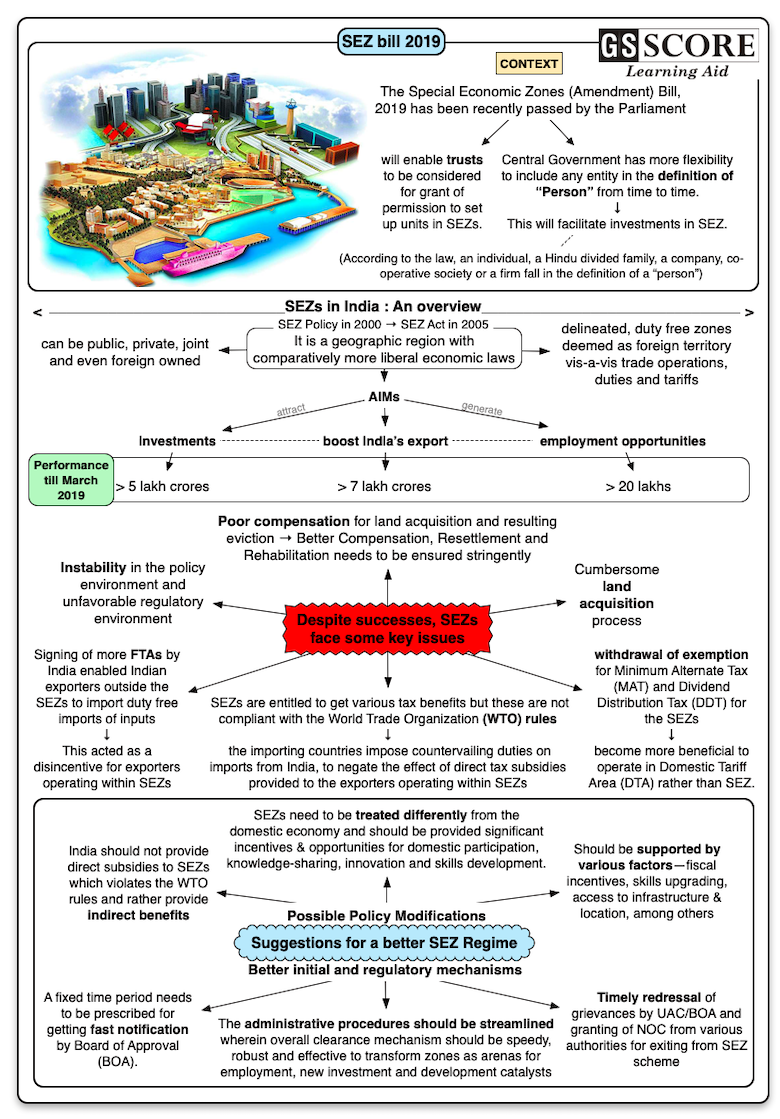

The Special Economic Zone (SEZ) Bill, 2019 has been recently passed by both Houses of the Parliament.

Issue

Context

The Special Economic Zone (SEZ) Bill, 2019 has been recently passed by both Houses of the Parliament.

BACKGROUND

A Special Economic Zone is a geographical region that has economic laws that are more liberal than a country’s prevailing economic laws. In India SEZs are specifically delineated, duty-free enclaves that can be deemed as foreign territory for the purposes of trade operations, duties and tariffs. They can be set up by any private or public, Joint or exclusively State-owned, or even foreign-owned company, anywhere in India. A multi-product SEZ is required to have 1000 hectares while the single product SEZ can be set up in as little 100 hectares.

Evolution of SEZ in India

- India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model.

- But EPZ Model soon failed to make its impact due to multiplicity of controls and clearances, absence of world-class infrastructure, and an unstable fiscal regime.

- Then, with an aim to attract the foreign investments and boost India’s export, Special Economic Zone Policy was introduced in 2000.

- By 2005, all EPZs had been converted to SEZs.

- Till 2006, SEZs in India functioned under the provisions of the Foreign Trade Policy. Then, in order to instil confidence in investors and signal the Government's commitment to a stable SEZ policy regime Special Economic Zones Act, 2005, was passed by Parliament, which came into force in 2006.

- As of March 2019, there are 232 SEZs in operation. Kandla SEZ (Gujrat), Noida SEZ (UP), Vishakhapatnam SEZ (Andhra Pradesh), Cochin SEZ (Kerala) are some examples of SEZ in India.

Analysis

Performance of SEZ in India

The three important objectives of the SEZs Act, 2005 are to generate employment opportunities, encourage investments and increase India’s exports.

- EXPORT: In 2018-19, a growth of 21% over the exports of the corresponding period of FY 2017-2018 has been observed

- EMPLOYMENT: As of March 2019, employment of more than 20 lakh person days has been generated by SEZs.

- Investment: The investments accumulated into the SEZs for the period from 2006 to 2019 amount to 5,07,644 crores.

But, as per CAG Report, SEZ units have been achieving the prescribed net foreign exchange (NFE) earnings mainly through domestic sales, defeating one of the sub-objectives of the scheme, which was to augment exports.

Overall, the SEZ scheme in India has shown a tremendous growth in infrastructure investment, employment and exports. At the end of March 2019, the investment in SEZs was a whopping ?5 lakh crore plus and the employment was over 20 lakh and exports were over ?7 lakh crore

Positive Impact of SEZs on the Indian Economy

- Balance of Payment: India's trade deficit widened to USD 15.36 billion in May 2019 from USD 14.62 billion in the same month last year and SEZs are a key remedy to improve the trade imbalance.

- Import Substitution by domestic Production: Baba Kalyani-led committee on special economic zones (SEZ) has suggested that certain sectors such as electronics are showing high domestic demand and need to have a plan for import substitution.

- Boost to MSME Sector: The SEZ policy has significant constraints for MSMEs, despite its high importance for the Indian economy. MSMEs accounted for 28.24 percent of India’s exports coming from SEZs in 2016-17.

- Increased Share of Manufacturing in GDP: Although about 30 percent of operational SEZ are engaged in manufacturing but still manufactured goods dominate India’s exports from SEZs.

Negative Impact of SEZ in India

Despite the huge rate of approval and establishment of SEZs, and thus their apparent success, the development of SEZs has faced considerable opposition and is stalling in some cases. Some of the key problems due to SEZ are as follows:

Economic

- Foregone Revenue: As per the CAG, in 2016-17, the revenue loss to the government on account of concessions to SEZs was Rs 10,182 crore.

- Loss of Employment for Farmers: SEZ model that replaces farming on fertile agricultural land with autonomous, private industrial enclaves that mostly just provide jobs for urban skilled and semi-skilled workers.

Social

- Poor Compensation: The compensation to the land owners, even if paid in full, is woefully inadequate.

- Forced Eviction & Poor Rehabilitation: For rural farmers, it is not just the loss of their land but the displacement is very painful since it breaks the family and neighbourhood bonds that are not easy to establish in a new setting.

- No Alternative Employment for Rural Poor: In most of the cases, the displaced people have found little new employment in these projects.

- Landless Worker & Non – Farm Workers – This section does not receive any compensation and are left without any redress for the severe disruption to their livelihoods that they face.

- Discrimination – Land Holdings of the vulnerable groups like SC’s and ST’s are targeted because such people are least likely to be able to resist the process

- Toll on Health – The frequency of deaths peaked in the period 2005 to 2007, the period immediately following the main wave of SEZ evictions. Moreover, due to pollution from SEZ, cases of acute respiratory diseases are reported every year.

- Impact on Women - Poverty, indebtedness and unemployment due to SEZ has forced women to undertake more work and struggle hard for making ends meet. Violence against women also increased due to increased frustration.

Political

- SEZs have hit at the sovereignty of local bodies, as they function as self-governing autonomous bodies.

- Enormous power has been given to Development Commissioners for granting environmental clearance for SEZs. They are able to bypass the State Pollution Control Boards as they work directly under government control.

Environmental

- The SEZ Act 2005 does not require “Environmental Impact Assessment” as part of the application for new units because SEZs are only permitted to contain “non-polluting” industries and facilities

- The water requirement, as demanded by POSCO Steel website, is 286 million litres per day. In a situation when Tamil Nadu is facing severed water crisis even for drinking purposes, such huge demand of water is infeasible to be met.

- Water pollution due to the release of untreated waste water into water bodies by SEZ has led to the deaths of a number of livestock and increased GHGs in the atmosphere.

Challenges faced by SEZ in India

The SEZ Developers have highlighted the following challenges faced by them in operating SEZs in India

- Land Acquisition: The land for SEZ is usually obtained, with the recommendations of the state governments, through Land Acquisition Act. The flaws in the archaic land acquisition have been replaced by the new Land Acquisition Act, 2013 but the process of land acquisition and getting permissions from custom authorities is still cumbersome.

- Free Trade Agreements: Signing of more Free Trade Agreements (FTAs) by India enabled Indian exporters outside the SEZs to import duty free imports of inputs. This acted as a disincentive for exporters operating within SEZs

- Withdrawal of Tax Incentives: After the withdrawal of exemption for Minimum Alternate Tax (MAT) and Dividend Distribution Tax (DDT) for the SEZs, it has become more beneficial to operate in Domestic Tariff Area (DTA) rather than SEZ.

- Non-compliance with WTO rules results in export incompetitiveness - SEZs are entitled to get various tax benefits but these are not compliant with the World Trade Organization (WTO) rules. Therefore, the importing countries impose countervailing duties on imports from India, to negate the effect of direct tax subsidies provided to the exporters operating within SEZs

- Other Important challenges are:

- Slowdown in global demand and lack of incentives to operate in the SEZs

- Instability in the policy environment and unfavorable regulatory environment

- Poor market response

- Non-availability of skilled labour force

Analysis of 2019 Bill

- The Bill amends the SEZ 2005 Act. It also replaces the SEZ (Amendment) Ordinance, 2019, that was promulgated in March.

- The Act does not permit ‘trusts’ to set up units in SEZs. Now, the amendment will enable trusts to be considered for grant of permission to set up units in SEZs.

- Now, the Central Government has more flexibility to include any entity in the definition of “Person” from time to time. This will facilitate investments in SEZ.

- According to the law, an individual, a Hindu divided family, a company, co-operative society or a firm fall in the definition of a “person".

Suggestions

- The government should ensure due Compensation, Resettlement and Rehabilitation of the displaced land owners.

- A fixed time period needs to be prescribed for getting fast notification by Board of Approval (BOA).

- Timely redressal of grievances by UAC/BOA and granting of NOC from various authorities for exiting from SEZ scheme.

- India should not provide direct subsidies to SEZs which violates the WTO rules and rather provide indirect benefits

- The administrative procedures should be streamlined wherein overall clearance mechanism should be speedy, robust and effective to transform zones as arenas for employment, new investment and development catalysts rather than enclaves for absorbing underemployed workers.

- SEZs need to be treated differently from the domestic economy and should be provided significant incentives & opportunities for domestic participation, knowledge-sharing, innovation and skills development.

- Several success stories (China) demonstrate the effective use of SEZs as policy tools to increase employment and exports, attract FDI and improve economic growth supported by various factors—fiscal incentives, skills upgrading, access to infrastructure & location, among others.

|

Difference between National Investment and Manufacturing Zone (NIMZ) and Special Economic Zone (SEZ): NIMZ is different from SEZs in these following aspects:

|

Conclusion

Therefore, it cannot be denied that the objectives of the SEZ in terms of the production of goods and services of global standards, earning foreign exchange, improvement in infrastructure and employment are more relevant today than ever before. They probably need to be supported more through incentives and government interventions rather than being hounded as is no alternative to bring in Export led economic development.

Learning Aid

Critically analyze the role of Special Economic Zones in the economic and social sphere of India.