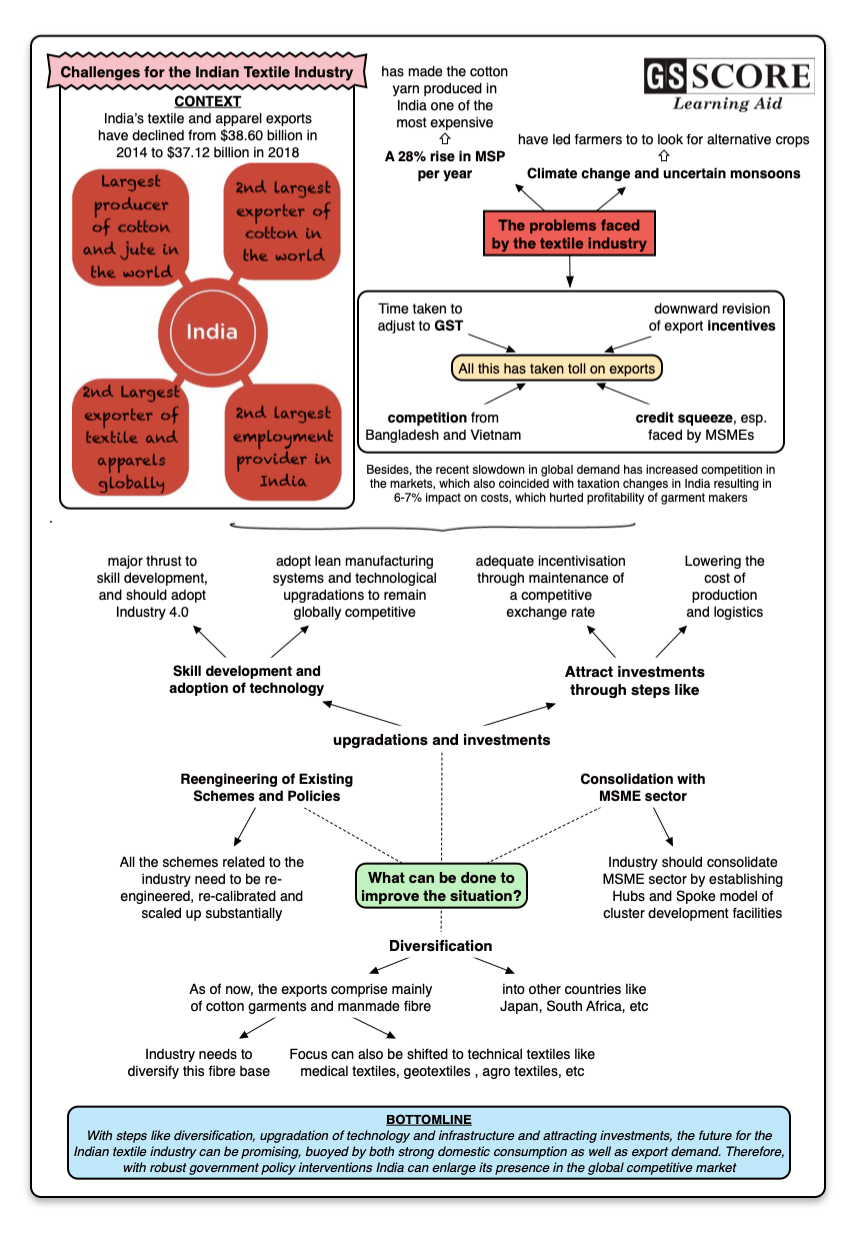

India’s textile and apparel exports have declined from $38.60 billion in 2014 to $37.12 billion in 2018.

Issue

Context

India’s textile and apparel exports have declined from $38.60 billion in 2014 to $37.12 billion in 2018.

What is pulling down Indian textile industry?

- Impact of MSP on cost of raw materials: Once the cheapest in the world, cotton yarn produced in India is now among the most expensive in the world due to a 28 per cent rise per year in the minimum support price.

- Changing cropping pattern: India has the largest acreage with 12.2 mn hectares under cotton cultivation, which is around 42% of the world area of 29.3 mn hectares. But because of climate change and uncertainty of Indian monsoon, the farmers in cotton growing areas of Maharashtra and Gujarat are now looking towards alternative crops which are resulting into decrease in cotton production area.

Facts:

- India is:

- The largest producer of cotton and jute in the world.

- The second largest exporter of cotton in the world.

- The second largest exporter of textile and apparels globally.

- Textiles industry is second largest employment provider in India.

- India is:

- Declining share of exports: The time taken by the industry to align to the new goods and services tax (GST) regime, downward revision of export incentives, and the credit squeeze particularly faced by small and medium enterprises adversely impacted exports.

- Global competition: India faces competition from countries like Bangladesh which have competitive manufacturing costs and enjoy duty-free access to major textiles and apparel markets like Europe. According to an analysis, India is projected to lose market share to Bangladesh and Vietnam for ready-made garment exports to the European Union (EU).

- Recent economic slowdown: The recent slowdown in global demand has increased competition in the markets, which also coincided with taxation changes in India resulted in 6-7% impact on costs, which hurted profitability of garment makers.

What need to be done?

|

Major government initiatives:

|

- Diversify exports:

- India’s apparel exports comprise mainly of cotton garments (51%), with manmade fibre (MMF) accounting for around 28%. Therefore India needs to diversify its fibre base as global consumption is diversified.

- India should focus on diversifying exports into countries such as Japan, Israel, South Africa and Hong Kong.

- Promoting skill development and adoption of technology :

- Textile industry needs to give major thrust to skill development, and should adopt Industry 4.0.

- The industry also needs to adopt lean manufacturing systems and technological upgradations to remain globally competitive.

- Focusing on technical textiles: India should focus more on Technical textiles which are textiles for automotive applications, medical textiles (e.g., implants), geotextiles (reinforcement of embankments), agro textiles (textiles for crop protection), and protective clothing (e.g., heat and radiation protection for fire fighter clothing, molten metal protection for welders).

- Consolidation with MSME sector:

- Textile industry should consolidate MSME sector by establishing Hubs and Spoke model of cluster development facilities.

- Robust database: AS data collection remains an issue since the majority of the sector remains concentrated in small and micro units there is need to create a database of total jobs in the sector.

- Reengineering of Existing Schemes and Policies:

For the scale and growth momentum of the textile industry, all the schemes related need to be scaled up substantially. They also need re-engineering and re-calibration to suit the ambitious goals being adopted.

- Attract Investment into the Sector:

To attract more investment in this sector:

-

- Investments need to be adequately incentivised through maintenance of a competitive exchange rate.

- Lowering the cost of production and the cost of logistics should be given highest priority.

Way forward:

The future for the Indian textile industry looks promising, buoyed by both strong domestic consumption as well as export demand. Therefore with robust government policy interventions India can enlarge its presence in the global competitive market.

Learning Aid

Practice Question:

Instead of having large growth potential, why Indian textile industry is lagging behind in global competitive market? By listing some government initiatives suggest some measures to boost Indian textile industry.