Reserve Bank released the results of the September 2018 round of its Consumer Confidence Survey (CCS).

Context

Reserve Bank released the results of the September 2018 round of its Consumer Confidence Survey (CCS).

About

- The survey seeks qualitative responses from households, regarding their sentiments on general economic conditions, overall price situation, employment, income, spending, scenario

- Consumer confidenceis a key driver of economic growth and is widely considered a leading economic indicator of household spending on consumption. Confident consumers buy more goods and services, providing a boost to the Indian economy. Consumers tend to increase consumption when they feel confident about the current and future economic situation of the country and their own financial conditions.

- The survey was conducted in some major cities.

- The agency M/s Hansa Research Group Pvt. Ltd., Mumbai has been engaged to conduct the field work of this round of the survey on behalf of the Reserve Bank of India.

Findings

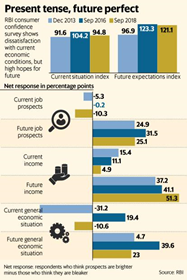

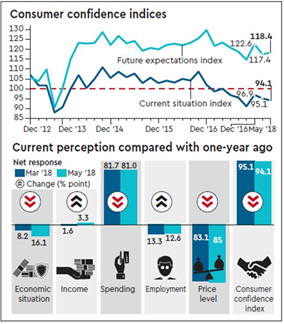

- Economic Condition:Only 29.1% of those surveyed said their economic condition had improved from what it was a year ago, while 34.4% said it had worsened.Perceptions on the current general economic situation dropped as compared with the preceding round and remained in the pessimistic zone.

- Price situation: While the majority of the respondents remained highly pessimistic about the price situation, there was a slight improvement in expectations one year ahead.

- Employment:2% said their employment prospects had improved, while 45.5% said they had worsened. However, those surveyed are hopeful that job prospects will improve a year from now. The one-year-ahead-expectations survey shows there is a net positive response of 25.1 percentage points.

- Income:On perceptions of income next the net response in September 2018, at 51.3 percentage points, is higher than 2013’s net response of 37.2 percentage points. People remain hopeful that incomes will rise; the government can derive some solace from that.

- The survey portrays reduced optimism on spending by consumers, particularly in respect of non-essential items.

- RBI’s current situation index of the consumer confidence survey is at 94.8 for September 2018, compared to 91.6 in December 2013, not too much of a gap, but, a marginal uptick is observed in the future expectations index at 121.1 points now, on the back of optimistic sentiments on future income, employment and the evolving price situation.

Significance

- Barometer of governance: It reflects the measurement of how happy people are with the government’s management of the economy. The government has done a considerable job of keeping people’s hopes alive. The risk for the government is that current reality may finally dampen future expectations, which is what seems to be happening in the markets.

- Boost to Indian Economy: In economies such as Indiaand the US, where personal consumption accounts for more than 60% and 70% of GDP respectively, consumer confidence has a particularly significant impact on the economy. Measuring it can provide critical insight into the economy's growth prospects. Consumer sentiment indices are essential tools used by global investors and will be an immense aid to individual and institutional investors in India.

- Monetary policy formulation: The results of this survey will provide useful information, data and statistics for monetary policy formulation in accordance with the market expectations and push and pull factors.

Learning Aid

An overview of the survey :