- The Defence Sector in India, being a strategic sector, was traditionally reserved for the Public Sector till 1991. Defence Public Sector Undertakings (Defence PSUs) and Ordnance Factory Board (OFB) monopolised defence products manufacturing while R&D was the exclusive turf of DRDO.

- The concept of FDI in general was introduced in India in 1991 with the opening of the Indian economy. However, the Defence Sector was opened up 100% in May 2001 for Indian Private Sector participation with FDI permissible up to 26%, both subject to licensing.

Issue

Background

Evolution of FDI in Defence Sector

- The Defence Sector in India, being a strategic sector, was traditionally reserved for the Public Sector till 1991. Defence Public Sector Undertakings (Defence PSUs) and Ordnance Factory Board (OFB) monopolised defence products manufacturing while R&D was the exclusive turf of DRDO.

- The concept of FDI in general was introduced in India in 1991 with the opening of the Indian economy. However, the Defence Sector was opened up 100% in May 2001 for Indian Private Sector participation with FDI permissible up to 26%, both subject to licensing.

- In August 2014, the Department of Industrial Policy and Promotion (DIPP) raised the limit up to 49% through Government route and above 49% through Cabinet Committee on Security (CCS), on case-to-case basis.

- The Government formulated a revised “Consolidated FDI Policy” in 2016, where the policy permitted FDI cap in defence, through automatic route up to 49% and above 49% under Government route on case to case basis, wherever it is likely to result in access to modern and “state-of-the-art” technology in the country.

- The Government further raised FDI cap to 100% on again in 2016. The phrase state-of-the-art was dropped for FDI above 49%. The CCS approval was no more required. However, the process of approval itself will include the Ministry of Defence (MoD) and the Ministry of Home Affairs (MHA) which will consider issues related to defence of the nation, internal security and every other matter which relates to the national security.

- The requirement of single largest Indian ownership of 51% of equity has also been removed. A lock-in period of three years on equity transfer has been done away with in FDI for defence.

Analysis

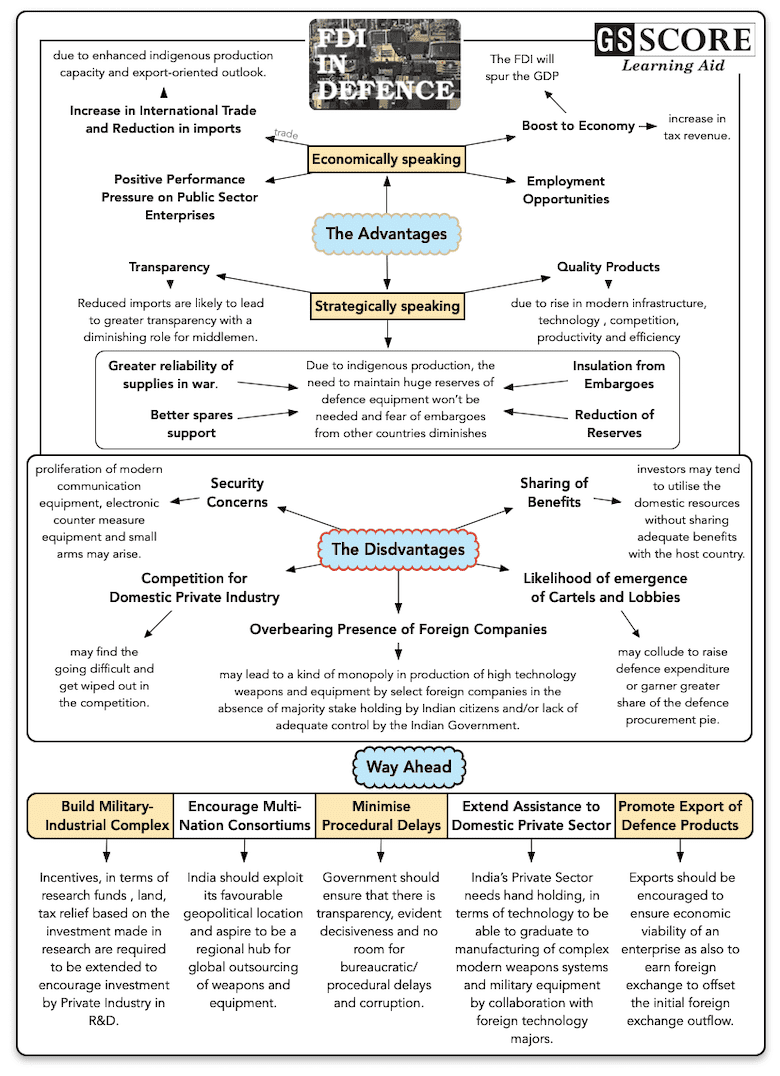

Advantages of FDI in Defence

- Transparency: Reduced imports are likely to lead to greater transparency with a diminishing role for middlemen.

- Quality Products: Infrastructure facilities are likely to improve due to higher capital infusion. Manufacture of improved quality products due to inflow of technology, expertise and better production facilities. Increased level of competition, productivity and efficiency will result. The cost of production is also likely to reduce due to economies of scale, making Indian weapons and equipment globally competitive.

- Reduction of Reserves: Higher FDI translates into better infrastructure, enhanced capacities and greater self-reliance. This would in turn also result in reducing the stock levels of reserves of munitions, weapons, equipment, assemblies and components held at various echelons of the Armed Forces.

- Boost to Economy: The capital base of the country will be positively affected due to inflow of foreign capital. This will also lead to increase in tax revenue.

- Positive Performance Pressure on Public Sector Enterprises: The public sector enterprises, namely, Defence Research and Development Organisation (DRDO), Defence PSUs and OFB will face increased performance pressure.

- Employment Opportunities: The FDI creates employment opportunities, both in organised and un-organised sector, for large number of unemployed people due to increased level of economic activity.

- Increase in International Trade: Increase in international trade, both by value and volume, due to enhanced production capacity and export-oriented outlook.

Disadvantages

- Security Concerns: Security issues especially with respect to proliferation of modern communication equipment, electronic counter measure equipment and small arms may arise. Moreover, in India which has significant internal security issues including Naxal violence and terrorism, permitting enhanced FDI for all items in the Defence Products List has a fair potential to give negative results.

- Competition for Domestic Private Industry: The Indian private industry is not yet well established in the defence sector. The JVs that are formed post investment by established foreign defence companies, will offer stiff competition to domestic private defence industry. Hence, opening of floodgates for more than 49 percent (and up to 100 percent) FDI in defence sector is likely to dwarf many domestic players, who may find the going difficult and get wiped out in the competition.

- Overbearing Presence of Foreign Companies: Unrestricted FDI in defence sector may lead to overbearing presence or a kind of monopoly in production of high technology weapons and equipment by select foreign companies in the absence of majority stake holding by Indian citizens and/or lack of adequate control by the Indian Government.

- Sharing of Benefits: Foreign investors may tend to utilise the domestic resources without sharing adequate benefits with the host country.

- Emergence of Cartels and Lobbies: There is a likelihood of the emergence of cartels and lobbies which collude to raise defence expenditure or garner greater share of the defence procurement pie.

Implications of FDI in Defence on Self-Reliance and Indigenisation

- Build industrial capability and ecosystem: Utilise FDI as a route to attract much needed foreign capital to boost building of the indigenous defence industrial manufacturing capability.

- Induction of modern technology: Enhanced FDI, that enables majority stake holding by foreign company, represents not merely acquisition of funds but also realistic possibilities of access to coveted modern technologies for weapons and equipment. The weapons and equipment so manufactured, on becoming globally competitive, in turn, would attract more FDI and better technology and the progressive cycle goes on.

- Reduction in imports: FDI in defence is likely to substantially improve the country’s capacity to manufacture defence weapons and equipment locally and meet both qualitative and quantitative requirements of the Armed Forces.

- Greater reliability of supplies in war.

- Better spares support

- Insulation from Embargoes: Presently, India is procuring most of the critical weapons systems and equipment that are either manufactured or both manufactured and integrated abroad. When the same weapons systems and equipment are manufactured in the country, indigenous production will tend to insulate the country from unilateral imposition of embargoes by whimsical foreign suppliers.

Way Forward

- Enhance interaction between Armed Forces and Industry: The Armed Forces need to actively interact with the industry to enable focus on the technology desired in the future weapons systems and equipment.

- Enhance FDI Cap: It is strongly recommended to permit enhanced FDI, above 49 percent through Government route, in deserving cases without being overly protective about the Defence Public Sector Enterprises. Further liberalised FDI Policy in the Defence Sector is the need of the hour.

- Minimise Procedural Delays: Government should ensure that there is transparency, evident decisiveness and no room for bureaucratic/procedural delays and corruption.

- Build Military-Industrial Complex: Suitable incentives, in terms of provision of funds for research, tax relief based on the investment made in research projects, provision of land on concessional rates to defence vendors, are required to be extended to encourage investment by Private Industry in R&D.

- Extend Assistance to Domestic Private Sector: India’s Private Sector needs hand holding, in terms of technology to be able to graduate to manufacturing of complex modern weapons systems and military equipment by collaboration with foreign technology majors.

- Encourage Multi-Nation Consortiums: India should exploit its favourable geopolitical location and aspire to be a regional hub for global outsourcing of weapons and equipment. BrahMos Cruise Missile is an excellent example of high-grade output of consortium approach.

- Promote Export of Defence Products: Exports should be encouraged to ensure economic viability of an enterprise as also to earn foreign exchange to offset the initial foreign exchange outflow.

- Explore Strategic Partnership Model: The partnership would essentially provide for long-terms needs of the Armed Forces. This route encourages the Industry to invest in Research and Development.

- National Defence Industrial Policy: There is a genuine requirement to articulate National Defence Industrial Policy which should deal with all relevant issues pertaining to defence design, development and production.

Learning Aid

Practice Question:

Critically analyse the FDI policy of India in defence sector. Suggest some way forward.