Context

The RBI's composite financial inclusion index (FI-Index) is showing growth.

About

About Financial Inclusion Index (FI-Index):

- The FI-Index has been conceptualized as a comprehensive index incorporating details of banking, investments, insurance, postal as well as the pension sector.

|

The financial Inclusion Index is based on a range between 0 and 100.

|

- It comprises three broad parameters - access, usage, and quality.

- The Index is responsive to ease of access, availability, usage of services, and quality of services, comprising all 97 indicators.

- A unique feature of the financial inclusion index is the Quality parameter which captures the quality aspect of financial inclusion as reflected by:

- Financial literacy

- Consumer protection

- Inequalities and deficien cies in services

|

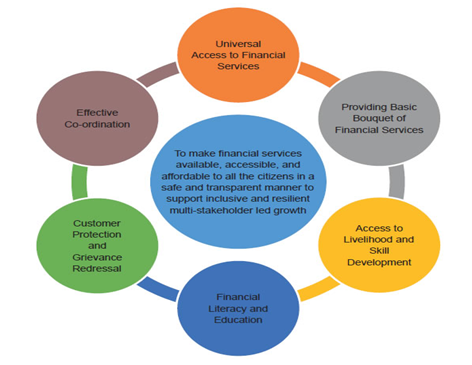

Government Vision: National Strategy for Financial Inclusion (NSFI)

Defining Financial Inclusion in the Indian Context:

|

Issues with financial inclusion in India:

- Challenges faced in accessing financial services while opening an account, seeking credit, or opening other financial inclusion products like Micro Insurance, Pension, Investments, and Remittances.

- Issues faced while using digital financial services.

- Attitude of the financial service provider.

- Complete knowledge of the product features including terms and conditions.

- Knowledge of Customer Rights.

- Grievance Redressal Mechanisms.

- Satisfaction in using the products.

Conclusion

The quality of financial services delivered to various target groups would be very useful to see the impact of financial inclusion policies on overall financial wellbeing.