- The most standout feature of this year’s Union Budget discussion has been the concern with the credibility of the budget numbers.

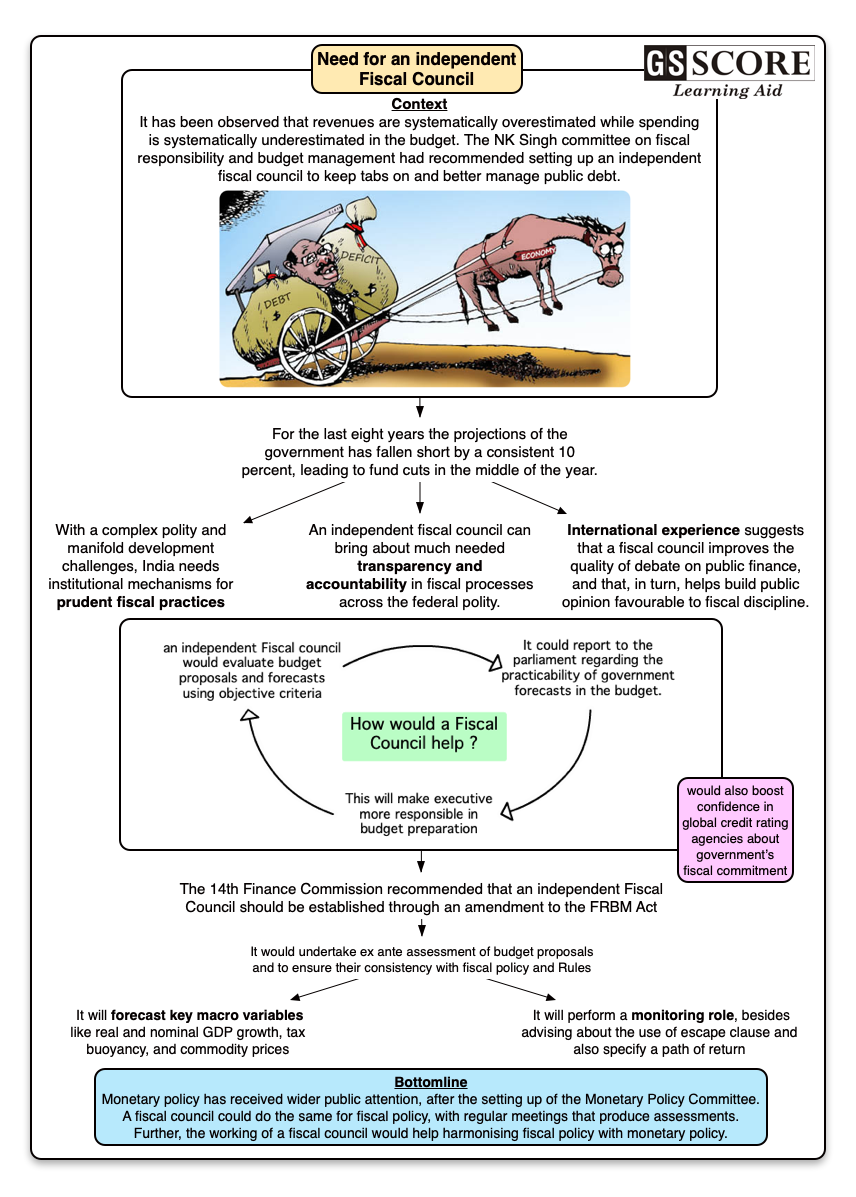

- It has been observed that revenues are systematically overestimated while spending is systematically underestimated in the budget.

Issue

Context:

- The most standout feature of this year’s Union Budget discussion has been the concern with the credibility of the budget numbers.

- It has been observed that revenues are systematically overestimated while spending is systematically underestimated in the budget.

- The NK Singh committee on fiscal responsibility and budget management had recommended setting up an independent fiscal council to keep tabs on and better manage public debt.

About:

- Countries with independent fiscal councils tend to produce relatively more accurate budget forecasts and stick better to fiscal rules, research suggests.

- The over-ambitious revenue targets combined with the lack of transparency in tax administration lead overzealous taxmen to exceed their brief in a quest to fulfil unrealistic targets.

- Also, a 2017 CAG report found that the tax department had resorted to ‘irregular’ and ‘unwarranted’ methods to meet targets.

- Thus, the FRBM report has recommended establishing a fiscal council to advise and assess government's spending and fiscal policy,

- In 2017, the N.K. Singh committee on the review of fiscal rules set up by the finance ministry suggested the creation of an independent fiscal council that would provide forecasts and advise the government on whether conditions exist for deviation from the mandated fiscal rules.

Background:

- The FRBM Review Committee headed by NK Singh was appointed by the government to review the implementation of FRBM.

- In its report submitted in January 2017, titled, ‘The Committee in its Responsible Growth: A Debt and Fiscal Framework for 21st Century India’, the Committee suggested that a rule based fiscal policy by limiting government debt, fiscal deficit and revenue deficits to certain targets is good for fiscal consolidation in India.

- Fiscal councils are now part of the institutional fiscal apparatus of over 80 countries, including several emerging and developing economies.

- Also, in past, it has been observed, that the finance ministry tends to overstate revenue projections and understate expenditures.

- One way to such problems is to institute an independent and statutory watchdog to oversee the state of public finances and to come up with its own assessments, if not its own projections, of government revenues and expenditures.

- In 2018, the D.K. Srivastava committee on fiscal statistics established by the National Statistical Commission (NSC) also suggested the establishment of a fiscal council that could co-ordinate with all levels of government to provide harmonized fiscal statistics across governmental levels and provide an annual assessment of overall public sector borrowing requirements.

Analysis

The conduct of Fiscal Policy: A major area of government failure

- Worldwide experience has shown pro-cyclicality in the conduct of fiscal policy.

- Myopic view of the policy makers and in particular, electoral budget cycles imparts a deficit bias in calibrating fiscal policy.

- This is aided further by the lack of transparency and fiscal illusion.

Why there is a need for Fiscal Council?

- With a complex polity and manifold development challenges, India need institutional mechanisms for prudent fiscal practices.

- An independent fiscal council can bring about much needed transparency and accountability in fiscal processes across the federal polity.

- International experience suggests that a fiscal council improves the quality of debate on public finance, and that, in turn, helps build public opinion favourable to fiscal discipline.

- In a globalised world of enormous capital flows, market volatility across the world and especially in emerging markets, in response to monetary policy changes in major economies, and geopolitical tensions that ebb and flow, causing currencies and commodity prices to swing, countries like India need macroeconomic management as an active function round the year.

- Also, it is supposed to report to the parliament regarding the practicability of government forecasts in the budget. This will make executive more responsible in budget preparation.

- For the last eight years the projections of the government has fallen short by a consistent 10 percent, leading to fund cuts in the middle of the year. Thus, an independent Fiscal council would evaluate budget proposals and forecasts using objective criteria.

- This would also boost confidence in global credit rating agencies about government’s fiscal commitment.

Main functions of Fiscal Council:-

- The 14th Finance Commission recommended that an independent Fiscal Council should be established through an amendment to the FRBM Act, by inserting a new Section mandating the establishment of an independent Fiscal Council to undertake ex ante assessment of budget proposals and to ensure their consistency with fiscal policy and Rules.

- The council is supposed to be appointed by, and report to, Parliament and should have its own budget.

- The functions of the council include ex ante evaluation of the fiscal implications of the budget proposals which includes evaluation of how real the forecasts are and their consistency with the fiscal rules and estimating the cost of various proposals made in the budget.

- The ex post evaluation and monitoring of the budget was left to the CAG.

Way Ahead

- Apart from advisory functions, it will forecast key macro variables like real and nominal GDP growth, tax buoyancy, and commodity prices.

- Similarly, it will do a monitoring role about the use of escape clause and also specify a path of return.

- Monetary policy has received wider public attention, after the setting up of the Monetary Policy Committee.

- A fiscal council could do the same for fiscal policy, with regular meetings that produce assessments.

- Further, the working of a fiscal council would help harmonizing fiscal policy with monetary policy.

Learning Aid

Practice Question:

The 14th finance Commission has recommended establishment of an independent Fiscal Council, so that budget numbers meet with less skepticism than they do today. Discuss. Also, critically examine how important it is to maintain the independence of this body with least political interference?