Economy: Service Sector

RUCO initiative (Repurpose Used Cooking Oil)

Libra

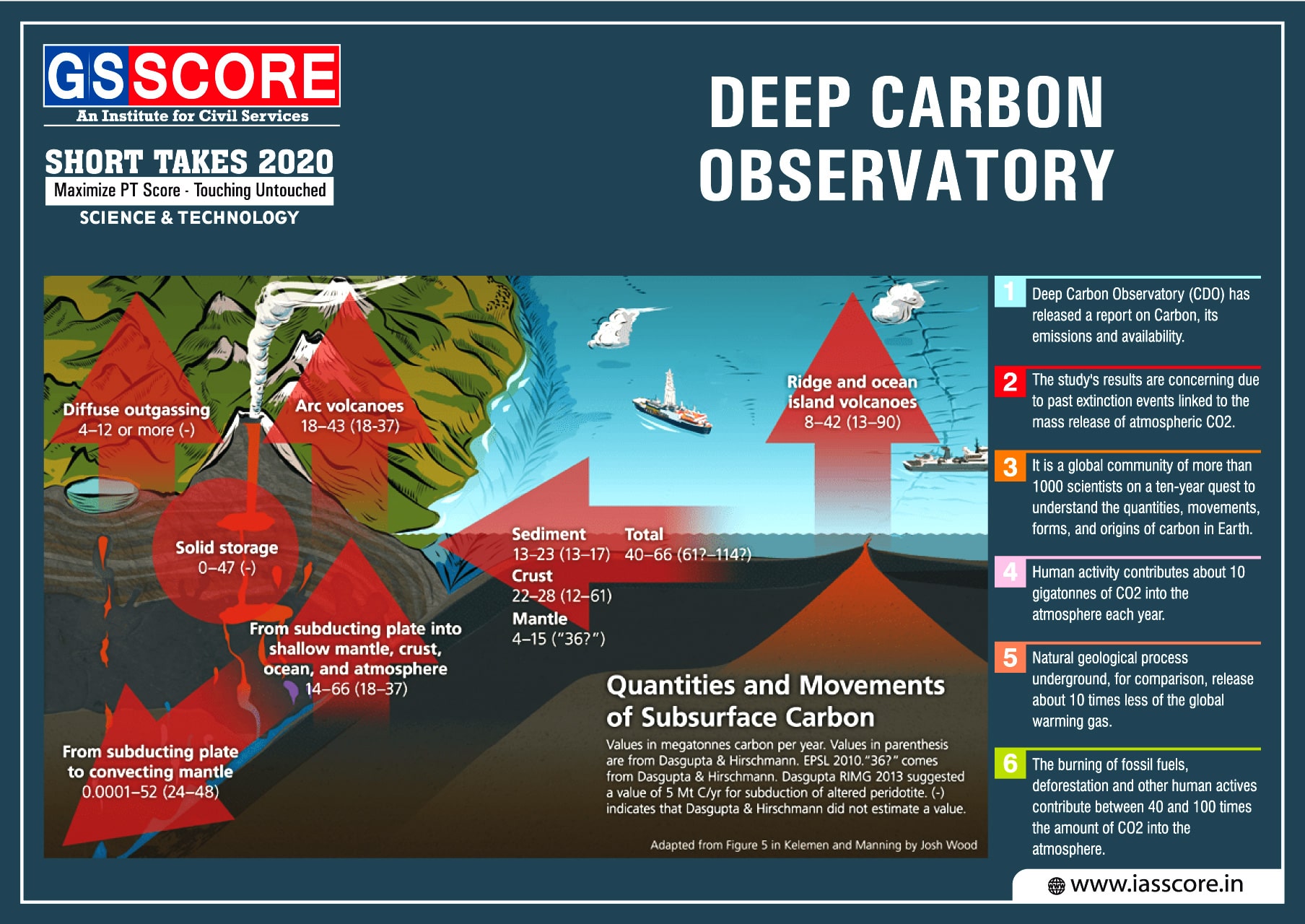

Deep Carbon Observatory

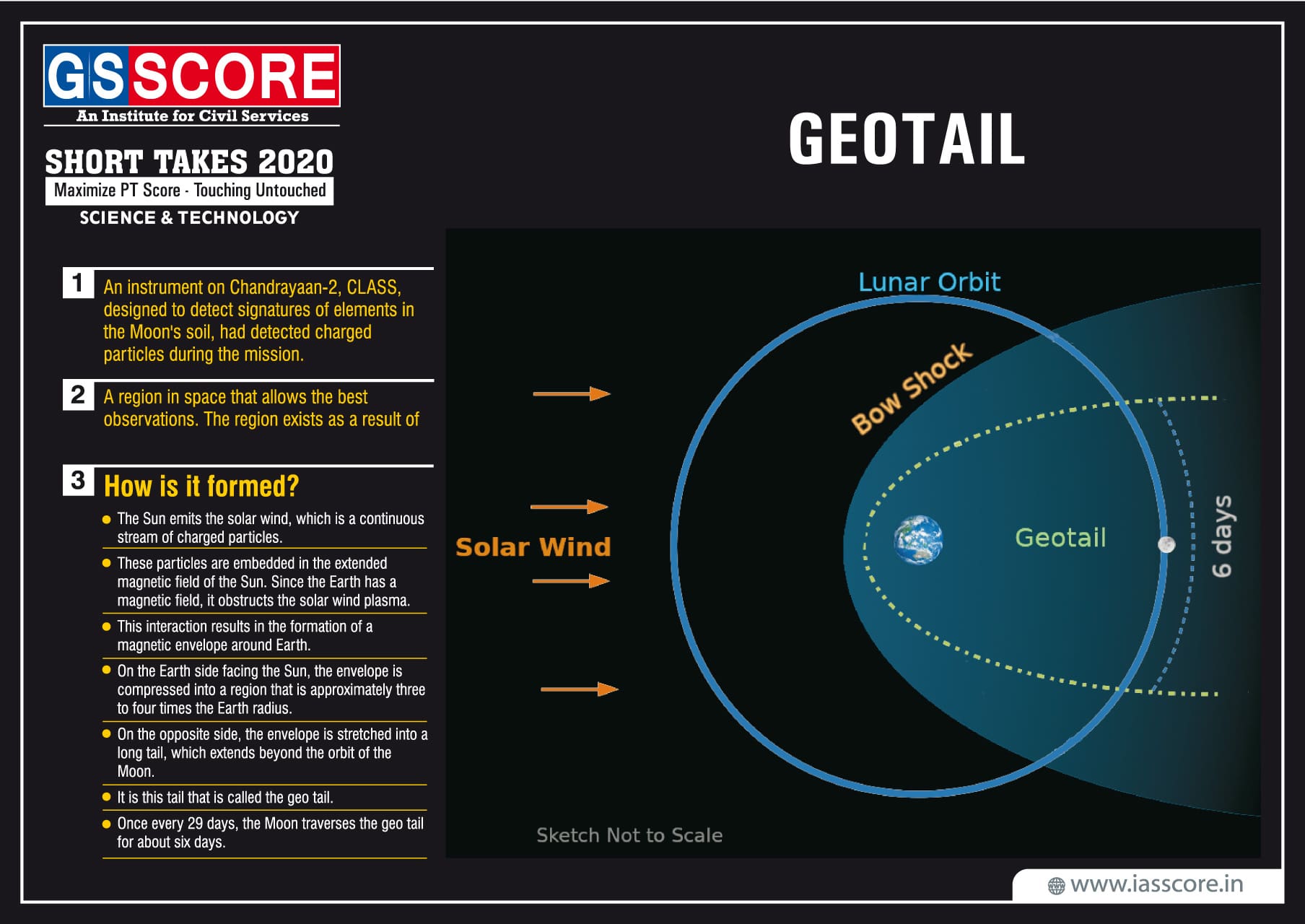

Geotail

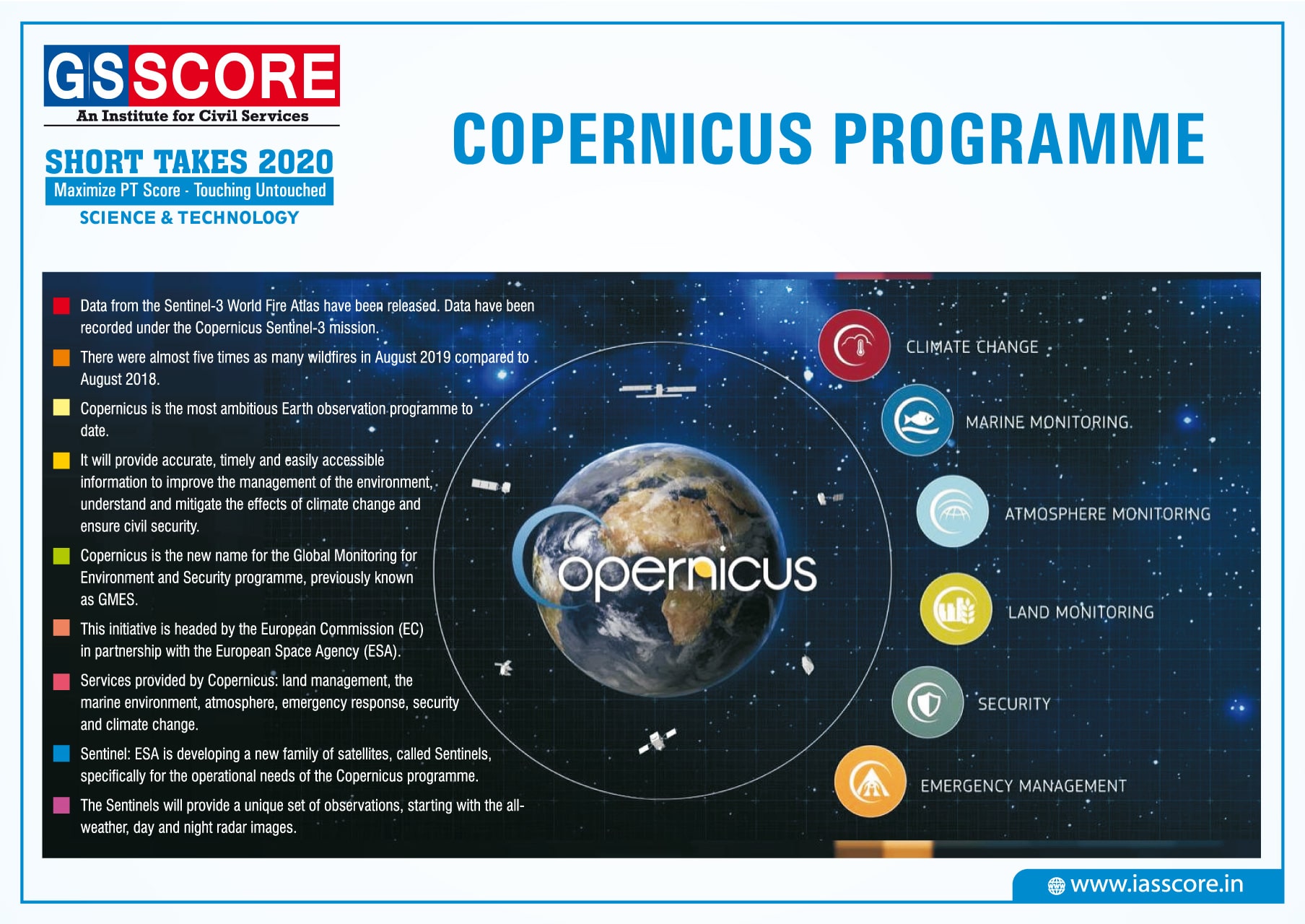

Copernicus Programme

Service Sector

- India’s services sector has not only outperformed other sectors of the Indian economy, but has also played an important role in India’s integration with world trade and capital markets.

- There is, however, a concern about the sustainability of a services-led growth process which largely stems from exports of skill-based services.

- The prevailing view is that for services growth to be sustained, the sector cannot remain dependent on external demand. It must also be driven by internal demand.

- More broad-based growth within the services is also required to ensure balanced, equitable and employment oriented growth, with backward and forward linkages to the rest of the economy.

- In this regard further infrastructural and regulatory reforms and FDI liberalization in services can help diversify the sources of growth within India’s services sector and provide the required momentum.

- In recent years, there has been a debate in the country regarding the selection of the sector which can lead the growth process in the country. This debate originated from the fact that the services sector contributed over 62 per cent in the GDP during the decade 2001–12.

India and Global Services

Services sector have been hit hard after the Great Recession among the western developed economies. Rather during 2017 there was a strong signal of recovery reported from this part of the world which had a positive impact on the services-oriented countries. Latest features about the services sector at global and India levels are as given below:

- As per the latest data4, India’s ranking improved from 14th position in 2006 to 7th position in 2016, among the world’s 15 largest economies in terms of overall GDP.

- In 2016, services GVA growth rate (at constant prices), was highest in India at 7.8 per cent followed by China at 7.4 per cent. As per the ILO’s estimates, among the top 15 economies, the services sector accounted for more than two thirds of total employment in 2016 in most of them except India and China, with India’s share of 30.6 per cent being the lowest.

- Services export growth, both for World and India, which had dipped to negative territory in 2015 after an interregnum of six years from 2009, returned to positive territory in 2016.

- As per the latest WTO data for 2017 (first half) world’s services export growth was 4.3 per cent while it was 9.9 per cent for India (0.2 per cent for China and the highest 18.4 per cent for Russia).

Services Performance of India

Major feature of India’s services performance are as given below:

- Out of the 32 States and UTs, it is the dominant sector, contributing over 50 per cent of the gross state value added (GSVA) in 15 states and UTs. The major services in most of the states are trade, hotels and restaurants, followed by real estate, ownership of dwellings and business services.

- The GVSAs show wide variation in terms of share and growth of services—Delhi and Chandigarh are at the top with over 80 per cent share, while Sikkim is at the bottom with 31.7 per cent share.

- In terms of services GSVA growth, Bihar is at the top and Uttar Pradesh at the bottom with 14.5 per cent and 7.0 per cent growth respectively in 2016-17.

FDI Inflows into Services Sector

- FDI data from the Department for Promotion of Industry and Internal Trade shows that gross FDI equity inflows (excluding re-invested earnings) into the services sector witnessed a strong recovery during April-September 2019 following a decline in 2018-19.

- Gross FDI equity inflows jumped by 33 per cent YoY during AprilSeptember 2019 to reach US$ 17.58 billion, accounting for about two-thirds of the total gross FDI equity inflows into India during this period.

- The jump in FDI equity inflows was driven by strong inflows into subsectors such as ‘Information & Broadcasting’, ‘Air Transport’, ‘Telecommunications’, ‘Consultancy Services’ and ‘Hotel & Tourism’.

Trade in Services Sector

- RBI’s Balance of Payments data suggests that services exports during April-September 2019 maintained their momentum from 2018-19, with a growth (YoY) of 6.4 per cent.

- The jump in export growth of travel, software, business and financial services offset the contraction in export growth of insurance and other services (including construction, etc.)

- The robust growth in business services exports was driven by higher receipts for R&D services, professional and management consultancy services, and technical and trade related services.

- Trends in the composition of services exports over the past decade show that the shares of traditional services, such as transport, and value-added services, such as software, financial services and communications, have witnessed a decline.

- Meanwhile, the share of travel services has increased over the past decade and that of business services has risen slightly.

- The share of software services has declined by 4 percentage points over the past decade to reach 40 per cent of total services exports in 2018-19.

- Yet, India’s services exports remain concentrated in software services, accounting for twice the share of the second-largest component, business services.

- This has made the software sector, and therefore overall services exports, susceptible to changes in exchange rate, global IT spending, stringent USA visa norms, and rising cost pressures due to increased local hiring in export destinations.

- Even though global IT spending, as projected by Gartner in October 2019, is expected to accelerate in 2020, rising production costs and uncertainty related to Brexit and USA’s visa norms pose downward risks to India’s software exports.

- Services import growth (YoY) during April-September 2019 was 7.9 per cent.

- An increase in import growth for transport, software, communication and business services offset the contraction in imports of financial and insurance services and the slowdown in imports of travel services.

- Increased business services payments were primarily driven by professional, management and consultancy services and technical and trade related services.

- Besides software services, India runs a small trade surplus in travel, insurance and financial services.

- However, within travel services, India persistently runs a trade deficit in education services with education imports, i.e., expenditure incurred by Indian students traveling abroad for education purposes on tuition, room and boarding, reaching about US$ 3 billion in 2018-19.

- Adding to this other payments for education purposes such as fees paid for correspondence courses abroad, which constitute as payments for receiving education services abroad, there has been a marked increase in India’s education services imports in the recent years amounting to US$ 5.0 billion in 2018-19.

- From a long-run perspective, India’s focus on boosting services exports during bilateral trade negotiations augurs well for mitigating bilateral trade deficits with trading partners.

- Looking ahead, world trade volume for goods and services are projected to recover in 2020 following a deceleration in 2019.

- Global uncertainty, protectionism and stricter migration rules would be key factors in shaping India’s services trade ahead.

Manufacturing vs. Services

- All the focus being on the manufacturing exports in India has distracted attention from what might be a no less noteworthy development.

- In past few years, it is India’s exports of services that has changed in the most significant, and perhaps alarming, way.

- What makes this development puzzling is that in recent years the composition of Indian exports of services is more favourable than that of Indian exports of manufactured goods. More of the former goes to the United States, and more of the latter to Asia.

- Realising India’s medium-term growth potential of 8-10 per cent will require rapid growth of exports.

- How rapid this should be is suggested by comparing India’s export performance in services with China’s performance in manufacturing at a comparable stage of the growth surge.

- India’s competitiveness will have to improve so that its services exports, currently about 3 per cent of world exports, capture nearly 15 per cent of world market share. That is a sizeable challenge, and recent trends suggest that a major effort at improving competitiveness will be necessary to meet it.

Global negotiations

India aims to position itself as a key player in world services trade. To promote services exports, the government has taken a number of policy initiatives – SEIS (Service Exports from India Scheme) for increasing exports of notified services from India; organising GES (Global Exhibitions on Services); and SCs (Services Conclaves). Besides, some initiatives in sectors like tourism and shipping have also been taken in this regard. Given the potential of India’s services exports, services-sector negotiations both at multilateral and bilateral and regional levels are of vital importance to India. Some of the recent negotiations are as given below.

WTO negotiations

Though, the 11th Ministerial Conference (MC) of the WTO ended without a Ministerial Declaration or any substantive outcome, India saw certain favourable outcome from the 10th MC of the multi-lateral trade body

- Implementation of preferential treatment in favour of services and service suppliers of least developed countries (LDC) and increasing LDC participation in services trade;

- To maintain the current practice of not imposing customs duties on electronic transmissions (e-Commerce) until the next Ministerial Conference to be held in 2017.

- India, together with 20 other members have notified preferential treatment to LDCs in services trade. India has offered this in respect of:

- Market access

- Technical assistance and capacity building; and

- Waiver of visa fees for LDC applicants for business and employment.

Bilateral Agreements

The bilateral agreements signed by India in recent times are:

- Comprehensive bilateral trade agreements signed, including trade in services, with the governments of Singapore, South Korea, Japan and Malaysia. An FTA in services and investment was signed with the Association of South East Asian Nations (ASEAN) effective since mid2015.

- India has joined the RCEP (Regional Comprehensive Economic Partnership) pluri- lateral negotiations. The proposed FTA includes the 10 ASEAN countries and its six FTA partners, viz. Australia, China, India, Japan, South Korea and New Zealand. The RCEP is the only mega-regional FTA of which India is a part.But in November 2019,India opted out of RCEP.

- India is also engaged in bilateral FTA negotiations including trade in services with Canada, Israel, Thailand, the EU, the EFTA (European Free Trade Association), Australia and New Zealand. Dialogue is under way with the US under the India-US Trade Policy Forum (TPF), with Australia under the India-Australia JMC (Joint Ministerial Commission), with China under the India-China Working-Group on Services, and with Brazil under the India-Brazil Trade Monitoring Mechanism (TMM).

Restrictions and Regulations

- One major issue in services is the domestic barriers and regulations.

- Domestic regulations, in strict WTO terms, include licensing requirements, licensing procedures, qualification requirements, qualification procedures, and technical standards but here other restrictions and barriers are also considered.

- While there are many domestic regulations in our major markets, which deny market access to us and therefore need to be negotiated at multilateral and bilateral levels, there are also many domestic regulations in India which hinder the growth of this sector.

- Since domestic regulations perform the role of tariffs in regulating services, there is need to list the domestic regulations in India which need to be curbed to help growth of the sector and its exports, while retaining those which are necessary for regulating the sector at this stage.

- An indicative list of some important domestic regulations in India which need to be examined for suitable policy reforms9 in the services sector is as follows:

- trade and transport services

- construction development

- Accountancy services

- legal services

- education services

The need for reforms

- Indian services sector have the potential to garner higher economic benefits to the country.

- But there are many issue both general and sector specific including domestic regulations hinder the growth prospects of the services sector.

- If these issues are addressed deftly the sector could lead to exponential gains for the economy.

- The need of policy reforms in this regards are outlined in the following way:

General Issues

There are some general issues related to the policy framework which hamper the healthy growth and expansion of the services sector in the country. They are broadly related to the following areas:

Nodal agency and marketing:

Despite having strong growth potential in various services sub-sectors, there is no single nodal department or agency for services. An inter-ministerial committee for services has been set up to look into this. But services activities cover issues beyond trade and a more proactive approach and proper institutional mechanism is needed to weed out unwanted regulations and tap the opportunities in the services sector in a coordinated way.

Disinvestment:

There is plenty of scope for disinvestment in services PSUs under both central and state governments. Speeding up disinvestment in some services-sector PSUs could not only provide revenue for the government but also speed up the growth of these services.

Credit related:

The issues here include ‘collateral free’ soft loans to support the sector’s cash needs and possibility of considering even export or business orders as collateral for credit-worthy service firms.

Tax and Trade Policy related:

These include use of ‘net’ instead of ‘gross’ foreign exchange criteria for export benefit schemes, the issue of retrospective amendments of tax laws like,

- Amendment to the definition of royalty to include payment of any rights via any medium for use of computer software,

- Tax administrative measures to tackle delay in refunds,

- Introducing VAT (value added tax) refund for foreign tourists, and

- Addressing the issue of bank guarantees based on past performance to avail of export promotion benefits in services.

Outlining future

With plenty of opportunities, the services sector is like an uncharted sea. As yet, its potential has not been tapped fully by India. A targeted policy of removing bottlenecks in major and potential services can result in large dividends in the form of higher services growth and services exports, which in turn can help in pulling up the economy to higher growth levels. The future actions in the sector can be outlined as given below:

- India’s services sector, which showed resilient growth after the recovery of the global economy following the global financial crisis, has been showing subdued performance in recent times. Despite the slowdown, the prospects continue to be bright for many segments of the sector.

- In future, government’s focus on the following are expected to provide impetus to logistics services—

- infrastructure development,

- favourable regulatory policies like liberalisation of FDI norms,

- increasing number of multimodal logistics service providers,

- growing trend of outsourcing logistics to third party service providers, and

- entry of global players.

- Though shipping services are at a low key at present, with increased imports of POL (petroleum, oil and lubricants) for stocks build up to take advantage of low crude oil prices, containerisation of export and import cargo and modernisation of ports with private sector participation, recovery of the shipping and port services sector can be expected.

- The prospects for Indian aviation services have improved following—

- the fall in prices of aviation fuel, which accounts for nearly 40 per cent of the operating expenses of airlines in India;

- liberalisation of FDI policies in civil aviation; and

- strong growth in passenger traffic – expected to continue in the near future.

- The outlook for the retail industry remains positive as India continues to remain an attractive long-term retail destination despite the various challenges faced by the sector. Following initiatives are expected to give a fillip to the sector—

- allocation of Rs. 1000 crore to technology and start-up sectors,

- promotion of cashless transactions via RUPay debit cards, and

- growth of e-commerce.

- Government’s focus on the tourism sector including easing visas by eTV and building tourism infrastructure could help in the recovery of the tourism sector.

- Despite challenges in the global market, the Indian IT industry is expected to maintain double or near-double- digit growth as India offers depth and breadth across different segments of this industry, such as, IT services, BPM, ER&D, internet and mobility and software products.

- In the telecom sector, the introduction of 4G which could be a game changer and inclusion of fibre optic connectivity which will tremendously increase the reach and bandwidth along with greater use of mobiles in government’s social sector programmes could give a further boost to this fast growing sector.

Several relevant and contemporary suggestions have been articulated by a Working Paper of the Ministry of Finance by late February 2016. Dealing with the sectors like tourism, shipping and port, IT and software the advices are deeper and effective

Tripura gets its first SEZ

Context

- The Ministry of Commerce and Industry has notified the setting up of the first ever Special Economic Zone (SEZ) in Tripura.

- It will be developed by Tripura Industrial Development Corporation (TIDC) Ltd.

About

- The SEZ is being set-up at Paschim Jalefa, Sabroom, South Tripura District, which is 130 km away from Agartala.

- It will be a Sector Specific Economic Zone for Agro-Based Food Processing.

- The estimated investment in the project will be around 1550 Crore.

- The SEZ is estimated to generate 12,000 skilled jobs.

- Rubber based industries, textile and Apparel Industries, bamboo and Agri-food Processing Industries will be set-up in the SEZ.

- Setting up of the SEZ in Sabroom will open up new avenues to attract private investment considering the proximity of the Chittagong Port and construction of the bridge across Feni River in South Tripura which is underway.

- After it is set up, 100 percent Income Tax exemption will be provided on export income for SEZ units under Section 10AA of the Income Tax Act for the first 5 years.

- Also 50 percent exemption will be provided for the next 5 years and 50 percent of the ploughed back export profit for another 5 years.

SEZs-

- A special economic zone (SEZ) is an area in which the business and trade laws are different from the rest of the country.

- SEZs are located within a country's national borders, and their aims include increased trade balance, employment, increased investment, job creation and effective administration.

- To encourage businesses to set up in the zone, financial policies are introduced. These policies typically encompass investing, taxation, trading, quotas, customsand labour regulations.

- Additionally, companies may be offered tax holidays, where upon establishing themselves in a zone, they are granted a period of lower taxation.

- The benefits a company gains by being in a special economic zone may mean that it can produce and trade goodsat a lower price, aimed at being globally competitive.

Special Economic Zones in India-

- India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia's first EPZ set up in Kandla in 1965.

- The second EPZ, SEEPZ (Santa Cruz Electronics Export processing Zone) was set up in Maharashtra in 1974.

- In April 2000, the Government of India adopted a new policy framework titled ‘Export and Import Policy 2000’ for the establishment of public, private or joint public-private SEZs.

- India witnessed remarkable growth in number of formal, notified and operational approvals post enactment of SEZ Act in 2005. The spread of SEZs within the States is to achieve balanced growth across all regions of the country.

- The sector wise distribution of SEZ’s clearly shows that majority of the formal approvals granted have been in IT/ITES sector which comprises nearly 64% of the total formal approvals granted till date.

- The SEZ scheme in India has shown a tremendous growth in infrastructure investment, employment and exports.

Conclusion-

SEZs policy in India with respect to frequent changes in the policy environment is one of the major reasons of slackening the confidence of investors to continue and make fresh investments in SEZs. Therefore, to build a strong confidence amongst the potential/existing investors, it is imperative to frame a stable, favorable and highly transparent SEZs policy with long term perspectives.

Operation Twist

Context

The Central Bank announced that it will conduct simultaneous sale and purchase of 10,000 crore of government securities of varying tenor. This move is on the lines of US Federal Reserve’s Operation Twist

About

The Reserve Bank of India (RBI) announced simultaneous sale and purchase of government bonds. RBI will sell short-term bonds of 10,000 crore, it will also purchase long-term securities of the same value.

- Operation Twist of United States: RBI’s move resembles the 2011 Operation Twist of the US Federal Reserve Bank. It was intended to make long-term borrowing cheaper and spur bank lending. The Fed had swapped short-term bonds for longer-term debt.

- Difference with the US version: US version of the Operation Twist had started mid-2011 and lasted till late-2012. In case of RBI it is not clear if this is a one-time exercise or part of continuing operations.

- Aim: The hope is that with yields coming down, banks will cut lending rates given that lending to the government is deemed to be the safest, and if that comes down, so should the remaining rates as well.

How does Operation Twist get its name?

- The US Federal Reserve was the first central bank that attempted such an exercise of buying and selling government securities at the same time. This happened in 1961.

- At that time, the “twist" was a new dance craze sparked by singer Chubby Checker. Since then the name for such an exercise carried out by a central bank has stuck.

- Used as a measure in the financial crisis: Much later, Operation Twist was tried in the US in the aftermath of the financial crisis. In this case, the Federal Reserve purchased government securities with maturities varying from six years to 30 years and sold government securities with maturities of three years or less.

- The idea is to twist the yield curve: The yield curve is a graph that plots the yields of government securities (or other financial securities) of different maturities.

- The yield is the per-year return an investor can earn on a financial security by staying invested in it till maturity.

- When a central bank buys government securities, the prices go up. At a higher price, the yields or the returns come down as the interest paid on the securities stays the same.

- Vice versa, when the bank sells government securities, the prices fall and the return or the yield on the security goes up.

- This creates a visual effect of a twist in the yield curve.

Why did long term yields increase?

- No response to monetary easing: Over the past few months, long-term bonds failed to respond to RBI monetary easing. In fact, the long term 10-year premium widened against the repo rate to 140-150 basis points (bps).

- Widening yield gap: While the term premium for long term bonds touched around 150 bps, the short term yields had fallen below RBI’s benchmark repo rate of 5.15%, making the yield curve steeper.

- Fears of fiscal slippage: There have been fears of fiscal slippage. There are concerns that the government’s borrowing programme will be exceeded because there are problems on the fiscal side; i.e. it might borrow more to meet its fiscal deficit target.

- Pause on rate cuts: After lowering its repo rate by 135bps in five consecutive rate cuts in 2019, the central bank’s monetary policy committee (MPC) decided to keep rates on hold for the meanwhile.

- The MPC wants to wait for further government measures in the forthcoming budget and take a note of the effects of future policy actions before taking a decision to cut rates.

Benefits of RBI’s Operation Twist

- Yield anomaly corrected: With RBI’s Operation Twist the net liquidity in the system will remain unchanged, but the anomaly between the yields of short and long-term bonds will be corrected.

- As RBI will buy long-term bonds, its demand will go up and yields will go down and the opposite will happen when it sells bonds.

- Through this, the central bank is narrowing out the differential between the short- and long-term yields, and will flatten the yield curve.

- Spur private borrowing: The simultaneous sale and purchase of government bonds may aid governments borrowing plan by making it cheaper. It is expected to dampen term premium to stimulate private sector borrowing.

- With the long-term yields coming down, government will be able to borrow money cheaper against its bonds, as well as induce demand for private sector loans.

Will money supply increase because of RBI’s move?

- If the central bank buys government securities a few times, it will increase the money supply in the economy, which is likely to lead to higher inflation, with a greater amount of money chasing the same amount of goods and services.

- But by selling securities worth a similar amount, RBI will not end up increasing the money supply because of this operation.

How can this be made to have an effective impact?

- A one-off operation will not help: The idea is to drive down the yields on 10-year government securities. This can happen if the government continues with Operation Twist. A one-off operation will not help and yields will climb back soon.

HDI 2019 Report

Context

Recently, Human Development Report 2019 says that India is home to 28% of world’s poor.

About

- The annual HDI 2019 report, ranked India at the 129th position, one rank above last year’s ranking, out of a total 189 countries.

- India remains the home to 28 percent of global poor. About 41 per cent of the world’s poor live in South Asia.

- Between 1990 and 2018, India’s HDI value increased by 50 per cent (from 0.431 to 0.647), which places it above the average for countries in the medium human development group (0.634) and above the average for other South Asian countries (0.642).

- This means that in the last three decades, life expectancy at birth in India increased by 11.6 years, whereas the average number of schooling years increased by 3.5 years. Per capita incomes increased 250 times.

- The report finds that despite progress, group-based inequalities persist on the Indian subcontinent, especially affecting women and girls.

- While Singapore has the region’s lowest incidence of intimate partner violence against women, the report states that a staggering 31 per cent of women in South Asia have experienced intimate partner violence.

- India is only marginally better than the South Asian average on the Gender Development Index (0.829 vs 0.828), and ranks at a low 122 (of 162) countries on the 2018 Gender Inequality Index.

- The report states that as the number of people coming out of poverty is increasing, the world is veering towards another type of poverty. The old inequalities were based on access to health services and education whereas the next generation of poverty is based on technology, education and climate, according to the report.

- The report ranked countries after analysing reduction in absolute poverty, gains in life expectancy, education, and access to health care.

- India has both types of poverty. Even as Indians continue to face a lack of access to healthcare and education, many others are becoming poor based on the new criteria.

What is HDI?

- The underlying principle of the HDI, considered path breaking in 1990, (created by Pakistani economist Mahbub ul Haq) is elegantly simple: National development should be measured not only by income per capita, but also by health and education achievements.

- The HDI is the composite measure of every country’s attainment in three basic dimensions:

- Standard of living measured by the gross national income (GNI) per capita.

- Health measured by the life expectancy at birth.

- Education levels calculated by mean years of education among the adult population and the expected years of schooling for children.

- This index makes it possible to follow changes in development levels over time and to compare the development levels of different countries.

- Additional indices have been developed to capture other dimensions of human development to identify groups falling behind in human progress and to monitor the distribution of human development.

- In 2010 three indices were launched to monitor poverty, inequality and gender empowerment across multiple human development dimensions

- The Multidimensional Poverty Index (MPI),

- The Inequality-adjusted Human Development Index (IHDI)

- The Gender Inequality Index (GII).