In a latest development, the government has launched drive to make taxation fairer and taxpayers fearless in the country.

Context

In a latest development, the government has launched drive to make taxation fairer and taxpayers fearless in the country.

About

- The programme involves faceless assessment, faceless appeal and a tax payer charter. It seeks to improve tax payer experience and ease of doing business.

- The Faceless Assessment Scheme aims to eliminate the human interface between the taxpayer and the income tax department.

- Under the Faceless Appeals system introduced by the government, appeals will be randomly allotted to any officer across the country and the identity of the officer deciding the appeal will remain unknown. Further, decisions will be team-based.

- The aim of the tax payer Charteris that of nurturing the relationship between the Revenue departments and the community that they serve, a relationship of mutual trust and respect.

- The drive to honour honest tax payers comes after a series of steps in recent months aimed at making the administration more accountable for its dealings with tax payers, reduce tax litigation and for making compliance easy.

- The emphasis is on making every rule-law, policy people-centric and public friendly

- The initiative reflects India’s vision towards 'minimum government, maximum governance.

Issues of tax evasion in India

- Even though India’s income tax was instituted in 1922 by the British, our tax history explains the high degree of tax delinquency today.

- The government’s deficiency in governmental expenditures is most notably attributed to wide spread tax evasion.

- Relative to other developing countries, the fact that India’s income tax comprises 5% of its GDP is due to the fact nearly 1-3% of the population is exposed to income taxation. According income tax department, out of population of 130 crore people, only 1.5 crore pay income tax.

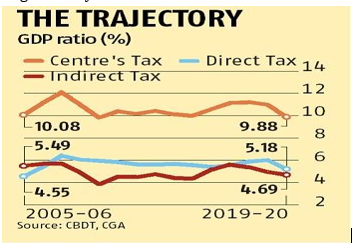

- Although India has improved its tax-to-GDP ratio in the last few years, it is still far lower than the average OECD ratio which is 34 per cent. India's tax-to-GDP ratio is lower than some of its peers in the developing world. Developed countries tend to have higher tax-to-GDP ratio.

- India faces more difficulties in proliferating its income tax than a country like China, who subjects 20% of its population, because there is an emphatically low amount of formal wage earners.

- The exorbitant levels of tax evasion has inspired the creation of a black money parallel economy. Black money inherently causes inflation and hinders the government’s ability to bring down the prices of commodities.

- In fact, the large volume of black money actually diverts governmental resources from national welfare and encourages the continuation of illegal activity.

Initiative taken by the government to improve tax collection

- The focus of the tax reforms in recent times has been on reduction in tax rates and on simplification of direct tax laws.

- Several initiatives have been taken by the CBDT for bringing in efficiency and transparency in the functioning of the IT Department. This includes bringing more transparency in official communication through the newly introduced Document Identification Number (DIN) wherein every communication of the Department would carry a computer generated unique document identification number.

- Similarly, to increase the ease of compliance for taxpayers, IT Department has moved forward with prefilling of income tax returns to make compliance more convenient for individual taxpayers. Compliance norms for startups have also been simplified.

- The government had in 2019 offered businesses the option of a lower corporate tax rate to those not availing of any incentives and to new manufacturers.

- Also steps have been taken to rationalize personal income tax rates to make the slabs more progressive so that tax payers’ transition from lower slab to higher one is more smooth.

- The government has also created Voluntary Disclosure of Income Schemes, whereby black income and assets can actually be declared without penalty or prosecution.

- The Corporate Tax rates were reduced from 30 percent to 22 percent and for new manufacturing units the rates were reduced to 15 percent. Dividend distribution Tax was also abolished.

- With a view to provide for resolution of pending tax disputes the IT Department also brought out the Direct Tax “Vivad se Vishwas Act, 2020” under which declarations for settling disputes are being filed currently.

- IT Department has also made efforts to ease compliances for taxpayers during the Covid times by extending statutory timeliness for filing returns as also releasing refunds expeditiously to increase liquidity in the hands of taxpayers.

Suggestions to improve tax collections

- There is a reasonable opportunity to raise revenue since our tax-to-GDP ratio is about 16%.Following steps can be taken in this direction:

- Cap on tax-free long-term capital gains: Long-term capital gains on listed securities were exempt from income-tax to increase participation by retail investors in capital markets. But ultra high networth individuals (HNIs) have benefited from tax-free capital gains more than retail investors. A reasonable cap on exemption for capital gains will protect retail investors’ interest and at the same time increase tax collection.

- Link transactions to filed taxes:2 million transactions couldn’t be linked to tax returns filed. Significant tax collection can happen if this information is used to detect undisclosed income. A sustained campaign to highlight the ability of tax department to detect undisclosed income will improve tax compliance.

- Curtailing unaccounted money:Real estate provides a major avenue for deployment of cash/parallel economy proceeds. Trading hubs, party contractors, big-ticket purchases and cash couriers are all worth tracking for bringing the parallel economy under the tax net and increasing tax collection.

- Increase service tax: While service tax net has been widened, there may be more opportunities, especially in the unorganized sector. A nominal tax on a presumptive basis may incentivize the unorganised sector to come under the service tax net.

- Need for effective dispute settlement mechanism:Huge tax arrears suggest the need for launching an effective dispute settlement mechanism. A consent system can save considerable time and effort and convert arrears to actual tax collection.

Conclusion:

To foster economic growth and development India needs sustainable sources of funding for social programs and public investments. Programs providing health, education, infrastructure and other services are important to achieve the common goal of a prosperous, functional and orderly society. And they require that government raise revenues. While the recent initiatives taken by the government are significant step towards raising the revenue, more such efforts are needed in this direction.