28th February 2022 (6 Topics)

Context

The Ukraine crisis has forced the US and the European Union (EU) to exclude some Russian banks from the SWIFT payment system.

About

About SWIFT:

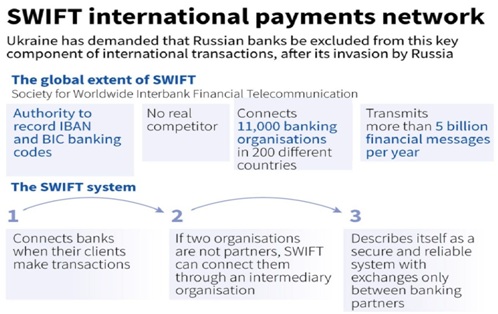

- The SWIFT system stands for the Society for Worldwide Interbank Financial Telecommunication

- It is a secure platform for financial institutions to exchange information about global monetary transactions such as money transfers.

- While SWIFT does not actually move money, it rather acts as a secure messaging system that links more than 11,000 financial institutions in over 200 countries and territories, alerting banks when transactions are going to occur.

- SWIFT was founded in 1973 and is based in Belgium. It is overseen by the National Bank of Belgium, in addition to the US Federal Reserve System, the European Central Bank and others.

Has any country ever been banned from SWIFT in the past?

- The ban on select Russian banks from SWIFT isn't the first time that such a harsh measure has been implemented.

- Iran lost access to SWIFT in 2012 as part of sanctions over its nuclear program, though many of the country's banks were reconnected to the system in 2016.

- When it lost access, Iran lost almost half of its oil export revenues and 30 per cent of foreign trade.

How will SWIFT ban affect Russia?

- Banning Russian banks from SWIFT would be a major blow to the banks and damage the country’s economy right away and, in the long term, cut Russia off from a swath of international financial transactions.

- Russian companies and individuals will find it harder to pay for imports and receive cash for exports, borrow or invest overseas.

Is there a way around SWIFT?

- While this is the first time that some Russian banks have been excluded from the SWIFT system, Russia has been threatened with similar sanctions when it annexed Crimea in 2014.

- Since then, Russia has been working on alternatives, including the SPFS (System for Transfer of Financial Messages) — an equivalent of the SWIFT financial transfer system developed by the Central Bank of Russia.

- China too has its own version of SWIFT, launched in 2015, called Cross-Border Interbank Payment System (CIPS) to internationalise the use of Yuan.

- With Russia being excluded from SWIFT, there’s a rising concern that China and Moscow would join hands and the two countries are in talks to collaborate on a venture to combat SWIFT.

- This would be disconcerting as both countries have emerged as rivals of the West in Europe and the Indo-Pacific, respectively.