The Supreme Court order quashing the Reserve Bank of India’s rules on bad loans comes as a major disappointment to the dogmatic effort to clean-up the stressed banking system, which sought to shift the balance of power from defaulting corporate promoters to ordinary bank depositors.

Issue

Context:

The Supreme Court order quashing the Reserve Bank of India’s rules on bad loans comes as a major disappointment to the dogmatic effort to clean-up the stressed banking system, which sought to shift the balance of power from defaulting corporate promoters to ordinary bank depositors.

About:

- The Supreme Court order quashing a circular issued by the RBI on resolution of bad loans is a setback to the evolving process for debt resolution.

- Declaring the central bank’s order as ultra-vires, this is likely to significantly affect the implementation of the bankruptcy process and the Insolvency Bankruptcy Code (IBC) over time.

- The SC order may also subsequently renew friction between the Centre and the RBI in terms of mutually agreeing on a timeline for recovering dues from large corporations and deciding an appropriate time period for framing and implementing debt-restructuring programmes.

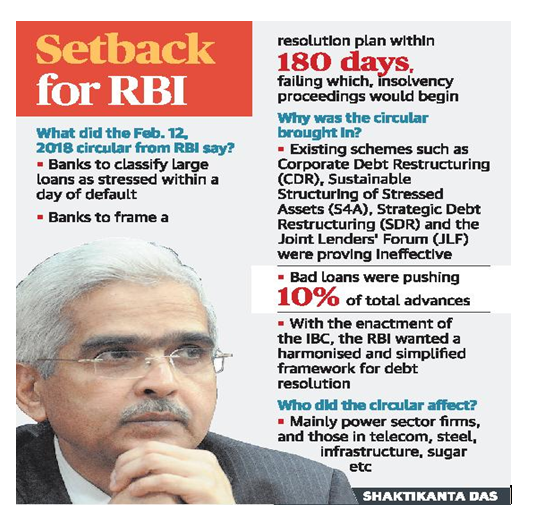

RBI’s February 12 Circular

- In its February 12, 2018 circular, the RBI asked lenders to institute a board-approved policy for resolution of stressed assets.

- At the same time, commercial banks were told to start the resolution process as soon as a borrower would default on a term loan, and then were given a period of 180 days to cure it. If the borrower still failed to pay the defaulted sum in this extended period, the matter would then dragged to bankruptcy proceedings at the National Company Law Tribunal (NCLT).

- The voiding of the February 12, 2018 circular could slow down and complicate the resolution process for loans aggregating to as much as ?3.80 lakh crore across 70 large borrowers, according to data from the ratings agency ICRA.

- As of March 31, 2018, 92% of this debt had been classified as non-performing, and banks have made provisions (percentage of bad asset that has to be ‘provided for’) of over 25-40% on these accounts.

- Under previous guidelines – before the February 12 circular – India’s banks had the freedom to initiate the resolution process any time after 60 days from default-day. With the SC’s order now, defaulters are likely to get more time now before being sent to the bankruptcy court (or say, NCLT).

Aim behind this circular

- To break the nexus between banks and defaulters, both of whom were content to evergreen loans under available schemes.

- It introduced a certain credit discipline banks had to recognise defaults immediately and attempt resolution within a six-month timeframe.

- The borrowers risked being dragged into the insolvency process and losing control of their enterprises if they did not regularise their accounts.

- RBI data prove the circular had begun to impact resolution positively.

- It is this credit discipline that risks being compromised now.

- It is not surprising that international ratings agency Moody’s has termed the development as “credit negative” for banks.

- It is true that the circular failed to take into account the peculiarities of specific industries or borrowers and came up with a one-size-fits-all approach. It is also true that not all borrowers were deliberate defaulters, and sectors such as power were laid low by externalities beyond the control of borrowers.

Immediate challenges for the RBI

- To see whether it would like to use or revive any of its old debt-restructuring schemes.

- It will now have to come up with a new framework on dealing with stressed assets (or bad loans).

- The latter challenge is likely to take some time, meaning one may expect it to rely more or less on conventional monetary policy instruments to regulate and strengthen credit dissemination processes.

Last warning to RBI

- The policy was found to be directly contrary to the court’s judgment of December 2015 that the Reserve Bank could not withhold information sought under the RTI Act.

- The 2015 judgment had rejected the RBI’s argument that it could refuse information sought under the RTI on the grounds of economic interest, commercial confidence, fiduciary relationship or public interest.

- The court had observed that there was “no fiduciary relationship between the RBI and the financial institutions”.

- The court, in 2015, reminded the RBI that it had the statutory duty to uphold the interests of the public at large, the depositors, the economy and the banking sector.

Why did RBI refuse?

- The RBI had refused to provide information to the petitioner, claiming “fiduciary relationship” between itself and the banks in question.

- Such information, the regulator had then said, was exempted from being revealed under Section 8(1) (d) and (e) of the RTI Act.

- Section 8 allows the government to withhold from public some information in order to “guard national security, sovereignty, national economic interest, and relations with foreign states”.

- The information to the petitioners was denied by the RBI despite orders from the Central Information Commissioner (CIC) to do so.

- It had forced banks to recognize defaults by large borrowers with dues of over ?2,000 crore within a day after an instalment fell due; and if not resolved within six months after that, they had no choice but to refer these accounts for resolution under the Insolvency and Bankruptcy Code.

Way Forward

- The RBI should study the judgment closely, and quickly reframe its guidelines so that they are within the framework of the powers available to it under the law.Else, the good work done in debt resolution in the last one year will be undone.

- The RBI could have addressed these concerns when banks and borrowers from these sectors brought these issues to its notice.

- By taking a hard line and refusing to heed representations, the RBI may only have harmed its own well-intentioned move.

- That said, it is now important for the central bank to ensure that the discipline in the system does not slacken.

- The bond market does not allow any leeway to borrowers in repayment, and there is no reason why bank loans should be any different.

Learning Aid

Practice Question:

The recent tussle between the RBI and the SC points out to the delicate balance RBI has to maintain in its functioning. Comment.