Recently, the Comptroller and Auditor General (CAG) has highlighted the non-utilisation ?94,000 crore of collected cess for secondary and higher educationsince 2007.

Issue

Context

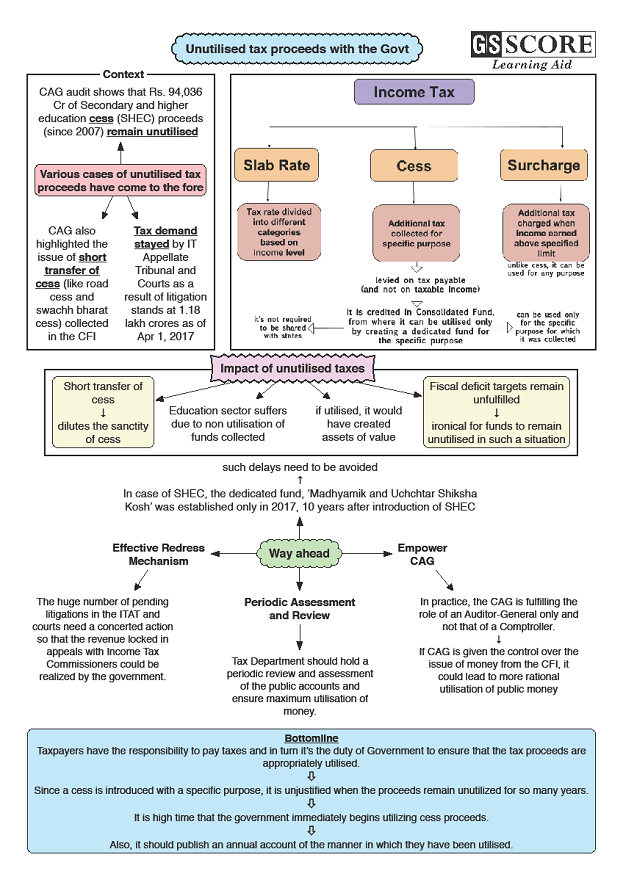

- Recently, the Comptroller and Auditor General (CAG) has highlighted the non-utilisation ?94,000 crore of collected cess for secondary and higher educationsince 2007.

About:

More on News:

- Higher and Secondary Education Cess was introduced in 2007. The cess was getting accumulated in Consolidated Fund of India(CFI).

- After 10 years, i.e. in 2017, Madhyamik and Uchchtar Shiksha Kosh was created.

- On the other hand, in 2017-18, the public expenditure on school and higher education was estimated to be ?79,435.95 crore.

- The CAG also said that the schemes on which the cess proceeds were to be spent were not identified.

- Similarly, the state governments have not even utilised 25% of the cess collected, meant for welfare of construction workers in the last six years.

- CAG has also highlighted the issue of short transfer of cess collected in the CFI.

- There was a short-transfer of ?4,891 crore collected as Swachh Bharat cess into the Rashtriya Swacchata Kosh since FY16, the year the cess was introduced.

- In case of road cess, the short transfer is ?72,726 crore since FY11 and in case of clean energy, it is ?44,505 crore.

What is Cess?

- A cess is a tax on tax, levied by the government for a specific purpose. It is levied on the tax payable and not on the taxable income.

- To meet specific socioeconomic goals, a cess is preferred over a tax because it is relatively easier to introduce, modify, and abolish.

- Swachh Bharat Cess, Krishi Kalyan Cess and Clean Environment Cess are few examples of cess levied by the Government of India.

Cess Collection Mechanism

- The proceeds of all taxes and cesses are credited in the CFI.

- The approval of the Parliament is necessary to withdraw funds from the CFI.

- The tax proceeds are shared with the States and Union Territories according to the guidelines by the Finance Commission. But the cess proceeds need not be shared with them.

- In order to utilize the cess proceeds lying in CFI, the government has to create a dedicated fund.

- As long as a dedicated fund is not created, the cess proceeds remain unutilised. For example, the dedicated fund for primary education is the ‘Prarambhik Shiksha Kosh’, or PSK, while that for higher and secondary education is the ‘Madhyamik and Uchchtar Shiksha Kosh’.

Analysis

What are the implications of non utilization tax proceeds?

- Education Sector Suffers: India spends 2.7% of its GDP on education despite a constant demand from experts and academics to increase it to 6%. It is a high degree of economic and social injustice that the cumulative unutilised SHEC funds far exceeded the expenditure on both school and higher education for the year 2017-18.

- Complexity in the System: Short transfer of Cesses dilutes the sanctity of cess and adds complexity in the system. Even the Judiciary has reiterated that the amount collected through a cess should be used for its mandated purpose only.

- Fiscal Consolidation: On one hand, the fiscal projections in the budget for revenue collection by the government are made too ambitious every year, while on the other hand, money is lying idle in the accounts. If this money would have been circulating in the economy, it would have created assets of greater value like Hospitals, Bridges, Roads, Schools etc.

- Macro Economic targets not achieved: According to FRBM, the government should eliminate revenue deficit and reduce fiscal deficit to 3% (medium term) of the GDP. The fiscal deficit target of 3% of GDP has now been pushed to 2020-21.

- If the government prints new currency to overcome the Fiscal deficit, then it will add new capital to the economy, thus increasing inflation and lowering the value of rupee. It is again ironical to have huge amounts of money unutilised in such a situation.

Structural problems in Taxation system of India

- Inequitable Tax Structure: India simultaneously has a tax base for direct taxes that is too small; and a tax base for indirect taxes that is too large. Consequently, too little tax revenue is raised; and too much of the tax burden is paid by the poor. The ratio of direct taxes to indirect taxes in total tax revenue in India is 35:65, whereas it is the exact opposite at 65:35 in OECD countries

- Regressive Taxation: Taxes on consumption tend to be regressive, because poor people spend a greater proportion of their income on consumption—and consumption is taxed at high rates in India.

- Double Taxation Dividend: Due to double taxation of dividend, the rate of domestic saving and capital formation has failed to increase appreciably. Companies pay corporation and other taxes (such as excess profit tax or surtax) to the Government. A portion of net profit after tax is usually distributed among shareholders in the form of dividend. A portion of such dividend income is again taxed away in the form of personal income tax.

- Untaxed Domain: Under India’s taxation system, Agricultural income is not taxed. The substantial benefit of this provision is taken up by the wealthy and large farmers by exploiting the loopholes in the law. Around 2,800 cases have shown agricultural income of ?1 crore and more in the last seven years.

- Lack of Assessment: There is lack of assessment and periodic review of the public accounts in which the tax collections are accrued. Due to this, there are surplus collections in some public accounts whereas on the other hand, there are expenditure deficits on the other public accounts. Example: A sum of Rs. 90,000 crore was lying unspent in the CAMPA Funds, assigned for the purpose of environmental degradation.

- Complexity in Tax Structure: GST Regime with five main tax rates, several exemptions, a cess and a special rate for gold has made it very complicated.

Suggestions

- Rely more on Progressive Taxation: Indian taxation system should be reformed in such a way that it relies more on progressive Direct Taxation rather than Regressive Indirect Taxes. For example, Long term Capital Gains Tax must not be rolled out because it is a Direct Tax. It will reduce the need for the government to levy cess.

- Empower CAG: In practice, the CAG is fulfilling the role of an Auditor-General only and not that of a Comptroller. If CAG is given the control over the issue of money from the Consolidated Fund of India, it lead to more rational utilisation of public money because CAG ensures financial accountability of the government in the Parliament.

- Periodic Assessment and Review: The Tax Department should hold a periodic review and assessment of the public accounts and ensure maximum utilisation of money.

- Simplify GST for better Tax Buoyancy: The first target should be to move to at least a three-rate structure—a lower rate for essential goods, a relatively high rate for luxury goods, and a standard rate for the majority of goods and services.

- Faster Establishment of Cess Fund: There should not be inordinate delays in the establishment of Dedicated Funds to transfer the collected cess proceeds from CFI, so that they could be used from the time they are getting collected.

- Effective Redress Mechanism: The huge number of pending litigations in the Income Tax Appellate Tribunal (ITAT), the High Court, and the Supreme Court need a concerted action so that the revenue locked in appeals with Income Tax Commissioners could be realized by the government.

Conclusion

Taxes in democratic societies indicate the presence of a collective socio-economic vision aimed at improving livelihoods. Since a cess is introduced with a specific purpose, it is unjustified when the proceeds remain unutilized for so many years. It is high time that the government immediately begins utilizing cess proceeds. Importantly, it should also publish an annual account of the manner in which they have been utilized.

Learning Aid

Practice Question:

Highlight the structural problems of Indian taxation System, discuss the measures needed to make it more efficient and equitable.