6th September 2024 (11 Topics)

Context

In India's federal structure, a notable issue is the Vertical Fiscal Imbalance (VFI), where States spend more money than they can raise through their own revenues. This imbalance occurs because the responsibility for spending is decentralized to the States, but the ability to collect taxes and generate revenue is largely controlled by the Union government.

What is Vertical Fiscal Imbalance (VFI)?

- Vertical Fiscal Imbalance occurs when there is a disparity between the revenue collected by different levels of government and their expenditure responsibilities. In India:

- States are responsible for 61% of the revenue expenditure but only generate 38% of the revenue receipts.

- This disparity means that States rely heavily on transfers from the Union government to meet their expenditure needs.

- Constitutional Allocation of Responsibilities:

- The Union government is tasked with collecting major taxes, including Personal Income Tax, Corporation Tax, and a portion of indirect taxes, to ensure efficiency in tax collection.

- States are responsible for providing public services and goods (education, health, police, law and order, forests, drinking water, etc.), which is best managed at the local level due to better understanding of local needs.

- In some sectors, the share of state expenditure is disproportionately high. For instance, states incur 77 per cent of the total government spending on health(2023-24) and 75 per cent on education (2020-21).

Finance Commission's Role in Tax Devolution

- The Finance Commission addresses VFI by recommending how Union-collected taxes should be distributed among States.

- These recommendations are based on the "Net Proceeds" of taxes (Gross Tax Revenue minus surcharges, cesses, and costs of collection).

- Besides tax devolution, the Finance Commission also recommends grants under Article 275 of the Constitution for specific needs. However, these grants are often conditional and short-term.

- Grants to local governments, both rural and urban, are devolved as per the provisions under Article 280(3) (bb) and (c) of the Constitution.

Impact of Imbalance:

- According to the 15th Finance Commission, India's VFI is larger and rising compared to other federations. It pointed out that although the Union collected 62.7 per cent of the combined revenues of both the Union and the state governments, states alone were responsible for 62.4 per cent of the total expenditure.

- This imbalance has worsened during crises, such as the COVID-19 pandemic, exacerbating the gap between States' revenues and their expenditure responsibilities.

- The 14th and 15th Finance Commissions recommended devolution shares of 42% and 41% of net proceeds, respectively. To eliminate VFI, the average share of net proceeds devolved should be approximately 48.94%.

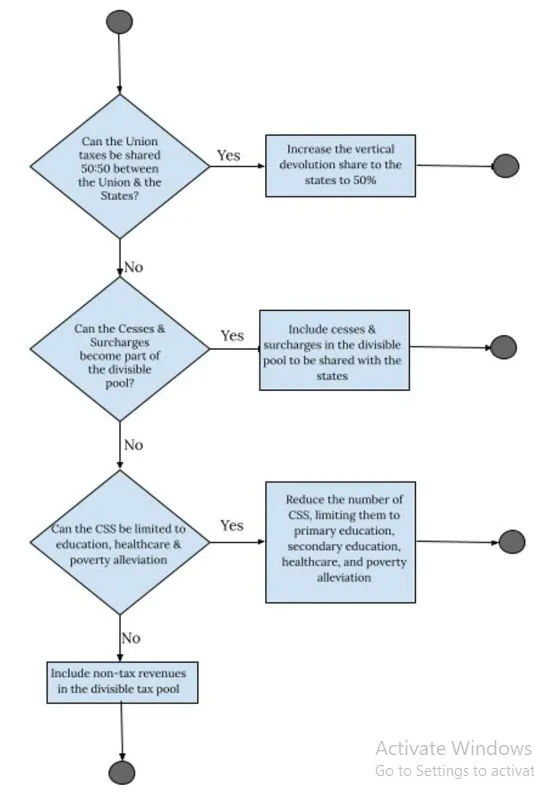

- Many States are advocating for a fixed tax devolution share of 50% by the 16th Finance Commission. This demand is supported by the fact that substantial cesses and surcharges are excluded from the net proceeds, which reduces available resources for States.

Implications of Increasing Tax Devolution:

- Enhanced Autonomy: Increasing the share of tax devolution to States would provide them with more untied resources, enhancing their financial autonomy.

- Efficient Expenditure: With a more balanced financial framework, States can better address local needs and improve the efficiency of their expenditures.

- Cooperative Federalism: Adjusting tax devolution to mitigate VFI will contribute to a healthier system of cooperative fiscal federalism, aligning financial responsibilities with revenue generation.

Fact Box: Fiscal Imbalance

|

More Articles