Insolvency Law Committee‘s Second Report: Recommends UNCITRAL Model Law for Cross Border Insolvency issues.

The Insolvency Law Committee (ILC) constituted by the Ministry of Corporate Affairs to recommend amendments to Insolvency and Bankruptcy Code of India, 2016, has submitted its 2nd Report to the Government, which deals with cross border insolvency.

Issue

Context:

The Insolvency Law Committee (ILC) constituted by the Ministry of Corporate Affairs to recommend amendments to Insolvency and Bankruptcy Code of India, 2016, has submitted its 2nd Report to the Government, which deals with cross border insolvency.

Background:

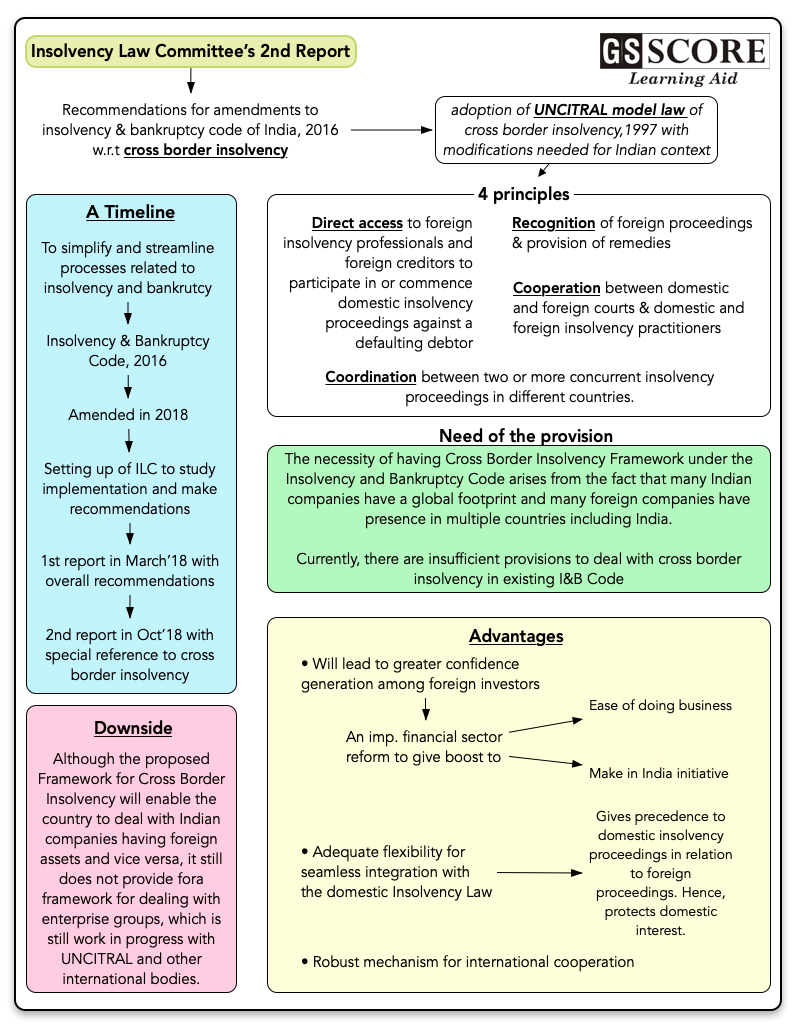

- The Insolvency and Bankruptcy law 2016 came into being to simplify and streamline the processes regarding insolvency and bankruptcy. Insolvency means an individual or an organisation is no longer able to pay debts to the creditors and the bankruptcy means that debtor has to liquidate his assets in order to make payments to his creditors.

- The aim of the law is to maximise the value of assets, to promote entrepreneurship, to promote availability of credit and to balance the interests of all stakeholders.

- In order to implement the law certain bodies were created such as Insolvency and Bankruptcy Board of India (IBBI), National Company Law Tribunal (NCLT), Insolvency Professionals and Information Utilities (IUs).

- At present the Law is being utilized extensively which has highlighted several operational and interpretational issues. To resolve the issues coming up in the process of implementation of the code, central government brought in amendments to the IB Code in November 2017 and subsequently replaced it by the Insolvency and Bankruptcy Code (Amendment) Act in January 2018.

- The immediate amendments to the IB Code were followed by the constitution of a formal Insolvency Law Committee by the Ministry of Corporate Affairs to study the major issues in the corporate insolvency process in a systematic manner.

- The Insolvency Law Committee submitted its first report in March 2018 which recommended amendments to the IB code, 2016 based on the experience gained from the implementation of the code.

- In its first report, with respect to cross-border insolvency, the committee noted that the existing provisions in the IB Code (section 234 and 235) do not provide a comprehensive framework for cross-border insolvency matters.

- The committee decided to provide a comprehensive framework for this purpose based on theUnited Nations Commission on International Trade Law(UNCITRAL) Model Law on Cross-Border Insolvency, 1997 which could be made a part of the Code by inserting a separate part for this purpose.

- Given the complexity of the subject matter and the requirement of in depth research to adapt the UNCITRAL Model Law for India, the committee decided to submit its recommendations on cross-border insolvency separately.

- Accordingly the committee has come up with its second report exclusively to recommend adoption of the UNCITRAL Model Law and the modifications necessary in the Indian Context.

Analysis

Increased integration of Indian economy with the global economic standards have made it imperative for India to synchronize its laws and rules in sync with international economic norms. The increased investments of foreign nationals and the expansion of corporate houses of foreign origin in India demands robust laws for seamless flow of foreign capital and friendly atmosphere for doing business in India. While the IB code has made some inroads in dealing domestic cases of insolvency and bankruptcy, the Code seems to be lacking when it comes to the insolvencies originating from the investments and businesses across borders.

So the need for a framework to deal with cross-border insolvencies arises due to:

- Insufficient provisions in IBC 2016: sections 234 and 235 of the Code which envisage entering into bilateral agreements and issuance of letters of request to foreign courts by Adjudicating Authorities under the Code resulted in an ad-hoc framework that was susceptible to delay and uncertainty for creditors and debtors as well as for courts.

- Non enforcement of the foreign judgements: the mechanism for enforcement of foreign judgments under the Civil Procedure Code, 1908 is not broad enough to include all insolvency orders such as orders regarding reorganization processes, administrative and interim orders, etc., rendering many judgments and orders in the insolvency process unenforceable in India.

- International character of the economy: Increased financial integration of the world has made it imperative for the world economies to have rule based financial transactions between the creditors of one jurisdiction(one country) with that of the debtors another (another country). This is because creditors and the corporate frequently transact business in more than one jurisdiction.

- To boost ease of doing business: It is evident from the global experience that cross-border decisions and their outcomes are considerably affected by the insolvency laws in force in a country.

- To boost ‘Make in India’ initiative: In order to sustain the influx of foreign companies India and set up manufacturing facilities, a robust framework is needed when it comes to cross-border insolvency.

In this backdrop, the Insolvency Law Committee has recommended that the framework based on UNCITRAL Model Law be adopted with necessary modifications.

|

The UNCITRAL Model Law on Cross-Border Insolvency, 1997 (Model Law): It was identified as a framework which was globally recognised and accepted. The Model Law was approved by UNCITRAL by consensus in 1997 and since then it has been implemented by 44 countries, including the United Kingdom, the United States of America, Japan, South Korea and Singapore. |

The model law based on UNCITRAL has four main principles:

Access

- It allows foreign insolvency professionals and foreign creditors the direct access to domestic courts and confers on them the ability to participate in and commence domestic insolvency proceedings against a debtor.

- Direct access with regards to foreign creditors is envisaged under the Code even presently. With respect to access by foreign insolvency professionals to Indian courts, the Committee has recommended that the Central Government be empowered to devise a mechanism that is practicable in the current Indian legal framework.

Recognition:

- The Model Law allows recognition of foreign proceedings and provision of remedies by domestic courts based on such recognition. Relief can be provided if the foreign proceeding is either a main or a non-main proceeding. If domestic courts determine that the debtor has its centre of main interests (“COMI”) in the foreign country, such a foreign insolvency proceeding is recognised as the main proceeding. If domestic courts determine that the debtor has an establishment (applying a test based on carrying on of non-transitory economic activity), such a foreign insolvency proceeding is recognised as the non-main proceeding.

- Recognition as a main proceeding will result in automatic relief, such as a moratorium on transfer of assets of the debtor, and allow the foreign representative greater powers in handling the estate of the debtor. For non-main proceedings, such relief is at the discretion of the domestic court.

Cooperation:

- The Model Law lays down the basic framework for cooperation between domestic and foreign courts, and domestic and foreign insolvency professionals. Given that the infrastructure of Adjudicating Authorities under the Code is still evolving, the cooperation between Adjudicating Authorities and foreign courts is proposed to be subject to guidelines to be notified by the Central Government, and not “direct” per se.

- However, direct cooperation between Adjudicating Authorities and foreign insolvency professionals, foreign and domestic insolvency professionals inter-se and between domestic insolvency professionals and foreign courts has been retained as is provided under the Model Law.

Coordination:

- The Model Law provides a framework for commencement of domestic insolvency proceedings, when a foreign insolvency proceeding has already commenced or vice versa. It also provides for coordination of two or more concurrent insolvency proceedings in different countries by encouraging cooperation between courts.

Advantages:

Increasing Foreign Investment

- The adoption of the Model Law provide added avenues for recognition of foreign insolvency proceedings, foster cooperation and communication between domestic and foreign courts and insolvency professionals and so on.

- Its adoption shall also enable India to align with global best practices in insolvency resolution and liquidation.

- There will be significant positive signalling to global investors, creditors, governments, andinternational organizations such as the World Bank as well as multinational corporations with regard to the robustness of India's financial sector reforms.

Flexible

- The Model Law is designed to be flexible and to respect the differences amongst national insolvency laws. Therefore, necessary carve outs may be made in relation to the Model Law to maintain consistency with domestic insolvency law while adopting a globally accepted framework.

Protection of domestic interest

- The Model Law enables refusal of recognition of foreign proceedings or provision of any other assistance if such action contradicts domestic public policy.Hence, it provides enough flexibility to protect public interest.

Priority to domestic proceedings

- The Model Law gives precedence to domestic insolvency proceedings in relation to foreign proceedings. For example, a moratorium due to recognition of a foreign proceeding will not prevent commencement of domestic insolvency proceedings.

Mechanism for cooperation:

- The Model Law incorporates a robust mechanism for cooperation and coordination between courts and insolvency professionals, in foreign jurisdictions and domestically. This would facilitate faster and effective conduct of concurrent proceedings.

Downside:

Although, the proposed Framework for Cross Border Insolvency will enable the country to deal with Indian companies having foreign assets and vice versa, theissues such as treatment of insolvency of enterprise groups will still remain a challenge. The proposed framework is meant for individual companies and not enterprise groups. As the UNCITRAL and other international bodies continue to study these issues and devise internationally workable solutions, the cross-border framework is expected to further evolve.

Learning Aid

Practice Question

The inclusion of the Cross Border Insolvency Chapter in the Insolvency and Bankruptcy Code of India, 2016, will be a major step forward and will bring Indian Insolvency Law at par with that of international standards. Elaborate.