Context

With the partial removal of Russian fossil fuels from the international market, there has been a volume of implications for the Indian global energy markets.

Background

- Russia is the largest net exporter of fossil fuels (coal, oil, and gas).

- It is the world’s largest oil (crude and products) exporter shipping 8 million barrels per day (b/d) into global markets.

- The world’s largest natural gas exporter with 210 BCM (billion cubic meters) of exports through pipeline alone.

- Russia is also amongst the top ten coal producers in the world accounting for over 5 percent of global output.

Analysis

Why India is vulnerable to fluctuation in global oil economy?

India’s long-term vulnerability to price shocks emanates from the given points:

- There is a marked increase in global crude prices on trend basis over the last three decades.

- India’s exchange rate has been depreciating on a persistent basis over this period.

- India’s dependence on imported oil has steadily increased.

|

India's domestic Crude Oil and Natural Gas Production:

|

Crude Oil: Requirement & Impact in India Market

|

Crude Oil:

|

- Oil price risk is the biggest threat to the Indian economy as supply losses even in the worst cases are not likely to result in significant volume risk.

- The production losses from Russia (of up to 1 million barrels per day) will be manageable in the short term, but a more severe supply shock will need a collective response from the supply side, but this is very difficult to achieve.

- The worst-case estimate for the loss of supply from Russia put it at around 4 mb/d.

- OPEC (Oil-producing and Exporting Countries) production increases can make up less than 40 percent of this loss.

- US shale production increases are constrained by capital discipline in the industry and supply increases from Iran are subject to reaching a nuclear deal.

- Oil sector is likely to remain in deficit in 2022 with the supply deficit in the worst case put at about 1.3 mb/d.

- Crude prices are expected to remain volatile ranging from US$100/b to US$130/b.

Natural Gas: Requirements and Impact on India

- India is likely to be exposed to both price and volume risk, especially in the case of its spot gas imports.

- India’s self-sufficiency ratio for natural gas in 2021-22 was 50.9 percent.

- Roughly 50 percent of imported gas LNG (liquefied natural gas) about 75-80 percent is sourced through long-term contracts and the rest through spot purchases.

- However, any sustained increase in gas and oil prices in the international market could lead to an upward price shift in negotiations for long-term contracts.

- Exporters are likely to demand a higher slope in their revised contracts. Germany has signed an agreement with Qatar for LNG supplies recently.

- Competition from Europe (which will probably buy gas at any price) for Middle Eastern LNG could reduce space for favourable price negotiations by India.

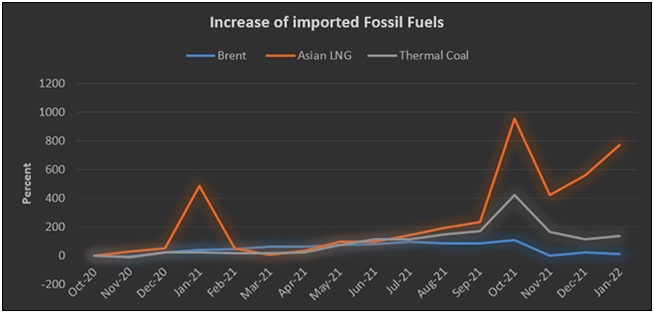

Import of LNG:

- Under a scenario where Russian flows on Nord Stream 1, the Yamal-Europe pipeline, and the Ukraine routes are curtailed between April 2022 and March 2023, the ability of Europe to refill its storage is expected to be severely compromised and lead to global price increases.

- In this context, Indian industrial gas users are likely to substitute gas with alternative fossil fuels primarily coal and pet coke.

- In the long run, higher gas prices will compromise India’s goal of increasing the share of gas in its primary energy basket from 6 percent to 15 percent which will mean higher carbon emissions.

|

Liquefied Natural Gas (LNG):

|

What measures are required?

- Reduce dependence: There is a need to reduce India’s dependence on imported oil by accelerating the pace at which the pursuit of non-conventional energy sources is being carried on.

- Accelerate search for domestic reserves: There is also a need to accelerate unexploited domestic oil and gas reserves, both offshore and on land.

- Diversify sources: As far as global crude prices are concerned, there is a need to diversify sources from which crude oil is being imported into India.

- Increase storage capacity: The capacity for storage of oil needs to be expanded so that more options are available for absorbing external price shocks.

- Protection, with awareness: Consumers and industrial users need to be exposed to long term trend in global crude prices while they should also be protected against excessive volatility around this trend.

- Releases from strategic reserves can reduce the volatility in supply and therefore prices.

- Releases from strategic reserves can reduce the volatility in supply and therefore prices.

Way Forward

The partial removal of Russian oil, gas, and coal from international markets led to the Global Energy Crisis. The Europeans are trying to replace Russian energy resources. However, we expect the result of such actions to be an increase in gas prices on the spot market and an increase in the cost of energy resources for end consumers.

In recent context, the Indian diplomacy should negotiate with the exporters and the support the Indian Industry with the help of Government-owned banks. This implications led big-boost in the Indian energy sector.