Context

Under proposed changes in the recent budget there is a shift in India’s tax policy. It will follow the approach of US, which taxes its citizens irrespective of their tax residence.

About

- Change in definition of tax residence:Under the changes proposed in budget 2020, an Indian citizen who is not liable to be taxed in any other country or territory shall be deemed to be resident in India.

- India will have taxation rights:The way the amendment to the Act is worded suggests that Non-resident Indians(NRIs) working in countries with no income tax liability will have to pay the tax in India.

- It will be taxed only when the income is derived from an Indian business or profession.

- Objective: Theintent is to plug a gap that leaves the India income of an NRI out of the tax net.

- Current law: Under current law, the worldwide income of an Indian resident is taxable in India. In the case of NRI, only the income earned in India is taxable.

- American case: American citizens who work in foreign countries have the liability to file tax returns and pay taxes in the US—even if they are resident in another country.

- The country where they reside offers credits for the taxes they pay in the US for their local tax obligations, as per bilateral tax treaty rules.

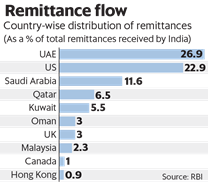

- India is world’s top recipient of remittanceswith its diaspora sending $79 billion back home in 2018, followed by Mexico and China.

- The new proposal is yet to be passed in both houses of the parliament.

Residential status and Changes proposed

- Residential status of an individual will have to be tested for each financial year Individual must meet any of the following conditions and both additional conditions:

- Conditions:

- You are in India for 182 days or more in the financial year (FY).

- You are in India for 60 days or more in the FY and 365 days or more in the four FYs immediately preceding the relevant FY.

- Additional conditions:

- You are resident in India in two of the 10 FYs immediately preceding the relevant FY.

- You are in India for seven years immediately preceding the relevant FY for 729 days or more.

- Conditions:

- Ordinarily Resident (OR): If you meet any of the first set of conditions and both the additional conditions, you shall be considered a resident in India.

- Resident but not ordinarily resident (RNOR):If you meet any of the first conditions but do not meet the additional conditions, you shall be considered a RNOR in India.

- Non-resident Indian (NRI): If you do not meet any of the first conditions, you shall be an NRI.

- Changes proposed: From FY 2020-21, a NRI will start becoming 'not ordinarily resident' and in the FY 2024-25, he/she will become an 'ordinarily resident'. This will happen due to the changes proposed in the 'not ordinary resident' condition for an individual in this Budget.

- Budget 2020 has proposed changes in the number of years required for being a resident by an individual to qualify as 'ordinarily resident'from at least two years currently to at least four years out of the previous 10 years.

- Earlier it was possible to be classified as non-resident by staying out of the country for 183 days in a year, this has now been, in effect, enhanced to 245 days.

- In the first condition, 182 days will be reduced to 120 days for being regarded as a resident from an income tax perspective.

Implications

- Blow to NRI working in West Asia:A change in definition of tax residence could end up hitting Indians working abroad, including countries like the UAE which levies no income tax; unless a bilateral treaty bails them out.

- NRIs and expats working in countries in West Asia account for a major chunk of foreign remittances received by India.

- Bilateral treaties will have final say: Tax treaties with countries will be decide where NRIs will actually be taxed.Tax treaties will have tie-breaker provisions to decide which country gets taxation rights.

- Tie-breaker rules to decide residence status for taxation rights take into account factors such as the country in which the individual has his house, parents and ancestral home.

- This means NRIs who are resident in both the countries will have to invoke provisions in tax treaties to get relief.

- Benefit:The proposal is part of the larger effort to target high net worth individuals who keep moving around countries in such a way to avoid paying their fair share of tax in any country.

- Will make it difficult for NRIs to evade taxes.

- These changes willwiden the tax base by bringing in more people into the tax net.

- More resources will be available for welfare spending.