15th July 2022 (8 Topics)

Context

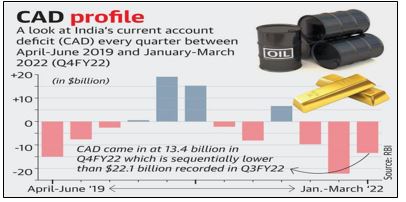

India's current account deficit is expected to deteriorate in the current fiscal on account of costlier imports and decreased merchandise exports.

About

Key Facts:

- The recently released data by the government showed that the trade deficit had widened in June to an all-time high and the imports have surged past $66 billion.

- Retail inflation moderated slightly to 7.01% in June, and the ministry attributed it to measures taken by the government and the central bank as well as fears of a global recession that dragged oil prices lower.

The Current Account Deficit (CAD) is the shortfall between the money received by selling products to other countries and the money spent to buy goods and services from other nations.

Positives:

- The agricultural sector is picking up with the long-range forecast for the monsoon season.

- Recovery in rural demand

- Double-digit growth of bank credit in recent months

- Economic activity is showing an upward trend despite the ongoing geopolitical tensions

- The services sector is showing signs of robust recovery

- Strong economic activity is evident in robust GST collection

Concerns:

- Food inflation hovers around 8.0%. But if compared with many other countries, it is very much under control in India. Import of essential commodities is getting costlier.

- Retail inflation in India continues to be higher than RBI’s tolerance level of 6%, stabilization policy measures. This is the sixth successive month in which retail inflation has been above the RBI's tolerance level of 6%.

- Fears of a recession are hovering globally and it may hurt India’s exports and push down Indian Rupee. Small Businesses Face High Inflation and Fear of Recession.

What can be done?

- The MPC (Monetary Policy Committee) is expected to hike policy repo rates to control the inflationary pressures.

|

Management of Inflation:

|

- An increase in customs duties and the imposition of windfall tax are expected to boost government revenues and assist in keeping the fiscal deficit to GDP ratio unchanged from its budgeted level.

- Little moderation in the international prices of food items, industrial metals, and crude oil global has been observed. But the reason for the same may be driven by the fear of setting of recession

- India has also diversified its crude imports, increasing its sourcing from Russia.