14th December 2024 (12 Topics)

Context

Sanjay Malhotra has recently taken over as the 26th Governor of the Reserve Bank of India (RBI), succeeding Shaktikanta Das, who served as the Governor during a challenging period. Sanjay Malhotra steps into a challenging role with significant expectations, inheriting a legacy that sets a high bar. As the new RBI Governor, he will contend with seven critical priorities.

Shaktikanta Das’s leadership

- Das’s leadership was marked by his ability to manage various crises, such as the Covid-19 pandemic, financial troubles with companies like IL&FS and Yes Bank, and tensions between the RBI and the government.

- His tenure focused on maintaining financial stability, improving the banking system, and promoting digital innovations like the central bank digital currency and UPI.

- Das’s work earned him recognition as one of the best central bankers

Critical Priorities in front of RBI’s Governor

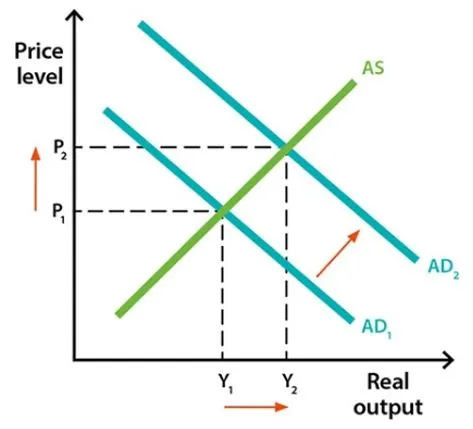

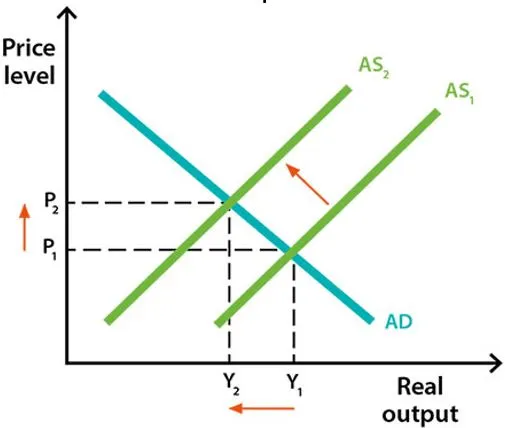

- Taming Inflation Without Hurting Growth: Inflation has been volatile, mainly due to supply-side issues in sectors like food and energy. Malhotra must find ways to control inflation without negatively affecting economic growth. Traditional methods like raising interest rates may not work well because inflation is driven by factors like global supply shocks, not just domestic demand. A balance is needed to ensure liquidity in the market and support sectors in need of credit, while managing inflation.

- Global Monetary Policy Differences: Global monetary policy divergence is at its peak, with the US Federal Reserve maintaining restrictive monetary policies to combat inflation while several emerging markets are exploring rate cuts to support growth.

- India’s interconnectedness with global capital flows and trade necessitates a calibrated approach to avoid capital flight and rupee depreciation.

- RBI must employ nuanced tools, including targeted liquidity operations and foreign exchange market interventions, to preserve external sector stability without undermining domestic growth prospects.

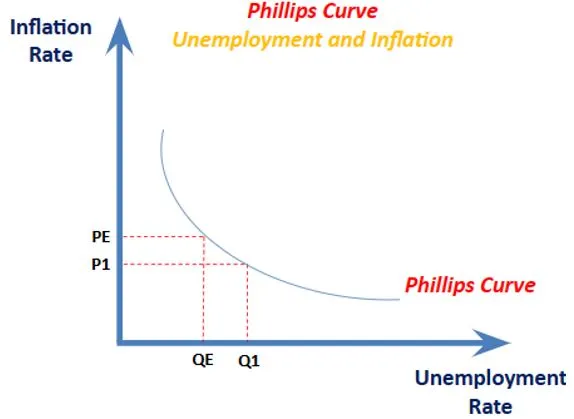

- Reassessing the Inflation Targeting Framework (FIT): The RBI follows a framework that targets keeping inflation at around 4% (with a margin of 2% above or below). However, rising global uncertainties and supply-side challenges (like climate change and geopolitical issues) make this framework less effective. Malhotra may need to revise this framework, potentially allowing for more flexibility and considering both inflation control and economic growth.

- In particular, the persistence of supply-side shocks has flattened the Phillips Curve, weakened monetary transmission channels, and complicated the extraction of accurate signals from headline inflation. The reduced efficacy of standard policy levers against predominantly cost-push shocks, coupled with shifts in consumption patterns and digitalisation-induced pricing anomalies, highlights the technical challenges of maintaining rigid, point-based targets in a changing economic landscape.

- Managing Currency Volatility: The Indian rupee has been fluctuating due to global financial instability and other factors. The RBI has tried to stabilize the rupee, but it’s a challenge. Malhotra may need to use strategies like diversifying reserves, promoting trade in currencies other than the dollar, and working with other central banks. While a weaker rupee could help exports by making Indian products cheaper, it also poses risks like higher import costs and pressure on companies with foreign debt.

- Enhancing Financial Inclusion: India has made significant progress in financial inclusion, with over 500 million accounts opened under the Pradhan Mantri Jan Dhan Yojana (PMJDY). However, there are still challenges in ensuring these accounts are used effectively, providing better access to credit, and bridging the digital divide. Malhotra will need to support digital banking and ensure that people are well-equipped to use financial services.

- Addressing Climate Risks and Green Finance: Climate change poses risks to the financial system. Malhotra will need to address these risks by promoting "green finance" and encouraging investments in sustainable projects. This might involve offering incentives for green investments, requiring companies to disclose their climate-related risks, and working with other countries on climate stress testing.

- Maintaining Financial Stability: The financial system must be stable to support economic growth. This includes ensuring that non-banking financial companies (NBFCs) are well-regulated, addressing risks related to the growing fintech sector, and preventing any gaps in regulations. Malhotra will need to strengthen the oversight of these institutions and ensure that they don’t pose risks to the broader financial system.

Fact Box:Key-Concepts

|

More Articles