Context

The easing of global prices has boosted fertiliser availability and cut the subsidy bill. However, asymmetry in the pricing structure has led to a worsening nutrient imbalance due to the over-application of urea and DAP.

Background:

- The year 2022 saw global prices of fertilisers go high due to the post-Russiainvasion of Ukraine in February.

- Landed prices of urea imported into India (cost plus freight) are ruling at around $550 per tonne, as against $900-1,000 average in November-January 2021-22, when global demand for food and plant nutrients surged with the lifting of Covid lockdowns by most countries.

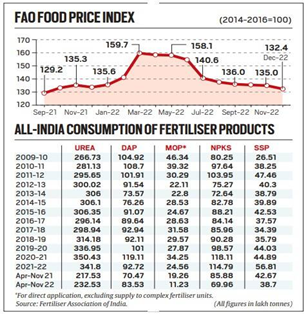

- The United Nations Food and Agriculture Organisation’s Food Price Indexhit 159.7 points in March 2022.

- From that all-time high, the index — which is a weighted average of global prices of a representative basket of food commodities over a base period value, taken at 100 for 2014-2016 — has fallen for nine consecutive months.

- However, till December 2022 a number of 132.4 points was below even the year-ago value of 133.7 points and the lowest since the 129.2 points of September 2021.

About

About Di-ammonium Phosphate (DAP):

- It is a very popular fertilizer because of its excellent physical properties and nutrient content.

- It is free-flowing, dust-free and does not normally give any storage problems.

- DAP is almost water-soluble and ultimately leaves an acid effect on soils because of the ammonia (NH4) it contains.

- DAP on incorporation into soil reacts with water and gets converted into HPO4 and NH4.

- Ammonium (NH4) follows the same routes as in the case of urea.

- Phosphorus in DAP is present in the best available form (HPO4).

- Depending upon the soil reaction (pH),phosphorus exists in 3 forms which can be absorbed by plant roots.

- These are HPO4, H2PO4 and PO4. Phosphorus, which is immobile in the soil, is not subjected to leaching losses.

Reasons behind increased consumption of urea and DAP:

- High subsidy on urea: The government has fixed the maximum retail price (MRP) of urea at Rs.5,628 per tonne, while the MRPs of other fertilisers are technically decontrolled.

- DAP – a cheaper substitute: Companies have been told not to charge more than Rs.27,000/tonne for DAP (Rs.29,000-31,000/ tonne for NPKS complexes), which has 46% P and 18% N.

- Thus, the choice of fertilisers is primarily a function of prices and not of NPKS complexes or other macro and micronutrients in the fertilisers.

What are the impacts of global ease on the prices of fertilisers?

- It significantly improves overall availability. No major shortage of any fertiliser, except MOP, has been reported during the on-going Rabi cropping season.

- Reduction in fertiliser subsidy of the government.

Challenges emerged:

- Over-use of fertilisers: India’s fertiliser sector has been riddled with distortions from excessive use of urea. The diammonium phosphate or DAP is seeing a similar phenomenon of over-application due to under-pricing. The effects of overconsumption of urea and DAP:

- The current NPK ratio of 13:5:1, as against the ideal 4:2:1, would adversely affect crop yields

- It will adversely affect the health of plants and humans, due to the unavailability of a balanced nutrient mix.

- Increase in Urea consumption: Urea has 46% nitrogen (N), while DAP contains 46% phosphorus (P) plus 18% N and MOP has 60% potassium (K).

- Neem oil supposedly also acted as a mild nitrification inhibitor, allowing a more gradual release of nitrogen. Increased nitrogen use efficiency would, in turn, bring down the number of urea bags required per acre.

- Worsening of nutrition imbalances:The consumption of both urea and DAP has shot up, with their sales for the year ending March 2023 likely to top 350 lt and 120 lt respectively.

Suggestive measures:

- To restrict DAP used to rice and wheat.

- The danger is of even this well-accepted fertiliser loses out to DAP because of flawed pricing.

- To raise SSP’s acceptance by permitting sale only in granular, not powdered, form.

- SSP powder is prone to adulteration with gypsum or clay.

- Farmers can be assured of quality through granules, which will also promote a slower release of P without drift during application.