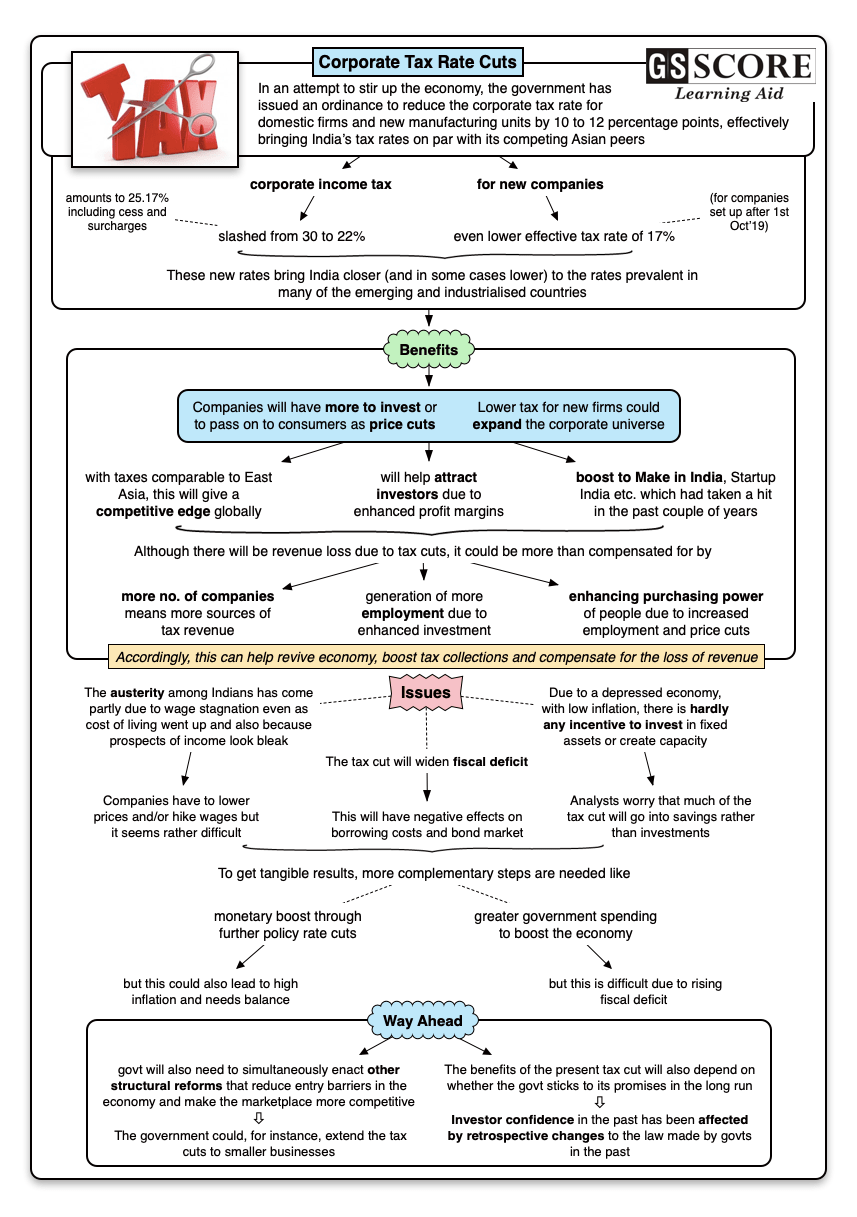

In its boldest gambit yet to stir up the economy, the government has issued an ordinance to reduce the corporate tax rate for domestic firms and new manufacturing units by 10 to 12 percentage points, effectively bringing India’s tax rates on par with its competing Asian peers.

Issue

Context

In its boldest gambit yet to stir up the economy, the government has issued an ordinance to reduce the corporate tax rate for domestic firms and new manufacturing units by 10 to 12 percentage points, effectively bringing India’s tax rates on par with its competing Asian peers.

Background

- The Indian economy is currently going through its worst deceleration in six years. The earliest markers of an economy's health are found in car showrooms, retail malls and the rapidity of activity in farms. Recent months' data related to these suggests that the Indian economy is going through a slowdown.

- The latest measures are by far the biggest, and the boldest step to revive the Indian economy, which until recently, was feted as a global growth engine. The goal is to turn India into an investors’ hub, demonstrate the government's intent to walk the talk on economic management, restore investors' confidence and boost sentiments and demand.

Tax rate changes

- The government has slashed the corporate income tax rate from 30 percent to 22 percent for all companies. Inclusive of cess and surcharges the effective corporate tax rate in India now comes down to corporate tax to 25.17 per cent.

- Newer companies, which are set up after October 1, 2019, will be subjected to an even lower effective tax rate of 17 percent.

- The new rates bring India closer, in some cases lower, to the rates prevalent in many of the emerging and industrialised countries. The new corporate income tax rates in India will be lower than USA (27 percent), Japan (30.62 percent), Brazil (34 percent), and Germany (30 percent) and is similar to China (25 percent) and Korea (25 percent).

Analysis

Benefits of corporate tax rate cut

- The benefits are immense, as for every rupee of profit a company makes progressively, it has more with itself to invest or pass on to consumers through price cuts.

- It might expand the corporate universe as new firms will now be taxed at 15 per cent.

- The present tax cut can help revive economy, boost tax collections and compensate for the loss of revenue.

- The big boost to shareholder value is unmistakable and the equity market showed its appreciation by surging the most in a single day in over a decade.

- It can make India more competitive on the global stage by making Indian corporate tax rates comparable to that of rates in East Asia.

- Thus India is likely to attract investors from across the globe as lower tax outflow could increase the share of profit making companies in India over time.

- Above factors will generate more employment and will help increase the purchasing power of the people thereby boosting sales which have been hit in major sectors like automobile sector.

- It will give boost to government initiatives like Make in India, Startup India etc. which had taken a hit in the past couple of years.

Issues surrounding the corporate tax rate cut

- The government cannot rely on a tax cut alone, and needs a monetary boost through further policy rate cuts and, perhaps, even advocate greater government spending to boost the economy which is difficult due to rising fiscal deficit.

- The tax cut is expected to cause a yearly revenue loss of ?1.45 lakh crores to the government. The negative effects of this widening fiscal deficit on borrowing costs and bond market cannot be ignored, and hence, it is important to ask whether the benefits to the economy justify the fiscal costs.

- The rupee is likely to remain around the present level, whereas bond yields could inch up to 7 per cent level in the near term according to currency and bond dealers.

- Some see the present tax cut simply as a concession to corporate houses rather than as a structural reform that could boost the wider economy.

- In a depressed economy, when inflation is low, there is hardly any incentive for the producer to invest in fixed assets or create capacity. Analysts worry that much of the tax cut will go into savings rather than investments.

- The austerity among Indians has come partly due to wage stagnation even as cost of living went up and also because prospects of income look bleak. The pain is deeper in rural India. For this to change, companies have to lower prices of products or share their profits through wage hikes. Public spending too has to increase. This seems difficult from both companies and government side.

Way forward

- The government will also need to simultaneously enact along with these tax cuts other structural reforms that reduce entry barriers in the economy and make the marketplace more competitive. The government could, for instance, extend the tax cuts to smaller businesses.

- The benefits of the present tax cut will also depend on whether the government sticks to its promises in the long run. Investor confidence in the past has been affected by retrospective changes to the law made by governments in the past.

Learning Aid