The estimated growth of 7.53% in ‘nominal’ terms is the lowest since 1975-76. Also, this is the first time since 2002-03 that nominal GDP growth is projected to be in single digits. Why is this major concern?

Issue

Context

The estimated growth of 7.53% in ‘nominal’ terms is the lowest since 1975-76. Also, this is the first time since 2002-03 that nominal GDP growth is projected to be in single digits. Why is this major concern?

Analysis

Background

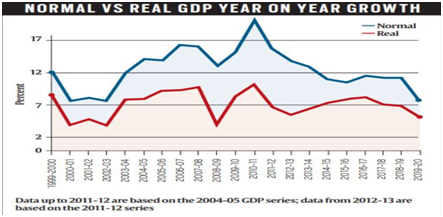

- National Statistical Office (NSO) released the first advance estimates of the national income that projected growth in India’s GDP at market prices for 2019-20 at 4.98% in “real” terms, the lowest since the 3.89% in the global financial crisis year of 2008-09.

- But even more significant was the estimated growth of 7.53% in “nominal” terms, which is the lowest since the 7.35% for 1975-76.

- Also, this is the first time since 2002-03 that nominal GDP growth has been in single digits.

What is nominal GDP and how is it different from real GDP?

- GDP is the total market value of all goods and services produced in the economy during a particular year, inclusive of all taxes and subsidies on products.

- The market value taken at current prices is the nominal GDP.

- The value taken at constant prices — that is prices for all products taken at an unchanged base year — is the real GDP.

- In simple terms, real GDP is nominal GDP stripped of inflation.

- Real GDP growth thus measures how much the production of goods and services in the economy has increased in actual physical terms during a year.

- Nominal GDP growth, on the other hand, is a measure of the increase in incomes resulting from rise in both production and prices.

But why should nominal growth matter at all?

- In the normal course, real growth is what one would ordinarily look at. But the current fiscal year seems extraordinary because the gap between nominal and real GDP growth is just 2.6 percentage points.

- This is marginally higher than the difference of 2.5 percentage points in 2015-16.

- But in that year, real GDP growth was 8%, which translated into a nominal growth of 10.5%.

- In 2019-20, not only is real GDP growth expected to be the lowest in 11 years, but also the implied inflation (also called GDP deflator, or the increase in prices of all the goods and services produced in the economy) is just 2.6%.

- Simply put, producers have not gained from either higher output or higher prices.

- Households and firms generally look at the “topline” — how much their income has grown relative to the previous year.

- When that growth falls to single digits in a country like India, which has been used to a minimum 5-6% GDP increase year after year and an equal rate for inflation, it is unusual.

- Low nominal GDP growth is associated more with developed western economies.

Other implications on corporates and the government

- In the past, listed companies have seen their turnover double in five years or so, which comes with a nominal year-on-year growth of 14-15%.

- If the latter falls to 7-8%, the same doubling would take 9-10 years.

- This can have a psychological impact — although it could also be the case that the value of their inputs, including salaries paid to employees, would also be rising at a slower rate.

- Their net earnings or profits would not to the same extent.

- The problem is more serious when it comes to the government because as assumed nominal GDP would grow by 12% to Rs 211.01 lakh crore. However, the NSO’s latest projection of nominal GDP for 2019-20 is only Rs 204.42 lakh crore, which is Rs 6,58,374 crore below the Budget estimate.

- High nominal GDP growth also makes the government’s debt seem more manageable.

- For state governments too, low nominal GDP growth is a matter of concern because their budgets normally assume double-digit increases in revenues.

- The Centre’s compensation formula to states from the Goods and Services Tax also promised to meet any annual revenue shortfall below 14%. That again, did not ever factor in the possibility of GDP growth (real plus inflation) falling to 7.5% levels.

What government can do about it?

- The government has exhausted its options to fill a widening hole.

- It has tapped the Reserve Bank of India (RBI) for extra dividend, held over several states’ share in revenue and delayed payments to several agencies.

- The hope now is that divestment in its prized companies could fetch a large chunk.

- The government is also trying to hawk its land.

- Analysts believe that fiscal deficit would slip to 3.8-4% as against the budgeted 3.4% of GDP.

- The government will have to borrow more from the market to plug the widening deficit.

- Beyond the impact on market rates, the government and its agencies are already crowding out the private sector.

- With total public sector borrowing estimated at 9% of GDP, it leaves precious little of the savings in the economy for the private sector.

Way forward

For GDP growth to revive private investment needs to recover and for that, funds need to flow. The economy is in a tight spot. It needs the government’s push but not a complete takeover.