Context

Recently, National Pharmaceutical Pricing Authority (NPPA) has raised the ceiling prices of 21 essential medicines by 50%. In this context, we are bringing out an analysis of pharma sector in India.

Background

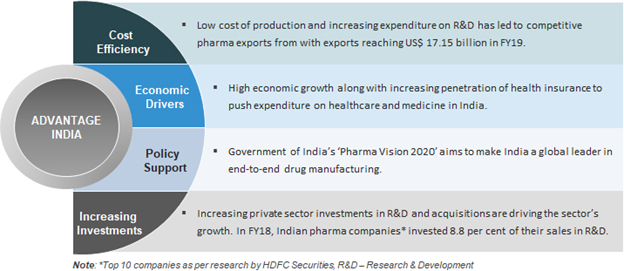

- India is the largest provider of generic drugs globally. Indian pharmaceutical sector industry supplies over 50 per cent of global demand for various vaccines.

- The pharmaceutical sector was valued at US$ 33 billion in 2017.

- As per Economic Survey 2018-19 the country’s pharmaceutical industry is expected to expand at a CAGR of 22.4 per cent over 2015–20 to reach US$ 55 billion. India’s pharmaceutical exports stood at US$ 17.27 billion in FY18 and have reached US$ 19.14 billion in FY19.

- Indian companies received 304 Abbreviated New Drug Application (ANDA) approvals from the US Food and Drug Administration (USFDA) in 2017.

- Pharmaceutical exports include bulk drugs, intermediates, drug formulations, biologicals, Ayush & herbal products and surgicals.

- India's biotechnology industry comprising bio-pharmaceuticals, bio-services, bio-agriculture, bio-industry and bioinformatics is expected to grow at an average growth rate of around 30 per cent a year and reach US$ 100 billion by 2025.

Analysis

Problems & Challenges

India is the third largest manufacturer of pharmaceutical products in terms of volume and it is growing steadily. The market has seen the entry of many foreign players as well as rise of many domestic manufacturers. However, the industry faces many speed breakers:

- Lack of R&D:

- The Indian pharma industry faces lack of research components and real time good manufacturing practices.

- No doubt investment (as % of sales) in research & development by Indian pharma companies increased from 5.3 per cent in FY12 to 8.5 per cent in FY18 but it is still low as compared to US counterparts that invest in R & D 15–20% of their sales.

- China is ascending at a great speed to a leading position worldwide in terms of Research and Development investment, scientific publications and patents. China is known for its mass-production of low-level generic drugs and as a ‘world factory’ of active pharmaceutical ingredients (APIs). India is importing APIs from china at large sacle

- Why?

- Simple enough answer, the lower the profits for the companies, the lower the investments. So the companies sight that due to the low income they are not able to develop products the way they want.

- Compliance issues and good manufacturing practices:

- This has somehow always been a problem for the Indian companies. The ongoing rumor is that the United States Food and Drug Administration is trying to block the growth of the companies.

- Why is the approval of USFDA important?

-

- The approval of USFDA is important because the largest consumer of pharma products is the USA and India is a major exporter. The opinion of the USFDA is considered to be the standard in the sector as well.

- The companies are trying to improve their standards and this issue can be solved by having officials who are more stringent and inspections on a regular basis can be done

-

- Highly fragmented industry

- The Indian pharma industry is highly fragmented. The market is overloaded with generic manufacturers.

- Why is this a problem?

- This is a cause for concern because high fragmentation causes instability, volatility and uncertainty. This is certainly not a good omen for the pharma sector.

- Pharmaceutical companies can review their strategies to survive in a volatile environment.

- Some of the actions that can be taken by the companies are they can periodically review their product portfolio and build more customer centric products.

- The companies need to build their organisation in such a way that will enable better operational ability and agility.

- Low Margins of profits due to government pricing policies – Drug Price Control Order

- Indian pharma companies are not getting proper profits; their earnings are basically very low as compared to their counterparts in other countries such as the US.

- Their income is not sufficient enough to invest money on research component.

- The companies sight that the reforms of the Government for the essential medicines has caused them to lower the price of drugs. This has been done by the Government for the betterment of the public. So the Government has to think of a way to promote the pharma companies as well.

- Funding for the pharma companies might be a way to move forward.

- National Pharmaceutical Pricing Authority (NPPA) has recently raised the ceiling prices of 21 essential medicines by 50% as China has increased the prices of APIs.

- Stronger IP regulations

- IP regulation has always been a thorn in the skin for the companies, especially the foreign companies. The companies strongly feel that the rules have to be amended and the so-called victim of the lax regulations have been the foreign entrants.

- The solution to this answer might be provided by the IPR Think Tank formed by the Government to draft a stronger national IP policies.

- The U.S. recognises and encourages secondary patents. India, however, does not. India’s rejection of secondary patents has kept blockbuster medicines affordable for many.

- Dependency on China

- The pharma industry is dependent on China for the supply of raw material for generic medicines production.

- India’s dependence on Chinese APIs imports makes the former vulnerable to the price mechanisms.

- Lack of Policy Support

- India needs user friendly government policy for the common man to establish small scale, raw material manufacturing units/ incubators in all states of the country to improve availability of raw materials to manufacture generic drugs at affordable rates.

- The government and industry should facilitate the pharmacist community to become entrepreneurs and promote incubators’ establishment.

- Lack of good quality of indigenously produced Raw Materials

- Raw material produced from small scale units should be properly validated in the testing laboratory of the state to ascertain their quality specifications.

- There is a need for a functional testing laboratory in every state to fasten the work of specification of raw materials.

- Small scale produces may be re-processed in another industry or via a chain of industry for quality products that can be used for parenteral/tailor-made formulations.

- Lack of Skilled Labour

- Skilled manpower from academic institutions can be achieved through continuing education programmes.

- Pharmaceutical Marketing Malpractices

- The pharmaceutical industry has been accused of adopting questionable practices in relation to the marketing of their products. The main focus of attention in this respect has been the suspect interactions between pharmaceutical companies and healthcare practitioners/ providers (HCPs). The unethical marketing practices comprises of:

- Claims made during promotional activities that are:

- Misleading and give rise to unjustifiable drug use leading to risks.

- Not capable of substantiation.

- Not in good taste.

- Comparative with another drug, without any substantive basis for such comparison.

- Unqualified in the use of terms such as safe.

- An improper representation of the true nature of the drug.

- Interaction with HCPs comprises of following malpractices

- Free samples of drugs

- Offering of gifts or monetary benefits to HCPs or family members.

- Providing travel or lodging facilities to HCPs in relation to attending seminars, continuing medical education (CME) programmes.

- Extension of grants or funds for medical research or clinical trials.

Suggestions

- Research schemes

- Should be initiated by the industry via direct contact with identified researcher/faculty.

- Incentives should be paid to students contributing towards development of any research formula for the industry.

- Industry-Academia Tie-Up

- Industries should contact Indian academic institutions to get qualified students who have the knowledge and aptitude for research and development in pharma.

- Industry should explore the availability of qualified students beyond metro cities.

- International Collaborations

- The industry and the government must collaborate with the international research organisations for research and development to invent new formulas, drugs and treatments.

- Internal Industrial Trainings:

- Every industry has its own protocol to serve the society. Therefore, the pharma industry should train students as per their need. Only a few industries are thinking in this line.

- Adoption of user-friendly policies will help establish small scale industry and encourage students and middle class business owners with ambitions in this line. This will also help overcome the problem of unemployment for pharmacists and promote entrepreneurship in the nation.

- Setting Up Special Pharma Research Centers

- With changing times, students are getting exposure through internet about research/ technology around them.

- Indian academic institutions are full of ideas born from the young, creative brains of students.

- Indian pharma industry can explore these ideas for future progress.

- There are ample opportunities for industries to represent their data via academic pharma institutions.

- Pharmacy students are highly qualified persons in handling of instruments with having good knowledge of data interpretation and data mining. The important part is that there is no significance of instrumental data without interpretation. Therefore, such knowledge of students can be explored by the industry at the cost of living wedges.

Steps by Government

- 100% FDI in Pharma Sector

- The Union Cabinet has given its nod for the amendment of the existing Foreign Direct Investment (FDI) policy in the pharmaceutical sector in order to allow FDI up to 100 per cent under the automatic route for manufacturing of medical devices subject to certain conditions.

- The drugs and pharmaceuticals sector attracted cumulative FDI inflows worth US$ 15.98 billion between April 2000 and March 2019, according to data released by the Department of Industrial Policy and Promotion (DIPP).

- Setting Pharma Parks

- In October 2018, the Uttar Pradesh Government announced that it will set up six pharma parks in the state and has received investment commitments of more than Rs 5,000-6,000 crore (US$ 712-855 million) for the same.

- National Health Protection Scheme

- The National Health Protection Scheme is largest government funded healthcare programme in the world, which is expected to benefit 100 million poor families in the country by providing a cover of up to Rs 5 lakh (US$ 7,723.2) per family per year for secondary and tertiary care hospitalization. The programme was announced in Union Budget 2018-19.

- It has the potential to turn India into the largest pharma manufacturer of the world in about three years.

- Ease of Doing Business

- In March 2018, the Drug Controller General of India (DCGI) announced its plans to start a single-window facility to provide consents, approvals and other information. The move is aimed at giving a push to the Make in India initiative.

- E-Pharmacies

- The Government of India is planning to set up an electronic platform to regulate online pharmacies under a new policy, in order to stop any misuse due to easy availability.

- Pharma Vision 2020

- The Government of India unveiled 'Pharma Vision 2020' aimed at making India a global leader in end-to-end drug manufacture. Approval time for new facilities has been reduced to boost investments.

- Affordability and

Problems & Challenges

India is the third largest manufacturer of pharmaceutical products in terms of volume and it is growing steadily. The market has seen the entry of many foreign players as well as rise of many domestic manufacturers. However, the industry faces many speed breakers:

- Lack of R&D:

- The Indian pharma industry faces lack of research components and real time good manufacturing practices.

- No doubt investment (as % of sales) in research & development by Indian pharma companies increased from 5.3 per cent in FY12 to 8.5 per cent in FY18 but it is still low as compared to US counterparts that invest in R & D 15–20% of their sales.

- China is ascending at a great speed to a leading position worldwide in terms of Research and Development investment, scientific publications and patents. China is known for its mass-production of low-level generic drugs and as a ‘world factory’ of active pharmaceutical ingredients (APIs). India is importing APIs from china at large sacle

- Why?

- Simple enough answer, the lower the profits for the companies, the lower the investments. So the companies sight that due to the low income they are not able to develop products the way they want.

- Compliance issues and good manufacturing practices:

- This has somehow always been a problem for the Indian companies. The ongoing rumor is that the United States Food and Drug Administration is trying to block the growth of the companies.

- Why is the approval of USFDA important?

-

- The approval of USFDA is important because the largest consumer of pharma products is the USA and India is a major exporter. The opinion of the USFDA is considered to be the standard in the sector as well.

- The companies are trying to improve their standards and this issue can be solved by having officials who are more stringent and inspections on a regular basis can be done

-

- Highly fragmented industry

- The Indian pharma industry is highly fragmented. The market is overloaded with generic manufacturers.

- Why is this a problem?

- This is a cause for concern because high fragmentation causes instability, volatility and uncertainty. This is certainly not a good omen for the pharma sector.

- Pharmaceutical companies can review their strategies to survive in a volatile environment.

- Some of the actions that can be taken by the companies are they can periodically review their product portfolio and build more customer centric products.

- The companies need to build their organisation in such a way that will enable better operational ability and agility.

- Low Margins of profits due to government pricing policies – Drug Price Control Order

- Indian pharma companies are not getting proper profits; their earnings are basically very low as compared to their counterparts in other countries such as the US.

- Their income is not sufficient enough to invest money on research component.

- The companies sight that the reforms of the Government for the essential medicines has caused them to lower the price of drugs. This has been done by the Government for the betterment of the public. So the Government has to think of a way to promote the pharma companies as well.

- Funding for the pharma companies might be a way to move forward.

- National Pharmaceutical Pricing Authority (NPPA) has recently raised the ceiling prices of 21 essential medicines by 50% as China has increased the prices of APIs.

- Stronger IP regulations

- IP regulation has always been a thorn in the skin for the companies, especially the foreign companies. The companies strongly feel that the rules have to be amended and the so-called victim of the lax regulations have been the foreign entrants.

- The solution to this answer might be provided by the IPR Think Tank formed by the Government to draft a stronger national IP policies.

- The U.S. recognises and encourages secondary patents. India, however, does not. India’s rejection of secondary patents has kept blockbuster medicines affordable for many.

- Dependency on China

- The pharma industry is dependent on China for the supply of raw material for generic medicines production.

- India’s dependence on Chinese APIs imports makes the former vulnerable to the price mechanisms.

- Lack of Policy Support

- India needs user friendly government policy for the common man to establish small scale, raw material manufacturing units/ incubators in all states of the country to improve availability of raw materials to manufacture generic drugs at affordable rates.

- The government and industry should facilitate the pharmacist community to become entrepreneurs and promote incubators’ establishment.

- Lack of good quality of indigenously produced Raw Materials

- Raw material produced from small scale units should be properly validated in the testing laboratory of the state to ascertain their quality specifications.

- There is a need for a functional testing laboratory in every state to fasten the work of specification of raw materials.

- Small scale produces may be re-processed in another industry or via a chain of industry for quality products that can be used for parenteral/tailor-made formulations.

- Lack of Skilled Labour

- Skilled manpower from academic institutions can be achieved through continuing education programmes.

- Pharmaceutical Marketing Malpractices

- The pharmaceutical industry has been accused of adopting questionable practices in relation to the marketing of their products. The main focus of attention in this respect has been the suspect interactions between pharmaceutical companies and healthcare practitioners/ providers (HCPs).Theunethical marketing practices comprises of:

- Claims made during promotional activities that are:

- Misleading and give rise to unjustifiable drug use leading to risks.

- Not capable of substantiation.

- Not in good taste.

- Comparative with another drug, without any substantive basis for such comparison.

- Unqualified in the use of terms such as safe.

- An improper representation of the true nature of the drug.

- Interaction with HCPs comprises of following malpractices

- Free samples of drugs

- Offering of gifts or monetary benefits to HCPs or family members.

- Providing travel or lodging facilities to HCPs in relation to attending seminars, continuing medical education (CME) programmes.

- Extension of grants or funds for medical research or clinical trials.

- Claims made during promotional activities that are:

- The pharmaceutical industry has been accused of adopting questionable practices in relation to the marketing of their products. The main focus of attention in this respect has been the suspect interactions between pharmaceutical companies and healthcare practitioners/ providers (HCPs).Theunethical marketing practices comprises of:

Suggestions

- Research schemes

- Should be initiated by the industry via direct contact with identified researcher/faculty.

- Incentives should be paid to students contributing towards development of any research formula for the industry.

- Industry-Academia Tie-Up

- Industries should contact Indian academic institutions to get qualified students who have the knowledge and aptitude for research and development in pharma.

- Industry should explore the availability of qualified students beyond metro cities.

- International Collaborations

- The industry and the government must collaborate with the international research organisations for research and development to invent new formulas, drugs and treatments.

- Internal Industrial Trainings:

- Every industry has its own protocol to serve the society. Therefore, the pharma industry should train students as per their need. Only a few industries are thinking in this line.

- Adoption of user-friendly policies will help establish small scale industry and encourage students and middle class business owners with ambitions in this line. This will also help overcome the problem of unemployment for pharmacists and promote entrepreneurship in the nation.

- Setting Up Special Pharma Research Centers

- With changing times, students are getting exposure through internet about research/ technology around them.

- Indian academic institutions are full of ideas born from the young, creative brains of students.

- Indian pharma industry can explore these ideas for future progress.

- There are ample opportunities for industries to represent their data via academic pharma institutions.

- Pharmacy students are highly qualified persons in handling of instruments with having good knowledge of data interpretation and data mining. The important part is that there is no significance of instrumental data without interpretation. Therefore, such knowledge of students can be explored by the industry at the cost of living wedges.

Steps by Government

- 100% FDI in Pharma Sector

- The Union Cabinet has given its nod for the amendment of the existing Foreign Direct Investment (FDI) policy in the pharmaceutical sector in order to allow FDI up to 100 per cent under the automatic route for manufacturing of medical devices subject to certain conditions.

- The drugs and pharmaceuticals sector attracted cumulative FDI inflows worth US$ 15.98 billion between April 2000 and March 2019, according to data released by the Department of Industrial Policy and Promotion (DIPP).

- Setting Pharma Parks

- In October 2018, the Uttar Pradesh Government announced that it will set up six pharma parks in the state and has received investment commitments of more than Rs 5,000-6,000 crore (US$ 712-855 million) for the same.

- National Health Protection Scheme

- The National Health Protection Scheme is largest government funded healthcare programme in the world, which is expected to benefit 100 million poor families in the country by providing a cover of up to Rs 5 lakh (US$ 7,723.2) per family per year for secondary and tertiary care hospitalization. The programme was announced in Union Budget 2018-19.

- It has the potential to turn India into the largest pharma manufacturer of the world in about three years.

- Ease of Doing Business

- In March 2018, the Drug Controller General of India (DCGI) announced its plans to start a single-window facility to provide consents, approvals and other information. The move is aimed at giving a push to the Make in India initiative.

- E-Pharmacies

- The Government of India is planning to set up an electronic platform to regulate online pharmacies under a new policy, in order to stop any misuse due to easy availability.

- Pharma Vision 2020

- The Government of India unveiled 'Pharma Vision 2020' aimed at making India a global leader in end-to-end drug manufacture. Approval time for new facilities has been reduced to boost investments.

- Affordability and Availability of medicines Mechanism

- The government introduced mechanisms such as the Drug Price Control Order and the National Pharmaceutical Pricing Authority to deal with the issue of affordability and availability of medicines.

Conclusion

- Medicine spending in India is projected to grow 9-12 per cent over the next five years, leading India to become one of the top 10 countries in terms of medicine spending.

- Going forward, better growth in domestic sales would also depend on the ability of companies to align their product portfolio towards chronic therapies for diseases such as such as cardiovascular, anti-diabetes, anti-depressants and anti-cancers that are on the rise.

- The Indian government has taken many steps to reduce costs and bring down healthcare expenses. Speedy introduction of generic drugs into the market has remained in focus and is expected to benefit the Indian pharmaceutical companies. In addition, the thrust on rural health programmes, lifesaving drugs and preventive vaccines also augurs well for the pharmaceutical companies.

- Lack of R&D:

- The government introduced mechanisms such as the Drug Price Control Order and the National Pharmaceutical Pricing Authority to deal with the issue of affordability and availability of medicines.

Conclusion

- Medicine spending in India is projected to grow 9-12 per cent over the next five years, leading India to become one of the top 10 countries in terms of medicine spending.

- Going forward, better growth in domestic sales would also depend on the ability of companies to align their product portfolio towards chronic therapies for diseases such as such as cardiovascular, anti-diabetes, anti-depressants and anti-cancers that are on the rise.

- The Indian government has taken many steps to reduce costs and bring down healthcare expenses. Speedy introduction of generic drugs into the market has remained in focus and is expected to benefit the Indian pharmaceutical companies. In addition, the thrust on rural health programmes, lifesaving drugs and preventive vaccines also augurs well for the pharmaceutical companies.