- The Comptroller and Auditor General (CAG) of India has pulled up the government for increased use of off-budget financing for schemes and subsidies in its Compliance of the Fiscal Responsibility and Budget Management (FRBM) Act report for FY17.

- This practice of off- budgeting masks the true extent of fiscal and revenue deficits.

Issue

context-

- The Comptroller and Auditor General (CAG) of India has pulled up the government for increased use of off-budget financing for schemes and subsidies in its Compliance of the Fiscal Responsibility and Budget Management (FRBM) Act report for FY17.

- This practice of off- budgeting masks the true extent of fiscal and revenue deficits.

- The CAG of India recommended that the government to institute a policy framework for off-budget financing, which, should include a disclosure about its rationale and objective to Parliament.

About -

- Off-Budget Accounting refers to expenditure that’s not funded through the budget. In terms of revenue spending, off-budget financing was used for covering the fertilizer bills through special banking arrangements; food subsidy bills of the Food Corporation of India through borrowings.

- Such off-budget financing are not part of calculation of the fiscal indicators despite fiscal implications. Governments across the world use this to escape budget controls.

Background -

Fiscal Responsibility and Budget Management (FRBM) Act:

- FRBM became an Act in 2003 which provides a legal-institutional framework for fiscal consolidation.

- The objective of this Act is to ensure inter-generational equity in fiscal management, long-term macroeconomic stability by achieving sufficient revenue surplus, better coordination between fiscal and monetary policy, and transparency in fiscal operation of the Government.

- The FRBM Bill was to bind future governments to a pre-specified fiscal policy framework which is an entirely anti-democratic measure.

- The FRBM Act which became effective from July 5, 2004 mandated the Central Government to eliminate revenue deficit by March 2009 and subsequently build up a revenue surplus. The Act also mandated the Central Government to reduce fiscal deficit to an amount equivalent to 3% of GDP by March 2009.

- The FRBM Act provides for greater transparency in fiscal operations, quarterly review for fiscal situation and regulating direct borrowing and control expenditure to effect fiscal discipline.

Analysis

Why is it Problematic?

- Off-budget financing by its nature isn’t taken into account when calculating fiscal indicators. But the cost is borne by the budget through some mechanism or the other.

- Such financing tends to hide the actual extent of government spending, borrowings and debt and increase the interest burden.

Report by CAG

- It said that off-budget financing was being used by the government (in the fiscal 2016-17) to defer fertiliser arrears, food subsidy bills and outstanding dues of Food Corporation of India (FCI).

OFF-BUDGET FUNDING IN FY17

REVENUE SPENDING:

1. Deferred fertilizer arrears/bills through special banking arrangements

2. Food subsidy bills/arrears of Food Corp. of India through borrowings

3. Accelerated Irrigation Benefit Program through National Bank for Agriculture and Rural Development borrowing

CAPITAL SPENDING:

1. Indian Railway Finance Corp. borrowing for railway projects

2. Power Finance Corp funding of power projects

- Off-budget financing includes mechanisms like market borrowing and ways and means advances, which are outside the purview of parliamentary oversight for e.g., Special banking arrangements were used to conceal the deferment of fertiliser subsidies.

- Spending on irrigation was masked by borrowing by the National Bank for Agriculture and Rural Development (NABARD).

- Railway expenditure was covered by borrowing by the Indian Railway Finance Corporation, and spending on power projects by the Power Finance Corporation.

- Though these provides flexibility in meeting requirement of capital intensive projects, it would pose fiscal risk in the long term, in case the entity that raises the funds fails to meet debt servicing.

- Despite this, the government resorts to off-budget methods of financing to meet its revenue and capital requirements.

- The quantum of such borrowings is huge and current policy framework lacks transparent disclosures and management strategy for comprehensively managing such borrowings.

What is the case with Food Corporation of India?

- To illustrate off-budget financing, the CAG report gave the example of Food Corporation of India (FCI).

- The difference between the cost of procurement of foodgrains and cost of providing them to fair price shops is what FCI demands from the government as subsidy.

- When the budget allocation of a financial year is not sufficient to clear all the dues of food subsidies bill raised by FCI, the dues of such subsidies are carried over to next financial year.

- It is evident that there was increase of about 350% over subsidy arrears in the five years preceding 2016-17.

- But the government has passed on its own food subsidy burden on to the FCI, rather than servicing it from the budget.

- This require financing from a number of methods including very high interest cash credit facility which increases actual cost of this subsidy substantially.

- The FCI has borrowed to pay for that burden and has also borrowed from NSSF to the tune of tens of thousands of crores to service that debt.

- In 2017-18, the FCI took loans of Rs 65,000 crore from the NSSF, partly for fresh expenditure and also to repay some of the principal of an earlier loan.

- However, all this money should have been part of official government expenditure in the Budget.

CAG favours a Policy for Disclosure

- A policy framework for off-budget financing that should include disclosures to parliament about the amount, rationale and objective of such funding. Off-budget financing being outside the parliamentary control has implication for fiscal indicators as they "understate" government's expenditure in the year by keeping them off the budget.

- Such off-budget financial arrangement, defers committed liability (subsidy arrears/bills) or create future liability and increases cost of subsidy due to interest payment . In order to address these issues, it said the government should consider "putting in place" a policy framework for off-budget financing. The framework should specify the rationale and objective of off-budget financing, quantum of off-budget financing and sources of fund, among others.

- Government may consider disclosing the details of off-budget Borrowings through disclosure statements in Budget as well as in Accounts. In Indian context, at state level, expenditure related to activities undertaken by the Government is considered off-budget if they are not routed through consolidated fund of the state or, outside the budgetary process or, not accounted for in the budget document.

Government Argument:

- The government has made amendments in the FRBM architecture through the Finance Act, 2018, presented along with Budget 2018-19.

- In the revised FRBM architecture, the government focused on achieving the fiscal deficit target of 3% of gross domestic product by the end of 2020-21.

- Government refuted the CAG charge by maintaining that since amendments to the FRBM Act in 2018 include a debt target, it has legislative control over Off-Budget financing.

Case Study

UDAY: Discoms cut down on fresh borrowing

- State-run electricity distribution entities (discoms), which had saved a substantial Rs 34,000 crore on interest costs due to the UDAY scheme in the two years ended December 2018, seem to be on a belt-tightening mode. According to data reviewed by FE, fresh borrowings by discoms of 12 major states in the 18 months ended Match 31, 2018 was only Rs 1.2 lakh crore, one-fifth lower than anticipated by the Union power ministry.

- Borrowings were expected to be higher given these discoms’ combined accumulated losses of Rs 66,436 crore (which is usually financed entirely via fresh borrowings) during the period and the allowed working capital limit of Rs 87,595 crore (banks and financial institutions could lend only 25% of a discom’s revenue in the previous year as working capital).

- States’ reluctance to fund losses of discoms is also said to be a reason for distribution companies cutting down on borrowings, as they are unsure of sovereign backing for post-UDAY losses. On a pan-India basis, discoms continue to lose 35 paisa on every unit of electricity sold (ACS-ARR gap), as they failed to meet the UDAY target to eliminate the ACS-ARR by FY19.

Recapitalising public sector banks

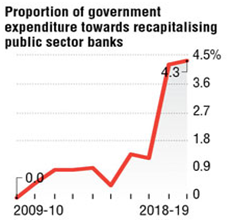

- Over the last few years, the government had spend a lot of money on recapitalising public sector banks. In 2009-10, the government spent no money in recapitalising public sector banks. In 2018-19, it will end up spending Rs 1.06 lakh crore on the same.

- Above figure plots the proportion of government money spent on recapitalising public sector banks, over the years. These banks have ended up with a huge amount of bad loans, which has led to the government having to constantly investing money in these banks, to keep them going. Bad loans are loans which haven't been repaid for a period of 90 days or more. Other than public sector banks, the government also spends a lot of money to keep many public sector enterprises going.

Way Forward

- The objective of the FRBM Act, 2003 was to provide for the responsibility of the Central Government to ensure inter-generational equity in fiscal management and long-term macro-economic stability. However, successive governments have resorted to methods like –

- Rolling over additional subsidy burden

- Taking back unspent amounts from ministries

- Converting certain expenditure entries to ways and means advances

- Running down the cash reserves

- Investors require a fiscal deficit number that is credible and that reflects the true level of government borrowing and spending.

- The more transparent it is, the better the market works and the more money can be raised going forward.

- Thus, the government should not sacrifice the effectiveness of the bond markets to its short-term desire to raise more finance while appearing fiscally conservative.

- Also, investing the small savings fund (NSSF) into the troubled and loss-making public sector units like state-owned airline Air India should be avoided.

Learning Aid

Practice Question:

“The budget math is always a lot of smoke and mirrors and various governments have used various means to prima facie meet the targets." Examine. In light of this statement discuss how successive governments in India have used off-budget financing to meet their fiscal targets?