20th December 2022 (6 Topics)

Context

Recently passed Energy Conservation (Amendment) Bill, 2022 empowers the Government to establish carbon markets in India and specify a carbon credit trading scheme.

What are carbon markets?

- To meet Nationally determined contributions (NDCs), one mitigation strategy is becoming popular with several countries— carbon markets.

- Article 6 of the Paris Agreement provides for the use of international carbon markets by countries to fulfil their NDCs.

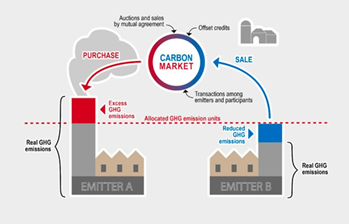

- Carbon markets are essentially a tool for putting a price on carbon emissions— they establish trading systems where carbon credits or allowances can be bought and sold.

- A carbon credit is a kind of tradable permit that, per United Nations standards, equals one tonne of carbon dioxide removed, reduced, or sequestered from the atmosphere.

- These markets create incentives to reduce emissions or improve energy efficiency.

Sentiments of countries about carbon markets

- About 83% of NDCs submitted by countries mention their intent to make use of international market mechanisms to reduce greenhouse gas emissions.

What are the types of carbon markets?

- There are broadly two types of carbon markets that exist today— compliance markets and voluntary markets.

|

Voluntary Markets |

Compliance Markets |

|

|

|

|

|

|

|

Examples of compliance carbon markets are the:

|

|

Cap-and-Trade vs Carbon Tax

|

Advantages:

|

Related Indian Initiatives

|

- These markets may promote the reduction of energy use and encourage the shift to cleaner fuels.

- Through this kind of carbon trading, companies can decide if it is more cost-efficient to employ clean energy technologies or to purchase additional allowances.

- Since government-regulated trading schemes may prompt companies to innovate, invest in, and adopt cost-efficient low-carbon technologies.

What are the challenges to carbon markets?

- Effectiveness of carbon markets: Some companies simply buy credits without making any effort to reduce emissions themselves.

- It is cheaper for them to buy carbon credit than to invest in emission-reducing technologies.

- Environmental activists argue that only high-quality carbon offsets are effective in reducing emissions. High-quality carbon offsets have certain features:

- Additionality: Emission reductions must be additional i.e., they would not have occurred in the absence of a market for offset credits e.g., a renewable project could be set up only because a high emitter paid for it.

- Verifiable: There must be proper audits to ensure the monitoring, reporting, and verification of emission cuts.

- Permanence: The emission reduction should not be reversed.

- However, many credits available in markets are of poor quality i.e., they do not meet the above criteria.

- Buying carbon credits can deviate rich nations from the path of reducing emissions.

- It is difficult to establish the amount of carbon reduced by offset projects (like afforestation or wind energy project).