Ratings agency Moody’s has reacted predictably to the turbulence in the economy by revising the outlook on its sovereign rating for India from stable to negative.

Context

Ratings agency Moody’s has reacted predictably to the turbulence in the economy by revising the outlook on its sovereign rating for India from stable to negative.

About

- Moody’s Investor Service changed its outlook for India’s sovereign rating(Baa2) from stable to negative, saying that the domestic economic downturn could be structural.

- The agency’s action does not amount to a rating downgrade, but comes as a caution against policy inaction. Moody’s credit rating of Baa2, the second-lowest investment grade score, is better than those of other agencies, such as S&P and Fitch, who have assigned the lowest investment grade to India with a stable outlook.

- However, the Union finance ministry said that India’s potential growth rate remains unchanged, as evident from the assessment by the International Monetary Fund (IMF) and other multilateral organizations that continue to hold a positive outlook on India.

- The government has undertaken a series of financial sector and other reforms to strengthen the economy as a whole. Government of India has also proactively taken policy decisions in response to the global slowdown. These measures would lead to a positive outlook on India and would attract capital flows and stimulate investments

- India has often criticized the methodology followed by rating agencies.

- India’s ratings were upgraded to Baa2 from Baa3 in 2017 citing progress on 'economic and institutional reforms’ by the Narendra Modi Governmnet.

- Moody’s said India’s potential gross domestic product (GDP)growth and job creation will remain constrained unless reforms are advanced to directly reduce restrictions on the productivity of labour and land, stimulate private sector investment, and sustainably strengthen the financial sector.

A look at the Indian Economy and Issues

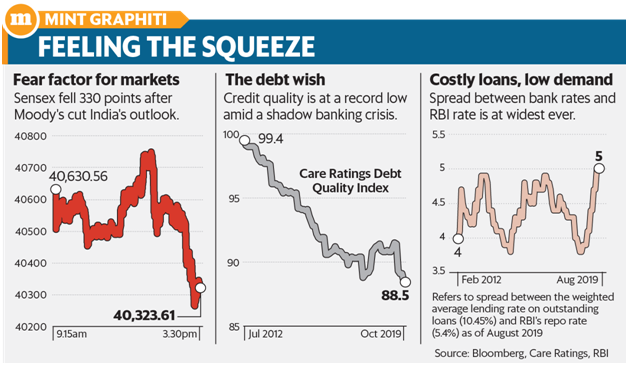

- None of the issues that Moody’s has highlighted are unknown. The growth slowdown and its effects on the fiscal deficit and borrowings are the main worries.

- The tax revenue growth is nowhere near budgeted levels and with prolonged slowdown it is clear that tax revenues will undershoot by a wide margin.

- The government has been forced to spend more to stimulate the economy. To push expenditure on capital projects, the government gave away corporate tax concessions amounting to a whopping ?1.45 lakh crore.

- Even with the boost from the ?1.76 lakh crore dividend payout from the Reserve Bank of India, the budget arithmetic is optimistic and it now appears certain that the government will miss the fiscal deficit target of 3.3% of GDP. Moody’s has projected that the deficit will slip to 3.7% of GDP this fiscal.

- Ratings agencies are ultra-sensitive to fiscal deficit overruns but the positive factor here is that India’s borrowings are almost wholly domestic. External debt to GDP is just 20% but the ratings do have an impact on investor sentiment.

Way Out

- The increase in bank credit off-take reported by the RBI for the second successive fortnight is a positive sign.

- The government needs to press the pedal harder on reforms and in debugging GST.

- The government may also have little option than to go big on disinvestment in the remaining four months of this fiscal. The target of ?1.05 lakh crore that it set for itself in the budget has to be bested by a wide margin if the fiscal deficit slippage is to be contained.