22th February 2023 (9 Topics)

Context

India and Singapore have announced to link their payment apps, namely UPI and PayNow which will allow instantaneous and low-cost money transfers between the two countries.

- The linkage is set to ease financial transactions for the Indian diaspora.

About

About the move:

- Background: UPI payments through QR codes are already taking place in Singapore, though at a limited number of outlets.

- The announcement was done via a virtual address by both India and Singapore’s Prime minister.

- Aim: This move will aid the Indian diaspora in Singapore, especially students and migrant workers, by allowing instantaneous and low-cost money transfers between the two countries.

|

Singapore has now become the first country with which cross-border Person to Person (P2P) payment facilities have been launched. |

Significance:

- This will help the Indian diaspora in Singapore and bring the benefits of digitalisation.

- It will also help FINTECH through instantaneous and low-cost transfer of money from Singapore to India and vice-versa.

|

FINTECH or financial technology refers to the technological innovation in the design and delivery of financial services and products. |

Unified Payments Interface (UPI):

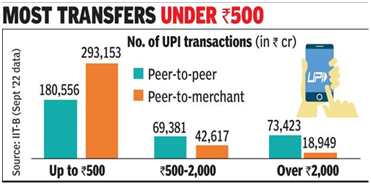

- Unified Payments Interface (UPI) is a system that powers multiple banks accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- It also caters to the “Peer to Peer” collection request which can be scheduled and paid as per requirement and convenience.

- Currently, UPI payments are made using the digital equivalent of existing currency notes. That means every rupee transferred via UPI is backed by physical currency.

|

The digital rupee will be legal tender in and of itself and need not necessarily be backed up by physical currency. |

Authorities concerned:

- The digital rupee/ currency will be operated by RBI and not by bank intermediaries in the case of UPI where each bank has a different UPI handler.

- The digital rupee will be settled by RBI instantly, whereas UPI payments are settled by transacting banks with RBI.

More Articles