just to meet its daily needs)

- Rationalizing non-Capex (capital) expenditureto avoid fiscal slippages

- Use tight monetary policyto achieve fiscal consolidation

- Import cut of non-essential goodsand make exports of Indian goods competitive

- Reforming the Indian marketto make it attractive for FDI and FIIs.

Governmental Intervention for managing Twin Deficit

- Improve the efficacy of public spending so that improvements in productivity increases in financial resources can drive higher public service delivery.

- Reduce the share of physical savings.

- Empower the States on the basis of their superior fiscal record to become the apex level of government responsible for public service delivery. This can be done by an increase in vertical devolution to the States equivalent to the current plan revenue expenditure.

- Reducing expenditure on fiscal ‘bads’ like food and fertiliser subsidy would then not trigger expenditure switching, thereby enabling a net reduction in the Central Government revenue deficit.

- The government should focus more on attracting more FDI, create a better environment for businesses, relax some regulations, and build the necessary infrastructure.

- India needs to maintain the balance of payments with its net capital inflow, which means it should focus more on FDIs rather than FPIs as a stable source of income.

|

PRACTICE QUESTION Q1. What is twin deficit? Examine as to how India can avoid the twin deficit problem amidst rising commodity prices and subsidy burden. Q2. Discuss how the twin deficit impacts the economy. Substantiate your answer with examples. |