According to a survey conducted by ACI Worldwide and YouGov 42% Indians prefer digital payments over cash during shopping.

Issue

Context

According to a survey conducted by ACI Worldwide and YouGov 42% Indians prefer digital payments over cash during shopping.

Backgrond

|

Digital Payment - Definition The Payment and Settlement Act, 2007 has defined Digital Payments as any “electronic funds transfer” that is any transfer of funds which is initiated by a person by way of instruction, authorization or order to a bank to debit or credit an account maintained with that bank through electronic means and includes point of sale transfers; automated teller machine transactions, direct deposits or withdrawal of funds, transfers initiated by telephone, internet and, card payment. |

- According to NITI AYOG, the digital payments market In India is all set to grow to $1 trillion by 2023 led by growth in mobile payments, which are slated to rise from $10 billion in 2017-18 to $190 billion by 2023.

- In the light of such a tremendous growth of digital payments, the regulations and security of the users’ data has become a challenge for the government.

- Accordingly, a committee on Digital Payments was constituted by Department of Economic Affairs, Ministry of Finance in August 2016 under the Chairmanship of Ratan P. Watal to recommend medium term measures of promotion of Digital Payments Ecosystem in the country. The Committee submitted its final report to Hon’ble Finance Minister in December 2016.

- On the basis of recommendations a group of stakeholders from different Departments of Government of India and RBI was constituted in NITI Aayog under the chairmanship Ratan P. Watal to facilitate the work relating to development of a metric for Digital Payments which was the most important recommendation of Watal committe. This group prepared a document on the measurement issues of Digital Payments. Accordingly, a booklet titled “Digital Payments: Trends, Issues and Challenges” was released in July 2017.

Analysis

Segments of Digital Payment Systems

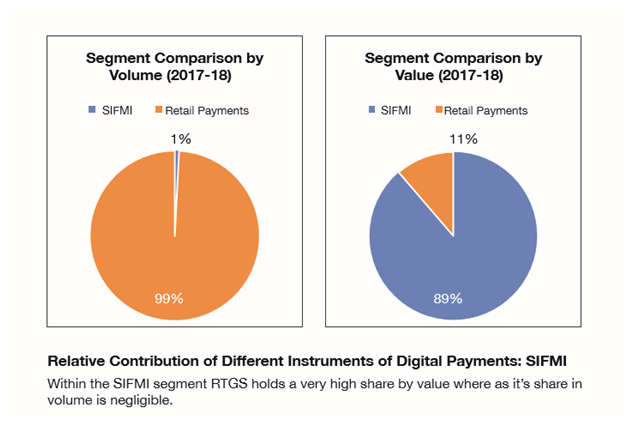

The payment system has two main segments.

- Systemically Important Financial Market Infrastructure (SIFMIs): It is defined as a multilateral system among participating institutions, including the operator of the system, used for the purposes of clearing, settling, or recording payments, securities, derivatives, or other financial transactions.

- Retail Payments: Under the Retail Payments segment which has a large user base, there are three broad categories of instruments. They are (1) Paper Clearing, (2) Retail Electronic Clearing, (3) and Card Payments.

SIFMI has a very low share in the overall Digital Payments transactions whereas in terms of value it has a significant share i.e. 89%.

Growth Trends in India (2017-18)

- Digital Payments have registered robust growth in 2017-18 both in volume and value terms.

- In volume terms the growth during the year 2017-18 was much higher than the trend growth rate during the last five years (2011-16)

- Growth in Total Retail Payments in value terms has been three times higher than the trend rate of the last five years.

- The UPI and IMPS Segment in volume of transactions registered a spectacular growth during 2017-18. UPI, despite being new product in the payment segment has shown great adoption rate among consumer and merchants

- Total Card Payments continued its growth momentum and exceeded the trend growth rate of the last five years both in volume and value terms

Policy Initiatives to promote Digital Payments

- In the Union Budget 2017-18, major policy announcements were made by the Hon’ble Finance Minister for promoting Digital Payments.

- Ministry of Finance has taken a major initiative in drafting a Bill for amendment of Payment and Settlement Systems Act, 2007, as envisaged in the Report of the Committee on Digital Payments 2016

- RBI has taken four major policy initiatives.

- National Electronic Funds Transfer (NEFT) system – Settlement at half-hourly intervals

- Master Directions on Prepaid Payment Instruments (PPIs)

- Rationalisation of Merchant Discount Rate

- Storage of Payment System Data

Emerging Global Trends

As per the report of Capgemini, a global leader in consulting, technology services and digital transformation, on ‘Trends in Payments 2018’, the Top 5 trends in Digital Payments across the world are as follows:

- Alternate payment channels such as contactless and wearables gain acceptance

- Banks and FinTech’s explore distributed ledger technology to transform cross-border payments.

- Instant payments processing likely to become the ‘new normal’ for corporate treasurers, industry at large.

- As global cyber-attacks rise, regulators focus on data-privacy law compliance.

- Infrastructure rationalization is likely as payments intermediaries come together or evolve.

Challenges in India

- The costs associated with online payment through RTGS and NEFT systems have also created a hindrance. These methods are not only expensive but also time-consuming at a time when there are a number of technologies available that offer real-time fund transfer.

- India is far from creating a robust digital payment ecosystem. There are several structural challenges that are hindering the growth of digital payments in the country and the biggest among them is the cyber-security.

- Digital inequality in India is also a challenge for deeper penetration of digital payments.

Opportunities

- According to NITI AYOG, the digital payments market In India is all set to grow to $1 trillion by 2023 led by growth in mobile payments, which are slated to rise from $10 billion in 2017-18 to $190 billion by 2023.

- Digital Payments offer unique opportunities. The Global trends indicate heightened customer expectations for value-added services, increased competition due to the emergence of FinTechs, new technologies, and an ever-changing regulatory landscape

- These emerging global trends are expected to impact the Indian Digital Payments ecosystem and provide impetus to the growth of Digital Payments.

Way Forward

- Measurement of Digital Payments is extremely important to monitor progress. The different components of Digital Payments have to be comprehensively studied with respect to global best practices and the list of indicators which are universally acceptable and relevant in the current context may be considered by RBI.

- A handbook of statistics may be prepared giving time series data on Digital Payments based on these standardized indicators which could be followed for all data collection and reporting agencies. This would bring uniformity and will reflect the growth in Digital Payments more accurately.

Learning Aid