6th September 2024 (11 Topics)

Mains Issues

Context

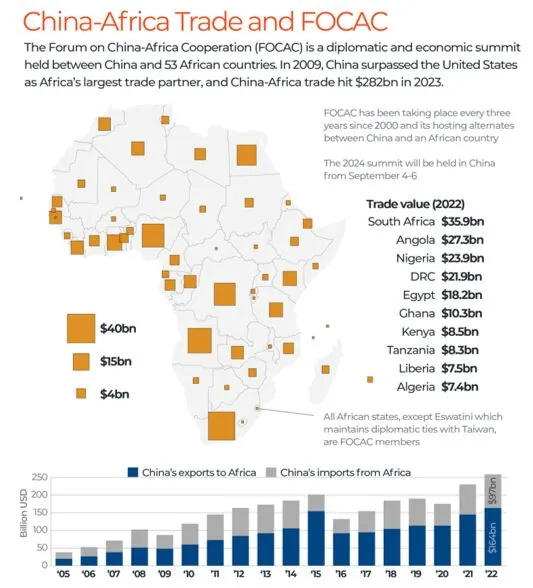

During the ninth Forum on China-Africa Cooperation (FOCAC), Chinese President Xi Jinping pledged $51 billion in funding to African countries

What is the FOCAC?

- The China-Africa summit, officially called the Forum on China-Africa Cooperation (FOCAC), has been held every three years since 2000.

- It was established to formalize and strengthen the strategic partnership between China and African nations.

- Membership: FOCAC includes 53 African nations (excluding Eswatini) and the African Union Commission.

- Purpose and Theme: The 2024 summit, themed “Joining Hands to Advance Modernization and Build a High-Level China-Africa Community with a Shared Future,” focuses on bilateral talks on political and economic cooperation, with a significant emphasis on infrastructure, governance, and economic development.

Africa-China Relations

- China supported African countries' decolonization efforts in the 1950s and 1960s, establishing strong bilateral relations. The transnational Tanzania-Zambia railway, completed in 1976, was China’s first major infrastructure project in Africa.

- China’s investment in Africa: China has been Africa's largest bilateral trading partner since 2009. In 2023, Africa-China trade reached $282 billion, with China importing 20% of Africa’s exports (mainly commodities) and exporting 16% of Africa’s imports (mainly manufactured goods).

- Beijing is also the continent’s biggest creditor. Between 2006 and 2021, it committed to investing $191bn in African countries.

- Belt and Road Initiative (BRI): Africa is a key partner in China’s BRI, aimed at enhancing cross-border economic, political, and cultural relations. China has invested over $120 billion in infrastructure for the BRI over the past decade.

- Debt Diplomacy: China has faced criticism for 'debt trap diplomacy,' where large loans for infrastructure projects lead to significant debt burdens on African nations, exemplified by Sri Lanka’s Hambantota port situation. However, China disputes these claims, attributing defaults to local mismanagement.

Impact on India

- Economic Influence: As China scales down its large-scale infrastructure investments amid its economic slowdown, there is an opportunity for India to engage more deeply with Africa. The changing dynamics could impact India’s competitive position in Africa’s infrastructure and trade sectors.

- Strategic Considerations: India might need to enhance its diplomatic and economic strategies in Africa to counterbalance China’s growing influence. This includes strategic investments, triangular development cooperation with third countries, and a greater role for

- Regional Balance: The shift in China’s focus from large projects to smaller, technologically advanced initiatives may open avenues for India to participate in different types of development projects in Africa, potentially influencing the regional balance of influence.

- In FY23, India’s bilateral trade with Africa reached almost $100 billion. Meanwhile, China’s total trade with the continent was nearly triple this at $282 billion.

- In term of FDI in 2021, India was last on the list, at $14 billion, while China ranked fifth at $44 billion.

India’s interests in Africa

|

PYQ

Q. Increasing interest of India in Africa has its pros and cons. Critically Examine. (2015)

Mains Issues

Context

Prime Minister Narendra Modi visited Singapore during his trip to South-East Asia. The visit was marked by agreements on semiconductors, digital technologies, health and skill development.

Key-highlights

- Given the breadth and depth of bilateral ties and immense potential, they decided to elevate the relationship to a Comprehensive Strategic Partnership. This would also give a major boost to India’s Act East Policy.

- India and Singapore announced four agreements on:

- Semiconductor: The MoU envisages cooperation to support India’s growing semiconductor industry while facilitating Singapore’s companies and supply chains to enter the Indian market.

- Singapore contributes around 10% of the global semiconductor output, along with 5% of the global wafer fabrication capacity (silicon wafer is a circular piece of ultra pure silicon, out of which chips are carved) and 20% of semiconductor equipment production.

- Nine of the world’s top 15 semiconductor firms have set up shop in Singapore.

- Singapore has players in all segments of the semiconductor value chain: integrated circuit (IC) design, assembly, packaging and testing; wafer fabrication, and equipment/ raw material production.

- Challenge: Singapore’s semiconductor industry is limited to “mature-node chips”, which are used in appliances, cars, and industrial equipment. It is not equipped to make high-end logic chips like the ones used in the AI sector.

- Digital Cooperation: The MoU on cooperation in digital technology will encourage greater interoperability between the digital economies of the two countries and build on earlier work such as the linking of the digital payment systems of India and Singapore.

- The main areas of cooperation under this MoU are data flows and data protection, digital utilities and digital public infrastructure, cyber-security and business-to-business linkages.

- Education and skill development: The two sides will cooperate on technical and vocational education and training

- Healthcare and medical research: There will be cooperation in disease surveillance, pandemic preparedness and prevention of communicable diseases.

- Semiconductor: The MoU envisages cooperation to support India’s growing semiconductor industry while facilitating Singapore’s companies and supply chains to enter the Indian market.

Why is India intensifying its efforts for chip?

- Semiconductor chips are critical in virtually everything from missiles to mobile phones and from cars to computers.

- However, the global chip industry is dominated only by companies from a very small number of countries, and India is a late entrant into this high-tech and expensive race.

- Supply disruptions during the Covid-19pandemic and the geopolitical tensions arising out of China’s aggressive moves in the Taiwan Strait and the South China Sea have brought great urgency to India’s efforts to develop its own semiconductor

- India launched the India Semiconductor Mission in 2021 with a Rs 76,000 crore chip incentive scheme, under which the central government offered half the plant’s capital expenditure costs as subsidy.

- The Cabinet approved semiconductor-related projects adding up to investments of about Rs 1.26 lakh crore.

- The government announced a partnership between the Tata Group and Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC) to set up a semiconductor fabrication plant.

India-Singapore Trade and Economic Relations

|

Mains Issues

Context

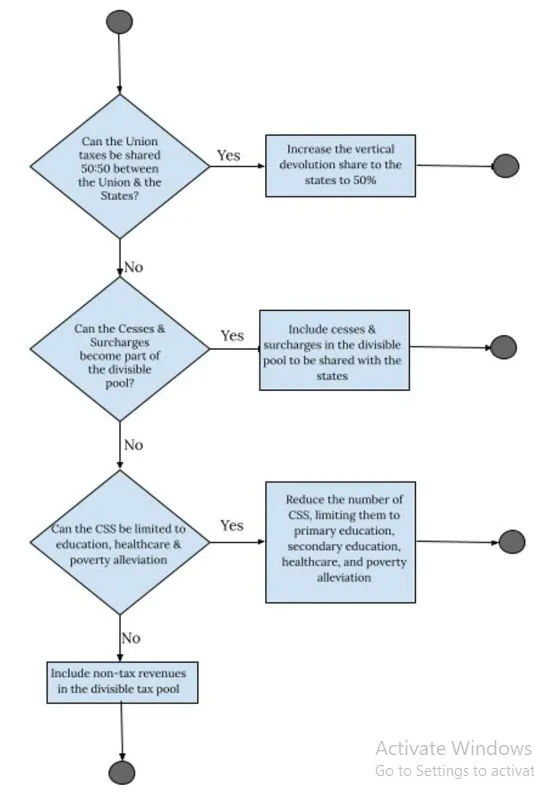

In India's federal structure, a notable issue is the Vertical Fiscal Imbalance (VFI), where States spend more money than they can raise through their own revenues. This imbalance occurs because the responsibility for spending is decentralized to the States, but the ability to collect taxes and generate revenue is largely controlled by the Union government.

What is Vertical Fiscal Imbalance (VFI)?

- Vertical Fiscal Imbalance occurs when there is a disparity between the revenue collected by different levels of government and their expenditure responsibilities. In India:

- States are responsible for 61% of the revenue expenditure but only generate 38% of the revenue receipts.

- This disparity means that States rely heavily on transfers from the Union government to meet their expenditure needs.

- Constitutional Allocation of Responsibilities:

- The Union government is tasked with collecting major taxes, including Personal Income Tax, Corporation Tax, and a portion of indirect taxes, to ensure efficiency in tax collection.

- States are responsible for providing public services and goods (education, health, police, law and order, forests, drinking water, etc.), which is best managed at the local level due to better understanding of local needs.

- In some sectors, the share of state expenditure is disproportionately high. For instance, states incur 77 per cent of the total government spending on health(2023-24) and 75 per cent on education (2020-21).

Finance Commission's Role in Tax Devolution

- The Finance Commission addresses VFI by recommending how Union-collected taxes should be distributed among States.

- These recommendations are based on the "Net Proceeds" of taxes (Gross Tax Revenue minus surcharges, cesses, and costs of collection).

- Besides tax devolution, the Finance Commission also recommends grants under Article 275 of the Constitution for specific needs. However, these grants are often conditional and short-term.

- Grants to local governments, both rural and urban, are devolved as per the provisions under Article 280(3) (bb) and (c) of the Constitution.

Impact of Imbalance:

- According to the 15th Finance Commission, India's VFI is larger and rising compared to other federations. It pointed out that although the Union collected 62.7 per cent of the combined revenues of both the Union and the state governments, states alone were responsible for 62.4 per cent of the total expenditure.

- This imbalance has worsened during crises, such as the COVID-19 pandemic, exacerbating the gap between States' revenues and their expenditure responsibilities.

- The 14th and 15th Finance Commissions recommended devolution shares of 42% and 41% of net proceeds, respectively. To eliminate VFI, the average share of net proceeds devolved should be approximately 48.94%.

- Many States are advocating for a fixed tax devolution share of 50% by the 16th Finance Commission. This demand is supported by the fact that substantial cesses and surcharges are excluded from the net proceeds, which reduces available resources for States.

Implications of Increasing Tax Devolution:

- Enhanced Autonomy: Increasing the share of tax devolution to States would provide them with more untied resources, enhancing their financial autonomy.

- Efficient Expenditure: With a more balanced financial framework, States can better address local needs and improve the efficiency of their expenditures.

- Cooperative Federalism: Adjusting tax devolution to mitigate VFI will contribute to a healthier system of cooperative fiscal federalism, aligning financial responsibilities with revenue generation.

Fact Box: Fiscal Imbalance

|

Mains Issues

Context

Recently, there has been a notable divergence between the growth rates of bank deposits and credit in India. For the quarter ending June 2024, while deposits grew at 11.7%, bank credit surged by 15%. This widening gap has raised concerns about an asset-liability mismatch and potential liquidity issues within the banking sector.

Deposit-Credit Gap

- Deposit Growth vs. Credit Growth: In June 2024, deposit growth was 11.7%, but bank credit grew at 15%, indicating that banks are lending more than they are receiving in deposits. When this gap increases, it can lead to liquidity problems, as banks may struggle to meet their lending obligations.

- Recent Trends: Bank credit grew by 14%, while deposits grew by only 11%. This continued disparity has highlighted the pressing issue of managing liquidity effectively within the banking sector.

- Factors Contributing to Slower Deposit Growth

- Shift to Capital Markets: One significant factor is the outflow of household savings from banks to capital markets. Post-COVID-19, there has been a surge in retail activity in capital markets. The rise in demat accounts (from 11.45 crore in FY23 to 15.14 crore in FY24) and the growth of mutual funds (with assets under management reaching Rs 64.97 lakh crore) reflect this trend.

- Increased Retail Participation: The increase in retail participation, especially through mutual funds, has contributed to the slower growth in bank deposits. The mutual funds industry, with 9.33 crore systematic investment plan (SIP) accounts, is drawing more savings away from banks.

Fact Box: Key-Concepts

|

Mains Issues

Context

Reserve Bank of India (RBI) Governor Shaktikanta Das addressed the need for private sector investment to boost India’s economic growth. Mr. Das highlighted the importance of private sector involvement in sustaining economic momentum, especially as consumption demand shows signs of revival.

Key Points:

- Governor Das emphasized that the private sector needs to increase its investments significantly. This is crucial for supporting sustainable economic growth and ensuring that the economy remains resilient to external uncertainties.

- The current conditions are favorable for investment, making it an opportune time for the private sector to invest more heavily.

- Economic Growth Drivers:

- Consumption: Higher domestic consumption can help protect the economy from external shocks.

- Investment and Exports: Both investment and exports are critical for maintaining economic momentum. These elements need to work in tandem to drive sustained growth.

- Manufacturing sector’s contribution would be “pivotal” in generating additional employment. Towards this, initiatives such as Make in India, Startup India, One District One Product, and the Production-Linked Incentive schemes are helping the sector gain competitiveness and grow faster.

- Services sector had remained the mainstay of growth in the Indian economy for the last several decades, but must now “explore new vistas of opportunities” with a focus on higher value-added services.

- MSME sector, in particular, holds a lot of promise to step up growth and employment opportunities.

Current Economic Status:

- Recent data shows that while growth has moderated slightly, fundamental drivers such as consumption and investment are gaining momentum.

- The RBI projects a GDP growth rate of 7.2% for 2024-25.

Private Sector Investment in India

- In India, private investment began to pick up significantly mostly after the economic reforms of the late-1980s and the early-1990s that improved private sector confidence.

- From independence to economic liberalisation, private investment largely remained either slightly below or above 10% of the GDP.

- Public investment as a percentage of GDP, on the other hand, steadily rose over the decades from less than 3% of GDP in 1950-51 to overtake private investment as a percentage of GDP in the early 1980s.

- It, however, began to drop post-liberalisation with private investment taking on the leading role in fixed capital formation.

- The growth in private investment lasted until the global financial crisis of 2007-08. It rose from around 10% of GDP in the 1980s to around 27% in 2007-08. From 2011-12 onwards, however, private investment began to drop and hit a low of 19.6% of the GDP in 2020-21.

Factors Contributing to the Decline

- Low Private Consumption: Strong consumption is necessary to encourage businesses to invest, as it signals future demand for their products.

- Policy Factors: Structural problems and policy uncertainty have also been cited as reasons for the decline in private investment. For example, the slowdown in economic reforms and changes in government policies can deter long-term investments.

- Reforms Correlation: The growth in private investment in the 1990s and early 2000s correlated with the economic reforms started in 1991. The subsequent decline has been linked to a slowdown in reforms and rising policy uncertainty.

- Government Measures and Tax Reforms

- Tax Cuts: In 2019, the Indian government reduced corporate taxes from 30% to 22% to stimulate private investment. The aim was to make investing more attractive for businesses.

- Facilitation of Tax Compliance: Simplification of tax compliance procedures and introduction of measures like the Goods and Services Tax (GST) have been designed to create a more business-friendly environment.

- National Infrastructure Pipeline (NIP)

- Regulatory Simplification: The government introduced the Single Window Clearance system to reduce the time and effort required to start and operate a business.

- Online Processes: Digital platforms like the Ministry of Corporate Affairs (MCA) 21 portal have been introduced to streamline business registration and compliance processes.

- Production Linked Incentive (PLI) Schemes: The PLI schemes offer incentives to companies for boosting domestic manufacturing in sectors such as electronics, textiles, and pharmaceuticals. The goal is to enhance competitiveness and attract foreign and domestic investment.

- Sector-Specific Incentives: Various incentives and subsidies are offered in sectors like renewable energy, manufacturing, and technology to stimulate investment.

- Banking Sector Improvements: Measures to strengthen the banking sector, including recapitalization of public sector banks and the introduction of the Insolvency and Bankruptcy Code (IBC), are aimed at improving credit availability and reducing non-performing assets (NPAs).

- Development Finance Institutions: Support for institutions like the National Bank for Agriculture and Rural Development (NABARD) and the National Housing Bank (NHB) to enhance financing options for specific sectors.

- FDI Liberalization: Reforms to relax FDI norms in various sectors, such as defense, retail, and aviation, to make India a more attractive destination for foreign investors.

- Automatic Route Expansion: Expansion of the automatic route for FDI to simplify the process and reduce bureaucratic hurdles.

- Startup India Initiative: Provides various benefits including tax exemptions, easier compliance norms, and funding support to encourage the growth of startups and innovative enterprises.

- Innovation and Technology Support: Grants and funding opportunities for research and development (R&D) and innovation, including support for tech startups and incubators.

- Special Economic Zones (SEZs): Creation of SEZs with incentives for businesses, including tax breaks and easier regulatory compliance, to attract investment in specific regions.

- Industrial Corridors and Clusters: Development of industrial corridors and investment in industrial clusters to boost investment in targeted regions.

Key-Concepts

|

Prelims Articles

Context

The Gaza–Israel conflict has spotlighted the Bedouin community in Israel and the unique challenges faced by this minority group within Israeli society.

About

- The Bedouin are part of Israel's Arab minority, which constitutes about 20% of the country's population.

- They are Palestinian citizens of Israel, holding Israeli citizenship but facing unique socio-economic challenges.

- Traditionally, Bedouins are nomadic. However, modern pressures and state policies have significantly impacted their traditional lifestyle, leading to issues of marginalization and neglect.

- The Bedouin’s primary area of settlement is the Negev Desert in southern Israel. This region is characterized by its harsh living conditions and has been a focal point of land and resource conflicts.

Prelims Articles

Context

The government announced that National Exit Test (NExT) will be mandatory for students enrolled in Ayush streams from the 2021-22 academic session onwards.

What is NExT?

- The National Exit Test (NExT) is designed to assess the clinical competency, medical ethics, and the ability to handle medico-legal cases of graduates in the Ayush systems, which include Ayurveda, Siddha, Unani, and Sowa-Rigpa.

- It is mandatory for obtaining a license and enrollment in State or national registers after completing a one-year internship.

- Legislative Background: The requirement for NExT is part of the provisions under the National Commission for Indian System of Medicine (NCISM) Act, 2020, and the National Commission for Homoeopathy (NCH) Act, 2020.

- These Acts came into force on June 11, 2021, and July 5, 2021, respectively. NExT is to be conducted by the Commissions within three years from the date these legislations were enforced.

- Government’s Aim: The government’s objective with NExT is to ensure a fair and transparent examination process while maintaining the quality of Ayush education and healthcare standards.

Fact Box: About AYUSH

|

Prelims Articles

Context

The recent focus on the Loss and Damage Fund (LDF) has been heightened due to the devastating landslides that struck Kerala’s Wayanad district. This disaster has sparked a crucial conversation about whether subnational entities, such as individual states or districts, can seek compensation through international climate finance mechanisms like the LDF.

Loss and Damage Fund (LDF)

- The LDF was created during the 2022 UNFCCC Conference (COP27) in Egypt.

- Its objective was to provide financial support to regions experiencing both economic and non-economic losses due to climate change, such as extreme weather events (e.g., landslides, floods) and slow-onset processes (e.g., rising sea levels).

- Governance: Managed by a Governing Board, with the World Bank serving as the interim trustee.

- Mechanisms: Includes direct access, small grants, and rapid disbursement options to facilitate resource allocation.

- India's Situation:

- India faced over $56 billion in damages from weather-related disasters between 2019 and 2023.

- However, the country has focused more on mitigation rather than adaptation and loss management in its climate policies. This has resulted in less active participation in loss and damage dialogues, which might affect how effectively Indian states, including Kerala, can leverage the LDF.

- India requires a clear legal and policy framework to streamline climate finance, particularly for adaptation and loss and damage, emphasizing locally led adaptation.

Editorials

Context

In the Union Budget 2024-25, the government introduced a Critical Mineral Mission to boost India's self-reliance in essential minerals. This initiative aims to enhance domestic production, improve recycling practices, and encourage international asset acquisition. The recent amendment to the Mines and Minerals (Development and Regulation) Act of 1957 aligns with these goals by facilitating private sector involvement in mineral exploration.

Objectives of the Critical Mineral Mission

- Expansion of Domestic Production: The mission focuses on increasing India’s capacity to produce critical minerals domestically, reducing reliance on imports.

- Recycling Prioritization: It aims to establish robust systems for recycling critical minerals, thus promoting sustainable resource management.

- Incentivising Overseas Acquisition: The mission seeks to encourage the acquisition of mineral assets abroad to secure supply chains.

Legislative Changes

- Amendment to the Act: The Mines and Minerals (Development and Regulation) Amendment Bill, 2023, revises the Mines and Minerals (Development and Regulation) Act of 1957.

- Removal of Six Minerals: The amendment removes six minerals from the atomic list, opening up exploration opportunities for the private sector.

- Private Sector Involvement: This legislative change aims to increase private sector participation in mineral exploration and development.

Implementation and Impact

- Mission Mode Efforts: The mission is being pursued with a sense of urgency, with ongoing efforts to achieve its objectives efficiently.

- Seminar Discussions: The Ministry of Mines organized a seminar to outline and discuss the mission's goals and strategies.

- Expected Outcomes: The mission is expected to enhance mineral resource management, support domestic industries, and strengthen international mineral supply chains.

Practice Question

Q. Evaluate the objectives and potential impact of the Critical Mineral Mission introduced in the Union Budget 2024-25. How do the recent amendments to the Mines and Minerals (Development and Regulation) Act support these objectives?

Editorials

Context

The National Food Security Act (NFSA) 2013 aimed to ensure food security through an improved Public Distribution System (PDS) in India. Despite initial concerns about high leakages in the PDS, recent data from the Household Consumption Expenditure Survey (HCES) 2022-23 shows a reduction in leakages, prompting a review of the effectiveness of the NFSA reforms.

PDS Leakages and Reforms

- Initial Concerns: In 2011-12, PDS leakages were high at 41.7%, causing apprehension about the system's effectiveness.

- Reform Success: States like Bihar, Chhattisgarh, and Odisha saw significant reductions in leakages due to early PDS reforms, showcasing the potential for nationwide improvements.

- Current Estimates: As per HCES 2022-23, leakages have decreased to 22%, indicating progress but still highlighting areas for improvement.

PDS Coverage and Expansion

- Increased Coverage: The NFSA expanded PDS coverage, increasing the proportion of households using the system from around 50% in 2011-12 to 70% in 2022-23.

- Coverage Shortfall: Despite expansion, the Centre falls short of NFSA’s mandated coverage, with only about 59% of the population having access to PDS as beneficiaries.

- State Variations: PDS reforms have led to varying improvements across states, with some states like Tamil Nadu experiencing increased leakages despite previously effective systems.

PDS Performance and Challenges

- Impact of Aadhaar: Aadhaar-based biometric authentication did not significantly reduce leakages compared to offline systems, questioning the efficacy of this reform.

- Innovations and Criticisms: New measures such as eKYC and cash transfers are seen as potentially disruptive and may undermine the effectiveness of the PDS.

- Policy Recommendations: Focus should be on completing the Census to address exclusions and including more nutritious items in the PDS, rather than on unproven technological fixes.

Practice Question

Q. Discuss the effectiveness of the National Food Security Act (NFSA) 2013 in improving the Public Distribution System (PDS) in India. What are the major challenges faced, and how can they be addressed to ensure better food security?

Editorials

Context

The International Labour Organization (ILO) has released its World Employment and Social Outlook study, highlighting a significant decline in labor’s share of income globally, primarily due to technological advancements like automation and artificial intelligence. This trend has intensified during the pandemic years, raising concerns about income inequality and job creation, especially among youth and women. The debate on universal basic income (UBI) and inheritance tax as potential solutions to address these issues is gaining traction.

Trends in Labor Income Share

- Global Decline: The global labor income share has decreased by 1.6% between 2004 and 2024, with nearly 40% of this decline occurring during the pandemic years (2019-2022).

- Economic Impact: The 1.6% drop represents a loss of $2.4 trillion in wages globally, which is more than half of India’s nominal GDP forecast for FY2023-24, highlighting the economic scale of the issue.

- Gender Disparities: In 2024, nearly 28.2% of young women are not in employment, education, or training, compared to 13.1% of young men, underscoring gendered disparities in the labor market.

Solutions and Policy Proposals

- Universal Basic Income (UBI): The concept of UBI has been discussed globally, with proposals such as Switzerland's referendum in 2016 and Andrew Yang's 2020 campaign idea of $1,000 a month for every American. Rahul Gandhi also proposed ?12,000 per month per family during the 2019 election campaign.

- Automation and Inequality: While automation and AI might create high-paying jobs, they also exacerbate income inequality. The debate continues on whether UBI can address these disparities and contribute to Sustainable Development Goal 10, which aims to reduce inequality.

- Inheritance Tax: Reintroducing an inheritance tax is suggested as a measure to address wealth inequality, particularly in developing nations like India, to balance the growing disparity exacerbated by automation and AI.

Practice Question

Q. Analyze the impact of technological advancements such as automation and artificial intelligence on labor income share and income inequality. Discuss the potential role of universal basic income and inheritance tax in addressing these challenges.