Context

India’s Finance Ministry presented the country’s interim budget for 2024 at a time when the overall economic landscape appears stable, backed by strong macroeconomic data. . The budget outlines a multi-pronged economic management strategy, including infrastructure development, digital public infrastructure, and tax reforms. Given that 2024 is an election year, the Vote on Account or Interim Budget would merely be an interim approval to spend money, without any major tax or policy changes expected. Noting that India’s economy will see an “unprecedented” development, four major areas of focus for the government have been highlighted:

- Poverty

- Youth

- Women

- Farmers

Important Estimation (key numbers):

- Fiscal Consolidation: FY24 fiscal deficit is estimated at 5.8% of GDP, below the budged 5.9%. The government pegged the FY25 target at 5.1%, with an aim to reduce it to 4.5% by FY26.

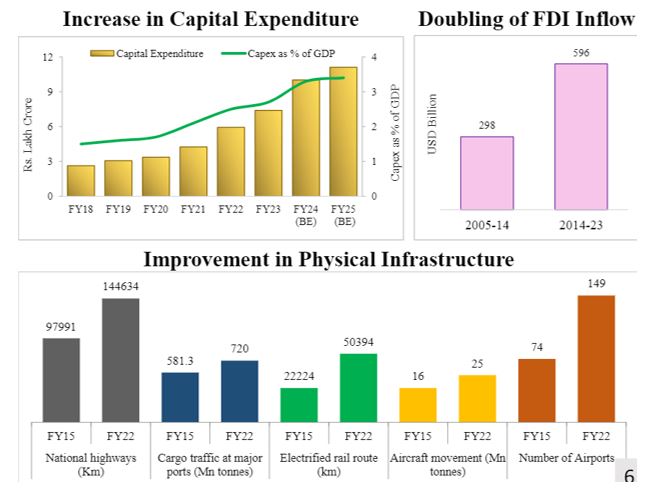

- Capital expenditure: It will rise by 11.1% to 11.11 trillion rupees ($133.9 billion) in fiscal year 2025, while tax revenue for the year would be 38.31 trillion rupees ($461.7 billion).

- Borrowings: The administration aims to borrow ?14.13 trillion ($170 billion) in the fiscal year starting April 1.

- Revenue Receipts: The revenue receipts for the current fiscal at ?30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalisation in the economy.

- Infrastructure: The outlay for infrastructure has been increased by 17% to Rs 11.11 lakh crore, or 3.4% of GDP, over the revised estimate of Rs 9.5 lakh crore in FY24.

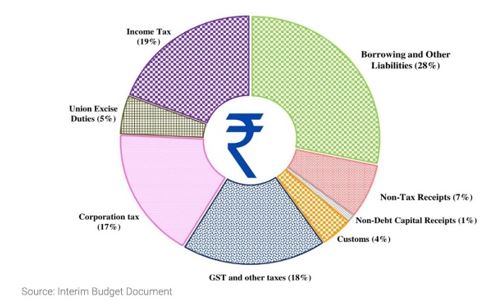

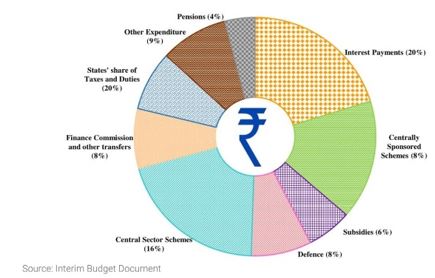

Below is the breakup of where the government gets its money and from where it spends it-

Where Does Rupee Come From? (Receipts) |

Where Does Rupee Go To? (Expenditure) |

|

The Budget stated that

|

|

The Interim Budget 2024 unveiled a series of transformative initiatives aimed at bolstering India’s growth, development, and global standing. Here’s a comprehensive look at the key highlights:

Key-Takeaways

- Taxes:

- No changes in tax slabs in keeping with convention; FY25 tax receipts seen at Rs 26.02 lakh crore.

- In a major announcement, the government has decided to withdraw outstanding direct tax demandsup to Rs 25,000 for the period up to financial year 2009-10 and up to Rs 10,000 for financial years 2010-11 to 2014-15.

- The only major change to taxation was tabled with respect to startups and investments made by sovereign wealth or pension funds, alongside tax exemption on certain income of some IFSC units – which are expiring on March 31.

- Railways

- In a bid to improve operations of passenger trains, the government announced three major economic railway corridor programmes to improve logistics efficiency and reduce cost —

-

- energy, mineral and cement corridors

- port connectivity corridors

- high traffic density corridors

- Enhancing Passenger Safety and Comfort The government is set to convert a staggering 40,000 standard rail bogies into state-of-the-art Vande Bharat coaches, elevating the safety, convenience, and comfort of passengers across the nation.

|

The Union Budget 2023 proposed a record budgetary allocation of ?2.40 lakh crore for the Indian Railways. |

|

Impact:

|

|

State of Indian Railways:

|

- Energy

- Rooftop Solarisation: Rooftop solar project to give 1 crore households 300 units of free electricity per month. Coal gasification and liquefaction of 100 million tonne to be set up by 2030. New scheme of bio manufacturing, biofoundry to be launched.

|

- The government will expand the electric vehicle ecosystem to support charging infra, and e-buses for public transport networks will be encouraged.

- The blending of compressed biogas into compressed natural gas for transport and piped natural gas will be mandatory.

- Bio-manufacturing and bio foundry scheme will be launched to provide environment-friendly alternatives for bio-degradable production

- Green Energy: Towards meeting the commitment to ‘net zero’ by 2070, the following measures were announced.

- Viability gap funding will be provided for harnessing offshore wind energy potential for the initial capacity of one giga-watt.

- Coal gasification and liquefaction capacity of 100 MT will be set up by 2030. This will also help in reducing imports of natural gas, methanol, and ammonia.

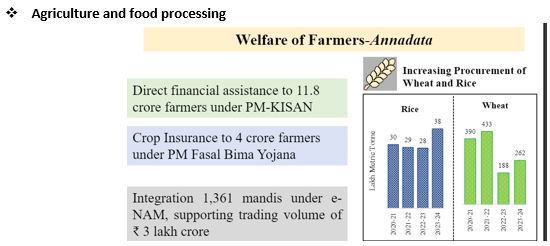

- Agriculture and food processing

- The government announced that the efforts for value addition in the agricultural sector and boosting farmers’ income will be stepped up.

- Pradhan Mantri Kisan Sampada Yojana has benefitted 38 lakh farmers and generated 10 lakh employment.

- Pradhan Mantri Formalisation of Micro Food Processing Enterprises Yojana has assisted 2.4 lakh SHGs and sixty thousand individuals with credit linkages.

- Promotion of post-harvest activities:Other schemes are complementing the efforts for reducing postharvest losses and improving productivity and incomes.

- Expansion of Nano DAP application: Following the success of nano urea, Nano DAP application on various crops will be expanded across all agro-climatic zones.

|

DAP usage in India

|

- Aatma Nirbhar Oilseeds Abhiyan: Strategy formulation to achieve self-reliance in oilseeds through research, adoption of modern farming techniques, market linkages, and crop insurance.

- Matsya Sampada: Promotion of investments in fisheries to generate employment opportunities, with a separate department set up for fisheries under the government's initiative.

|

Pradhan Mantri Matsya Sampada Yojana (PMMSY) Introduced by the Department of Fisheries, Pradhan Mantri Matsya Sampada Yojana (PMMSY), the aim of the scheme is to bring about Blue Revolution through the sustainable development of the fisheries sector over a period of five years (2020-2025) |

- Defense

- Defense Outlay: A substantial 11.1% increase in the Defence outlay, amounting to Rs 11,11,111 crore, demonstrates the government’s dedication to national security.

- Strengthening Deep Tech in Defence: The government is set to launch a comprehensive plan to strengthen deep tech capabilities in the Defence sector, ensuring India’s security and technological prowess.

|

The Central government aims to take India’s defence exports up to US$ 5 Bn by 2024-25. |

- Housing

- The government plans to launch a scheme for deserving sections of middle class living in rented houses or slums to build their own houses. Details are awaited.

- The government also aims to make 2 crore houses in the next five years under the PM Awas Yojana-Grameen and is close to achieving the 3 crore target.

- Housing for the middle class - The Government will launch a scheme to help deserving sections of the middle class, living in rented houses or slums, or chawls and unauthorized colonies, to buy or build their own houses. This is likely to free encroachment areas like slums for easier redevelopment.

- The Finance Minister also announced 2 crore more houses under the Pradhan Mantri Awas Yojana – Gramin (PMAY-G).

|

Cervical cancer, which develops in a woman’s cervix, is the second-most common cancer among women in India. It is caused by persistent infection by the human papillomavirus (HPV). India accounts for nearly a quarter of all cervical cancer deaths in the world. |

|

Pradhan Mantri Gramin Awaas Yojana is a flagship program of the Central Government in its mission to provide affordable housing for all. |

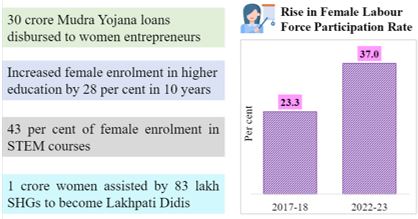

- Women

- Empowering Women (Triple Talaq Ban and Legislative Representation): The government’s commitment to women’s empowerment is highlighted by making Triple Talaq illegal and reserving one-third of legislative seats for women.

- Health Sector: The interim Budget announced the government’s plans to focus on vaccination against cervical cancer for girls aged 9 to 14.

- Other health-related schemes in her speech, including:

- The U-WIN platform for managing immunisations will be rolled out in the country.

- Extension of Ayushman Bharat coverage: The government will extend Ayushman Bharat cover to all Asha workers and Anganwadi workers and helpers.

- Expansion of medical colleges: The government will focus on setting up more medical colleges by utilising existing hospital infrastructure in the country.

- Umbrella scheme: Schemes under maternal and child health care will be brought under one comprehensive programme.

- An upgradation has also been announced of Anganwadi centres and expedited nutrition delivery and other steps for early childhood care.

- 'Lakhpati Didi' Scheme: The government announced that eighty-three lakh SHGs (self-help groups) with 9 crore women are transforming the rural socio-economic landscape with empowerment and self-reliance. Their success has assisted nearly one crore women to become ‘Lakhpati Didi’ already. Buoyed by the success, it has been decided to enhance the target for ‘Lakhpati Didi’ from 2 crore to 3 crore.

|

The term 'Lakhpati Didis' refers to women members of Self Help Groups (SHGs) who harness their entrepreneurial skills and earn a sustainable income of at least Rs 1 lakh per year per household. |

|

Impact:

|

- Investment

- The FDI inflow during 2014-23 was $596 billion marking a golden era. That is twice the inflow during 2005-14.

- For encouraging sustained foreign investment, the government is negotiating bilateral investment treaties with foreign partners, in the spirit of ‘first develop India’.

- Tourism:

- Interest free loans: Long-term interest free loans would be given to various states to develop tourist centers, while highlighting that spiritual tourism saw a boost last year.

- As much as 750 billion rupees at a 50-year interest free loan will be set aside for states to boost tourism.

- Rating system: A rating system based on the quality of facilities and services will be established.

- Lakshadweep Plan: Projects for port connectivity, tourism infrastructure, and amenities will be taken up on islands, including Lakshadweep. This will help in generating employment as well.

|

- New Innovation Fund (Technology)

- New-age technologies is enabling new economic opportunities and facilitating the provision of high-quality services at affordable prices for all, including those at the ‘bottom of the pyramid’.

- The government plans to set up a Rs 1 lakh crore corpus to back innovation. This includes 50-year interest-free loan, long-term financing or refinancing with long tenures with low or nil interest rates. The move is aimed at encouraging the private sector to scale up research and innovations "significantly in sunrise domains".

|

Impact: This will encourage the private sector to scale up research and innovation significantly in sunrise domains. |

Other Important Announcements

- Aqua Parks and Economic Corridor: Five integrated Aqua Parks are slated to be established, promising recreational spaces for communities. Additionally, the recently announced India Middle East Europe Economic Corridor is expected to be a game-changer for India’s economic landscape.

|

Middle East Europe Economic Corridor

|

- Bond sale program: The government announced a lower-than-expected bond sales program for the next fiscal year, as the nation prepares for big foreign inflows on global index inclusion.

|

Government Bond Index-Emerging Markets index

|

- FDI Focus: The government is set to push for bilateral treaties with foreign partners under the mantra of ‘First Develop India’ promoting foreign direct investment.

How India is handling the Global Situation?

- The global situation is becoming more complex and challenging due to wars and conflicts in different parts of the world.

- Disruption of global supply chain (impacted trade): Russia-Ukraine conflictand the Israel-Hamas war.

- However, India has successfully navigated the global challenges in fuel and fertiliser price spike.

- India successfully navigated complex global affairs post-Covid, assuming the G20 summit leadership, being the “Vishwaguru” during challenging times.

Success Stories

The FM made some announcements that will go on to benefit the sector both directly and indirectly:

- Sabka Saath, Sabka Vikas: A Decade of Poverty Alleviation Over the past decade, the government’s commitment to “Sabka Saath” has resulted in 250 million people breaking free from multidimensional poverty, symbolizing inclusive development.

- PM KISAN Yojana Success: 118 million farmers have received financial assistance under the PM KISAN Yojana, marking a crucial step towards rural prosperity.

- PM Awas Yojana (Gramin) - Despite all the challenges, the implementation of this scheme continued, achieving the target of close to 3 crore houses and now aims for 2 crore more houses to be taken up in the next five years.

|

At glance

|

- PM Mudra Yojana has sanctioned 43 crore loans amounting to Rs. 22.5 lakh crore, fostering entrepreneurial aspirations. Additionally, Startup India and Startup Credit Guarantee Schemes are assisting the youth.

- PM-SVANidhi has provided credit assistance to 78 lakh street vendors.

- Direct Transfer Impact: Savings and Credit Assistance Direct transfers of ?34 lakh crore through PM Jan-Dhan have led to significant government savings.

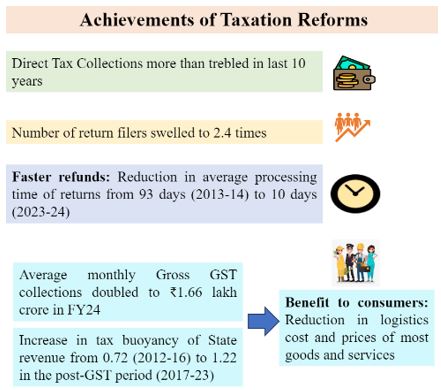

- GST Success and Skill India Mission: Over the last decade, the Indian economy has witnessed positive transformation, with moderate inflation and the successful implementation of GST. The Skill India Mission has trained and upskilled millions, establishing numerous educational institutions.

- India’s G20 Presidency Success: Building Global Consensus India’s successful G20 presidency showcased a forward-looking approach, building consensus on global solutions to challenges faced by the world.

- Scaling new heights in sports: The highest ever medal tally in Asian Games and Asian Para Games in 2023 reflects a high confidence level. Chess prodigy and our Number-One ranked player Praggnanandhaa put up a stiff fight against the reigning World Champion Magnus Carlsson in 2023. Today, India has over 80 chess grandmasters compared to little over 20 in 2010

|

Important Schemes announced in Budget 2023

|

Quick Analysis

- Tax: The budget focused on fiscal consolidation, infra, agri, green growth, and railways. However, no changes were made in the tax rates, which was a disappointment to salaried individuals.

- Industry status: The industry has been requesting industry status for years, believing it would unlock benefits like easier access to credit, tax breaks, and infrastructure development. This wasn’t explicitly addressed in the interim budget.

- Tax benefits: Tax incentives for homebuyers, such as increasing the deduction limit on home loan interest under Section 24, were expected. The interim budget remained silent on this as well.

- Affordable housing: Boosting allocations for schemes like PMAY (Urban) to improve affordability and encourage new projects in this segment was a key expectation. No major announcements appeared in the interim budget regarding this either.

- While the interim budget didn’t directly address the real estate sector’s key demands, the upcoming Union Budget might hold more concrete measures addressing industry concerns and potentially impacting market trends.

The interim budget is seen as a stop-gap financial plan during an election year, aimed at meeting immediate financial needs before a new government is formed. The full-fledged union budget will only be released after the elections. The Budget has been touted as a roadmap to “vikshit Bharat”, or developed India, by 2047.